Why are retail traders exiting debt price range?

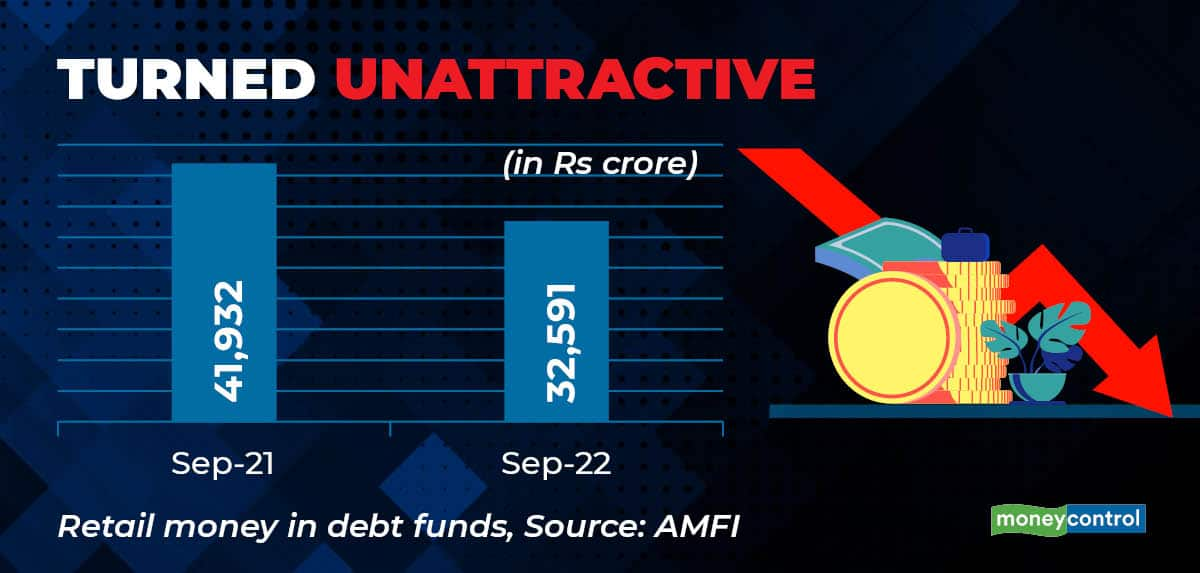

Small traders trimmed their funding in debt price range throughout classes over the last 12 months. Trade frame AMFI knowledge display that retail cash within the open ended debt price range declined by way of 22% to Rs 32,591 crore as of September 2022. Mavens characteristic this to traders being concerned in regards to the emerging yields and its penalties of conceivable suboptimal returns from the length price range. Maximum debt classes struggled to ship matching go back with the financial institution mounted deposits remaining yr. Secondly, sexy returns from the fairness marketplace over the past 3 to 4 years drew traders to equity-oriented mutual fund schemes.