Will have to I Spend money on the 16.88% Yielding Simplify Volatility Top class ETF (SVOL)?

I spent the weekend collecting some ideas about making an investment. I’ve some budget except Daedalus that I may need to building up the allocation to raised chance.

One of the vital budget that I’m eager about is SVOL. SVOL is the ticker for the Simplify Volatility Top class ETF. That is an actively controlled ETF this is integrated in america, so it isn’t probably the most property tax-efficient safety in the market.

When many securities fall in worth, your concepts can come from many spaces. I believe the practical factor once in a while isn’t to get distracted and simply upload on your major funding automobile. This may also be VWRA, IMID, CSPX, you identify it.

On the other hand, this may well be a superb opportunity to start out a place in an concept that chances are you’ll suppose isn’t a excellent worth to shop for closing time.

The VIX or the CBOE index which expresses the implied volatility of the S&P 500 index after all is in a position to be “freed” to upward thrust just about to 30:

We after all moved from an overly low volatility regime (beneath 16) to a miles upper regime. Fairness buyers would possibly want to get adjusted to larger worth actions quite than one of these lengthy length the place the S&P 500 does no longer have any more than 2% worth correction.

That were given me fascinated with SVOL.

That is the type of surroundings {that a} technique like SVOL will move to shit if it isn’t applied and carried out smartly.

Within the chart beneath, I plotted the associated fee motion of SVOL (most sensible candlestick chart) in opposition to the associated fee alternate within the VIX (orange chart):

There’s a easiest inverse worth dating between SVOL and VIX, within the closing two days, SVOL dropped 4.5% when the VIX climbed nearly 43% in the similar length.

That is the type of surroundings which might be headwinds for SVOL.

What’s the Giant Deal Over SVOL?

The fee chart that we see above is handiest the associated fee motion.

Here’s a glimpse of the previous dividend distribution of SVOL:

The primary commentary is that SVOL distributes dividends each month.

For the previous few months, the dividends are persistently US$0.30 per month. If we upload them up it’s about $3.60782.

Now, allow us to take SVOL’s worth prior to this plunge of about $22.78.

The dividend yield is 15.8%.

That may have perk a few of you up.

“If I put $1 million into this, I’m going to get a per month revenue of $13,000!”

However grasp up… why is the costs drifting down?

Most likely a greater method to assess efficiency is to have a look at the entire go back. In nearly all issues, it’s higher to not handiest take a look at the dividend yield however the capital returns with dividend yield.

The desk above displays the cumulative returns (most sensible) and annualized go back (backside). SVOL used to be incepted within the mid of 2021, so sadly we’re not able to look the way it plays within the loopy month of Feb-Mar 2020.

The go back here’s internet of expense ratios and what you possibly can earn from the beginning, as you notice the NAV of the fund go with the flow decrease.

The falling NAV and the top yield would possibly make you extra wary and unsure about what sort of returns an investor would be expecting going ahead. Is the NAV going to 0? Is go back sustainable in any respect?

The Elementary Foundation of SVOL

At Providend, how we take a look at each and every investments that come throughout our desk, be it via the boss, or a consumer and come to a decision whether or not we must upload to any of our portfolios is our Funding Philosophy. Our Funding Philosophy is made up of four pillars and the primary one is Financial Foundation.

In the event you had requested me, we must have modified that pillar to only Foundation, and it will were more practical.

SVOL is an actively controlled technique founded round preserving bonds, futures and choices. We will be able to crew what the fund holds to the next:

- 20-30% of the portfolio: Promote or brief VIX futures contracts.

- Nearly all of the portfolio: Spend money on T-bills, Notes, TIPS or Mounted Source of revenue ETFs.

- Fund would possibly doubtlessly promote mounted revenue choices to fortify revenue.

- Or to obtain the mounted revenue at extra horny costs.

- A small allocation to out-of-the-money VIX name choices or fairness put choices.

There’s a basic foundation for the usage of derivatives similar to futures and choices. Other crew of other people use choices and futures to hedge for his or her companies in the event that they want to lock in mounted income and prices for stuff that can be risky. Those may also be the costs of agricultural produce or to mend costs of fairness securities if a big sale and buy takes position later.

Those derivatives don’t seem to be with out dangers, and if you happen to get advantages, any person at the different finish may well be on the brief finish of it. Having dangers way that there’s some sanity to its go back as a result of with nearly all issues, there’s a go back on the finish of the rainbow as a result of there’s some kind of uncertainty.

The principle bulk of SVOL’s go back comes from shorting the VIX futures contracts to earn one thing name a Roll-yield.

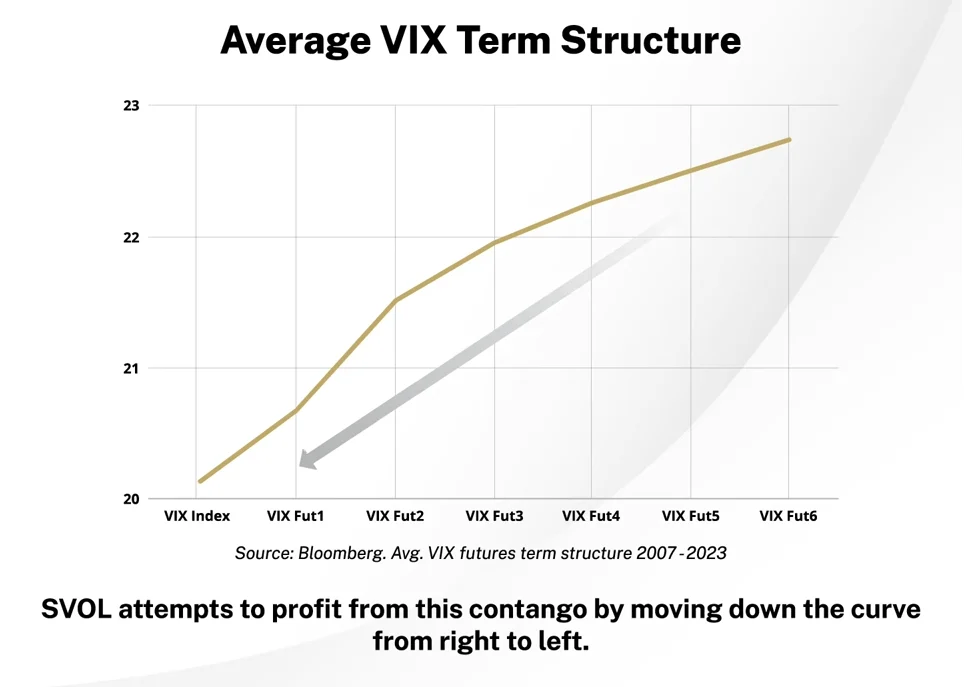

The representation beneath displays an ordinary VIX Time period Construction:

The x-axis displays a couple of VIX futures contracts which might be covered up from how a ways they’re going to mature with VIX Fut6 farther from adulthood. The y-axis displays the cost of the VIX futures.

We understand that the cost of the VIX futures this is nearer to lately (to the left) is not up to the VIX futures additional away. However why is that? I take a look at the VIX futures as a type of insurance coverage top class. Other people purchase the VIX to give protection to in opposition to attainable massive problem volatility to the S&P 500. The additional away you might be from lately, the larger the uncertainty, and so the cost of the long run is upper.

SVOL will promote a VIX futures this is additional away. As time passes, the cost of VIX must head down, because the curve, and the executive will purchase again the VIX futures at a lower cost.

The SVOL buyers take advantage of the unfold between the associated fee it used to be bought and what sort of it’s purchased again at.

A curve this is decrease closer lately and better farther from lately is alleged to be in Contango. On the other hand, this isn’t at all times the case.

A nearer-term VIX futures contract may also be dearer or as dear than the ones which might be additional away. When does that occur?

There are classes of uncertainty within the markets the place buyers puts larger call for on VIX coverage this is closer to lately.

An reverse sloping curve (the place the closer is extra expensive than the additional) is known as Backwardation.

For fairness buyers: A evaluation of the VIX futures, whether or not they’re sloping which approach or the pricing of the futures, may give a likelihood wager of the stage of “concern” or what buyers are considering relating to how lengthy the worry will closing.

In the event you roughly perceive this, you possibly can keep in mind that this brief promote of VIX futures isn’t with out chance for if the VIX jumps within the shorter tenor, you are going to purchase again dearer, dropping you cash. There may be chance right here and due to this fact there’s a foundation of the way returns come about.

With a purpose to brief promote the VIX futures, the portfolio want collateral and that’s the position of the mounted revenue at the portfolio. Predominantly, the mounted revenue is made up of Treasury payments however they have got the versatility of the usage of different mounted revenue choices if that items a greater alternative.

Finally, the portfolio spends a small quantity of its finances on out-of-the-money fairness places or VIX calls for defense. We will be able to quilt extra of this later.

What You might be Paying the Expense Ratio For?

In the event you take a look at what the fund holds, you’ll see what you might be paying the executive to do:

- Harvest the VIX roll yield via promoting VIX futures. There are occasions when the simpler chance as opposed to praise is to promote nearer to lately, and there are occasions when it’s higher to promote additional.

- To spend money on the income-producing belongings and, every now and then, write/promote choices in opposition to the belongings when the chance items itself.

- Execute methods to forestall tail chance from killing your portfolio.

You could have the similar concept as Simplify, the corporate managing the ETF, or chances are you’ll no longer, however you might be asking them to execute the tactic in your behalf while you purchase such an ETF.

What Drives the Returns of the ETF?

Simplify give you the following choice tree to assist us visualize underneath what stipulations will the ETF carry out smartly and when it’s going to no longer:

I believe extra advisers or monetary product suppliers must do that. I’m wondering does it is smart to stay coddling your purchasers or possibilities via underplaying the dangers of investments till they blow up in all our faces. The very first thing it’s important to recognize is if you wish to have top returns, you possibly can both must be open to the chance of both massive drawdowns, important volatility, or a top rate for the hassle put into chance control.

If we’re in a Contango time period construction and the VIX curve is steep, it lets in the fund to earn a fatter roll-yield. If the curve is flat or in Backwardation this is the place the tactic suffers (relatively like now).

Tail Chance Control

Given the fats yield, what’s the chance right here?

You probably have written or bought bare put choices on indexes or shares to earn revenue prior to, you possibly can know that the tactic is like choosing pennies on a railway observe. You might be more likely to earn after which get steamrolled sooner or later.

In Feb 2018, two VIX call-writing ETPs have been steamrolled all through what is referred to now as “Volmageddon”.

A type of merchandise is the VelocityShares Day by day Inverse VIX Quick-Time period word (ticker: XIV). In a single consultation, XIV shrank from $1.9 billion in belongings to $63 million.

Traders gravitate to budget like XIV on account of their greed for yield.

A mix of things popped the VIX to what you notice within the screenshot above. Believe if you don’t have any only one XIV however a couple of budget running methods of an identical vein attempting to shop for again their futures to restrict their losses.

That purchasing of the VIX fxxk issues up much more making a Recreation Forestall brief squeeze impact.

The losses wiped off the entire worth of the fund.

Would SVOL be matter to the similar chance?

Smartly, that’s the position of the put possibility purchasing or VIX name possibility. The portfolio spend a few of its finances via purchasing this “portfolio insurance coverage” persistently at a strike worth of fifty. Which means that if the VIX spikes close to or more than that, and the choices print, then the portfolio supervisor can promote the VIX name to monetize and restrict the losses.

Except that, SVOL have just a 20-30% publicity to those VIX futures promote. Which means that the fund is much less uncovered. I think that the problem is to effectively monetize the VIX calls in such an match.

“Volmageddon” is so mentioned that lead me to imagine if you happen to have been to construction some kind of VIX lined call-like technique, you possibly can cope with such an match.

The Problem is within the Execution

One of the vital major causes we come to a decision to not upload numerous budget to the portfolio is as a result of numerous issues doesn’t fulfill the Implementation pillar of our technique.

In most cases, those methods may also be expensive but when they don’t seem to be, we query whether or not the lively supervisor can execute persistently.

Most of these technique seems excellent on a slide deck, the massive query is whether or not they may be able to put in force and execute what they stated out to do smartly, and over an extended time period.

The staff were managing lovely smartly the previous 3 years in a marketplace the place derivatives are affecting markets an increasing number of.

However except implementation, I at all times ponder whether there are the “unknown knowns” or the stuff others find out about that the executive don’t find out about that might marvel and kill the fund. The staff at Simplify founded their industry on structuring merchandise round choices and I want to suppose they’re refined on this space.

I assume there’s chance in all methods. Lets argue that regardless of how a lot I find out about equities, we can not rule out issues changing into unhealthy dramatically in some way that we battle to consider.

This brings us to how this may have compatibility into your portfolio.

The Function of SVol in a Portfolio

The returns from our portfolio will come from the danger we take and so our portfolio must be made up of various sorts of chance that we’re compensated for.

SVOL is exclusive in that it lets in us to reap a distinct kind of chance premiums that can be much less correlated with the fairness and glued revenue. Whilst the tailwinds that may get advantages SVOL is an atmosphere this is excellent for equities, there are eventualities the place SVOL will do smartly when equities generally don’t do smartly.

This makes SVOL a excellent various.

Simplify recommends that if we have been so as to add SVOL, we must change a few of our equities allocation with SVOL as a substitute of the mounted revenue allocation.

The product is touted to have a decrease volatility than a portfolio of various equities.

Whilst the product do produce a excellent dividend go back, I believe how to see SVOL is to view its revenue go back to be a part of the entire go back of the fund, as a part of a portfolio founded round an accumulation technique.

Conclusion

SVOL is a fascinating product to review extra from an academic standpoint. I’d upload SVOL to my much less essential portfolio on account of the implementation issues and it’s brief running historical past.

Simplify produced what I believe is a horny complete video that explains the lengthy and brief in their product:

I proportion this with you no longer as a result of I like to recommend it however extra as a result of I need to take this chance to higher perceive a derivative-based, actively controlled ETF. If there are portions of this publish that you simply battle to grasp similar to roll-yield, contango, backwardation, promoting and purchasing out-of-the-money choices, which means that this product will not be so appropriate for you.

If I take into consideration what makes an revenue flow extra powerful, it’s one the place what drives the revenue isn’t just mounted revenue or equities however via different chance components.

Harvesting the premiums from different dangers turns out to suit the invoice.

I will be able to most certainly record again on how the dividend withholding tax may be handled.

If you have an interest in top yielding merchandise like SVOL, you may well be enthusiastic about my deep dive on the 12% yielding QYLD and an identical lined name writing ETFs.

If you wish to industry those shares I discussed, you’ll open an account with Interactive Agents. Interactive Agents is the main low cost and effective dealer I exploit and agree with to speculate & industry my holdings in Singapore, the US, London Inventory Alternate and Hong Kong Inventory Alternate. They let you industry shares, ETFs, choices, futures, foreign exchange, bonds and budget international from a unmarried built-in account.

You’ll be able to learn extra about my ideas about Interactive Agents in this Interactive Agents Deep Dive Collection, beginning with the way to create & fund your Interactive Agents account simply.