What Will Pressure the Returns of My Portfolios

I ended writing a part of my notes phase for some time as a result of there used to be some stuff that I must get thru earlier than writing about my revenue portfolio implementation.

One in all them is a put up about my psychological style and the way I take a look at returns.

Why is that necessary?

Should you don’t remember the fact that neatly, you are going to have numerous questions.

So, I determined to jot down this put up. This put up is ready 4,500 phrases, however should you don’t need to learn such a lot, the fast model is that my view is returns are pushed through other varieties of systematic menace and systematic mistakes made through quite a lot of teams of other people.

I’m really not positive what sort of returns I will be able to get at some point, however with historic returns information, I will get a excellent sense of whether or not the hazards that I take can be neatly compensated.

So I personal a portfolio make up of dangerous stuff like such an indication:

The portfolio is risky however most probably it averts the type of dangers that I don’t want to tackle such as though I wager on a sector like A.I and I’m incorrect, my revenue or wealth construction is impeded seriously.

I take a look at my very best to diversify the kind of menace publicity as a result of there are occasions when returns from some menace issue display up whilst any other isn’t paintings. Being various sufficient clean issues out behavorially.

The remainder of the item is the lengthy model.

Here’s the header level shape for me to concentrate on:

- Why can we wish to consider returns?

- What is predicted returns? How can we get sure anticipated returns?

- What drives returns in our investments? Taking dangers.

- Dangers may also be unhealthy regardless of the prime attainable returns, how can we save you the chance of destroy? Diversification.

- Proudly owning the hazards of a marketplace phase. The Index Portfolio.

- The emergence of computer systems and knowledge assortment permits us to modify how we view the drivers of returns.

- Instead of market-beta, are there different dangers with proof that they compensate us for risk-taking?

Many people are fairly enamored with producing returns however why is go back necessary to us?

That can be a excellent position to start out.

Why Do We Want to Suppose and Generate a Go back?

The primary reason why is that we’ve got a monetary function and to reach that function, we want some go back.

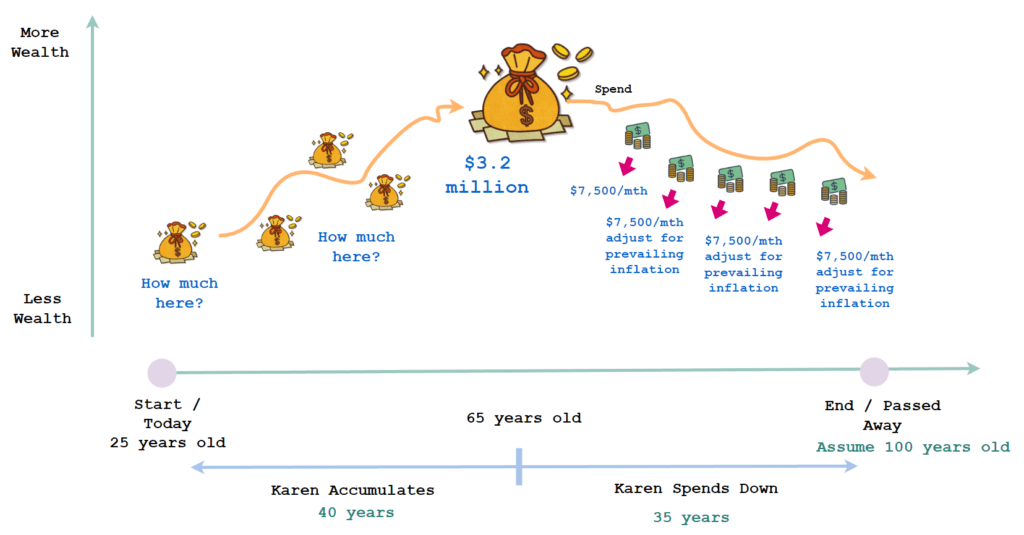

Your monetary function may well be to succeed in retirement or monetary independence like a Karen under:

We calculated that to have an inflation-adjusted revenue of $7,500 per thirty days, Karen wishes $3.2 million.

To succeed in that, Karen wishes to position in some capital, which depends upon whether or not she has but additionally a definite price of go back she use in her plan.

If Karen achieves 20% a yr if truth be told then she is going to achieve this function previous but when she achieves 2% a yr, then her function may must be driven again.

However What’s the Proper Charge of Go back to Use?

It is a excellent query.

We don’t have a crystal ball to look into the longer term to inform what’s going to earn excellent go back and what’s going to earn deficient returns at some point so we continuously take a look at what labored neatly up to now to come to a decision:

- What can assist us to construct wealth?

- How a lot is the velocity of go back shall we get, if we put money into that technique or safety lately?

Excellent planners attempt to use a cheap price of go back in accordance with the proof of the previous that leans relatively extra conservative (however what we see in the market is numerous making plans returns in accordance with very positive sequences).

Charge of Go back Lend a hand Us to Determine the Appropriate Funding Software and Technique

With a price of go back of say 4.5% annually for example, Karen can determine how a lot in lump sum she wishes to position in and on a ordinary foundation.

Or if Karen prefers to dedicate extra capital as a result of F.I. is a very powerful function for her, the monetary math can assist her determine what’s the minimal price of go back she wishes to reach.

And that may tell us what are the correct funding tools or technique Karen wish to allocate her capital into.

The velocity of go back guides to let us know whether or not we’re most probably to succeed in our targets and that is why it is necessary.

Charge of Go back Makes a Distinction within the Luck Odds in Source of revenue Making plans Throughout Spending Down.

Common readers of Funding Moats would know that I don’t believe the velocity of go back in our investments inside of our revenue solution to be a very powerful standards that resolve general luck (the income-to-capital ratio or secure withdrawal price ‘SWR’ is)

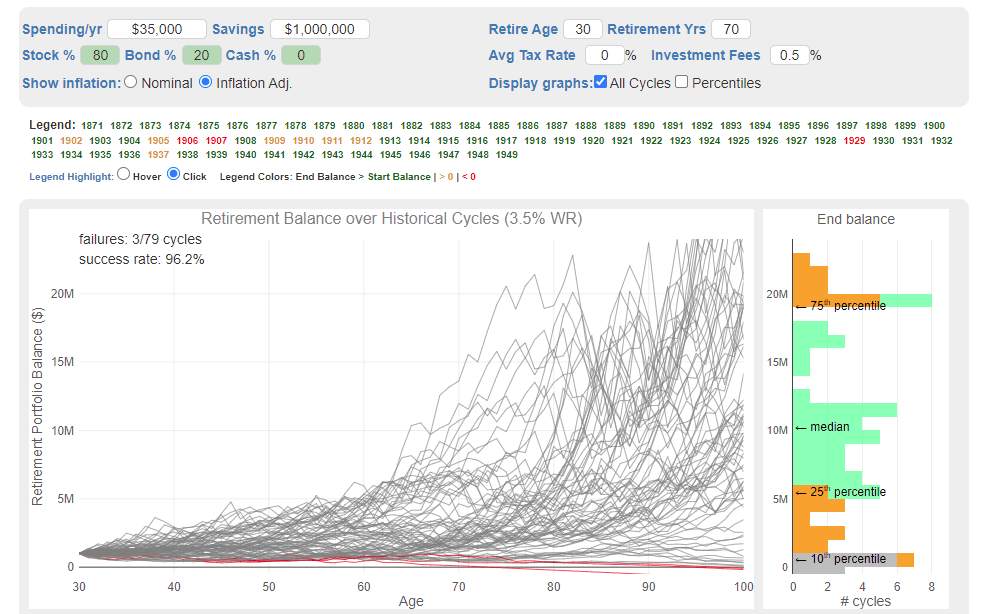

The chart above displays that if we will return in historical past from 1871 to lately, and we believe us residing thru all of the conceivable 70-year retirement classes, do we revel in retirement luck or run out of cash. On this case, out of 79 distinctive 70-year classes, the retiree ran out of cash in 3 of them. I received’t move into the element as a result of that isn’t the level.

Every of the ones 79 distinctive 70-year classes have a singular price of go back. Those are represented through the 79 strains in that chart. Some are very prime, some prime, some low, some very low.

Whilst returns subject, inflation and what sort of you spend subject as neatly.

It is necessary for us to appreciate the stage of returns in general luck charges.

What’s Anticipated Go back?

So, we wish to succeed in our monetary targets, and returns are a very powerful phase.

You can be excited by what your go back looks as if at some point.

You can be questioning about your anticipated go back.

The predicted go back is the go back you are expecting. Now a few of you could need to homicide me for pointing out the most obvious however for each and every more or less funding technique, asset magnificence, safety, packaged product, you might be expecting a go back in order that this technique or funding asset mean you can achieve your monetary function.

What anticipated returns imply is:

- It is important to purchase the product at a selected worth.

- Someplace at some point, you need to promote it.

- The variation can be your achieve.

All this may increasingly happen at some point.

If we calculate the returns on an funding that has been bought, towards the cost we purchase at, this is discovered go back. Normally, we measure our returns through dividing the returns over the annual time frame we put money into what we name annualization. That is in order that we will relate to the go back.

Some would problem me that there are some funding property that you are going to by no means promote as you handed directly to the following era.

Smartly… you do see at some bring to an end and it may be all through property switch. You purchased it for $20,000 however as you kicked the bucket, we price what you purchased at $2.5 million earlier than switch and so the variation between $2.5 mil and $20k is your discovered go back if we mirror upon your possession of that asset when you find yourself alive.

Does your discovered go back fit as much as the returns you are expecting?

That could be a excellent query.

It’s possible you’ll no longer need to delve such a lot up to now however are extra on what are the returns you can get at some point for a amount of cash you want to allocate.

It is very important word that maximum people want for an anticipated go back that fits our monetary function (seek advice from the former phase).

Now we have a bias that the worth we bought the funding asset at is far upper than the cost we paid for the funding asset. If I purchase an exchange-traded fund (ETF) such because the VWRA or a REIT like Mapletree Commercial Accept as true with at is $100,000, I need to be sure that I bought VWRA or Mapletree Commercial Accept as true with for a better worth. Maximum continuously no longer simply upper, however such a lot upper this is similar to X% annually for Y choice of years in order that I will achieve my monetary targets.

Can We Make Certain We Get a Certain Anticipated Go back?

Most of the people are shopping and promoting however no longer everybody makes cash from their shopping and promoting.

We need to build up the knowledge in those trades that we do.

You and I will make “trades” over other frequencies:

- An afternoon dealer buys and sells inside of mins or hours.

- An intermediate-term dealer purchase and preserve securities and promote inside of a couple of weeks.

- A longer term investor purchase and sells after retaining for years.

Trades can happen for buy-and-hold buyers as a result of you’ll be able to at all times price your funding property as should you bought them lately on the present worth.

What we be told continuously is that buying and selling is tricky however buying-and-holding technique has better luck price in incomes a excellent anticipated go back.

There are excellent investors who’ve mastered the behavioural facets, discovered their edge and are self-discipline. That will determine as neatly, however we will be able to continuously describe that making an investment over longer term (or on this case very, very longer term buying and selling on very, very low buying and selling frequency) is more uncomplicated for the Reasonable Retail Joe that has an afternoon process such as you and me to earn sure anticipated go back this is ok to succeed in our monetary function.

However what drives anticipated go back?

Returns are Pushed through Our Chance Taking. However Do You Get Compensated Smartly Sufficient for the Dangers You Take?

What drives returns is taking dangers.

There are lots of more or less menace similar to attainable deviation of marketplace worth consequence inside of a definite time frame (volatility), rate of interest menace, default menace, nation menace, menace in illiquidity.

Many would say an funding have prime returns and due to this fact the chance is prime.

A extra proper method is that the hazards are prime, and due to this fact we HOPE the returns are prime to make amends for the chance we tackle.

Which means that if we wish prime returns, we need to tackle prime dangers.

However we may no longer get the prime returns:

- If we sooner or later get the prime returns: Our risk-taking is claimed to be compensated. There’s a sure menace top class.

- If we sooner or later don’t get returns however lose cash: Our risk-taking is claimed to be uncompensated. That is a unfavorable menace top class.

- Time frames do subject.

So therefore we continuously say top class is repayment for menace taking.

Aren’t the Dangers on Some Funding Very Low However They’ve Prime Returns?

The dangers in some apparently prime returns, low menace investments are hidden.

Extra subtle buyers would possibly know of the chance examine to you. Or all people failed to acknowledge the chance earlier than hand.

A excellent instance is CPF SA this is very liquid, but very prime at 4% p.a. We see not too long ago within the govt coverage shift that it will get taken away. You’ll nonetheless earn the 4% through moving for your CPF RA account, however you are taking on illiquidity dangers, no longer getting access to your cash.

Some would say making an investment within the S&P 500 could be very low menace.

However going through this principle, if everybody thinks that the blue chip US firms are so low menace. and are keen to pay a better worth for the gang of businesses, the speculation would imply that making an investment in US blue chips must yield a decrease long term anticipated returns.

Investments that experience Low Chance and Correspondingly Decrease Returns

The constant revenue securities issued through Amazon or Microsoft have very low yield-to-maturity.

It is because they have got such a lot money on their balanced sheet, their industry produce a ton of loose money float, and mainly they don’t want the cash.

The chance of lending cash to those firms glance low, and the prospective returns glance to mirror that.

Now, examine that to the constant revenue factor through an organization like Carvana. The yield-to-maturity is north of 10%.

No longer All Your Chance Taking is In the end Compensated with Returns.

A few of you may have began companies one day on your existence or paintings in younger industry.

How is that have for you?

The fair ones will admit that no longer all industry undertaking determine. Some are fortunate to get again their most important however many misplaced their most important and deal with this as a excellent lesson that issues don’t seem to be as simple as we expect.

However the Towkay that be successful earns significantly better than many.

Because of this we word issues as take menace and hope we get compensated.

The Presence of Visual and Invisible Dangers Would possibly Be What Drives Returns in Mixture.

I’ve collated a couple of charts and illustrations to turn you the hazards which you could no longer know of making an investment in person firms:

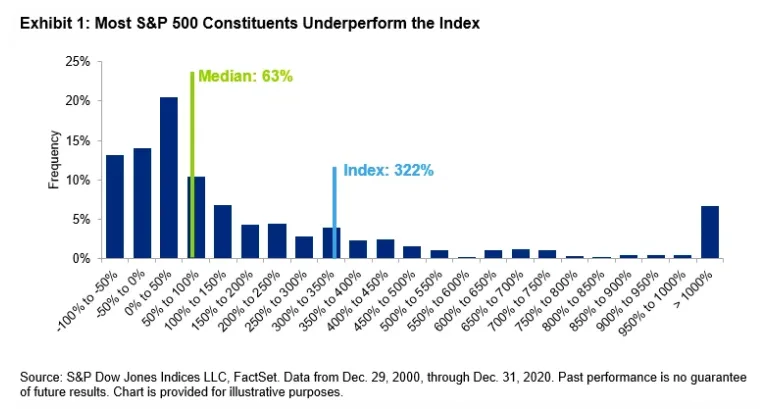

The chart above displays that if we measure the cumulative returns of person shares within the S&P 500 no longer they all generate income regardless of us making an investment for the long run. About 20-25% is under 0%.

If we measure the surplus lifetime returns or the returns above the typical of the index, the median and under choice of shares doesn’t earn extra lifetime returns. The index efficiency is skewed through a small choice of shares or firms with oversized returns.

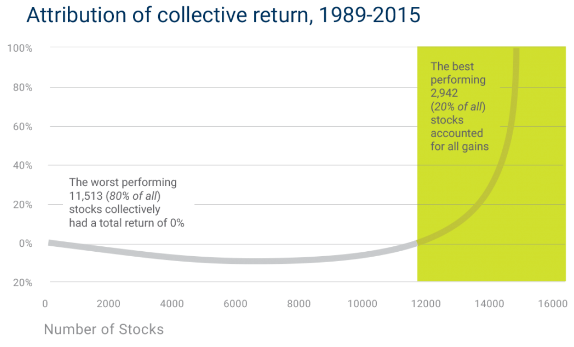

In an in depth research of 14,000 publically traded shares in america during the last 30 years, it’s discovered that 20% of publicly traded US shares have accounted for nearly all of the S&P 500 beneficial properties since 1989.

Those information let us know that there are dangers of your capital being very impaired, should you put money into a definite method, or proudly owning a gaggle of shares.

And those dangers is also visual or invisible to you.

However it’s this dangers that can give the presence of doubtless upper returns.

Wait… I believed Returns had been Pushed Basically through the Money Flows of the Underlying Asset?

Smartly, sure and no.

Some would say that they personal actual companies.

For instance, if I personal a REIT similar to Manulife US REIT, the REIT owns place of business constructions and there may be apartment money flows, then that’s the necessary factor?

In the similar case, if I personal a hard and fast revenue bond issued through Capitaland that can pay me a semi-annual coupon of two% over 5 years, there’s a contractual legal responsibility to pay me the cash and that drives returns isn’t it?

In each instances, we wish to ask once more:

- What’s the worth we purchase at?

- What’s the worth we promote, or test its valuation at?

The dominant pressure in play this is that shall we pay a prime worth for a money float this is a lot lesser, or getting lesser and lesser.

That is the cost chart of a local-listed REIT Manulife US REIT:

I don’t like to make use of this case as a result of a few of us may have PTSD from our possession of it, however I assume that is an instance. Once we personal it at $1.00 or so, the valuation is baked within the expectation of long term money flows that substantiate that $1.00 or so valuation.

The ones are actual money flows generated through actual homes.

In hindsight, the basics briefly time period trade and the marketplace revalues the REIT since the marketplace feels our money float expectancies once we purchase at $1.00 or so is wildly positive and long term money flows could be considerably decrease.

On this instance, actual money float however our realised returns does no longer catch up with our anticipated go back once we acquire it at $1.00.

Hindsight, it’s most probably we overpaid for our investments, which drives house the purpose that anticipated returns is how a lot we purchase at and what sort of we promote at.

The money flows subject extra fundamental-wise to verify the cost we pay for however additionally it is how a lot we paid for it sooner or later.

Every other excellent instance is PayPal right here:

Some buyers had been positive in regards to the long term money flows, and of their minds, the anticipated go back is upper but when we bought off our stocks lately, our discovered returns could be very other.

The fee we pay turns into necessary.

What in regards to the Dividend Money Glide that We Earn, Kyith? How must I take a look at that within the Context of Anticipated Go back?

A inventory that distributes dividends is similar. In reality, dividends are paid out of profits and we simply mentioned profits and money float.

So dividends is much less of a dialogue.

If Dangers pressure Returns, and We May Lose All Our Cash if Dangers are No longer Compensated, Then How Do We Make investments?

We will make investments, however we must be various sufficient!

Being various sufficient prevents us from taking up sure dangers that don’t seem to be smart.

I might continuously ask ourselves two questions:

- What are the hazards that should you tackle, however don’t determine, you is not going to forgive your self?

- What are the hazards that should you don’t tackle, you could no longer forgive your self if it really works out?

Those questions don’t lead to binary consequence. There are menace you are taking on that didn’t determine however it’s going to no longer have an effect on your existence and there are dangers that you simply don’t tackle however you might be k regardless of a excellent eventual consequence.

Should you resolution those questions honestly, the solution is a various portfolio.

Diversification additionally has any other benefit that can don’t understand: They will let you seize the returns of investments that carried out neatly.

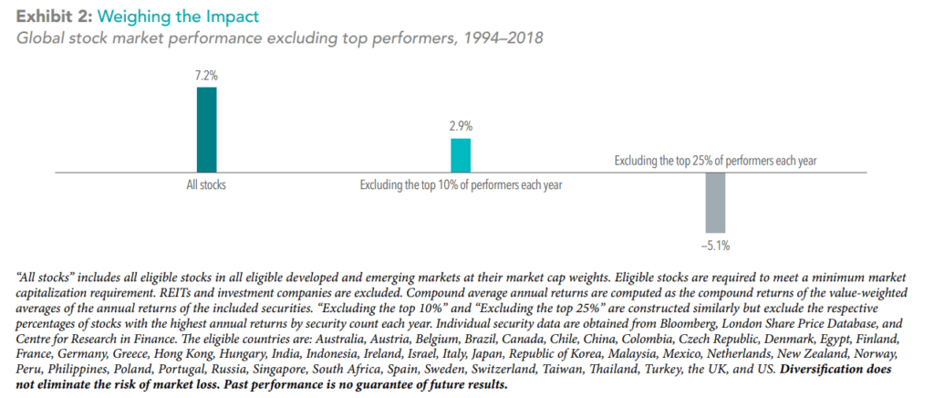

The chart under displays the efficiency of the worldwide inventory marketplace:

If we view the efficiency of all of the shares thought to be, the go back is 7.2% p.a.

But when we exclude the highest 10% of the marketplace performers each and every yr, the returns drop from 7.2% to two.9% p.a.! If we exclude the highest 25% of the performers, our returns change into -5.1% p.a.

What this displays is that diversification is robust no longer simply to mitigate problem dangers but additionally upside seize.

Keep in mind the charts that the returns of the median shares and under are deficient relative to the highest performers? Diversification is how you’ll be able to be sure that your portfolio stands a superb opportunity to seize the upside.

Making an investment in A Varied Portfolio

Whilst you put money into an ETF like VWRA, successfully, you might be retaining a various portfolio of advanced and rising marketplace shares. Should you preserve the CSPX, which is an ETF that tracks america Massive Caps. Should you preserve the EIMI, you put money into a basket of rising marketplace shares. Should you preserve a REIT ETF, you personal a basket of REITs.

This is similar for constant revenue.

In finance, we are saying there are two types of dangers:

- Non-Systematic Dangers: The dangers this is attributed to a selected constant revenue or corporate.

- Systematic Dangers: The dangers that have an effect on an general marketplace, or marketplace phase.

Once we diversify, we do away with the non-systematic dangers leaving us with the systematic dangers.

We’re nonetheless affected if there are occasions out there that have an effect on general profits expansion, dangers, margins similar to inflation, geopolitical occasions.

However should you personal 3 Singapore firms and an atomic bomb lands in Singapore, the have an effect on can be a ways more than proudly owning a portfolio of neatly various equities.

Returns in a Varied Portfolio is Pushed through the Dangers that the Portfolio is Uncovered To

If we upload all we be told in combination, that our function is to possess a portfolio made up of dangers as a result of a portfolio of dangers:

- Scale back the probabilities of unmarried blow-ups killing our capital.

- Earn sufficient returns for our monetary targets.

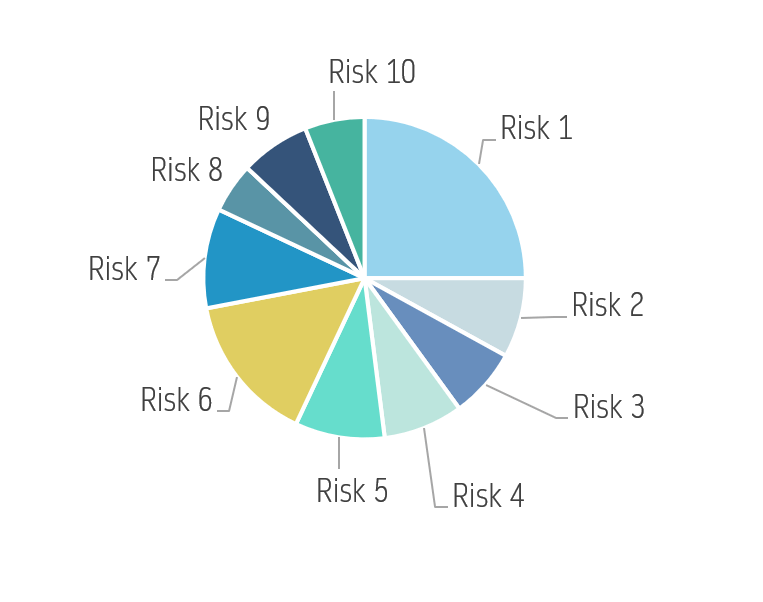

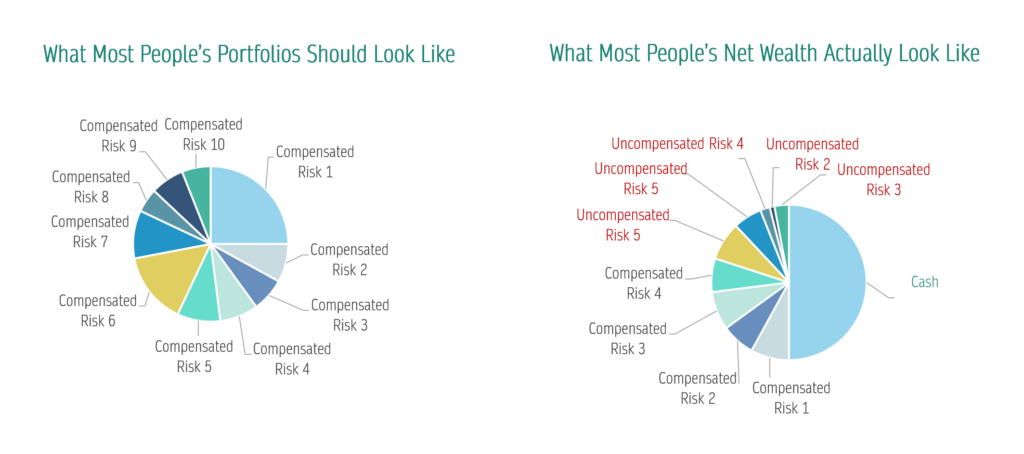

So that is what a portfolio looks as if:

This will likely fxxk with other people’s brains as a result of normally, they’re going to see a pie of various returns whilst I favor to steer with dangers.

Our long term anticipated returns, can be resolve through the returns for taking the ten dangers on this portfolio for example.

However is there a method to know what sort of returns we will be able to earn?

The Index Portfolio – A Portfolio that Owns the Marketplace Chance of a Phase of the Marketplace

What if shall we personal a basket of shares this is investable around the globe? What if shall we personal a basket of fixed-income tools this is investable around the globe?

That is the idea of the advent of index finances or index exchange-traded finances (ETFs).

Within the early days of the actively-managed unit accept as true with business, managers sought after to have a method to measure that they may do rather well so sure firms create those indexes that personal other marketplace segments similar to US firms, German firms, US Treasury expenses of 10-year tenor, Funding-grade bonds.

You may well be accustomed to indexes similar to:

- MSCI Global

- S&P 500

- FTSE-All Global Index

- FTSE 100

- STI Index

Fund managers of actively-managed finances measure their efficiency towards those indexes. Jack Bogle of Leading edge used to be amongst the ones early ones who surprise: As an alternative of making an investment within the energetic finances, why no longer simply create a fund that tracks the index and personal the index?

In order that gave delivery to the index finances or ETFs similar to SWDA, CSPX, VWRA, ES3 (those are the ticker symbols to the ETFs).

Whilst you personal those ETFs, you achieve the chance publicity similar to the basket of underling securities and due to this fact the eventual returns.

Normally, those indexes seeks to constitute the efficiency of the marketplace phase.

Thus, once we personal those index ETFs or unit trusts, we take at the menace of making an investment in a whole marketplace phase, or marketplace menace.

The Emergence of Computer systems and Therefore Marketplace Go back Information Gave Buyers a Glimpse if We’re Compensated Our Funding Chance Taking.

Possibly one of the most largest innovation used to be the emergence of the computer systems within the Sixties and Nineteen Seventies.

Because of that, the researchers up to now can codify and file down the returns of shares and different monetary tools.

With that, the researchers is in a position to analyze the knowledge and decipher various things.

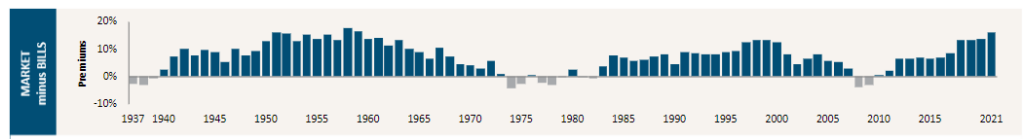

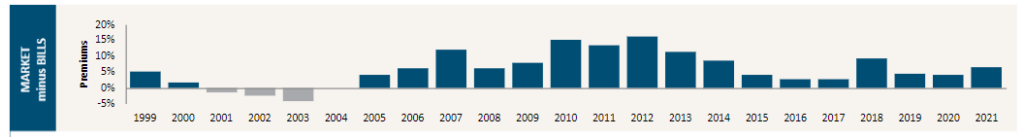

For one, it permits us to look through taking menace and put money into equities, is there a marketplace menace top class:

The chart above displays america fairness returns minus Treasury expenses. The variation permit us to look whether or not making an investment in equities over risk-free bonds is compensated with a top class.

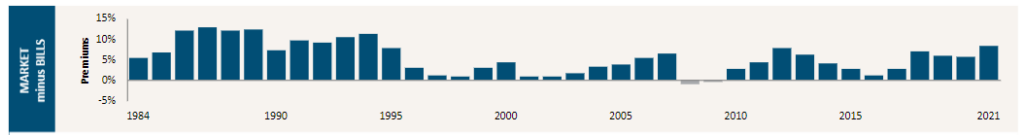

That is advanced ex US.

That is the rising markets.

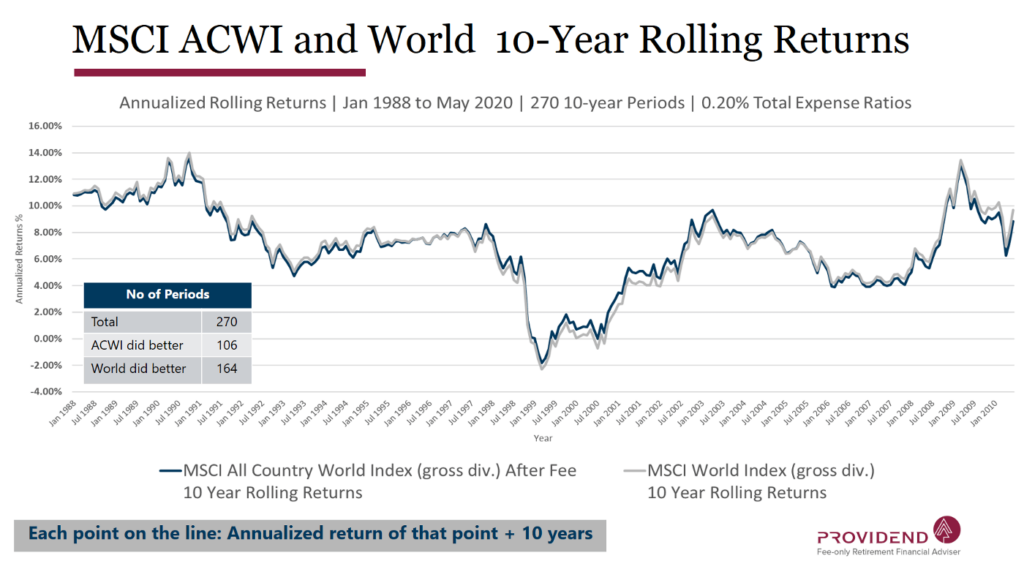

With information it additionally permit us to achieve self assurance in whether or not we will be able to be compensated if we make investments lengthy sufficient:

The above chart displays the 10 yr rolling returns of the MSCI All Nation Global Index (Evolved + Rising Markets) and MSCI Global (Evolved Markets). The knowledge let us really feel kind of what’s the returns to be anticipated.

There is not any constant go back and in sure 10 yr classes, the returns may also be unfavorable.

This displays that there’s menace of no longer understanding, and that is the chance that permit the opportunity of the upper go back.

The long run would possibly not glance very similar to the previous, however the previous provides us the most productive glimpse of the go back possibilities.

What We Need is to Craft a Portfolio of Compensated Dangers

I drew the next representation in my video Crafting an Preferrred Passive Funding Portfolio for Your Lifestyles Objectives:

Most of the people could have a portfolio at the proper as a result of many portions in their portfolio isn’t too evidenced founded. They finally end up with a portfolio they’re disillusioned with.

With the proof of historical past (information), we need to craft a portfolio with

- A less assailable basis founded round dangers that we’ve got a better chance of having compensated.

- Be various no longer round only one menace however extra in order that when one menace issue is correcting, different menace elements clean out the returns.

Excluding Marketplace Dangers, Are There Different Distinctive Compensated Dangers?

Marketplace Beta – The Unique Issue or Compensated Chance.

Within the Sixties, the main style to style returns and menace is the Capital Asset Pricing Style or CAPM for brief. In William Sharpe’s 1964 paper Capital Asset Costs: A Idea Of Marketplace Equilibrium Beneath Stipulations Of Chance, he describes menace within the CAPM framework because the sensitivity of an asset or portfolio and the chance of the whole inventory marketplace.

A market-cap weighted fairness index fund would have a marketplace beta of one. If we fill the portfolio with 50% money as an alternative of 100% fairness, the beta of the portfolio can be 0.5. If a 100% fairness portfolio move up through 10%, the portfolio with 50% money will move up through best part or 5%. The marketplace beta measures the sensitivity of the portfolio to marketplace menace.

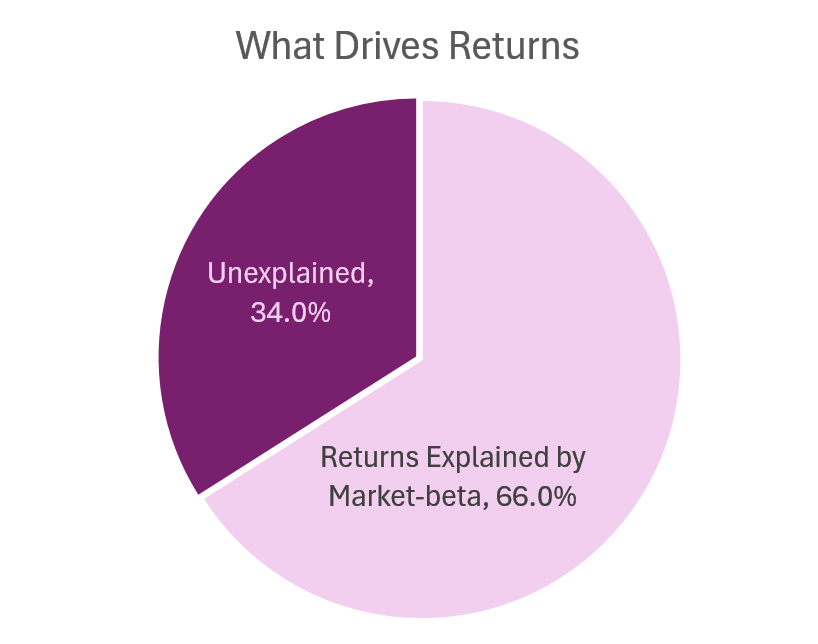

The CAPM says that 66% or 2/3 of the whole returns we will be able to earn may also be attributed to marketplace beta.

What in regards to the different 33%?

There is not any simple method to give an explanation for and so we name that portfolio supervisor talent.

Again then, we will best examine two portfolios with marketplace menace. If two portfolios have the similar beta, the variation in go back is attributed to the portfolio supervisor’s talent in inventory variety. If a portfolio supervisor can ship a better go back with the similar beta, other people would need any such supervisor. This supervisor is claimed so that you can ship Alpha.

Extra time, the CAPM is proven to be unsuitable through a sequence of additional analysis:

- 1981 – Rolf Banz – Small Shares had constantly upper reasonable returns that might no longer be defined through their marketplace beta. In different phrases, considered throughout the CAPM lens, small shares are producing Alpha, which feels bizarre.

- 1985 – Worth shares have upper returns, which can’t be provide an explanation for through marketplace beta.

Those analysis appear to give an explanation for that the marketplace isn’t too environment friendly and due to this fact some portfolio supervisor can constantly earn Alpha.

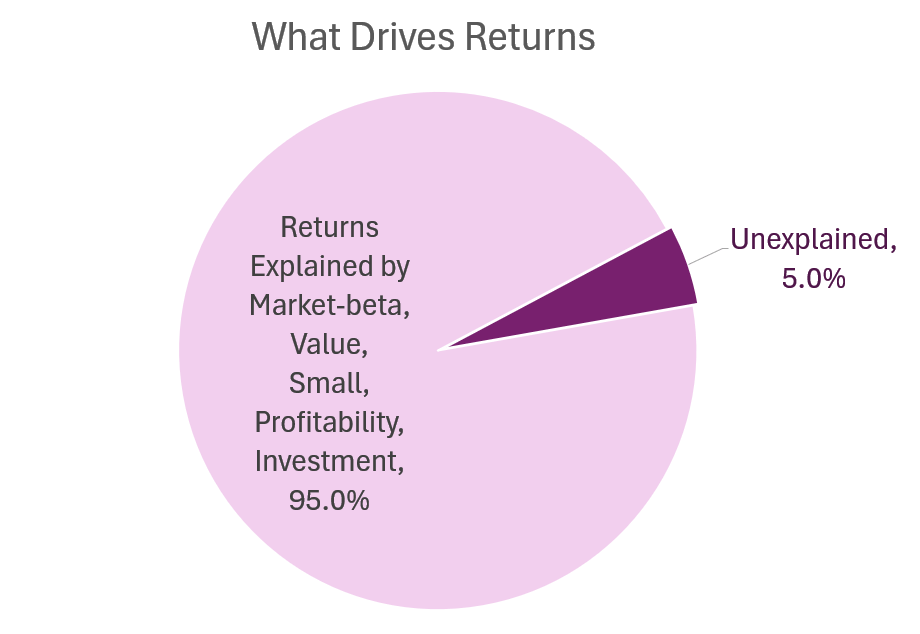

Fama-French Previously Identifies Different Compensated Dangers of their 3 or 5-Issue Style Research.

Eugene Fama and Kenneth French tested the knowledge and proposed that the marketplace isn’t inefficient however that different dangers had been unaccounted for.

Those dangers imply that the upper go back has some price and isn’t “loose cash.”

Of their Fama-French 3 Issue Style, the 2 proposed two extra up to now unidentified dangers which assist to give an explanation for the variation in returns at the side of marketplace dangers:

- Marketplace Beta

- Small Dimension

- Worth

After they added those two elements at the side of marketplace beta, the Alpha noticed in price and smaller shares disappeared.

Those 3 elements provide an explanation for 90% of the go back distinction between various portfolios.

Fama and French sooner or later known two extra dangers elements of their Fama-French 5 Issue style:

- Marketplace Beta

- Small

- Worth

- Profitability / High quality

- Funding

Those 5 elements provide an explanation for 95% of the returns distinction between various portfolios.

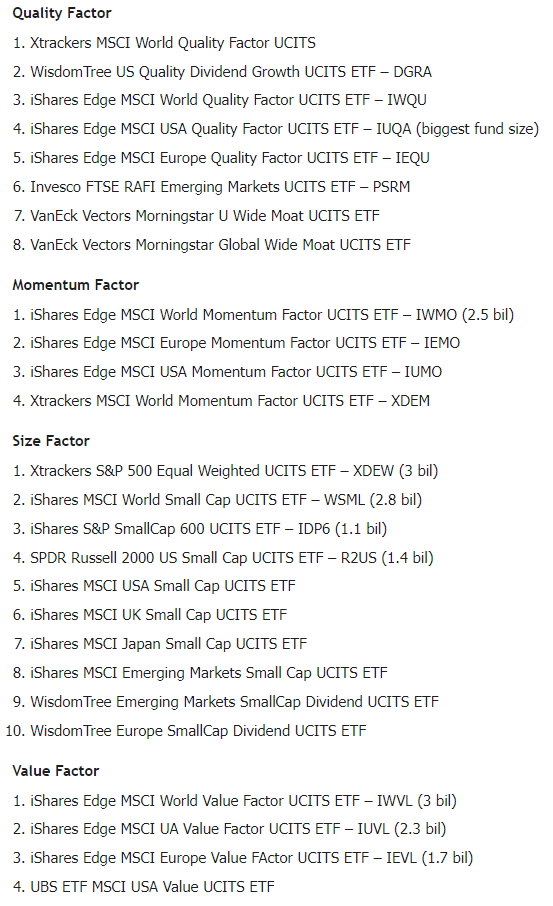

The Upward thrust of ETFs and Unit Trusts that Give Us Publicity to Those Components.

Now we requested ourselves a query:

If you wish to have a prime chance of incomes a prime anticipated returns, and if returns, in accordance with information display that majority of the returns may also be because of those elements, what would you do?

One of the most resolution is also to craft a portfolio that has publicity to those dangers spaces.

That is how I designed my portfolio.

Up to now, if in case you have a philosophy in opposition to price, or momentum, or making an investment in top quality firms, you want to discover a fund supervisor that has that philosophy and are exceptionally excellent at their process.

Now, you may have those Sensible Beta or issue finances that will let you specific those philosophy. I shared extra in Intro to Sensible Beta Passive Making an investment for Singaporeans.

Dimensional Fund Advisers is a reputation this is extra acquainted on this a part of the sector that has finances tilted in opposition to some elements.

Here’s a peek (non-exhaustive) on the different ETFs this is to be had at the London Inventory Change:

Have We Surfaced All of the Compensated Dangers Identifiable?

I need to suppose we haven’t.

Researchers are motivated to seek out new elements which are homogenous and provide an explanation for the variation in portfolio efficiency to be able to win analysis awards to advance their very own place. Finance business also are motivated to discover a special approach to promote to you.

Up to now, we’ve noticed a couple of analysis paper that comes out to give an explanation for those distinctive elements from small, to worth, then momentum, then high quality, with not too long ago extra on illiquidity.

I don’t suppose it’s the finish.

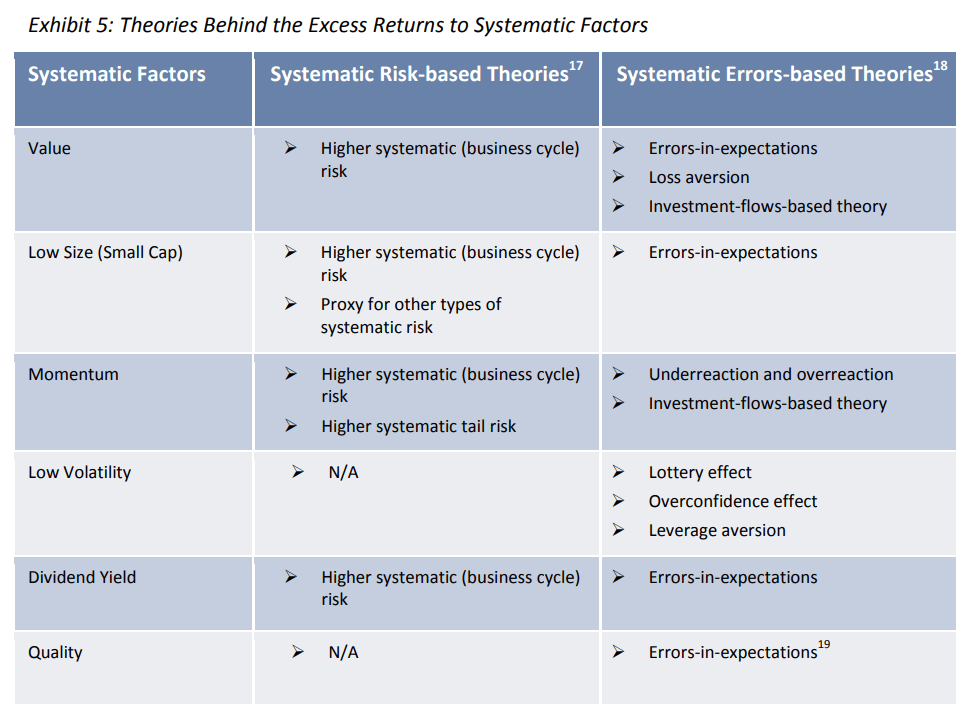

Excluding Dangers that Drives Issue Returns, Are There Different Drivers of Issue Returns?

In an previous phase, I shared that what drives returns is whether or not we take menace and whether or not we’re effectively compensated for the chance we take.

There are some who imagine that any other dominant pressure in play is the behavioural component.

As a collective, or other workforce of other people tend to be very positive, pessimistic about other securities at one time and this give upward push to the presence of things.

MSCI has one of the most higher framing for this in MSCI – Foundations of Issue Making an investment. (It is a excellent learn for the ones ).

They provide an explanation for that this can be a debate and the proponents normally fall into two camps:

- Systematic Chance-Based totally Theories: Those theories suppose that markets are environment friendly and that elements mirror “systematic” assets of menace. In addition they suppose that buyers are rational.

- Systematic Mistakes-Based totally Theories: Buyers show off behavioural biases or are topic to other constraints (e.g., time horizons, talent to make use of leverage, and many others.). Those elements exist as a result of buyers systematically make “mistakes.”

There are a lot of analysis that enhance each theories, and MSCI summarizes issues within the following desk:

Chance-based have a greater reason for Worth, Low Dimension, Momentum and Dividend Yield. Mistakes-based have a greater rationalization for the majority issues.

Which one do I imagine in?

I believe as an mixture the marketplace isn’t fully environment friendly, however proof have proven that even supposing it’s inefficient, no longer everybody people can benefit from that inefficiency. The marketplace continuously tries to reprice issues to mirror truthful price and we must acknowledge that. In fact, there are markets which are much less environment friendly similar to the true property marketplace.

I do suppose that as an mixture, human beings can not shed sure behaviours. We grew overconfident that developments last more, or too pessimistic that developments can not flip. We’re too pessimistic over shares that show off actual high quality and too positive about different issues.

What this phase manner is that there are authentic drivers of why we might get excellent (and deficient) returns.

If if truth be told, the hazards of making an investment in equities are decrease lately than up to now, returns are going to be decrease. However that can steadiness off if human beings doesn’t trade as we continuously makes mistakes.

Conclusion

And that is the prolonged model of what I believe drives returns.

I’m wondering what number of people take a look at issues similarly. It took a few months of flipping portions of those returns stuff in my head earlier than coming to this. Confidently it’s coherent sufficient.

What drives returns is necessary in that if what drives returns isn’t dangers or behaviour however one thing else, then my whole portfolio is also setup wrongly.

So I felt pressured to position this out earlier than the real portfolio notes.

Which must be the following one.

I invested in a various portfolio of exchange-traded finances (ETF) and shares indexed in america, Hong Kong and London.

My most popular dealer to industry and custodize my investments is Interactive Agents. Interactive Agents will let you industry in america, UK, Europe, Singapore, Hong Kong and lots of different markets. Choices as neatly. There are not any minimal per thirty days fees, very low foreign exchange charges for forex replace, very low commissions for quite a lot of markets.

To determine extra talk over with Interactive Agents lately.

Sign up for the Funding Moats Telegram channel right here. I will be able to proportion the fabrics, analysis, funding information, offers that I come throughout that allow me to run Funding Moats.

Do Like Me on Fb. I proportion some tidbits that don’t seem to be at the weblog put up there continuously. You’ll additionally make a choice to subscribe to my content material by means of the e-mail under.

I spoil down my sources consistent with those subjects:

- Construction Your Wealth Basis – If you recognize and practice those easy monetary ideas, your longer term wealth must be beautiful neatly controlled. To find out what they’re

- Energetic Making an investment – For energetic inventory buyers. My deeper ideas from my inventory making an investment revel in

- Finding out about REITs – My Unfastened “Path” on REIT Making an investment for Newbies and Seasoned Buyers

- Dividend Inventory Tracker – Monitor all of the not unusual 4-10% yielding dividend shares in SG

- Unfastened Inventory Portfolio Monitoring Google Sheets that many love

- Retirement Making plans, Monetary Independence and Spending down cash – My deep dive into how a lot you want to reach those, and the other ways you’ll be able to be financially loose

- Providend – The place I used to paintings doing analysis. Price-Most effective Advisory. No Commissions. Monetary Independence Advisers and Retirement Consultants. No rate for the primary assembly to know the way it really works

- Havend – The place I these days paintings. We want to ship commission-based insurance coverage recommendation in a greater method.