The S&P 500 Equivalent-Weight Has Earned MORE than the Usual S&P 500 In spite of the Contemporary Underperformance!

“Simply persist with the biggest firms.”

Those making those feedback won’t have observed the knowledge. Had they observed it, I ponder would they nonetheless how the sort of robust view.

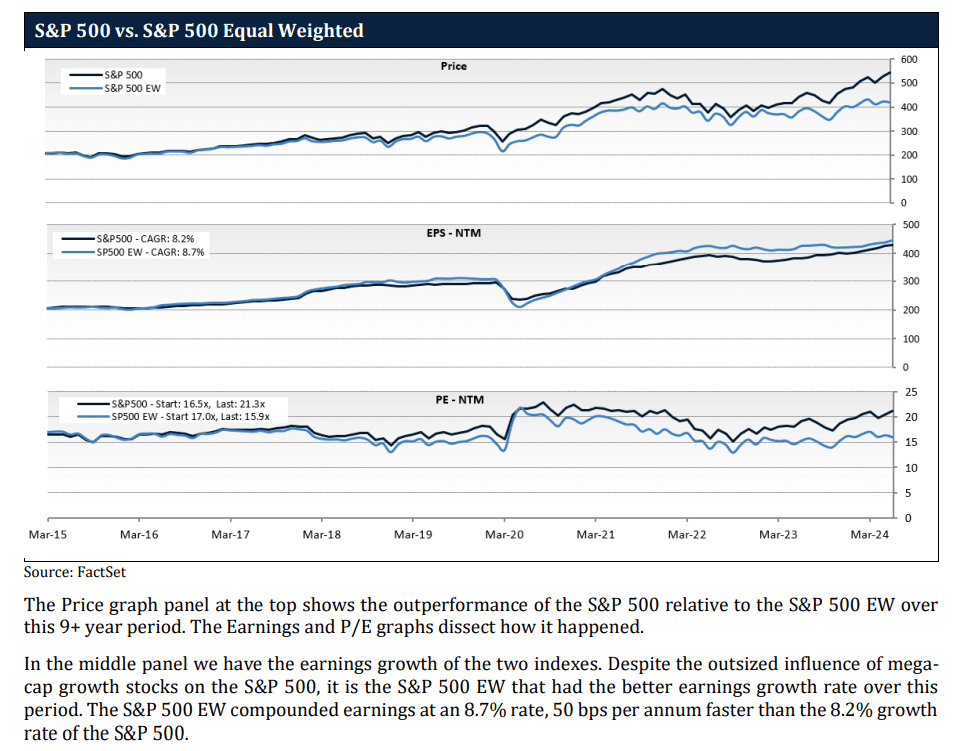

The chart underneath comes from Worth store Lyrical Asset Control in a paper “Caution Indicators”:

The bar charts display the yearly calendar yr efficiency of the marketplace cap-weighted S&P 500 (Your CSPX, VOO and SPY) minus the S&P 500 Equivalent Weight Index. The equal-weighted index flippantly distributes the portfolio around the 500 firms as a substitute of letting the biggest bobble to the highest.

We realize initially that there are relatively a couple of unfavourable bars, which signifies that there are lots of years the equal-weight index outperformed the capitalization-weighted S&P 500.

The chart underneath zoomed in and display us when the hot underperformance begins:

That’s most probably 9 years in the past. I didn’t know it was once that lengthy. And that’s lengthy sufficient for a large number of new traders to have the concept that market-cap weighted has a tendency to win out the equal-weighted index.

We will incessantly believe the equal-weighted index to be a bias against the smaller firms and this situation, inside the biggest US firms.

Does the basics substantiate this underperformance?

There are 3 chars above and the center chart presentations the adaptation in combination profits in line with percentage of the ultimate twelve months over this underperforming length.

You understand… I used to be rattling stunned the mixture EPS for the equal-weighted index is in reality upper all through this era!

That signifies that regardless of these types of communicate of what mega-cap dominance, the basics confirmed an excessively other image. This center chart is effective to me as a result of we don’t incessantly see a supply for the S&P 500 equal-weighted. We see that the distance was once beautiful slender between the 2 index for a very long time and began deviating in 2022.

The ultimate chart presentations the Worth Profits distinction and for those who felt the Marketplace Cap Weighted Index is costly, it’s possible you’ll wish to cross Equivalent Weighted as it by no means were given pricey.

After the Perfect 3-Month S&P 500 Marketplace-Cap Outperformance

I at all times ponder whether 30 is a small pattern dimension and on this case, I felt that the next desk of the sessions the place the S&P 500 outperform the equal-weight by means of so much isn’t relatively giant:

The following one’s three- and five-year efficiency wasn’t nice, nevertheless it was once additionally relatively clustered. Please notice that this isn’t the S&P 500 marketplace cap returns however the relative efficiency.

A Worth Store Will Ultimately Want to Pimp Worth…

This s the similar desk but when we evaluate in opposition to the most cost effective quintile (20%) of the highest 1,000 US Shares:

The underperformance in opposition to the most cost effective large-cap shares glance even worse.

Check out the knowledge and in point of fact mirror upon it.

I feel one of the vital primary underlying message is not to consider what you spot over the past yr, or two years as everlasting.

When you zoom out, the knowledge would possibly average your lens and modify your view issues.

The Exact ETF Struggle: SPY vs RSP

There are ETFs that began because the Aug 2004 length that let us to peer how is the true efficiency during the last twenty years.

This isn’t simply an educational workout however precise efficiency:

The orange line presentations the returns for those who make investments $1 million within the SPY ETF (marketplace cap weighted) as opposed to the RSP ETF (equal-weighted).

For a protracted whilst the equal-weighted has ruled and it’s in reality the marketplace cap weighted this is doing the catching up.

The lesson right here isn’t which is healthier than which however to understand that there are ebbs and flows to this.

There’s a UCITS S&P 500 Equivalent Weight ETF

I attempted to peer if there’s a tax environment friendly ETF so that you can make investments if you want to categorical this tactical or strategic allocation thought.

Turns in the market is the iShares S&P 500 Equivalent Weight UCITS ETF or EWSP.

That is an Aug 2022 included ETF this is domiciled in Eire. It has a 20 foundation level annual expense ratio and the present AUM is ready US $1.5 billion.

Present PE ratio for the gang of businesses is 21 occasions in comparison to 27 occasions for CSPX.

You’ll acquire EWSP thru Interactive Agents.

If you wish to industry those shares I discussed, you’ll open an account with Interactive Agents. Interactive Agents is the main cheap and environment friendly dealer I exploit and consider to take a position & industry my holdings in Singapore, the US, London Inventory Trade and Hong Kong Inventory Trade. They help you industry shares, ETFs, choices, futures, foreign exchange, bonds and budget international from a unmarried built-in account.

You’ll learn extra about my ideas about Interactive Agents in this Interactive Agents Deep Dive Collection, beginning with how you can create & fund your Interactive Agents account simply.