The New 6-Month Singapore T-Invoice in Past due-February 2023 Must Yield 4.0% (for the Singaporean Savers)

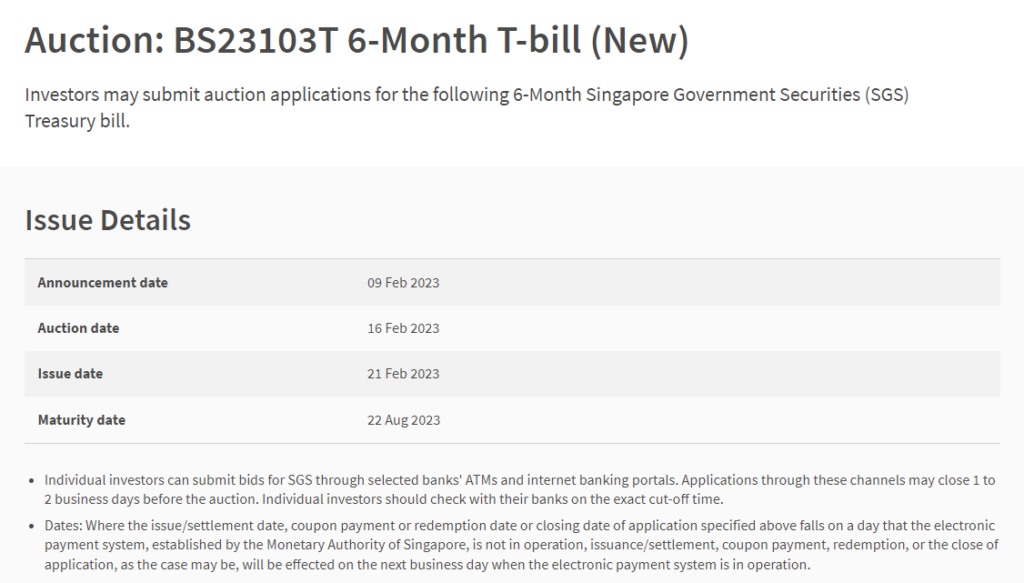

A Singapore Treasury Invoice factor (BS23103T) might be auctioned on Thursday, sixteenth February 2023.

If you want to subscribe effectively, get your order by way of web banking (Money and SRS) or in particular person (CPF) through fifteenth February. You’ll be able to additionally observe together with your CPF-OA and CPF-SA price range, however you would need to move right down to a financial institution (OCBC, UOB and DBS) and do it in particular person. You’ll be able to additionally observe the similar factor together with your money and SRS.

You’ll be able to view the main points at MAS right here.

Up to now, I’ve shared with you the virtues of the Singapore T-bills, their ideally suited makes use of, and subscribe to them right here: How you can Purchase Singapore 6-Month Treasury Expenses (T-Expenses) or 1-12 months SGS Bonds.

Within the final factor introduced two weeks in the past and just lately concluded, the present t-bills traded at a yield of four.02%. In spite of everything, the cut-off yield for the t-bill ended rather shut however decrease at 3.88%.

For the second one time, if you choose a non-competitive bid, you’ll be pro-rated the volume you bid and would yield 3.88%. If you want to be sure you secured all that you simply bid, it is going to be higher to make a choice a aggressive bid, however you wish to have to get your bid proper.

A excellent rule of thumb is to be sure you get what you wish to have and settle for regardless of the cut-off yield bid 50% of the final cut-off yield. On this case, you’ll be able to bid 1.95%. Whether or not the general cut-off yield is two% to 4.3%, your 1.95% bid will assist safe the entire allocation you wish to have.

Gaining Insights In regards to the Upcoming Singapore T-bill Yield from the Day-to-day Ultimate Yield of Current Singapore T-bills.

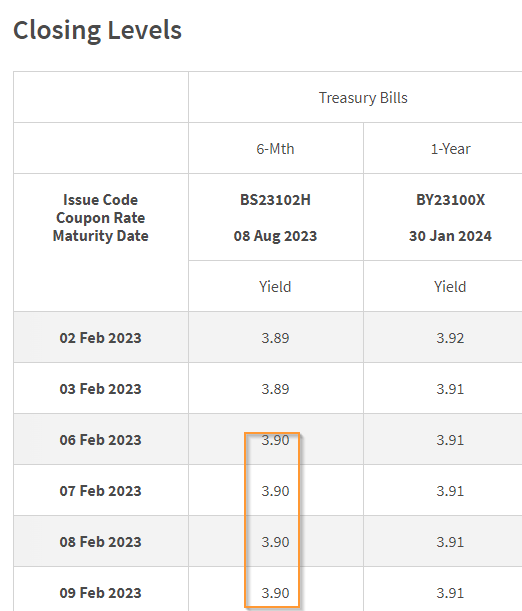

The desk underneath presentations the present pastime yield the six-month Singapore T-bills is buying and selling at:

The day by day yield at ultimate provides us a coarse indication of the way a lot the 6-month Singapore T-bill will business on the finish of the month. From the day by day yield at ultimate, we will have to be expecting the impending T-bill yield to business just about the yield of the final factor.

Lately, the 6-month Singapore T-bills are buying and selling just about a yield of 3.9%, which is moderately upper than the three.88% yield we seen two weeks in the past.

Gaining Insights In regards to the Upcoming Singapore T-bill Yield from the Day-to-day Ultimate Yield of Current MAS Expenses.

Normally, the Financial Authority of Singapore (MAS) will factor a 4-week and a 12-week MAS Invoice to institutional buyers.

The credit score high quality or the credit score possibility of the MAS Invoice will have to be similar to Singapore T-bills because the Singapore executive problems each. The 12-week MAS Invoice (3 months) will have to be the nearest time period to the six-month Singapore T-bills.

Thus, we will achieve insights into the yield of the impending T-bill from the day by day ultimate yield of the 12-week MAS Invoice.

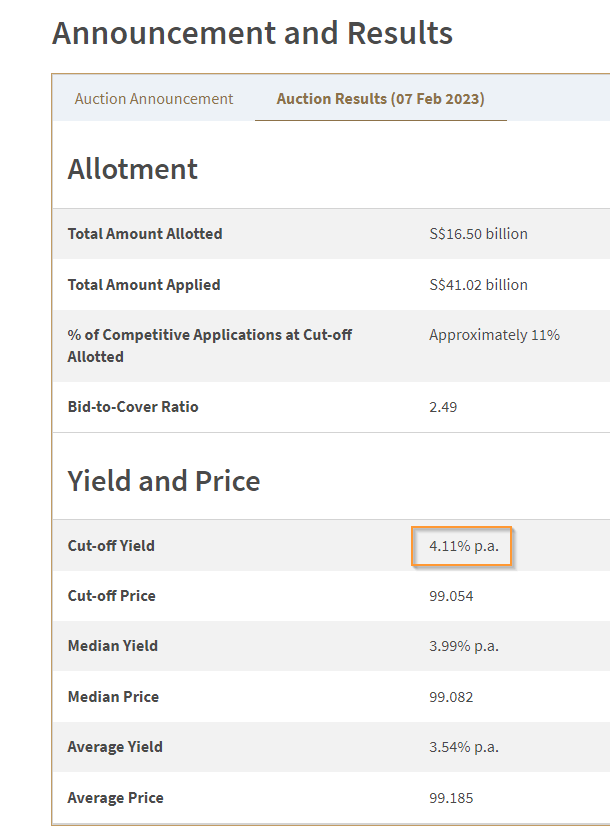

The cut-off yield for the most recent MAS invoice auctioned on seventh Jan (the day before today) is 4.11%. The MAS invoice presentations a slight decline from the final factor two weeks in the past.

Lately, the MAS Invoice trades just about 4.09%.

For the reason that the MAS 12-week yield is at 4.11% and the final traded 6-month T-bill yield is at 3.90%, what could be the T-bill yield this time spherical?

In contemporary months, there was an commentary that the yield of the six-month treasury payments is upper than the cut-off yield of the twelve-week MAS invoice. I do be expecting the eventual yield to be nearer to 4.0%.

Listed below are your different Upper Go back, Protected and Quick-Time period Financial savings & Funding Choices for Singaporeans in 2023

You can be questioning whether or not different financial savings & funding choices come up with upper returns however are nonetheless quite protected and liquid sufficient.

Listed below are other different classes of securities to believe:

| Safety Kind | Vary of Returns | Lock-in | Minimal | Remarks |

|---|---|---|---|---|

| Fastened & Time Deposits on Promotional Charges | 4% | 12M -24M | > $20,000 | |

| Singapore Financial savings Bonds (SSB) | 2.9% – 3.4% | 1M | > $1,000 | Max $200k in keeping with particular person. When in call for, it may be difficult to get an allocation. A excellent SSB Instance. |

| SGS 6-month Treasury Expenses | 2.5% – 4.19% | 6M | > $1,000 | Appropriate when you’ve got some huge cash to deploy. How to shop for T-bills information. |

| SGS 1-12 months Bond | 3.72% | 12M | > $1,000 | Appropriate when you’ve got some huge cash to deploy. How to shop for T-bills information. |

| Quick-term Insurance coverage Endowment | 1.8-4.3% | 2Y – 3Y | > $10,000 | Be certain they’re capital assured. Most often, there’s a most quantity you’ll be able to purchase. A excellent instance Gro Capital Ease |

| Cash-Marketplace Budget | 4.2% | 1W | > $100 | Appropriate when you’ve got some huge cash to deploy. A fund that invests in fastened deposits will actively let you seize the best possible prevailing rates of interest. Do learn up the factsheet or prospectus to verify the fund solely invests in fastened deposits & equivalents. MoneyOwl’s WiseSaver – Fullerton Money Fund instance. |

This desk is up to date as of seventeenth November 2022.

There are different securities or merchandise that can fail to satisfy the factors to present again your predominant, top liquidity and excellent returns. Structured deposits include derivatives that build up the level of possibility. Many money control portfolios of Robo-advisers and banks include short-duration bond price range. Their values might range within the brief time period and is probably not ideally suited if you happen to require a 100% go back of your predominant quantity.

The returns supplied don’t seem to be solid in stone and can range according to the present non permanent rates of interest. You will have to undertake extra goal-based making plans and use essentially the most appropriate tools/securities that will help you collect or spend down your wealth as a substitute of getting your whole cash in non permanent financial savings & funding choices.

If you wish to business those shares I discussed, you’ll be able to open an account with Interactive Agents. Interactive Agents is the main cheap and environment friendly dealer I exploit and consider to speculate & business my holdings in Singapore, the US, London Inventory Change and Hong Kong Inventory Change. They permit you to business shares, ETFs, choices, futures, foreign exchange, bonds and price range international from a unmarried built-in account.

You’ll be able to learn extra about my ideas about Interactive Agents in this Interactive Agents Deep Dive Sequence, beginning with create & fund your Interactive Agents account simply.