The approaching cashless society and gold

December 23, 2022 (Investorideas.com Newswire) Other people interested by having their actions and price range tracked have one thing new to be nervous about, with central banks all over the world poised to roll out their very own model of a Central Financial institution Virtual Foreign money (CBDC), that would substitute money.

What’s a Central Financial institution Virtual Foreign money?

A CBDC is just a virtual type of cash issued by way of a government. Consistent with LinkedIn, The Financial institution of Global Settlements defines CBDC as a virtual cost device denominated within the nationwide unit account this is an instantaneous legal responsibility of the central financial institution. In different phrases, the central financial institution is answerable for the CBDC this is issued and now not the personal sector that all of us have to come back to be informed and notice, in accordance with the standard banking gadget.

There is also some confusion as to the variation between a Central Financial institution Virtual Foreign money and a cryptocurrency, like Bitcoin. Whilst each are virtual currencies, a cryptocurrency isn’t felony smooth, with transactions verified and data maintained by way of a decentralized gadget the usage of cryptography, fairly than a centralized authority. As an alternative of bodily expenses and alter carried round in wallets, cryptocurrency is saved in virtual wallets; bills exist purely as virtual entries to an internet database describing explicit transactions.

A cryptocurrency may be described as a type of virtual asset in accordance with a community this is allotted throughout numerous computer systems. This decentralized construction lets them exist outdoor the keep an eye on of governments and central government (Investopedia). Additionally, as a result of a cryptocurrency is secured by way of cryptography, it’s just about inconceivable to counterfeit or double-spend.

Crypto backers say it is a peer-to-peer gadget that permits any person, any place to ship and obtain bills, that may both be saved in a virtual pockets or redeemed as different kinds of foreign money, like money.

Different benefits come with less expensive and sooner cash transfers, and decentralized methods that don’t cave in at a unmarried level of failure. The disadvantages of cryptocurrencies come with their value volatility, excessive power intake all the way through “mining”, and use in prison actions.

As for CBDCs, adherents say some of the major advantages is this is a extra inclusive gadget, the place each and every citizen has a handy guide a rough, secure and dependable virtual retail cost device.

Critics level to the inherent risk of a gadget that would usher within the “globalist” imaginative and prescient of a cashless society by which all transactions are traceable by way of authorities.

In recent times there were plenty of bulletins regarding the advent of Central Financial institution Virtual Currencies.

Nigeria was once the primary African nation to release a CBDC pilot and in September, 2021, El Salvador changed into the primary country to make use of Bitcoin as felony smooth, along america greenback. The BBC stated it resulted in fashionable protests as demonstrators feared it could deliver instability and inflation to the rustic.

The Central Financial institution of Nigeria reportedly introduced it’ll start, efficient in January, limiting money withdrawals from banks and ATMs to only $45 according to day as a part of a push to transport the rustic towards a cashless financial system.

In November, 2021, the Financial institution of England and the Treasury introduced consultations on a UK central financial institution virtual foreign money, that will take a seat along money and financial institution deposits, now not substitute them.

Alternatively, previous this month, Breitbart reported that Chancellor of the Exchequer Jeremy Hunt published that, as a part of his reform of Britain’s monetary services and products, the Financial institution of England would start consultations at the design of a CBDC that will act as a virtual model of the pound. Additional, the Royal Mint has it seems that been requested by way of the Treasury Division to make an NFT (non-fungible token). NFTs are virtual belongings in accordance with blockchain era.

Breitbart notes that, not like Bitcoin, a CBDC could be very similar to conventional fiat foreign money issued by way of a central financial institution, and would subsequently be afflicted by the similar inflationary problems if the central financial institution made up our minds to factor extra of it — like printing money. Amongst different criticisms:

The Financial institution of England has additionally admitted {that a} virtual pound might be “programmable“, that means that the federal government may doubtlessly upload mechanisms to stop other people from spending their very own cash on issues the state disapproves.

This has resulted in considerations that Western governments may enforce a gadget similar to the social credits rating in Communist China, which has already been used to blacklist hundreds of thousands of voters from travelling, together with those that dissented towards the authoritarian rule of Chairman Xi Jinping…

After introducing a virtual yuan pilot program in 2020, China is within the means of trying out it in main towns together with Beijing and Shanghai.

Whilst governments and central bankers declare that the shift to a cashless society will assist save you crime and building up comfort for odd other people, the actual motivation at the back of the “battle on money” is extra authorities keep an eye on over the person.

Consistent with Mises.org, the Chinese language authorities may simply observe virtual bills with a CBDC, and it might permit Beijing to watch cellular app purchases extra carefully. Some observers wonder if bills might be connected to China’s above-mentioned social-credit gadget.

If this appears like one thing best totalitarian governments would do, imagine: if a CBDC is carried out, the central financial institution may have get admission to to all transactions, in addition to being in a position to freezing accounts, just like the Canadian Liberal authorities did all the way through the 2022 trucker convoy protests. A CBDC may also give governments the ability to decide how a lot an individual can spend, identify expiration dates for deposits, or even penalize individuals who stored cash, writes Andre Marques in ‘Virtual Foreign money: The Fed Strikes Towards Financial Totalitarianism‘.

Just like the Financial institution of England, China, the Ecu Union, and the Financial institution of Canada, america central financial institution is sowing the seeds for its CBDC. Step one was once taken in August, when the Federal Reserve introduced an immediate cost gadget known as FedNow, scheduled to be introduced between Might and June, 2023.

Marques describes FedNow as “nearly similar” to Brazil’s PIX, carried out by way of the Central Financial institution of Brazil (BCB) in 2020. Offered to Brazilians as a secure, mobile-friendly insta-pay gadget with out consumer charges, actually the BCB has get admission to to transactions made via PIX and in keeping with Marques, It’s already an invasion of the privateness of Brazilians. And FedNow is about to practice go well with.

Moreover, the New York Fed has just lately introduced a 12-week pilot program with a number of industrial banks to check the feasibility of a CBDC in america. This system will use virtual tokens to constitute financial institution deposits.

The latter is particularly horrifying to consider, from a libertarian standpoint. As famous by way of investigative reporter Leo Hohmann on his weblog, you’ll be able to now be managed by way of merely chopping off the provision of virtual cash, which actually is not cash in any respect within the conventional sense. It is extra like a voucher gadget.

This can be simply completed when they lock everybody’s cash right into a checking account and substitute precise cash with virtual tokens. On the level by which the American center magnificence accepts the sort of gadget, it is sport over and we will be able to see tyranny sweep around the globe even sooner than it’s now…

The banksters and company titans may have captured everybody into their virtual beast gadget, which operates similar to a high-tech feudal gadget, the place you not actually personal the rest outright. You are going to change into the equal of a sharecropper within the previous feudal gadget of the Center Ages — your obedience to no matter new regulations they throw out for “sustainable dwelling” will not be not obligatory yet necessary.

The sustainability regulations will get started out as “tips” or “suggestions,” best to be later demanded and mandated, with heavy fines for disobedience. In the event you assume you’ll be able to forget about the fines, assume once more, as they now have direct get admission to in your virtual pockets and will merely deactivate no matter virtual tokens are in that account.

Why we love gold (and silver)

A part of the explanation other people like making an investment in gold and silver is their disdain for government-issued virtual currencies.

“Other people do not wish to reveal each and every unmarried factor they do,” Todd ‘Bubba’ Horowitz just lately instructed Kitco’s David Lin. “In the event you give extra energy and extra keep an eye on to 2 organizations, authorities and central banking, that best create debt and do not create any trade, I feel that it’s essential see a miles larger call for for gold.”

The editor of BubbaTrading.com prompt the federal government would ban paper cash and pressure US citizens to procure virtual currencies. This could make them flip in opposition to arduous belongings like valuable metals.

Even with out the CBDC development, and the approaching cashless society, at AOTH we imagine there are selection of the explanation why now could be the time to be purchasing gold and silver. We talk about every of them under.

Inflation hedge

40-year-high inflation is eroding the buying energy of fiat currencies, now not simply america greenback however the British pound, the euro, the Canadian greenback, and so on., as it takes extra devices of foreign money to shop for the same quantity of products as prior to.

Proudly owning gold (and silver) is still the most efficient protection towards inflation, stagflation, and rampant foreign money debasement, all the way through this era of extraordinary and irresponsible debt accumulation.

A stagflationary debt disaster looms

Nonetheless, some traders are asking: “If gold is the sort of nice inflation hedge, why hasn’t it finished higher, now that inflation is working rampant?” Obviously, the rate of interest hikes by way of america Federal Reserve and different central financial institution are operating towards gold, which provides neither a yield nor a dividend. Buyers are understandably piling into bonds, GICs or even financial savings accounts, which for the primary time in years are providing respectable hobby. However as soon as the rate of interest will increase prevent, and the greenback falls, investor hobby in gold and silver will go back, with a vengeance. In reality gold and silver have already began to show upper, in keeping with a marked decline in america greenback index, within the seven weeks for the reason that starting of November.

Supply: MarketWatch

Supply: Kitco

The Fed pivot

As quickly because the Federal Reserve realizes it may not stay elevating rates of interest with out pushing the financial system into recession, and it pauses the velocity hikes, will mark the start of the following bull marketplace for valuable metals.

The Fed will arguably be compelled into unwinding its tight financial coverage, turning into extra dovish within the new yr, because the central financial institution is faced by way of proof of a cave in in client spending, and a downward spiraling US financial system.

The indicators of a faltering financial system are all over the place. They come with persevered excessive inflation, particularly meals and effort, that isn’t mirrored within the Fed’s most popular inflation index, the core PCE; emerging inflation expectancies; dissipating client self belief; an approaching cave in in client spending, however the “Black Friday” jump; a plunging PMI and an inverted yield curve.

The three-month/ 30-year and the 5-year/ 30-year segments of the yield curve are helpful early signs of a recession. Lately the 3mo30yr remains to be pulling down and the 5y30y remains to be inverted, suggesting a recession is just a few months away. (Simon White, Bloomberg macro strategist, by way of 0 Hedge)

I see the Fed decreasing its charge hikes to twenty-five foundation issues prior to the tip of the primary quarter 2023 and pausing by way of the center of the yr. A reversal may practice in a while after.

Why the Fed pivot will occur sooner than other people assume

Central financial institution purchasing

The main gold holders are one of the global’s maximum robust countries, corresponding to america, Germany, Italy and France; they’re maintaining 60% in their international reserves as gold. It is a testomony to the importance of gold within the central banking gadget.

Ultimate month the International Gold Council stated central banks purchased 399 tonnes of gold within the 3rd quarter, by way of some distance probably the most ever in one quarterly length. Consistent with the WGC, central banks globally added any other 31 lots of gold to professional reserves in October, hanging central financial institution holdings at their very best stage since 1974. 12 months so far, central banks have amassed gold reserves at a tempo unseen since 1967.

Supply: QTR’s Fringe Finance

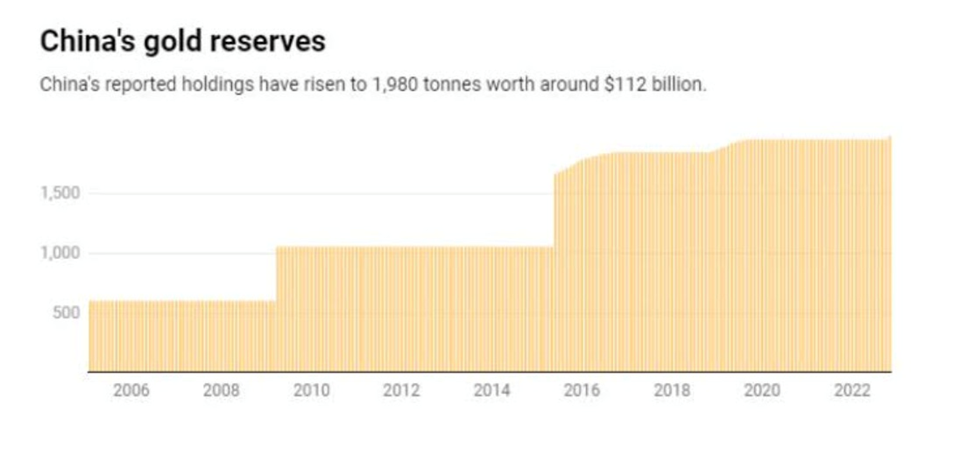

China, which is known for now not reporting its gold holdings, disclosed an building up in its reserves for the primary time since September, 2019 — including 32 tonnesworth round $1.8 billion, in keeping with Reuters. Its stockpile now sits at 1,980 tonnes, 6th amongst international locations with the most important professional nationwide gold reserves, together with Russia, Germany and the US, which is the most important at 8,133.5 tonnes.

The West vs the BRICS

Quoth the Raven notes that central banks proceed to snap up gold in what I imagine to be an acknowledgement that we’re at the verge of a drastic shift in for the worldwide financial system.

Through that, the monetary blogger approach there’s a “new chilly battle gold race” on, between the West and the BRICS countries, relating to Brazil, Russia, India, China and South Africa:

It began closing yr in August 2021, lengthy prior to our present inflationary disaster and the battle in Ukraine, once I predicted that China would attempt to concoct a gold-backed virtual foreign money that will put the U.S. greenback on its heels.

As Russia’s battle in Ukraine has improved, the rustic has allied itself with China additional and I’ve written and talked widely in regards to the danger that I feel their courting poses to the US and the West.

(At AOTH, we known a equivalent, if now not precisely the similar development, in Canada and america’s include of “friend-shoring”, which presumes a global divided between free-market economies and international locations that align with authoritarian regimes.)

Buddy-shoring threatens Western steel provides

Quoth the Raven observes that China’s contemporary central financial institution gold acquire is simultaneous with the rustic dumping US Treasuries and strengthening its business with Russia. Consistent with america Treasury Division, China bought $121.1 billion in US debt from the assault on Ukraine on the finish of February, to the tip of September.

In the meantime, Chinese language imports of gold from Russia surged in July, hovering greater than eightfold at the month and more or less 50 occasions the year-earlier stage, in keeping with China’s customs government.

However it is going additional than Russian-Chinese language cooperation, which in all honesty, is not anything new. Quoth the Raven states, The overall thought supporting my thesis folks being in the course of a brand new chilly battle could be for China, Russia and the BRICS countries to have keep an eye on over a blended general of gold that would problem the U.S. and the West.

In reality, I do not believe it is out of the image {that a} “race” for gold may get started as soon as the image of a brand new world financial technology turns into clearer.

The latter has to do with the rising divide between BRIC countries, like China and Russia, and the US. In July the BRICS countries introduced their purpose to create a brand new reserve foreign money that will “higher serve their financial pursuits”, a transparent affront to the supremacy of america greenback. Then there may be China’s all-but-certain plans to check out to ultimately take again Taiwan, and the truth that the US, with its $31 trillion in debt, is in in all probability probably the most precarious financial place it’s been in for many years, Quoth the Raven states.

Low provides and inventories

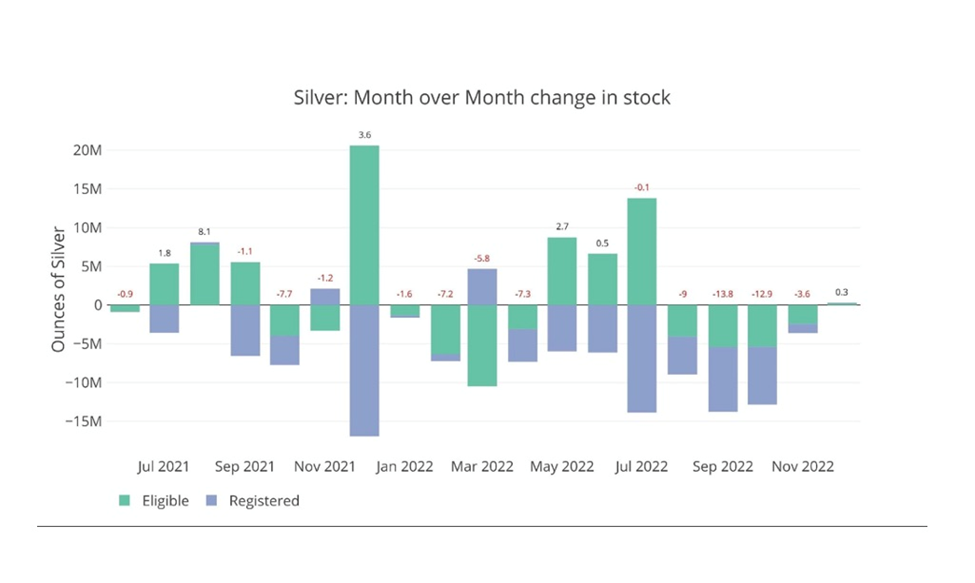

Directly to more effective causes for favoring valuable metals, all yr there was report call for for bodily gold and silver, which is emptying out the vaults in New York and London the place the metals are saved by way of the Comex change and the London Bullion Marketplace Affiliation.

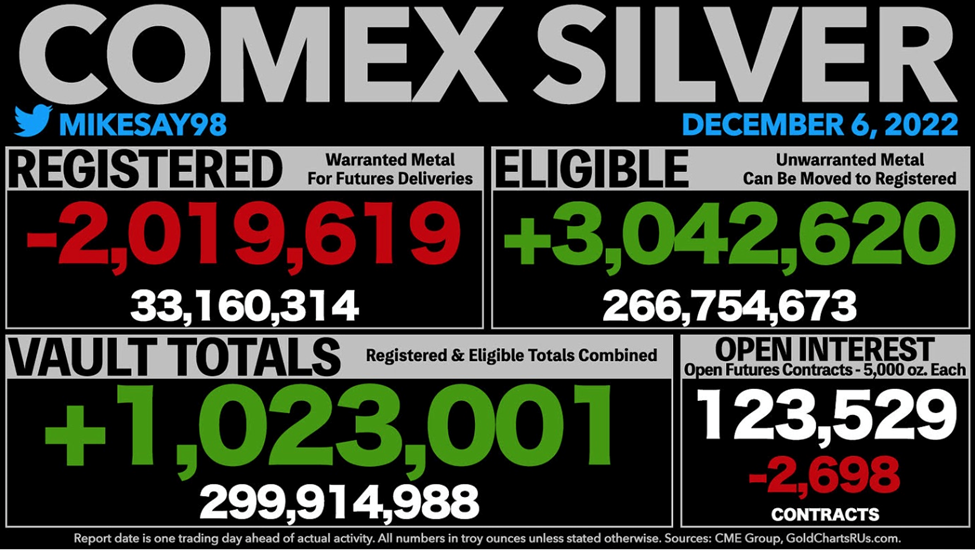

As an example registered silver in Comex vaults has fallen under 33.2 million oz., the bottom stage since 2017.

A Dec. 17 article by way of Schiff Gold effuses, The drainage of silver from Comex vaults for the reason that get started of the yr has been not anything wanting impressive. 48.5M oz. have left [the] Registered Mining since Jan 1. That represents greater than 50% of the stability of 82M oz. closing Dec 31.

Supply: Schiffgold.com

As a sign that inventories are even smaller than reported, Schiff Gold notes that best 77.6% of contracts for supply have had their steel delivered, resulting in the realization that:

Inventories are a lot thinner than the knowledge displays. Now we have possibly reached the ground of steel to be had for supply at present costs. For this reason silver is seeing such a lot of contracts stay unfulfilled AND why we now have additionally noticed a dip in web new contracts this overdue within the supply window. There may be merely no steel to be had so it isn’t being delivered.

Gold is a couple of months at the back of silver and may be a deeper marketplace, yet the similar tendencies are beginning to emerge.

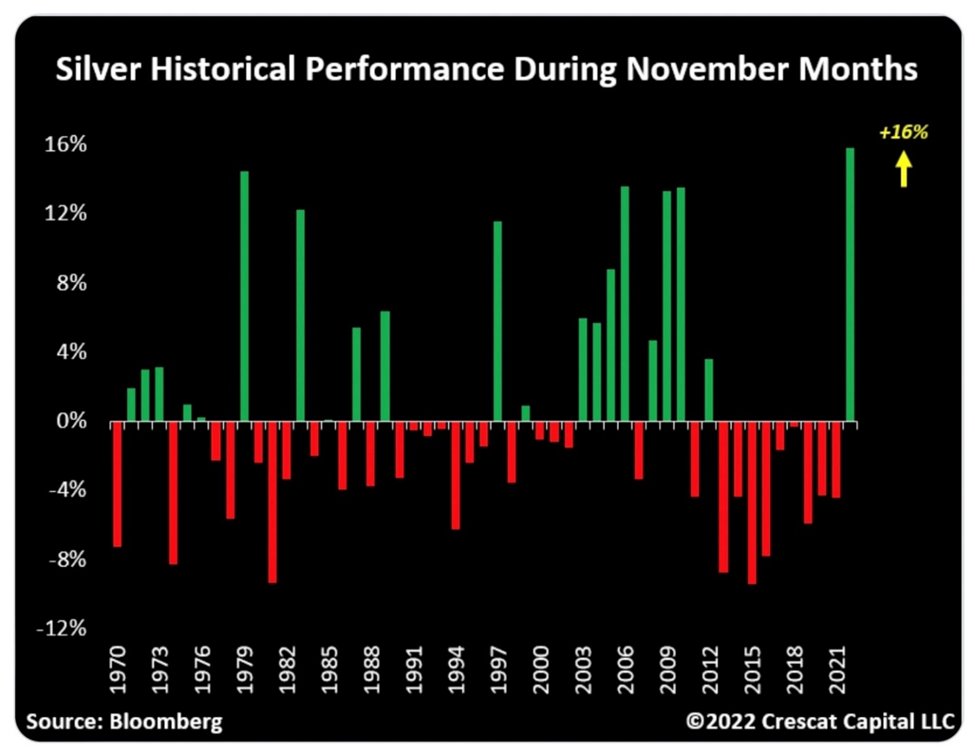

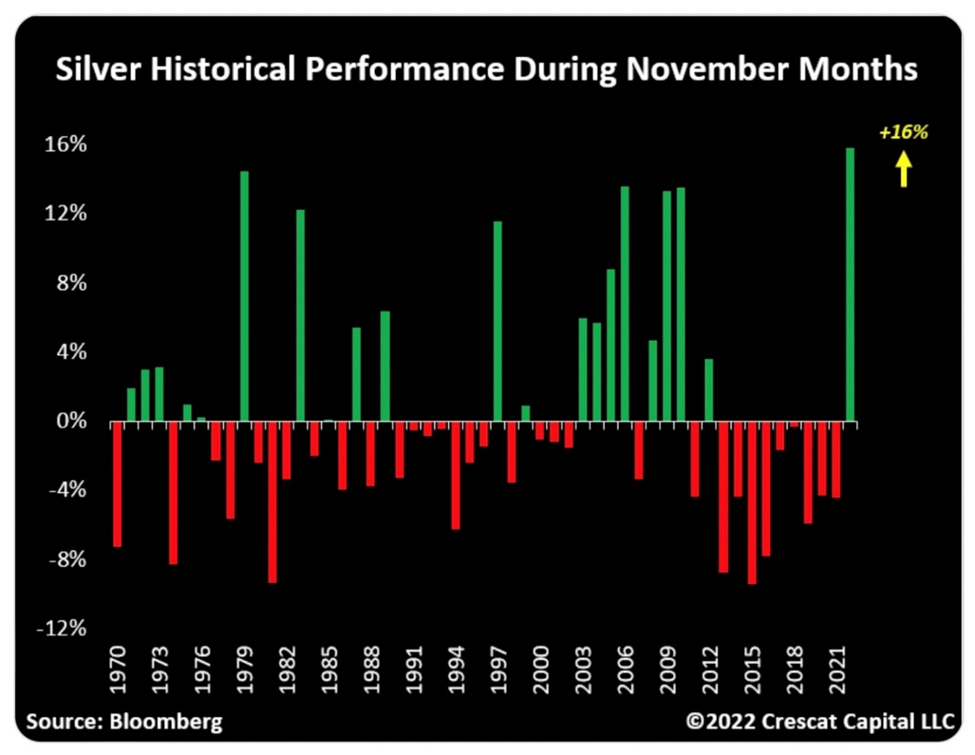

In November silver had its most powerful efficiency in 52 years.

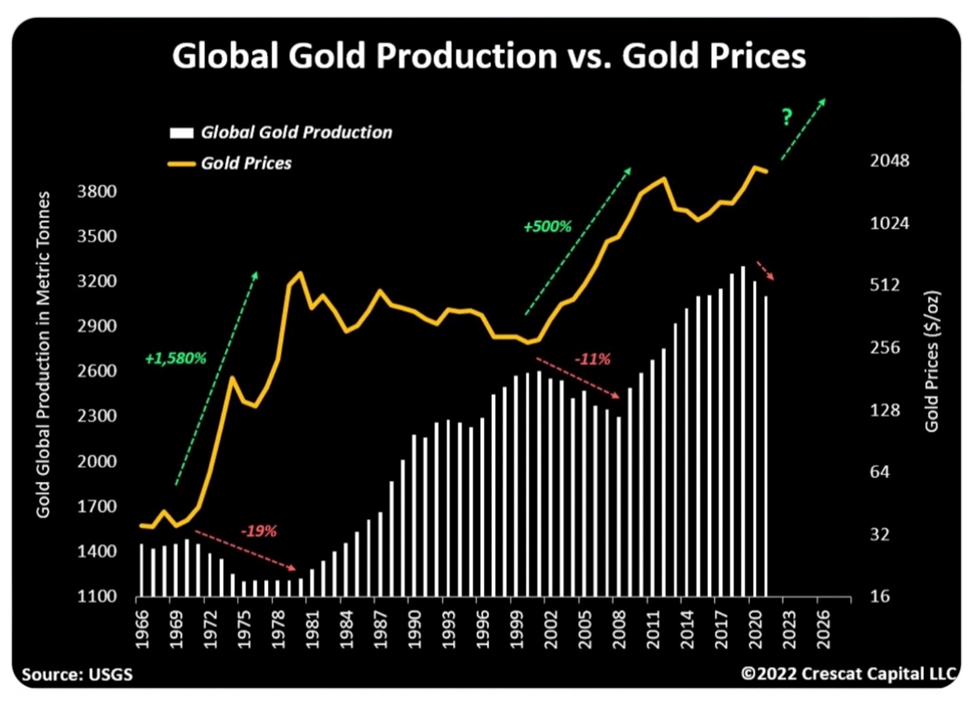

A key macro driving force prone to precipitate a transfer upper for each gold and silver, is the multi-year decline in gold manufacturing. Understand how the chart under displays a opposite correlation between a hiking gold value and decrease gold manufacturing.

A part of the problem is that mining corporations which historically taken with valuable metals, have re-directed their capital to battery metals, and different minerals (corresponding to copper, silver) that feed into the fairway financial system.

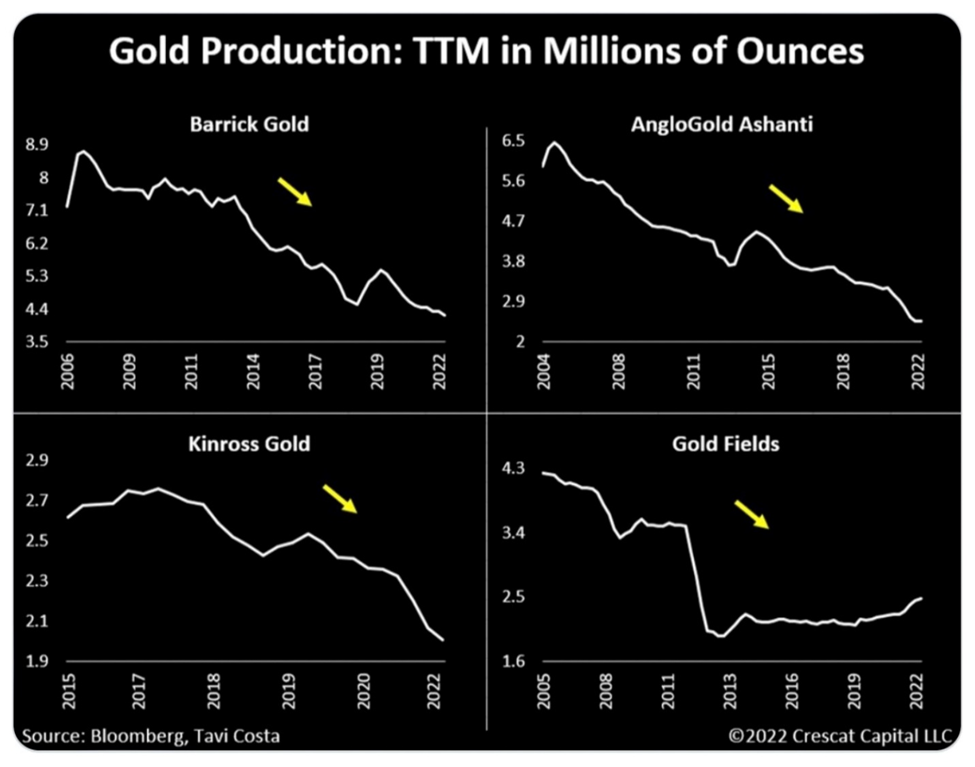

As an example Newmont, the arena’s biggest gold miner, is generating the same quantity of gold as 16 years in the past, with its reserves down 24% from the height in 2011. Different gold-focused miners have considerably contracted manufacturing.

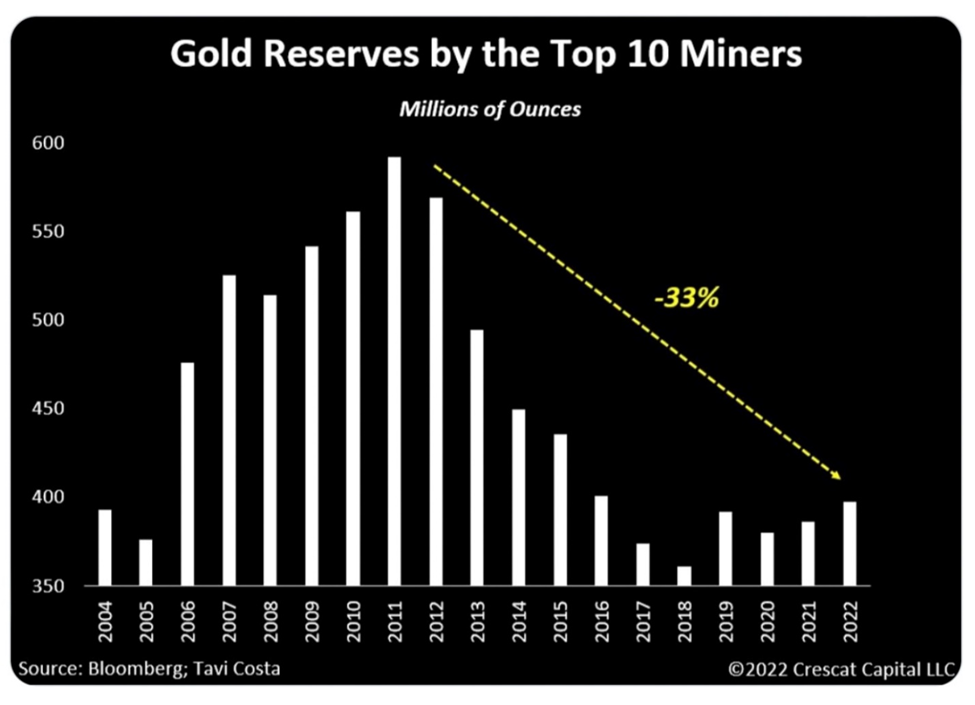

In the meantime, there were valuable few new gold discoveries. Lots of the low-hanging fruit has been picked; the rest deposits are in faraway places, with a loss of infrastructure, frequently requiring unreasonably excessive capital expenditures. Or they’re in high-risk international locations with governments at risk of expropriate the mine or impose different pricey kinds of useful resource nationalism. The result’s the reserves of the highest 10 mining corporations are down 33% over the past 15 years.

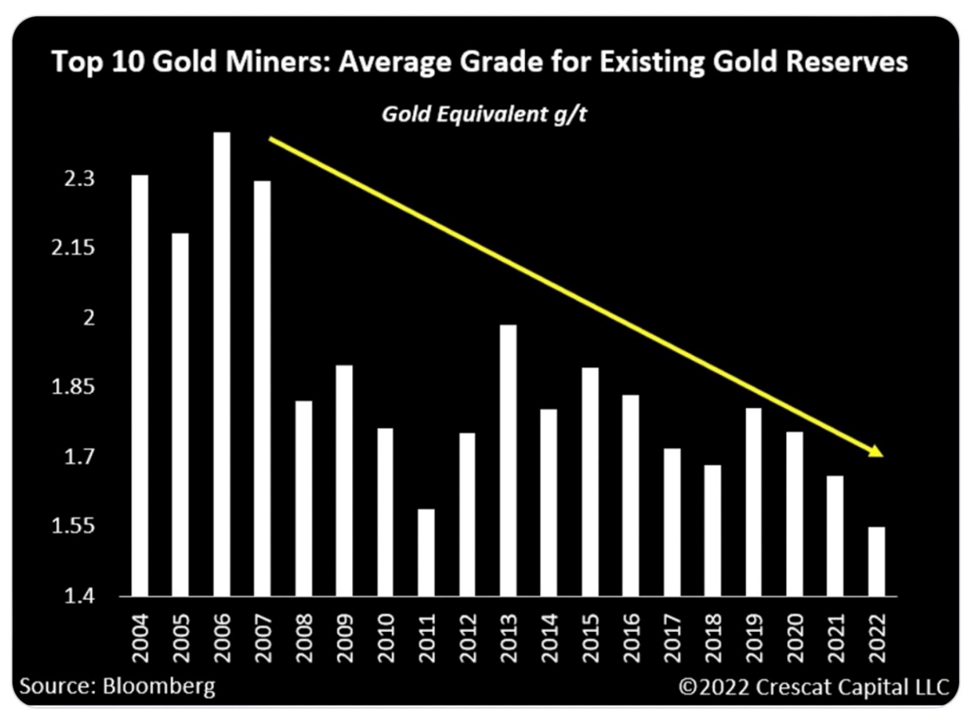

Decrease grades

No longer best that, the standard of the rest reserves is deteriorating. The typical grade of gold reserves for the highest 10 miners has been in a mundane decline. From a gold-equivalent 2.3 grams according to tonne in 2004, the common grade is now about 1.5 g/t.

Conclusion

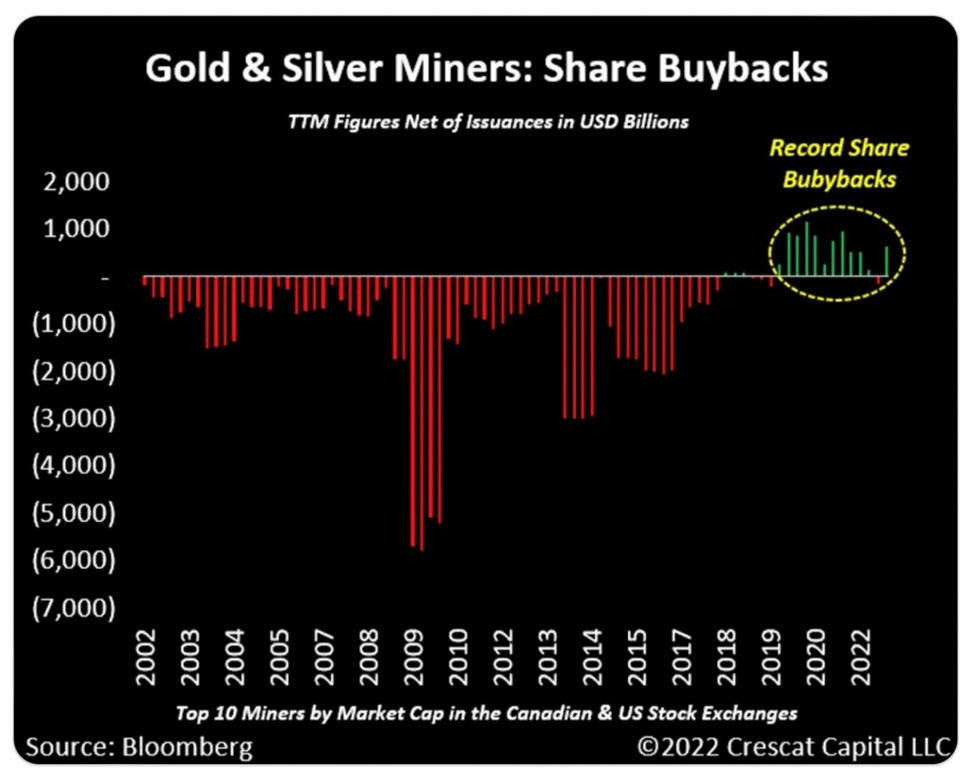

Whilst gold is lately close to 2011 highs, capital spending for gold miners is at traditionally low ranges. Moderately than spending extra money on new mines, staff and gear, those corporations are re-investing their earnings in inventory buybacks. After many years of continuing fairness dilution, the highest 10 gold and silver miners have had 3 years of report percentage buy-backs.

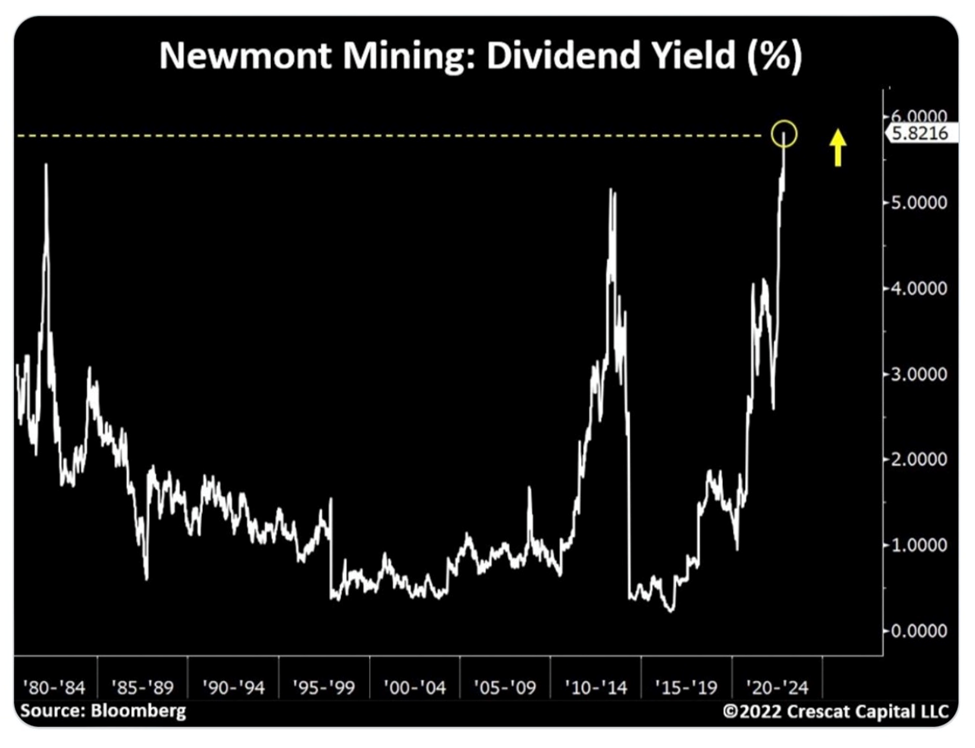

Mining corporations also are mountaineering their dividends to deal with and draw in traders. Newmont, as an example, has higher its dividend in six of the closing 9 quarters and the inventory now has the very best yield in 40 years.

The field is at considered one of its most-undervalued issues ever, with the P/E ratio of valuable and base steel miners within the S&P 500 Metals Mining Index at its lowest for the reason that monetary disaster.

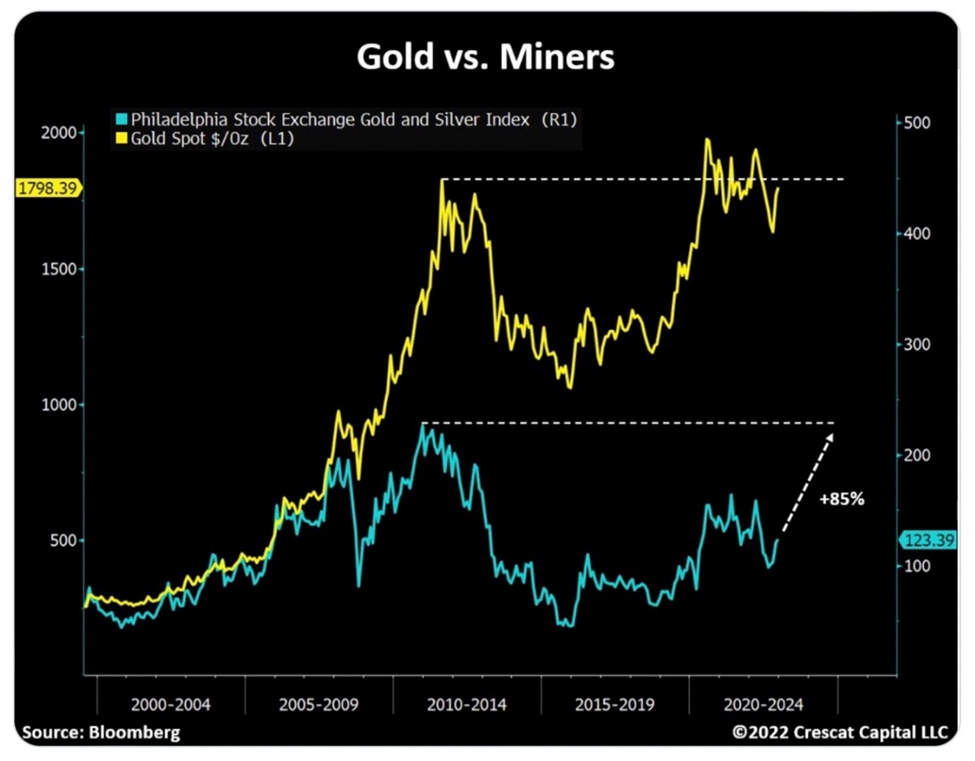

The 2 charts under display gold and silver are deeply undervalued, with gold miners wanting to surge 85% although the fee is going nowhere, and silver approach under-priced in comparison to commodities.

We additionally word that the gold sector does really well in a post-bubble contraction, like we’re lately witnessing, even outperforming bullion.

Hat tip to Bob Hoye from ChartsandMarkets.com, by way of 321gold, who writes that, [G]previous shares underperform after which get trashed at the preliminary segment of the contraction. Each have took place which is putting in a long bull marketplace for the field. Golds is not going to simply move up yet may outperform the S&P for a few years. Certainly, fund managers who would now not usually place golds, must personal them.

This confirms what I have been announcing for years that, traditionally, the best leverage to an expanding gold value is a high quality junior.

Richard (Rick) Generators

aheadoftheherd.com

subscribe to my unfastened publication

Felony Understand / Disclaimer

Forward of the Herd publication, aheadoftheherd.com, hereafter referred to as AOTH.

Please learn all the Disclaimer sparsely prior to you employ this web page or learn the publication. If you don’t conform to the entire AOTH/Richard Generators Disclaimer, don’t get admission to/learn this web page/publication/article, or any of its pages. Through studying/the usage of this AOTH/Richard Generators web page/publication/article, and whether or not you in fact learn this Disclaimer, you’re deemed to have authorised it.

Any AOTH/Richard Generators file isn’t, and will have to now not be, construed as an be offering to promote or the solicitation of an be offering to buy or subscribe for any funding.

AOTH/Richard Generators has primarily based this file on knowledge acquired from assets he believes to be dependable, yet which has now not been independently verified.

AOTH/Richard Generators makes no ensure, illustration or guaranty and accepts no duty or legal responsibility as to its accuracy or completeness.

Expressions of opinion are the ones of AOTH/Richard Generators best and are topic to switch with out realize.

AOTH/Richard Generators assumes no guaranty, legal responsibility or ensure for the present relevance, correctness or completeness of any knowledge equipped inside of this File and might not be held accountable for the end result of reliance upon any opinion or remark contained herein or any omission.

Moreover, AOTH/Richard Generators assumes no legal responsibility for any direct or oblique loss or harm for misplaced benefit, which you’ll incur because of the use and lifestyles of the tips equipped inside of this AOTH/Richard Generators File.

You compromise that by way of studying AOTH/Richard Generators articles, you’re performing at your OWN RISK. In no tournament will have to AOTH/Richard Generators accountable for any direct or oblique buying and selling losses led to by way of any knowledge contained in AOTH/Richard Generators articles. Data in AOTH/Richard Generators articles isn’t an be offering to promote or a solicitation of an be offering to shop for any safety. AOTH/Richard Generators isn’t suggesting the transacting of any monetary tools.

Our publications aren’t a advice to shop for or promote a safety – no knowledge posted in this web page is to be regarded as funding recommendation or a advice to do the rest involving finance or cash except for acting your personal due diligence and consulting with your individual registered dealer/monetary consultant.

AOTH/Richard Generators recommends that prior to making an investment in any securities, you discuss with a qualified monetary planner or consultant, and that you simply will have to behavior a whole and impartial investigation prior to making an investment in any safety after prudent attention of all pertinent dangers. Forward of the Herd isn’t a registered dealer, broker, analyst, or consultant. We hang no funding licenses and would possibly not promote, be offering to promote, or be offering to shop for any safety.

Richard does now not personal stocks of Dolly Varden (TSX.V:DV). DV is a paid advertiser on his web page aheadoftheherd.com

Extra Data:

This information is revealed at the Investorideas.com Newswire – a world virtual information supply for traders and trade leaders

Disclaimer/Disclosure: Investorideas.com is a virtual writer of 3rd birthday celebration sourced information, articles and fairness analysis in addition to creates unique content material, together with video, interviews and articles. Authentic content material created by way of investorideas is secure by way of copyright rules instead of syndication rights. Our web page does now not make suggestions for purchases or sale of shares, product or service. Not anything on our websites will have to be construed as an be offering or solicitation to shop for or promote merchandise or securities. All making an investment comes to menace and conceivable losses. This web page is lately compensated for information newsletter and distribution, social media and advertising and marketing, content material advent and extra. Disclosure is posted for every compensated information liberate, content material revealed /created if required yet another way the inside track was once now not compensated for and was once revealed for the only hobby of our readers and fans. Touch control and IR of every corporate immediately relating to explicit questions.

Extra disclaimer information: https://www.investorideas.com/About/Disclaimer.asp Be informed extra about publishing your information liberate and our different information services and products at the Investorideas.com newswire https://www.investorideas.com/Information-Add/ and tickertagstocknews.com

World traders should adhere to rules of every nation. Please learn Investorideas.com privateness coverage: https://www.investorideas.com/About/Private_Policy.asp