The 12 months When The entirety Began To Fall Aside – Funding Watch

by means of Michael

It amazes me that such a lot of other folks nonetheless can not perceive what is occurring. 2022 used to be supposedly going to be a yr when The united states entered a brand new golden age of prosperity, however that didn’t occur. As a substitute, it used to be an entire and utter crisis. Inventory costs fell by means of probably the most that we’ve got observed since 2008, the cryptocurrency trade got here aside on the seams, inflation soared to absurd heights, and residential gross sales simply saved declining all right through the yr. Surely, 2022 represented a significant turning level. American citizens have already jointly misplaced trillions of greenbacks, and plenty of professionals are telling us that 2023 will likely be even worse.

We warned time and again that the celebration on Wall Boulevard would ultimately come to an excessively sour finish, however most of the people didn’t wish to concentrate.

Smartly, the celebration has now ended, and the inventory marketplace losses that we’ve got witnessed over the last 365 days had been completely staggering…

As of last time on Friday night time, the Dow Jones Commercial Moderate fell by means of just about 3,500 issues because the get started of the yr, a 9.4 % drop.

The S&P 500 used to be additionally down by means of 957 issues this yr, with the tech-heavy index falling by means of virtually 20 %, capping off a brutal yr for the tech trade.

In the meantime, the Nasdaq sunk by means of greater than 5,600 issues, a just about 34 % decline in 2022.

Greater than a 3rd of all of the price of the Nasdaq is already long gone.

Simply consider that.

In fact some shares had been hit a lot more difficult than others.

Tesla is down about 70 % from the height, and Elon Musk “has turn out to be the primary individual ever to lose $200 billion from his web value”…

Tesla CEO and Leader Twit Elon Musk has turn out to be the primary individual ever to lose $200 billion from his web value, in keeping with a Bloomberg document.

Musk, 51, prior to now become the second one individual ever to acquire a fortune of greater than $200 billion in January 2021, after Amazon founder Jeff Bezos. Musk has now observed his wealth drop to $137 billion following a up to date drop in Tesla stocks.

Musk noticed his fortune height in November 2021, hitting $340 billion, and held the identify of the sector’s richest individual up till closing month. Musk used to be in the end toppled off the throne by means of Bernard Arnault, the CEO of French luxurious massive LVMH.

It’s a must to give him credit score for containing up so smartly beneath the instances.

200 billion greenbacks is an sum of money this is so huge that it’s virtually impossible.

Fb additionally were given monkey-hammered over the process 2022. At this level, Fb inventory has fallen over 64 % from the place it used to be closing January…

At the closing day of buying and selling this yr, Meta’s inventory used to be down greater than 64 % in comparison to January, with costs sinking from over $338-per-share to now $120-per-share.

The corporate has misplaced greater than $600 billion in valuation because it spend billions to make its debatable jump to digital truth with its Metaverse, with the efforts proceeding to come back up brief.

Possibly Fb shouldn’t have put such a lot effort into banning and censoring hundreds of thousands in their highest customers.

What a surprisingly silly factor to do.

Once I move on Fb at the present time, it simply feels so extremely useless.

There are nonetheless a couple of diehard customers putting round, however general it is only a pathetic hole shell of a social media platform at this level.

Talking of implosions, 2022 used to be an absolute crisis for the cryptocurrency trade. The next abstract of what we witnessed over the last 365 days comes from 0 Hedge…

Amongst the entire chaos and downfall of many crypto exchanges and main project capital corporations, the most important losers are crypto traders. If the burn of the endure marketplace used to be now not sufficient, hundreds of thousands of crypto traders who had their price range on FTX misplaced their lifestyles financial savings in a single day.

Terra used to be as soon as a $40 billion ecosystem. Its local token, LUNA — now referred to as Terra Vintage (LUNC) — used to be one of the crucial most sensible 5 greatest cryptocurrencies by means of marketplace capitalization. With hundreds of thousands of consumers invested within the ecosystem, the cave in introduced their funding to 0 inside hours. After the Terra cave in, crypto traders misplaced their price range on a sequence of centralized exchanges and staking platforms like Celsius, BlockFi and Hodlnaut. Crypto traders additionally misplaced considerably within the nonfungible token marketplace, with the cost of many fashionable collections down by means of 70%. Total, crypto traders are a few of the greatest losers of the yr.

The overall price of all cryptocurrencies exceeded 3 trillion greenbacks on the height of the marketplace.

Now the full price of all cryptocurrencies has fallen to lower than 1 trillion greenbacks.

Optimistically you were given out earlier than the crash took place.

2022 used to be additionally a yr after we skilled very painful inflation.

Meals costs, power costs and automobile costs all went totally nuts, and plenty of in comparison what we had been going thru to the Jimmy Carter generation of the Nineteen Seventies.

However this shouldn’t had been a wonder to any people. Beginning in 2020, our leaders completely flooded the machine with new money and the dimensions of the cash provide completely exploded.

Expanding the dimensions of the cash provide so dramatically used to be inevitably going to purpose costs to move haywire, and any person that concept differently used to be simply now not being rational.

In a determined try to combat the inflation monster that they helped to create, officers on the Federal Reserve aggressively raised rates of interest right through a lot of 2022.

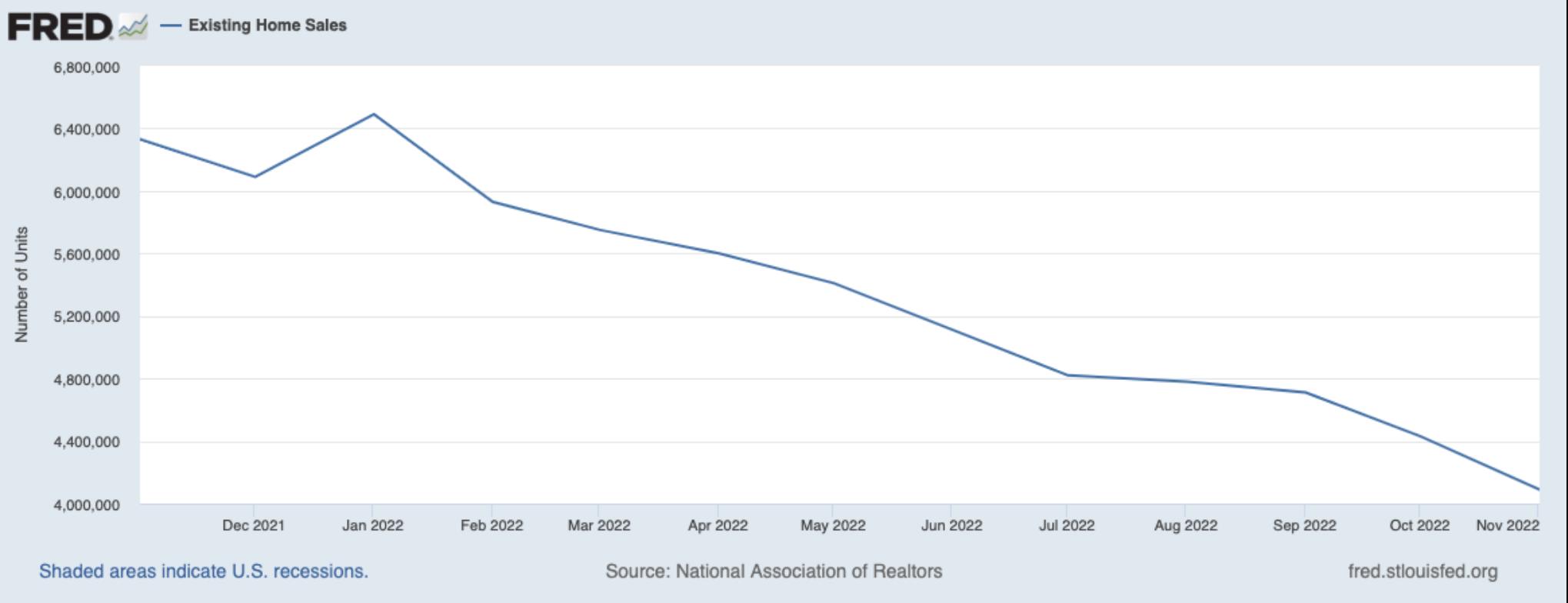

In consequence, we now in finding ourselves in the middle of any other scary housing crash. House values at the moment are regularly receding far and wide the country, and residential gross sales had been falling month after month.

House gross sales have already fallen by means of greater than a 3rd.

How a lot decrease can they most likely move?

I don’t know, however we’re being warned to brace ourselves for extra onerous instances forward.

If truth be told, even the IMF is publicly admitting that “the worst is but to come back”…

“The worst is but to come back, and for many of us 2023 will really feel like a recession,” the IMF stated in October, noting the slowdown “will likely be broad-based” and would possibly “reopen financial wounds that had been handiest partly healed post-pandemic.”

If handiest they knew.

We aren’t simply heading into a short lived financial downturn. In the end, all of the machine is beginning to fall aside throughout us, and the years forward are going to be extremely difficult.

Our leaders had been making mistake after mistake for many years, and now we get to pay the associated fee.

So buckle up and cling on tight, as a result of 2023 isn’t going to be delightful in any respect.