Scheme Booklet Registered via ASIC

Assessment

The cost of gold remains sturdy. In April 2024, the yellow steel’s value handed US$2,400 according to ounce for the primary time. The reason being multifaceted. The sector teeters on the point of a serious recession whilst some markets characteristic the rise to secure haven rush. Amidst ballooning rates of interest, financial institution screw ups and falling bond yields, call for for gold continues to upward push. At this exact second, gold is concurrently a very good portfolio diversifier and a compelling hedge in opposition to ongoing inflation — in particular if one invests in the precise corporate.

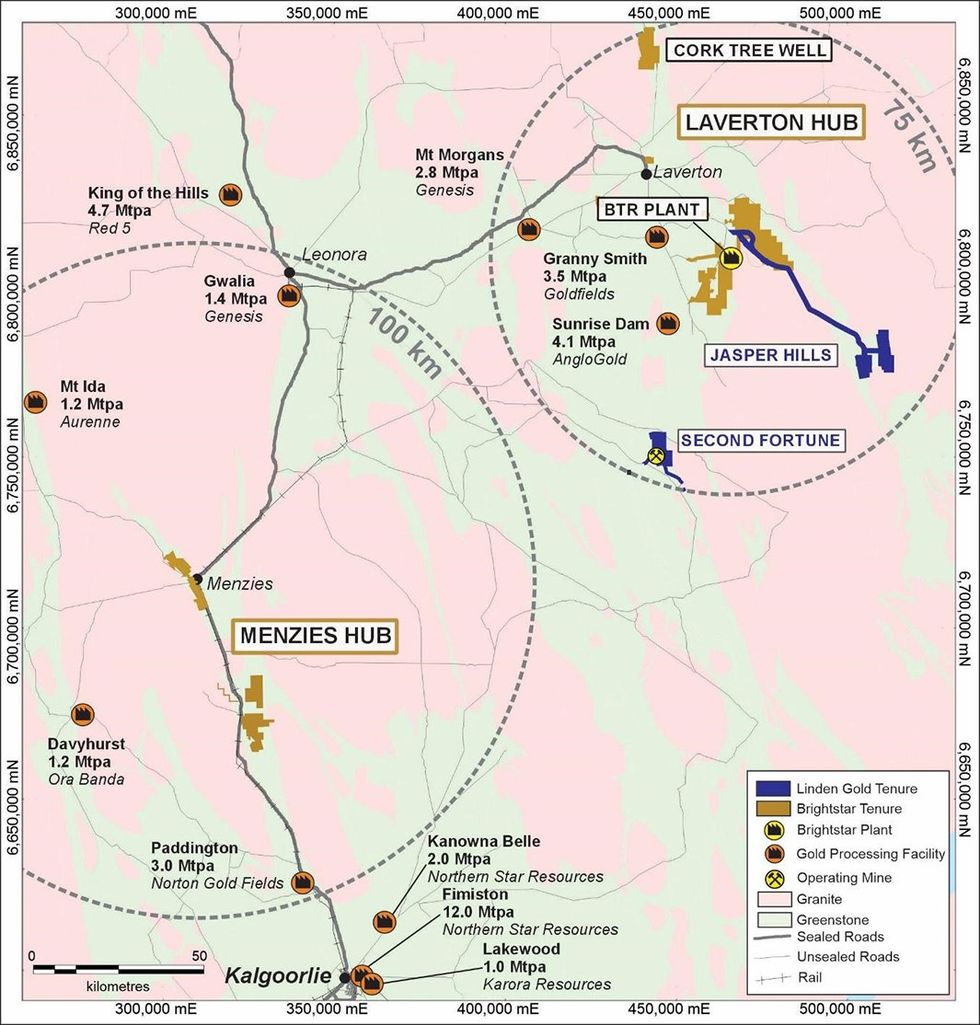

Brightstar Sources (ASX:BTR) targets to be that corporate. An rising mining and advancement corporate, Brightstar occupies a strategic land place of more or less 300 sq. kilometers within the Laverton Tectonic Belt and 80 sq. kilometers of the Menzies Shear Zone.

The corporate additionally owns an current processing facility that may doubtlessly supply super shareholder worth in a low-capital value restart situation.

That plant, as soon as totally refurbished and operational, may end up a key differentiator for the corporate, enabling speedy gold manufacturing at a low capital value. That is particularly noteworthy for the reason that many different gold firms buying and selling at the ASX are in large part serious about greenfield exploration and advancement. Even as soon as the ones firms uncover a promising useful resource, mining and processing amenities would nonetheless wish to be constructed, undertakings which is able to incur important in advance capital prices and take a number of years.

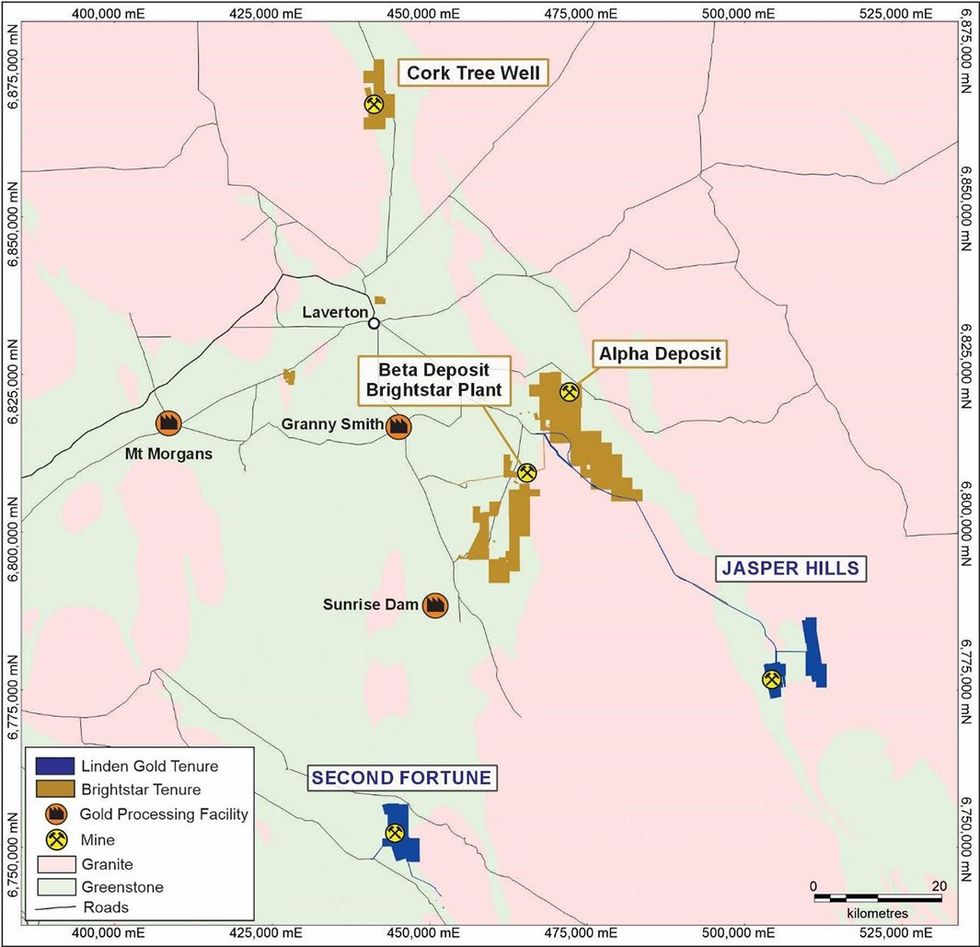

Brightstar’s Laverton gold belongings are all targeted on a One hundred pc-owned 300-square-kilometer tenure within the Laverton Tectonic Zone and all inside of 70 kilometers of the Laverton Processing Plant. Moreover, all sources inside of this zone are open alongside strike and at intensity. Handiest minor drilling systems were performed lately, paving the way in which for important exploration upside with the possibility of additional regional and greenfields discoveries.

Brightstar additionally owns One hundred pc of the Menzies Gold Venture, a contiguous land bundle of granted mining rentals over a strike period of more or less 20 kilometers alongside the Menzies Shear Zone and adjoining to the Goldfields Freeway.

In 2023 and 2024, the corporate introduced a mineral useful resource improve to the Cork Tree Neatly deposit (Laverton gold venture) and likewise delivered two maiden mineral useful resource estimates on the Hyperlink Zone and Aspacia deposits (Menzies gold venture). This has grown the full crew MRE via roughly 150 koz gold via natural exploration.

The corporate has additionally received a related hobby in 96.75 % stocks and 96.81 % choice

stocks and 96.81 % choice of Linden Gold Alliance, a gold manufacturer, developer and explorer with current mineral sources of 350 koz @ 2.1 g/t gold close to Brightstar within the Laverton district. Brightstar’s MRE has reached 1.1 Moz gold around the Menzies and Laverton initiatives, with an extra 0.35 Moz gold in sources added after the a success acquisition of Linden Gold Alliance. Brightstar has commenced the obligatory acquisition procedure for the remainder Linden stocks and choices in appreciate of which it has now not gained acceptances beneath the settlement.

In August 2024, Brightstar entered right into a scheme implementation deed to obtain One hundred pc of Alto Metals, which owns the Sandstone gold venture situated in East Murchison. The venture has a present mineral useful resource of one.05 Moz of gold at 1.5 g/t.

Next to the care for Alto Metals, Brightstar entered right into a $4 million drill-for-equity settlement with Topdrill to aggressively advance the consolidated Sandstone gold venture. The deal strengthens Brightstar’s monetary capability to meet its multi-hub exploration and advancement technique, which incorporates the Menzies and Laverton hubs and the Sandstone hub.

Brightstar additionally finished the purchase of the gold rights on the Montague East gold venture (MEGP) from Gateway Mining Restricted (ASX:GML). The venture is situated 70 km from the Sandstone gold venture. The purchase provides an additional 9.6 Mt @ 1.6 g/t gold for 0.5 Moz god to Brightstar’s JORC Mineral Useful resource Estimate, giving the corporate a complete mineral endowment of 38.3 Mt @ 1.6 g/t gold for two.0 Moz gold.

Corporate Highlights

- Brightstar Sources is an ASX-listed mining and advancement corporate with a couple of million oz. of gold sources and an on-site processing infrastructure.

- Brightstar’s mineral belongings are positioned throughout more or less 300 sq. kilometers of 100-percent-owned land within the Laverton Tectonic Zone and ~80 sq. kilometers within the high-grade Menzies Shear Zone.

- The Laverton Gold venture has a mineral useful resource of 9.7 Mt @ 1.6g/t gold for 511 koz gold and the Menzies gold venture has 13.8Mt @ 1.3g/t gold for 595 koz gold. It is a overall blended current mineral useful resource of 23 Mt @ 1.5 g/t gold for 1.1 Moz of gold

- In 2023, the corporate finished a scoping find out about into the improvement of its Menzies and Laverton gold initiatives and the refurbishment and restart of its processing plant in Laverton.

- The scoping find out about produced powerful working results and compelling monetary outputs, together with:

- 322 koz of gold recovered over 8 years (40 koz according to annum)

- Internet provide worth of AU$103 million (the usage of a gold value of AU$2,900/oz.)

- Inner charge of go back of 79 %

- Pre-production capital necessities of AU$22 million

- All-in maintaining prices of A$2,041/oz.

- As soon as refurbished, this infrastructure will permit Brightstar to fill a rising funding void for near-term gold builders in Western Australia, generating huge amounts of gold at low capital value.

- In 2023 and 2024, Brightstar finished a small-scale mining three way partnership with BML Ventures which concerned a 50/50 profit-sharing settlement to milk the Selkirk deposit at Menzies. In April 2024, Brightstar introduced that this three way partnership delivered a web cash in to Brightstar of $6.5 million.

- In June 2024, the corporate effectively received the entire issued bizarre stocks and choices in Linden Gold Alliance, a gold manufacturer, developer and explorer with current mineral sources of 350 koz @ 2.1 g/t gold close to Brightstar within the Laverton district.

- Linden is lately a gold manufacturer, mining 15-20 koz pa from its high-grade underground 2d Fortune Mine south of Laverton.

- Brightstar’s overall MRE around the Menzies and Laverton gold initiatives larger to one.45 Moz gold after obtaining Linden. The entire mineral sources are situated on granted mining licenses.

- As a part of the merger with Linden Gold, Brightstar launched a scoping find out about into Linden’s development-ready Jasper Hills gold venture, which delivered key metrics together with:

- 140 koz mined over 3.75 years (35 koz pa)

- Internet provide worth of AU$99 million

- Inner charge of go back of 736 %

- Pre-production capital necessities of $12 million

- All-in maintaining prices of AU$1,972/oz.

- Jasper Hills is situated simply 50 km SE of Brightstar’s processing plant within the Laverton gold venture

- Brightstar plans to proceed producing shareholder worth via a mixture of advancement and strategic acquisitions along side some exploration.

Key Tasks

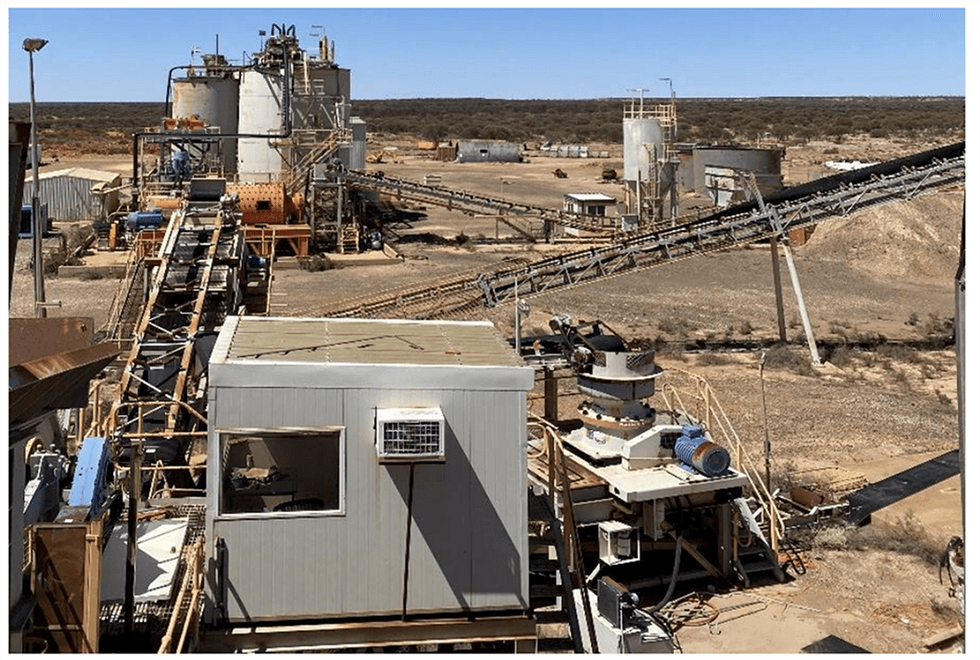

Brightstar Processing Facility

Positioned as regards to Brightstar’s current mineral belongings at Laverton, the Brightstar Processing Plant supplies the corporate with a substantial operational head get started over its friends.

Highlights:

- Intensive Infrastructure: Present amenities on the plant come with two ball generators, an influence station and gravity and elution circuits. Different infrastructure comprises:

- A tailings garage dam

- An on-site procedure water pond

- An operational 60-person lodging camp

- An airstrip on the within sight Cork Tree Neatly Venture

- Automobiles and kit come with a forklift, bobcat, two loaders, more than one mild automobiles and a 30-tonne crane.

- A Leg Up Over Competition: The presence of pre-existing processing infrastructure represents important time financial savings in comparison to greenfields advancement. Brightstar had an unbiased valuation finished which valued the processing plant at AU$60 million in substitute worth.

- Low In advance Capital Value: As a part of the scoping find out about launched in September 2023, GR Engineering estimated a capital value requirement to refurbish and increase the milling capability would value simply AU$18.5 million.

- With reference to Current Property: Brightstar’s primary advancement initiatives — Cork Tree Neatly, Jasper Hills, Beta and Alpha — are all as regards to the plant.

Gold doré bars (BTR005 – BTR016) poured on 9 March 2024

Cork Tree Neatly

Cork Tree Neatly is a previously working mine, generating 45 koz of gold over its lifespan. Positioned more or less 35 kilometers north of Laverton on Bandya Station Street, the venture’s JORC 2012-compliant mineral useful resource of 6.4 Mt at 1.4 g/t for 303 koz of gold.

Highlights:

- Promising Drilling Effects: Two 6,000-meter drill systems had been finished in past due 2022, and within the first quarter of 2023 delivered an uplift in tonnages and oz. at a discovery value of AU$30 according to ounce. In 2023 the JORC 2012 Mineral Useful resource Estimate larger via 20 % to 303 koz, representing a 65-percent build up to the indicated oz. to 157 koz @ 1.6 g/t gold.

- Upcoming Feasibility Research: The drilling program will underpin a number of feasibility research that Brightstar intends to habits later this 12 months. At this time, Brightstar has outlined a useful resource envelope over a strike period of roughly 1 kilometer and all the way down to 200 meters.

- Space Geology: The Cork Tree deposit is positioned alongside the western limb of the Erlistoun synclical construction, a chain which incorporates mafic volcanic lavas, tuffs and tuffaceous sediments along minor interflow graphitic shales and banded iron formation. The mine itself is composed of chlorite schist-altered high-magnesium basalt footwalls overlain via graphitic shales containing banded iron and chert beds. Gold mineralization is contained inside of sediments intruded via concordant porphyry sills spanning the period of the mineralized zone.

- Top-grade Assays from the 2024 Drill Program: First spherical of assay effects from 20 diamond drill holes at Cork Tree Neatly had been extraordinarily certain, with intercepts returned together with 34.4 metres @ 7.94 g/t gold from 43.5 metres (CTWMET004) and 27.6 metres @ 17.8 g/t gold from 51 metres (CTWMET003).

2d Fortune Gold Mine

2d Fortune is an working underground gold mine owned and run via Linden Gold, which is the topic of an off-market takeover via Brightstar introduced in March 2024. 2d Fortune has produced +14,000oz gold in FY24 12 months thus far and is administered beneath an ‘proprietor operator’ type.

2d Fortune has a high-grade MRE of 165kt @ 10.9 g/t gold for 58 koz. Restricted fashionable and systematic exploration has took place around the ~20km of strike period of potential geology at 2d Fortune. This gifts a great opportunity to leverage current staff, camp & similar infrastructure to unexpectedly assess objectives and habits environment friendly drilling systems to additional develop the MRE and lengthen the mine existence at 2d Fortune.

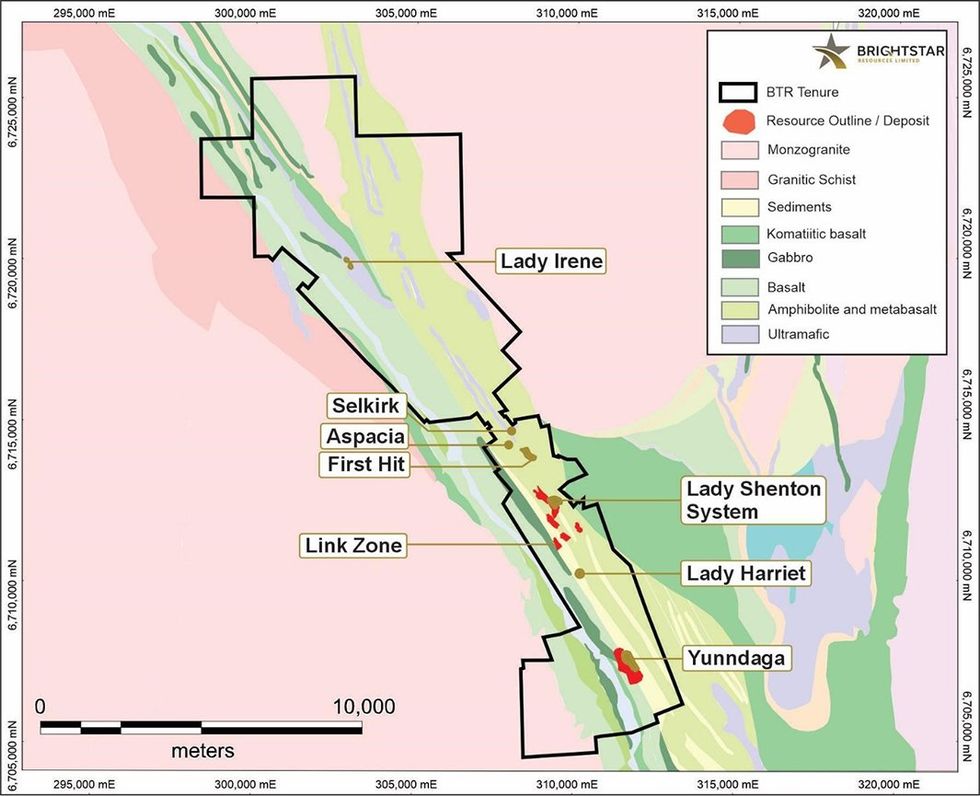

Menzies Gold Venture

Positioned 130 kilometers north of the globally important Kalgoorlie gold deposit, Menzies represents one among Western Australia’s main historical gold fields. The venture, totally owned and operated via Kingwest earlier than its merger with Brightstar, is composed of a contiguous land bundle of a strike period above 20 kilometers. All deposits at the moment are One hundred pc owned via Brightstar and lie inside of granted mining rentals.

Brightstar intends to leverage current processing infrastructure within the district to monetise the high-grade open pit oz. produced via this mine.

Highlights:

- Vital Ancient Manufacturing: Menzies has hosted more than one traditionally mined high-grade gold deposits which in combination produced a complete of over 800,000 oz. at 19 g/t gold. This comprises 643,000 oz. @ 22.5 g/t gold from underground.

- Benefit Sharing: Brightstar and BLM Ventures had a 50/50 profit-sharing three way partnership settlement to milk the Selkirk deposit at Menzies. In March 2024, Brighstar introduced the a success of completion of all of the ore processing from the Selkirk JV, with a complete of 430.7 kg of gold doré poured which netted Brightstar $6.5 million as a part of its cash in percentage.

- Space Geology: The Menzies Gold Venture is hosted alongside the Menzies Shear Zone within the western margin of the Menzies greenstone belt. It shows a geologic environment very similar to the Sand Queen Gold Mine at Comet Vale.

LAVERTON GOLD PROJECT – OTHER RESOURCES

Beta

Positioned right away adjoining to the Brightstar Plant, the Beta Venture features a 60-person camp. It incorporates a blended JORC 2012-compliant mineral useful resource of one,882 kt at 1.7 g/t for 102 koz of gold. The deposit happens alongside the Japanese Margin of the Laverton Tectonic Zone, notable for webhosting more than one primary gold occurrences together with Granny Smith, Keringal, Pink October and First light Dam.

Alpha

Website hosting a blended JORC 2012-compliant mineral useful resource of one,452 gold at 2.3 g/t for 106 koz, the Alpha Venture. Long run exploration systems and feasibility research will search to doubtlessly capitalize on Alpha’s shut proximity to Beta.

Control Workforce – Publish Of entirety of Linden Merger

Alex Rovira – Managing Director

Alex Rovira is a professional geologist and an skilled funding banker having centered at the metals and mining sector since 2013. Rovira has enjoy in ASX fairness capital markets actions, together with capital raisings, IPOs and merger and acquisitions.

Richard Crookes – Non-executive Chairman

Richard Crookes has over 35 years’ enjoy within the sources and investments industries. He’s a geologist via coaching having in the past labored as the manager geologist and mining supervisor of Ernest Henry Mining in Australia.

Crookes is managing spouse of Lionhead Sources, a important minerals funding fund and previously an funding director at EMR Capital. Previous to that he used to be an government director in Macquarie Financial institution’s Metals Power Capital (MEC) department the place he controlled all sides of the financial institution’s primary investments in mining and metals firms.

Andrew Wealthy – Govt Director

Andrew Wealthy is a point certified mining engineer from the WA Faculty of Mines and has acquired a WA First Magnificence Mine Managers Certificates. Wealthy has a powerful background in underground gold mining with enjoy predominantly within the advancement of underground mines at Ramelius Sources (ASX:RMS) and Westgold Sources (ASX:WGX).

Ashley Fraser – Non-executive Director

Ashley Fraser is an achieved mining skilled with over 30 years enjoy throughout gold and bulk commodities. Fraser used to be a founding father of Orionstone (which merged with Emeco in a $660-million consolidation) and is a founder/proprietor of Blue Cap Mining and Blue Cap Equities.

Jonathan Downes – Non-executive Director

Jonathan Downes has over 30 years’ enjoy within the minerals business and has labored in quite a lot of geological and company capacities. Skilled with gold and base metals, he has been in detail concerned with the exploration procedure via to manufacturing. Downes is lately the managing director of Kaiser Reef, a excessive grade gold manufacturer, and non-executive director of Cazaly Sources.

Dean Vallve – Leader Working Officer

Dean Vallve holds technical {qualifications} in geology & mining engineering from the WA Faculty of Mines, an MBA, and a WA First Magnificence Mine Managers Certificates. Vallve used to be in the past in senior mining and find out about roles at ASX indexed mid-cap sources firms Scorching Chili (ASX:HCH) and Calidus Sources (ASX:CAI).