Robinhood vs. moomoo vs. Webull

On the subject of making an investment, choosing the right buying and selling app could make a large distinction. No longer simplest will a easy consumer revel in with the entire options you search streamline your funding procedure, but in addition minimum charges can lend a hand take advantage of your attainable earnings.

Some common funding apps lately come with Robinhood, moomoo, and Webull. However the precise one varies in line with your personal tastes and wishes.

In partnership with moomoo, let’s discover each and every to provide you with a greater concept of which possibility may well be the most efficient have compatibility for you.

In case you’re interested in getting began with moomoo, open and fund an account right here to earn a “Magnificent 7” fractional proportion package deal or 1.5% Money Praise fit ($300 max) on Transfers. Phrases & Prerequisites practice. >>

Robinhood vs moomoo vs Webull

Every of those making an investment platforms means that you can spend money on shares, ETFs, or even crypto via ETFs. After all, each and every comes with the chance related to making an investment your price range available in the market. But when you have an interest in development an funding portfolio, this sort of 3 platforms may well be the precise have compatibility.

We’re going to match each and every platform on options, charges, buyer revel in, and extra. Let’s get began.

moomoo

moomoo is a well-liked buying and selling app that lets you spend money on inventory, ETFs, and choices. They even permit you to simply spend money on the Chinese language and Hong Kong inventory exchanges.

What units moomoo aside is their focal point on buying and selling. Each inventory and possibility buying and selling are the important thing options of the app.

Most sensible Options

- Prime money sweep APY: Moomoo lately gives a 5.1% APY via their money sweep Program.

- Loose get admission to to real-time information: You’ll faucet into information about real-time bids and asks for a wide array of shares, with out paying for the guidelines. Different perks come with details about upcoming IPOs that can assist you plan forward.

- Fractional stocks: You’ll purchase fractional stocks via moomoo’s platform.

- Customized inventory screener: If you have an interest to find a inventory that meets your particular parameters, you’ll use this device to filter out in line with many signs and dozens of filters to discover a inventory that can fit your funding targets.

- No choices contract charges: You’ll skip contract charges on fairness choices. whilst index choices shall be matter to a $0.50 consistent with contract price. Different charges might practice. For more information, talk over with moomoo.com/us/pricing

Charges

moomoo gives commission-free making an investment for U.S. shares and ETFs. However you’re going to face charges should you business during the Hong Kong inventory marketplace.

Buyer Enjoy

moomoo has the least choice of Trustpilot opinions of the 3 apps we’re evaluating, at round 50. It has a score of 2.9 out of five stars as of March 2024. moomoo has additionally earned at 4.6 out of five megastar rankings within the Apple App Retailer and Google Play Retailer, with over 20,000 reviewers.

All in all, the numbers counsel that moomoo customers are playing a greater revel in.

App Enjoy

Right here’s what the moomoo app seems like whilst you’re putting in place a business:

Pictures equipped don’t seem to be present and any securities are proven for illustrative functions simplest and isn’t a advice.

Robinhood

Robinhood was once the primary commission-free making an investment app. It was once the primary corporate to supply loose buying and selling, and it has made it a focal point to stay making an investment so simple as conceivable.

Most sensible Options

- Prime money APY reserved for Robinhood Gold: You’ll earn 1.5% APY on uninvested money. However in case you are a Robinhood Gold member, you’ll earn 5% in your uninvested money.

- Robinhood Retirement: You’ll earn as much as a 1% fit for each and every greenback you give a contribution towards retirement. However this can be a limited-time be offering for Robinhood Gold participants.

- Fractional stocks: The Robinhood platform helps fractional stocks.

Charges

Robinhood gives commission-free making an investment for shares, ETFs, and choices. The corporate earns cash during the subscription-based Robinhood Gold account, which comes with get admission to to such things as margin buying and selling. That $5 per 30 days subscription can upload up, particularly should you don’t have some huge cash invested.

Buyer Enjoy

It’s vital to indicate that Robinhood has noticed a large number of unfavourable press. It even needed to pay a $70 million positive to the FINRA. The unfavourable press is accompanied via a 1.3 out of 5-star score on Trustpilot, with over 3,500 reviewers. Thousands and thousands have reviewed the corporate at the Apple App Retailer, the place it earned 4.2 out of five stars.

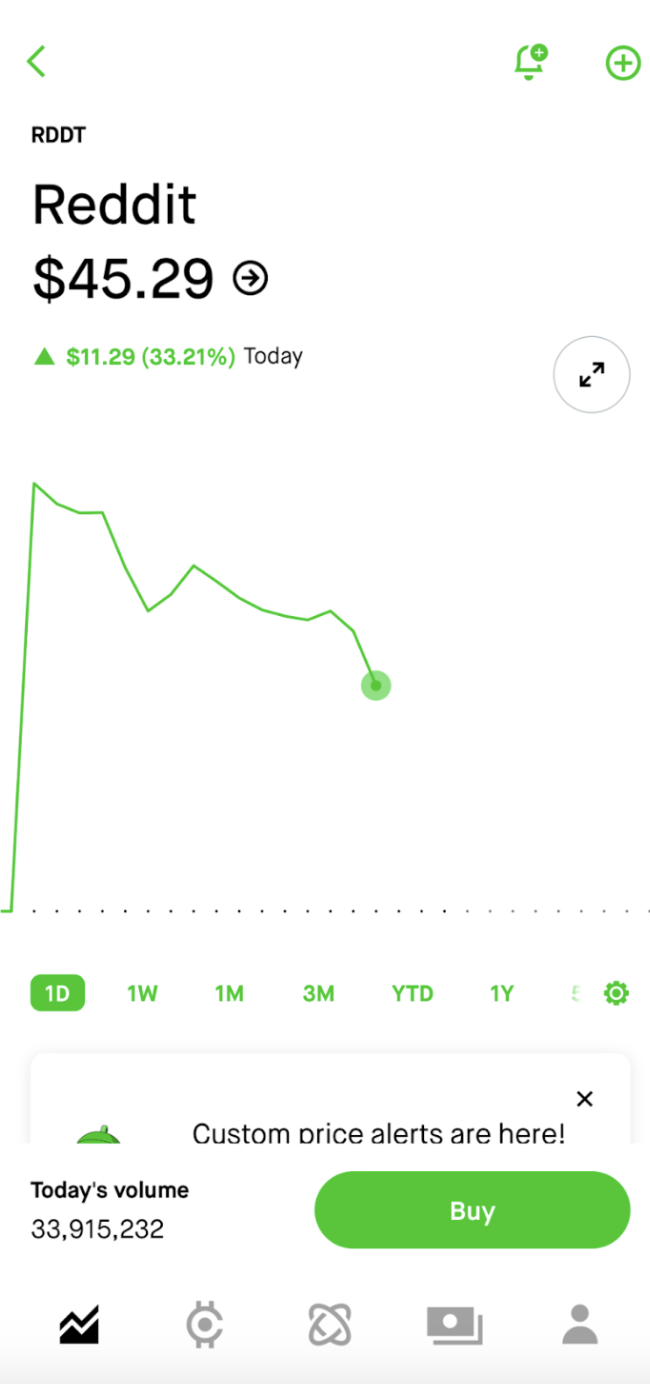

App Enjoy

Robinhood is understood for having the cleanest app interface. That is what the revel in seems like:

Pictures equipped don’t seem to be present and any securities are proven for illustrative functions simplest and isn’t a advice.

For more info, take a look at our Robinhood evaluation.

Webull

Webull is some other app that has fascinated about inventory buying and selling. They had been one of the vital first cellular apps so as to add a large number of charts and analysis into the making an investment procedure.

Most sensible Options

Webull’s highlighted options:

- Buying and selling sources: Webull customers can faucet into over 50 signs and 20 charting gear that can assist you set up your portfolio. With a powerful quantity of knowledge at your fingertips, you’ll make extra knowledgeable buying and selling choices.

- Fractional stocks: Webull helps fractional stocks on its platform.

- No choices contract charges: There are not any contract charges for buying and selling inventory and ETF choices on Webull.

Charges

Webull additionally gives commission-free trades for shares. However you’ll pay a 1% level unfold on all sides of a crypto business.

Buyer Enjoy

Webull has a 1.5 out of five megastar Trustpilot score, with not up to 200 reviewers. However app opinions are a lot upper. It earned 4.3 out of five stars within the Google Play Retailer, with over 188,000 opinions. And four.7 out of five stars within the Apple App Retailer, with over 297,000 opinions.

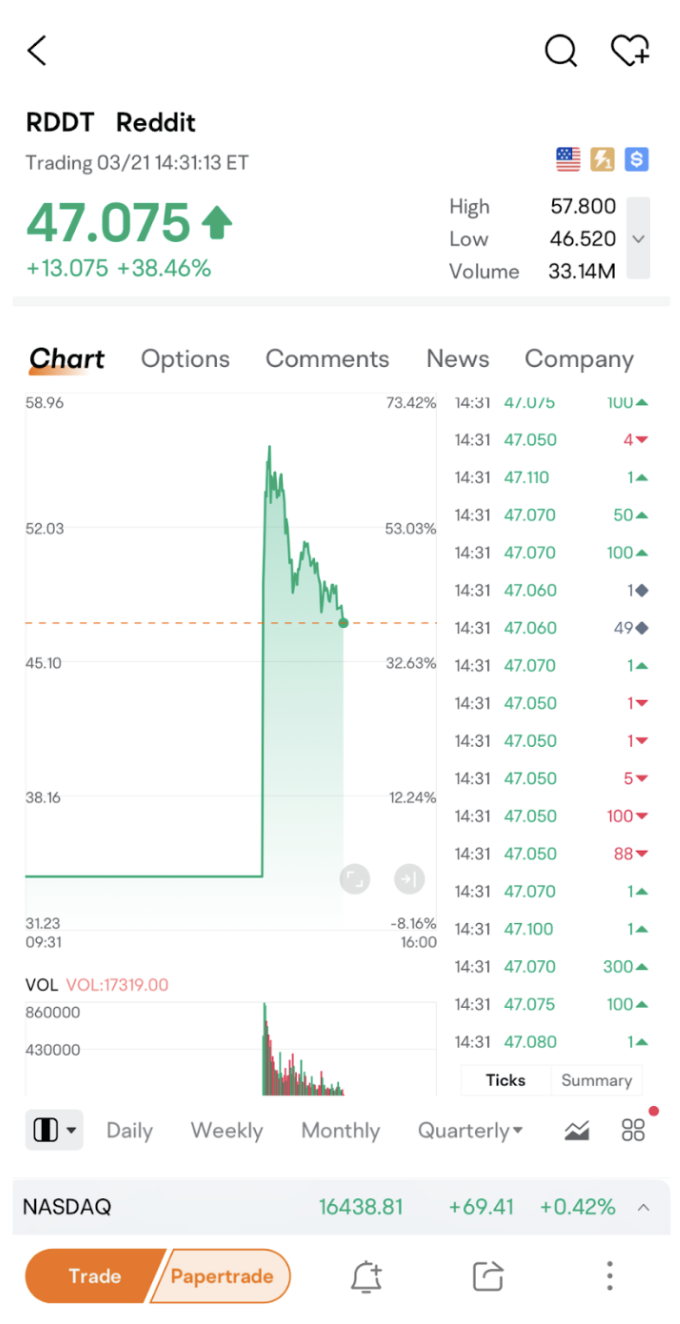

App Enjoy

Here’s what the app revel in on Webull is like:

Pictures equipped don’t seem to be present and any securities are proven for illustrative functions simplest and isn’t a advice.

Be informed extra in our Webull evaluation.

Robinhood vs moomoo vs Webull: Which Is Very best For You?

Robinhood’s easy platform may well be the precise have compatibility for newbies. Despite the fact that you will have get admission to to a couple marketplace data, it’s no longer as powerful as what moomoo or Webull has to supply.

Moomoo shines via providing a 5.1% APY money sweep and get admission to to the Hong Kong marketplace. Moomoo customers can faucet into an in depth array of loose sources to stick on best in their portfolio and make trades with reasonably priced charges. alongside the way in which.

The Backside Line

Robinhood, moomoo, and Webull each and every have execs and cons. As an investor, you’ll need to make a decision which possibility most closely fits your wishes.

In case you’re no longer certain the place to begin, believe giving moomoo a shot. You’ll no less than earn 5.1% APY in your uninvested money, and will get a “Magazine 7” fractional proportion package deal for deposits or a 1.5% Money Praise fit ($300 max) on transfers. Phrases & Prerequisites practice.

Choices buying and selling is dangerous and no longer suitable for everybody. Learn the Choices Disclosure File (j.us.moomoo.com/00xBBz) prior to buying and selling. Choices are advanced and you’ll briefly lose all the funding. Supporting medical doctors for any claims shall be furnished upon request.

Moomoo is a monetary data and buying and selling

app introduced via Moomoo Applied sciences Inc. Securities are introduced via Moomoo Monetary Inc., Member FINRA/SIPC. The writer is a paid influencer and isn’t affiliated with Moomoo Monetary Inc. (MFI), Moomoo Applied sciences Inc. (MTI) or every other associate of them. Any feedback or reviews equipped via the influencer are their very own and no longer essentially the perspectives of moomoo. Moomoo and its associates don’t endorse any buying and selling methods that can be mentioned or promoted herein and don’t seem to be answerable for any services and products equipped via the influencer. This commercial is for informational and academic functions simplest and isn’t funding recommendation or a advice to interact in any funding or monetary technique. Making an investment comes to chance and the prospective to lose primary.

Funding and fiscal choices must all the time be made in line with your particular monetary wishes, targets, targets, time horizon and chance tolerance. Any illustrations, eventualities, or particular securities referenced herein are strictly for tutorial and illustrative functions and isn’t a advice. Previous efficiency does no longer ensure long run effects.