Profligate spending and kicking the can down the street results in Debt Jubilee

January 5, 2024 (Investorideas.com Newswire) Decrease rates of interest and large asset purchases by means of central banks are the financial equipment of selection on the subject of restoring surprised economic techniques. The theory being that making the price of borrowing affordable for people and companies will lure them to spend, spend, spend.

Quantitative easing is a method utilized by the USA Federal Reserve and different central banks to stimulate the financial system in instances of disaster. The Fed buys up securities from its member banks, thereby including new cash to the financial system (that is the place the expression, the Fed is “printing cash” comes from). It is a manner of investment new expenditures, with out in fact dipping into the federal funds.

The theory is to disencumber extra money for banks to make loans to folks and companies, thus rising the financial system. The cash isn’t money, however credit score this is added to banks’ deposits. When it desires to print cash, the Fed lowers the benchmark federal finances price, and banks in flip decrease their rates of interest, making capital extra reasonably priced in order that companies and buyers are much more likely to borrow.

The Fed used quantitative easing within the wake of the 2008-09 economic disaster and it did so once more in 2020 to take care of the coronavirus pandemic. QE used to be a success in combating a economic meltdown all the way through 2008 and 2020, however the impact used to be a reliance on affordable credit score that fueled each a inventory marketplace bubble and an actual property bubble. Bond buyers additionally become hooked on Fed stimulus. It’s because all the way through QE, authorities bond yields dropped to close 0%, on the other hand this additionally intended that bond costs stayed increased. Bond yields and bond costs transfer in reverse instructions.

After the pandemic, the Fed’s financial coverage shifted 180 levels and it moved to quantitative tightening and a cycle of rate of interest hikes that experience handiest not too long ago leveled off.

Since June, 2022, the central financial institution has been shrinking its asset holdings, most commonly Treasuries and loan bonds. In step with Bloomberg, the present tempo permits a most of $60 billion in Treasuries and $35 billion in mortgage-backed securities to mature each and every month with out alternative.

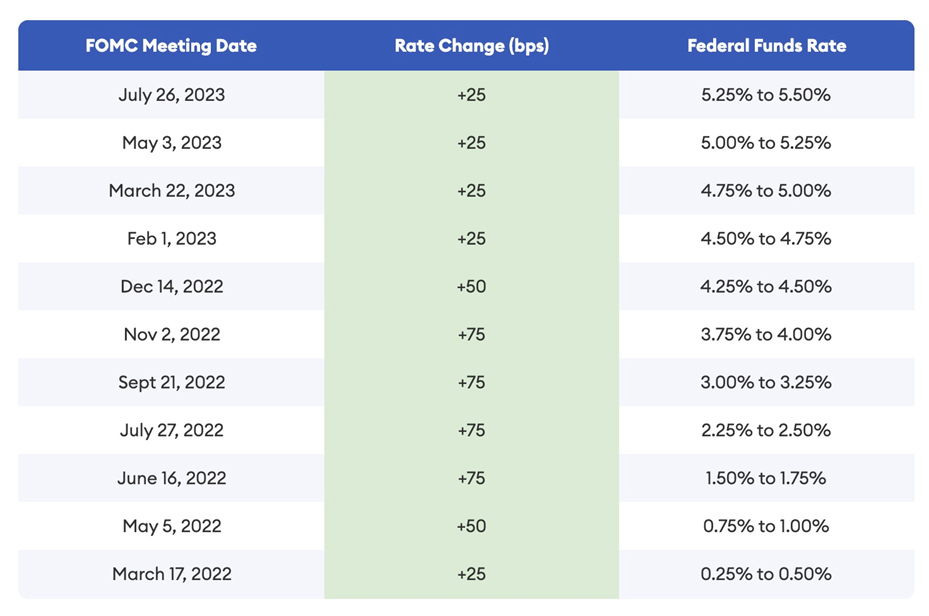

Between March 2022 and July 2023, the Federal Reserve lifted rates of interest 11 instances to the present vary of five.25-5.5%, to quell inflation that had risen to 40-year highs – the mix of financial easing by means of the Fed and prime authorities spending all the way through the pandemic together with direct stimulus bills to American citizens.

Supply: Forbes

International debt again on the upward push

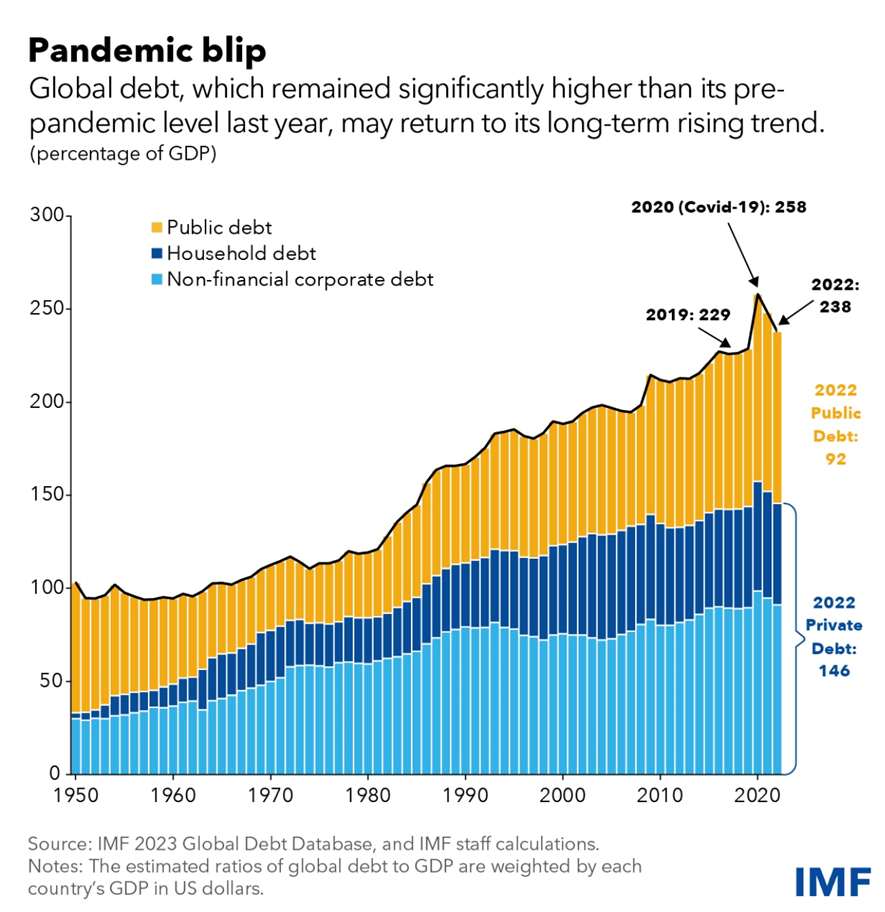

The worldwide debt burden retreated in 2022, on the other hand it stays above pre-pandemic ranges, states the newest (October) replace of the IMF’s International Debt Database.Overall debt stood at 238% of world GDP closing yr, 9 share issues greater than in 2019.

icles/2023/09/13/global-debt-is-returning-to-its-rising-trend”>IMF weblog put up reviews that regardless of financial enlargement restoration from the pandemic and higher-than-expected inflation, which reduces the “actual” price of debt (see segment under on inflating away the debt), public debt stays stubbornly prime:

Fiscal deficits stored public debt ranges increased, as many governments spent extra to spice up enlargement and reply to meals and effort value spikes at the same time as they ended pandemic-related fiscal beef up.

In step with the IIF (Institute of World Finance), international debt reached a staggering $307 trillion within the 3rd quarter of 2023, with giant will increase in each mature markets (US, Japan, France, UK) and rising markets (China, India, Brazil and Mexico). In a file, the economic services and products business crew mentioned international debt in greenback phrases rose by means of $10 trillion within the first part of 2023 and by means of $100 trillion during the last decade. It mentioned the worldwide debt to GDP ratio is now 336%, having risen for 2 immediately quarters. Sooner than 2023, the ratio declined for seven quarters. “The surprising upward thrust in inflation used to be the primary issue in the back of the pointy decline in debt ratio during the last two years,” the IIF mentioned. The file additionally said greater than 80% of the debt buildup got here from the evolved international, noting that “As greater charges and better debt ranges push authorities passion bills greater, home debt lines are set to extend.”

Family debt to GDP in rising markets used to be nonetheless above pre-pandemic ranges in large part because of China, Korea and Thailand.

Whilst public debt declined by means of 8% of GDP during the last two years, it handiest offset about part of the pandemic-related building up, in step with the IMF’s numbers. Personal debt, which contains family and non-financial company debt, fell by means of 12% of GDP, once more now not sufficient to erase the pandemic surge.

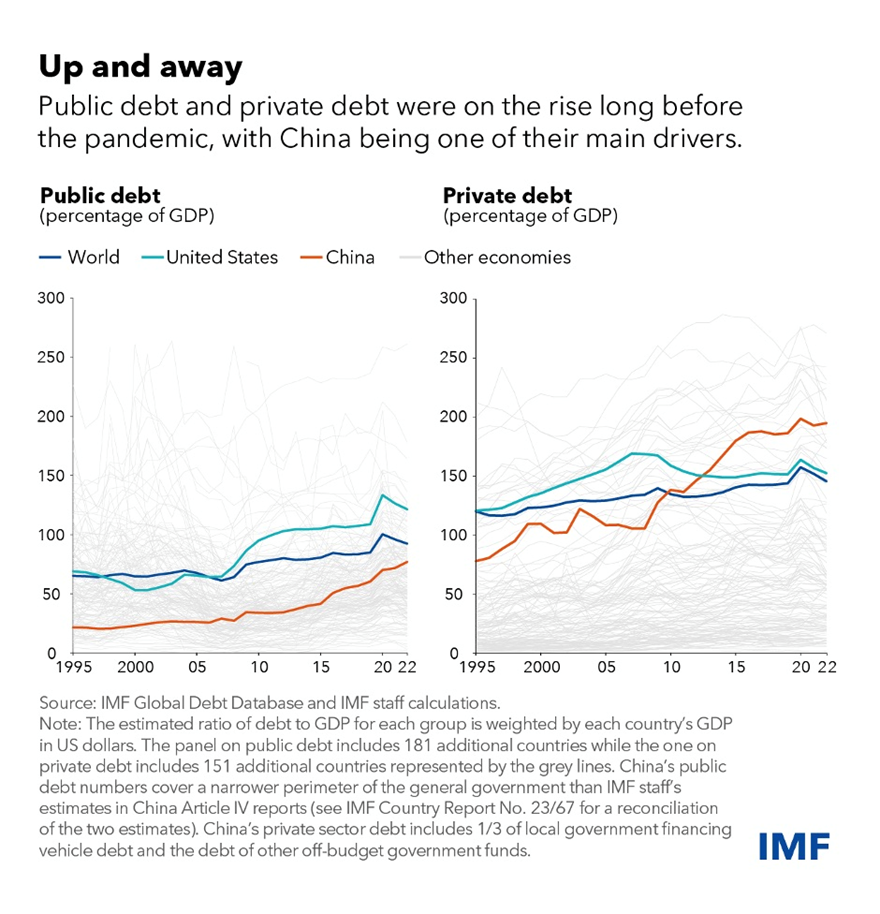

The IMF observes that prior to the pandemic, international debt to GDP ratios were growing for many years, with public debt tripling because the mid-Nineteen Seventies to succeed in 92% of GDP by means of the tip of 2022. Personal debt additionally tripled to 146% of GDP however over an extended time span, between 1960 and 2022.

Additionally, whilst a lot has been written on China’s expanding debt, the IMF notes that whilst China’s debt to GDP ratio has risen to about the similar degree as the USA, in greenback phrases its general debt is markedly decrease, at $47.5 trillion in comparison to the USA’s on the subject of $70 trillion. On the other hand, China’s 28% percentage of non-financial company debt is the most important on this planet.

Supply: IMF

US debt debacle

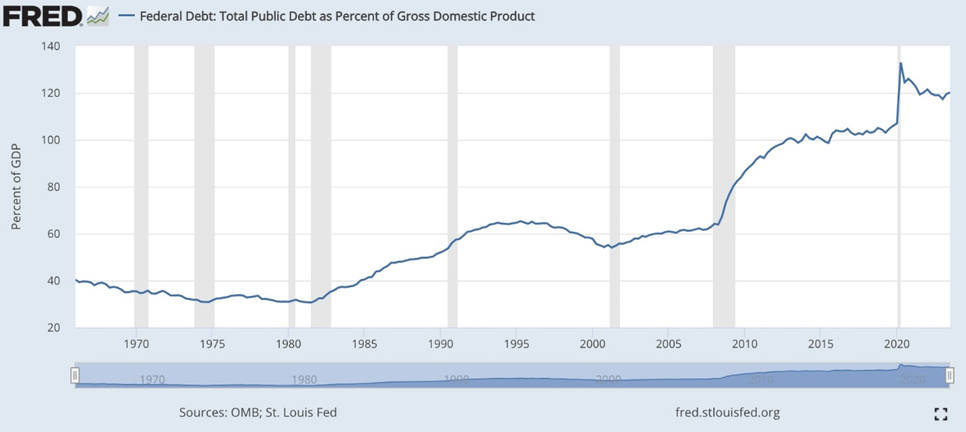

The USA has the arena’s perfect nationwide debt in greenback phrases, however Japan’s is greater with regards to GDP – 258% as opposed to the USA’s present 120%.

Supply: FRED

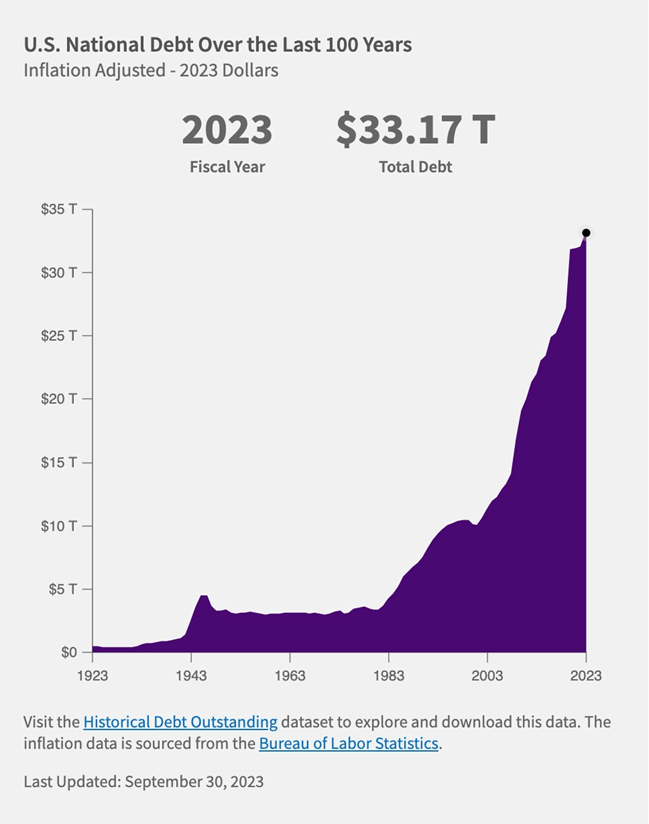

The USA Treasury not too long ago reported that, as of Dec. 29, 2023, general US debt surpassed $34 trillion for the primary time. Evaluate this to January 2009, when the debt used to be simply $10.6 trillion. For context, the debt rose by means of $1 trillion during the last 3 months, $2 trillion during the last six months, $4T during the last two years, and $11T during the last 4 years.

(Notice that the nationwide debt does now not come with money owed carried by means of state and native governments, nor does it come with money owed carried by means of folks, comparable to bank card debt or mortgages.)

Supply: FiscalData

Supply: 0 Hedge

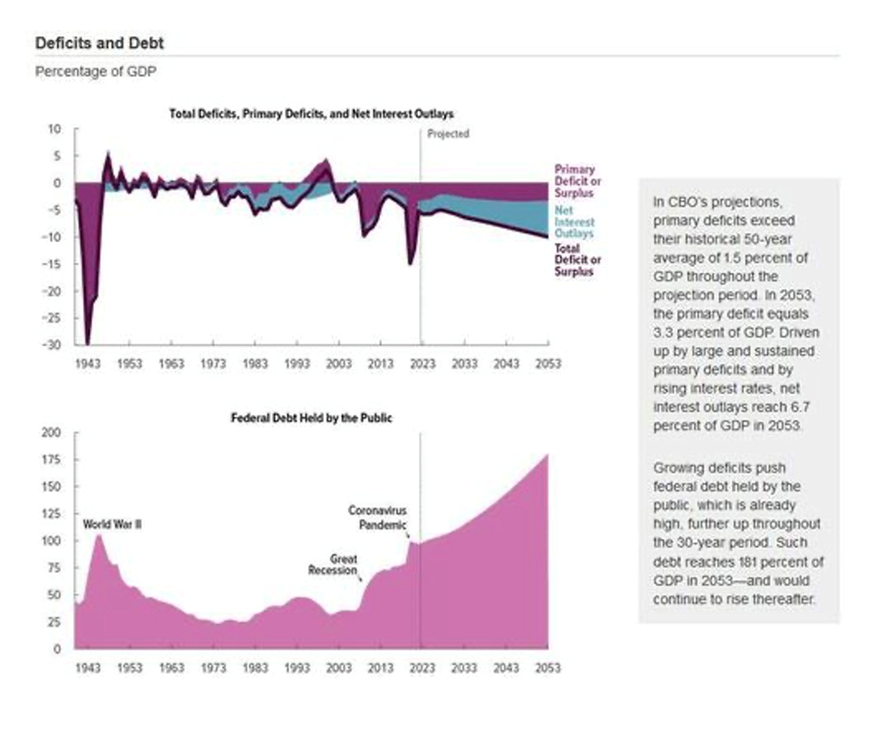

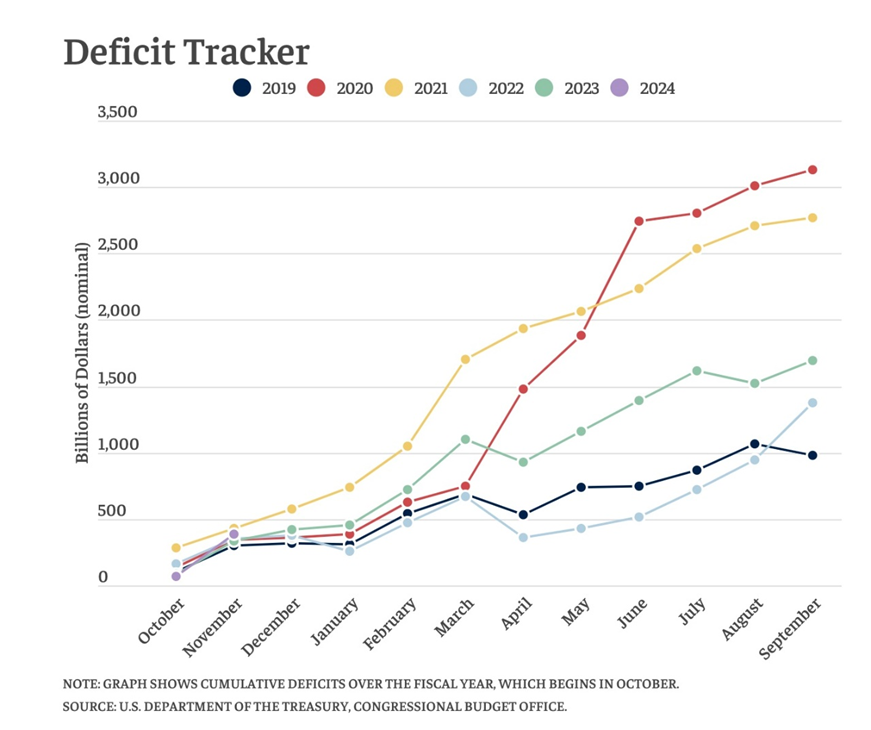

In step with the Bipartisan Coverage Heart’s deficit tracker, even prior to the pandemic, the government ran massive and rising funds deficits at just about $1 trillion in line with yr. Emergency spending measures to take care of the commercial fallout from covid-19 driven funds deficits to ranges now not observed since International Conflict II. Even though the deficit has fallen to pre-pandemic ranges, deficits are projected to develop considerably over the approaching a long time, states the BPC.

Supply: Bipartisan Coverage Heart

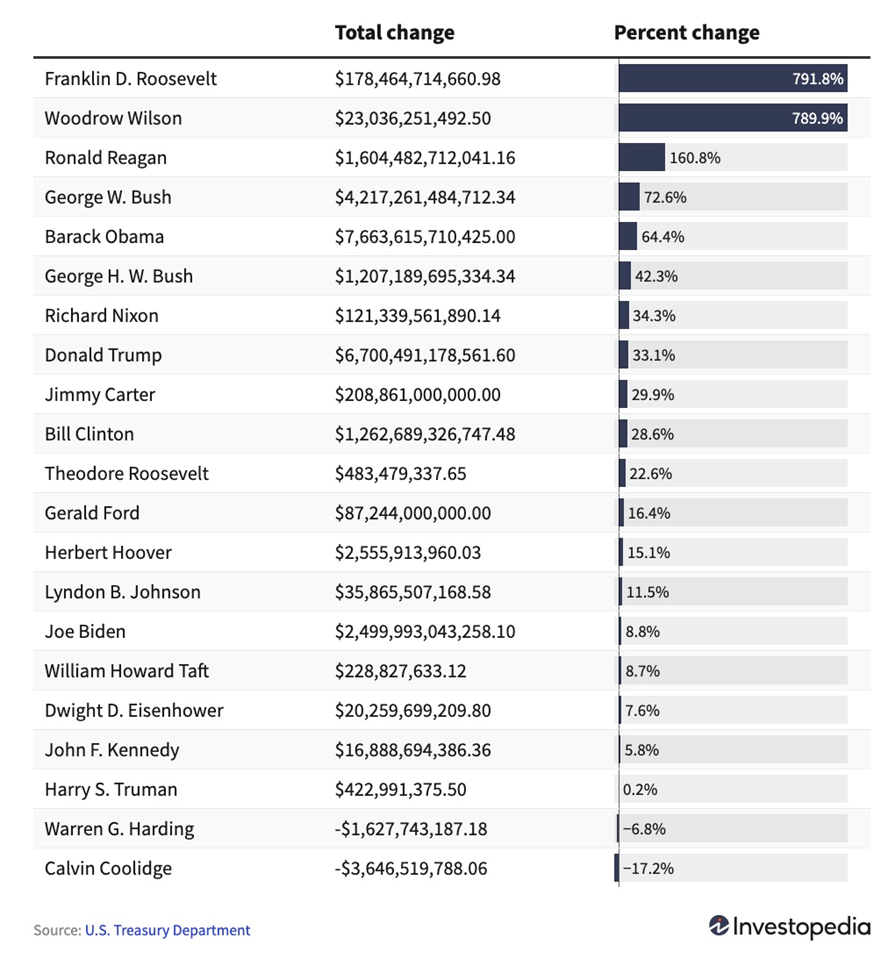

Presidents Trump and Biden have each been criticized as being particularly free with the general public handbag. Trump is in fact 8th on Investopedia’s checklist of essentially the most profligate presidents.

Debt by means of US President. Supply: Investopedia

When historical past is written to incorporate Biden, on the other hand, he’s prone to be up there. Since taking place of job in 2021, the nationwide debt has grown by means of over $6.24 trillion, in large part pushed by means of covid-19 aid measures. In step with Congressional Funds Estimates, Biden’s American Rescue Plan would upload $1.9T to the nationwide debt by means of 2031.

Amongst his different giant spends are: the trillion-dollar bipartisan infrastructure invoice signed into regulation in November, 2021; his amended scholar mortgage forgiveness program which might value $230 billion over 10 years; and his Inflation Relief Act, which makes a speciality of inexperienced power projects.

Investopedia notes the nationwide debt higher just about 40-fold below Abraham Lincoln (1861-65), the most important more than one in US historical past, whilst for presidents in both the 20 th or twenty first century, Roosevelt used to be the highest spender.

During the last 60 years, just about each and every US president has run a report funds deficit one day, with former Presidents Trump, Obama, and George W. Bush working the greatest US funds deficits in historical past, states the economic information and training web page.

Sooner than 1930, virtually all funds deficits run by means of the American authorities had been the results of wars. The federal government borrowed about $211 billion to lend a hand pay for International Conflict II. After invading Iraq and Afghanistan, and beginning a Conflict on Terror following the 9/11 assaults, the price of those 3 wars in September, 2021 used to be estimated at $8 trillion.

The continued value of wars is mirrored in the yearly army funds, which reached a report $600 billion in 2009 as Bush’s presidency ended, Investopedia states. In December, 2023, the USA licensed a $250 million support bundle to Ukraine to lend a hand in its battle with Russia. That is along with $75 billion (with a b) in help between January 2022 and October 2023.

Govt aid all the way through the Nice Recession and the pandemic has additionally value trillions. Obama’s 2009 American Restoration and Reinvestment Act used to be an $832 billion fiscal stimulus bundle. In 2020, following government-mandated trade shutdowns and a pointy upward thrust in unemployment, the Trump White Space handed the $2.2T CARES Act, which approved direct bills of $1,200 in line with grownup and $500 in line with kid for American households making not up to $75,000 a yr.

The next yr, President Biden handed every other stimulus bundle known as the American Rescue Plan Act, price about $1.9 trillion.

Investopedia issues out it is not handiest presidents who’re given the danger to run up, or constrain, the nationwide debt. Congress will have to vote on appropriations and projects proposed by means of the president, and contributors of Congress can introduce proposals which will have to be voted on prior to they’re despatched to the president for signature.

Inflating away the debt?

There’s a faculty of financial idea that claims it’s imaginable to “inflate away the debt“. That is when the federal government intentionally generates inflation as some way of decreasing its debt burden.

With out getting too technical, the best way this works is thru expansionist financial coverage. The Federal Reserve can, if it desires to, create extra inflation by means of expanding the cash provide, decreasing rates of interest, or enticing in quantitative easing (QE). As inflation rises the nominal price of the debt remains the similar however the “actual” price decreases, on account of inflation’s impact of eroding the foreign money’s buying energy.

We already know that inflating away the debt does not paintings. The Fed’s fresh rate-hiking cycle is a working example. For a yr and a part, the Fed stored elevating rates of interest, nevertheless it needed to prevent as a result of greater charges had been destructive the USA financial system. Inflating away the debt reasons financial destruction now not handiest regionally however in creating economies, whose currencies are price not up to the more potent US greenback reserve foreign money. Now that charges are shedding, the USA greenback is weakening.

A put up on Searching for Alpha says inflationists make two errors on the subject of authorities: the primary assumes that authorities debt is extra necessary than client debt, and the second one is that it isn’t really easy to inflate away authorities debt.

Creator Michael Shedlock additionally asks what will be the prices of a “a success” inflation marketing campaign. Those may come with (and feature incorporated) growing loan charges, greater power prices, and better long term prices of unfunded scientific liabilities and social safety bills, to not point out the upper passion at the nationwide debt.

“Inflationists act as though unfunded legal responsibility prices and passion at the nationwide debt keep consistent,” Shedlock writes. “Additionally neglected is the lack of jobs and growing defaults that can happen whilst this “inflating away” takes position. Tax receipts is not going to upward thrust sufficient to hide growing passion given a state of rampant overcapacity and international salary arbitrage.”

“Web passion prices soared to $659 billion in fiscal yr 2023, which ended September 30, in step with the Treasury Division. That is up $184 billion, or 39%, from the former yr and is just about double what it used to be in fiscal yr 2020.” CNN

A laugh information:

- Hobby prices just about doubled during the last 3 years, from $345 billion in 2020 to $659 billion in 2023.

- Hobby is now the fourth-largest authorities program, in the back of handiest Social Safety, Medicare, and protection.

- The government in 2023 spent extra on web passion than it did all spending on kids, and it additionally spent extra on passion than maximum main techniques or program spaces together with Medicaid, veterans’ techniques, meals and vitamin techniques, and training

Hobby bills over fiscal yr 2024 wll be simply over $1 trillion in step with Blomberg.

US Federal authorities web tax income for fiscal yr 2024 is budgeted $5.04 trillion.

How lengthy prior to passion bills at the debt exceeds revenues?

Debt Jubilee

The worldwide debt overhang has seriously curtailed governments’ talent to take care of a significant economic disaster comparable to a recession, battle or pandemic.

A cross-the-board ‘Debt Jubilee’ may sound radical, however a studying of historical past presentations that retiring debt can in fact make a rustic’s financial system, and its indebted citizenry, all of the higher for it.

The time period ‘Jubilee’ comes from the Previous Testomony. The guide of Deuteronomy refers to a sabbath yr all the way through which any slaves could be freed, and everybody could be allowed to go back to their circle of relatives farms and are living off the land. All the way through the Jubilee, all debt responsibilities could be forgiven – comparable to land or plants that borrowers had pledged to collectors.

The principle financial justification for a contemporary Debt Jubilee is unassuming. With money owed forgiven, governments may spend the cash recently dedicated to passion and important repayments on profitable techniques; companies would all at once be free of debt bondage and may enlarge/ rent extra personnel; and families would have extra disposable source of revenue, all of which might, in flip, building up mixture call for and inspire financial enlargement.

Canadian scholars leaving college owe a median $28,000; it isn’t unusual for regulation or scientific scholars to hold a debt load into their first process surpassing $100,000. Scholar mortgage debt is a significant inhibitor to university/ college grads with the ability to download a loan.

All the way through the economic disaster, the Obama management attempted bringing in loan forgiveness, however used to be not able to get it thru Congress. Ironic that during 2008 the Federal Reserve revealed $4 trillion to shop for up the banks’ dangerous money owed, whilst Congress sat again and allowed 10 million American house owners to be foreclosed.

An outright cancelation of sovereign debt should not be dominated out. All the way through the Despair, France and Greece had about part in their nationwide money owed written off totally. In 1953, the London Debt Settlement between Germany and 20 collectors wrote off 46% of its pre-war debt and 52% of its post-war debt. The rustic handiest needed to pay off debt if it ran a business surplus, thus encouraging Germany’s collectors to spend money on its exports, which fueled its post-war growth. In 2000, $100 billion price of money owed owed by means of creating nations had been wiped off the books.

Once more, this isn’t as far-fetched because it sounds. As a result of we are living in a fiat financial machine, currencies don’t seem to be subsidized by means of the rest bodily; the reserve foreign money, the USA greenback, used to be de-coupled from the gold usual within the early Nineteen Seventies. It isn’t like a raid on vaults filled with gold, that have an inherent, bodily retailer of price.

In truth there’s not anything combating central bankers from doing an entire international reset, hanging all debt again to 0.

Some great benefits of a Debt Jubilee would accrue to governments not sure to austerity techniques; companies that would spend money on their operations as an alternative of paying passion and important to company bondholders; and taxpayers, who would take pleasure in higher social spending and better family disposable source of revenue.

After all, now not everybody wins from a Debt Jubilee. The losers would come with bank card firms, auto producers and banks, all of which might lose the worth of the debt which for them is an asset.

Conclusion

We and others had been caution about debt for reasonably some time.

The Fed can telegraph its intentions of chopping rates of interest all it desires, the reality stays that at such unsustainably prime debt ranges, the passion bills will in the end cripple the government. Politicians are hooked on spending and the present financial machine permits it to proceed with out penalties, thru rampant money-printing.

In 2019, prior to the coronavirus disaster, the Committee for a Accountable Federal Funds (CRFB) calculated that web passion bills will just about triple over the following decade, to $928 billion by means of 2029. The projections are too conservative. In 2024 we are previous there, 5 years forward of time table – passion bills have surpassed $1 trillion, whilst the nationwide debt has ballooned from $23.2 trillion in pre-pandemic 2019 to $34 trillion, post-corona.

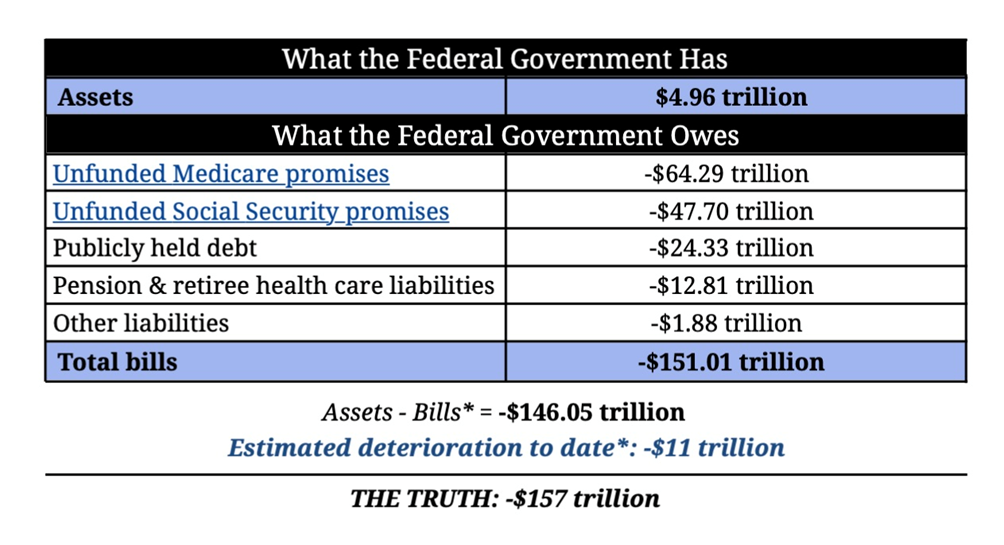

Some see the nationwide debt going a lot greater, for the reason that the best way it’s calculated now, does not come with unfunded Social Safety and Medicare guarantees. When that $151 trillion price of expenses is added, “the reality” is nearer to $164 trillion.

Supply: Reality in Accounting

The folks supposedly represented by means of the federal government cannot find the money for that degree of passion (they’re going to endure even greater passion bills on their very own debt), similar as companies can not find the money for greater passion bills on their debt. Firms will merely cross at the greater passion responsibilities to their consumers, minimize dividends or within the worst-case situations, lay off personnel.

However there’s a solution to keep away from this slow-moving automobile crash – a world debt reset – a Debt Jubilee, if you’ll. Believe what may well be completed if all of the central banks acted in combination in retiring all of the international’s debt – all $307 trillion of presidency, company and client loans. After all the economic establishments would cringe; their arms would want forcing. However…

A world huge reboots impact at the financial system could be quick and profound.

Richard (Rick) Turbines

aheadoftheherd.com

subscribe to my loose publication

Prison Realize / Disclaimer

Forward of the Herd publication, aheadoftheherd.com, hereafter referred to as AOTH.

Please learn all of the Disclaimer sparsely prior to you utilize this site or learn the publication. If you don’t conform to all of the AOTH/Richard Turbines Disclaimer, don’t get admission to/learn this site/publication/article, or any of its pages. Via studying/the usage of this AOTH/Richard Turbines site/publication/article, and whether or not you in fact learn this Disclaimer, you might be deemed to have permitted it.

Any AOTH/Richard Turbines report isn’t, and must now not be, construed as an be offering to promote or the solicitation of an be offering to buy or subscribe for any funding.

AOTH/Richard Turbines has based totally this report on data received from assets he believes to be dependable, however which has now not been independently verified.

AOTH/Richard Turbines makes no ensure, illustration or guaranty and accepts no accountability or legal responsibility as to its accuracy or completeness.

Expressions of opinion are the ones of AOTH/Richard Turbines handiest and are matter to modify with out realize.

AOTH/Richard Turbines assumes no guaranty, legal responsibility or ensure for the present relevance, correctness or completeness of any data supplied inside this Document and is probably not held chargeable for the end result of reliance upon any opinion or commentary contained herein or any omission.

Moreover, AOTH/Richard Turbines assumes no legal responsibility for any direct or oblique loss or injury for misplaced benefit, which you’ll incur on account of the use and life of the guidelines supplied inside this AOTH/Richard Turbines Document.

You settle that by means of studying AOTH/Richard Turbines articles, you might be performing at your OWN RISK. In no match must AOTH/Richard Turbines chargeable for any direct or oblique buying and selling losses led to by means of any data contained in AOTH/Richard Turbines articles. Knowledge in AOTH/Richard Turbines articles isn’t an be offering to promote or a solicitation of an be offering to shop for any safety. AOTH/Richard Turbines isn’t suggesting the transacting of any economic tools.

Our publications don’t seem to be a advice to shop for or promote a safety – no data posted in this web page is to be thought to be funding recommendation or a advice to do the rest involving finance or cash excluding acting your personal due diligence and consulting with your own registered dealer/economic guide. AOTH/Richard Turbines recommends that prior to making an investment in any securities, you talk over with a qualified economic planner or guide, and that you just must behavior an entire and unbiased investigation prior to making an investment in any safety after prudent attention of all pertinent dangers. Forward of the Herd isn’t a registered dealer, broker, analyst, or guide. We grasp no funding licenses and won’t promote, be offering to promote, or be offering to shop for any safety.

Extra Information:

This information is revealed at the Investorideas.com Newswire – a world virtual information supply for buyers and trade leaders

Disclaimer/Disclosure: Investorideas.com is a virtual writer of 3rd birthday celebration sourced information, articles and fairness analysis in addition to creates unique content material, together with video, interviews and articles. Authentic content material created by means of investorideas is safe by means of copyright regulations as opposed to syndication rights. Our web page does now not make suggestions for purchases or sale of shares, product or service. Not anything on our websites must be construed as an be offering or solicitation to shop for or promote merchandise or securities. All making an investment comes to possibility and imaginable losses. This web page is recently compensated for information newsletter and distribution, social media and advertising and marketing, content material advent and extra. Disclosure is posted for every compensated information free up, content material revealed /created if required however differently the scoop used to be now not compensated for and used to be revealed for the only passion of our readers and fans. Touch control and IR of every corporate without delay referring to particular questions.

Extra disclaimer information: https://www.investorideas.com/About/Disclaimer.asp Be informed extra about publishing your information free up and our different information services and products at the Investorideas.com newswire https://www.investorideas.com/Information-Add/

International buyers will have to adhere to rules of every nation. Please learn Investorideas.com privateness coverage: https://www.investorideas.com/About/Private_Policy.asp