Lithium Inventory Information – Global Lithium (TSXV: ILC) Publicizes Maiden Mineral Useful resource Estimate at The Raleigh Lake Lithium Mission, Ontario, Canada

Vancouver, British Columbia – March 1, 2023 (Newsfile Corp.) (Investorideas.com Newswire) Global Lithium Corp. (TSXV: ILC) (OTCQB: ILHMF) (FSE: IAH) (the “Corporate” or “ILC”) is happy to announce a maiden Mineral Useful resource Estimate (“MRE”) for the Raleigh Lake Lithium Mission (“Raleigh Lake”, “The Belongings”, the “Mission”), positioned roughly 25 km west of Ignace, Ontario, Canada. This MRE shall be printed in a comparable NI 43-101 Technical File (the “File”) inside of 45 days of the discharge of this press liberate.

The Mission contains MREs for each lithium and rubidium. The 2 MREs are intently comparable because of their spatial relationships, however their respective useful resource estimates are regarded as separate and distinctive.

The next highlights taken from the File, and set out underneath, will have to be regarded as within the context of the detailed data given there.

Lithium MRE Abstract

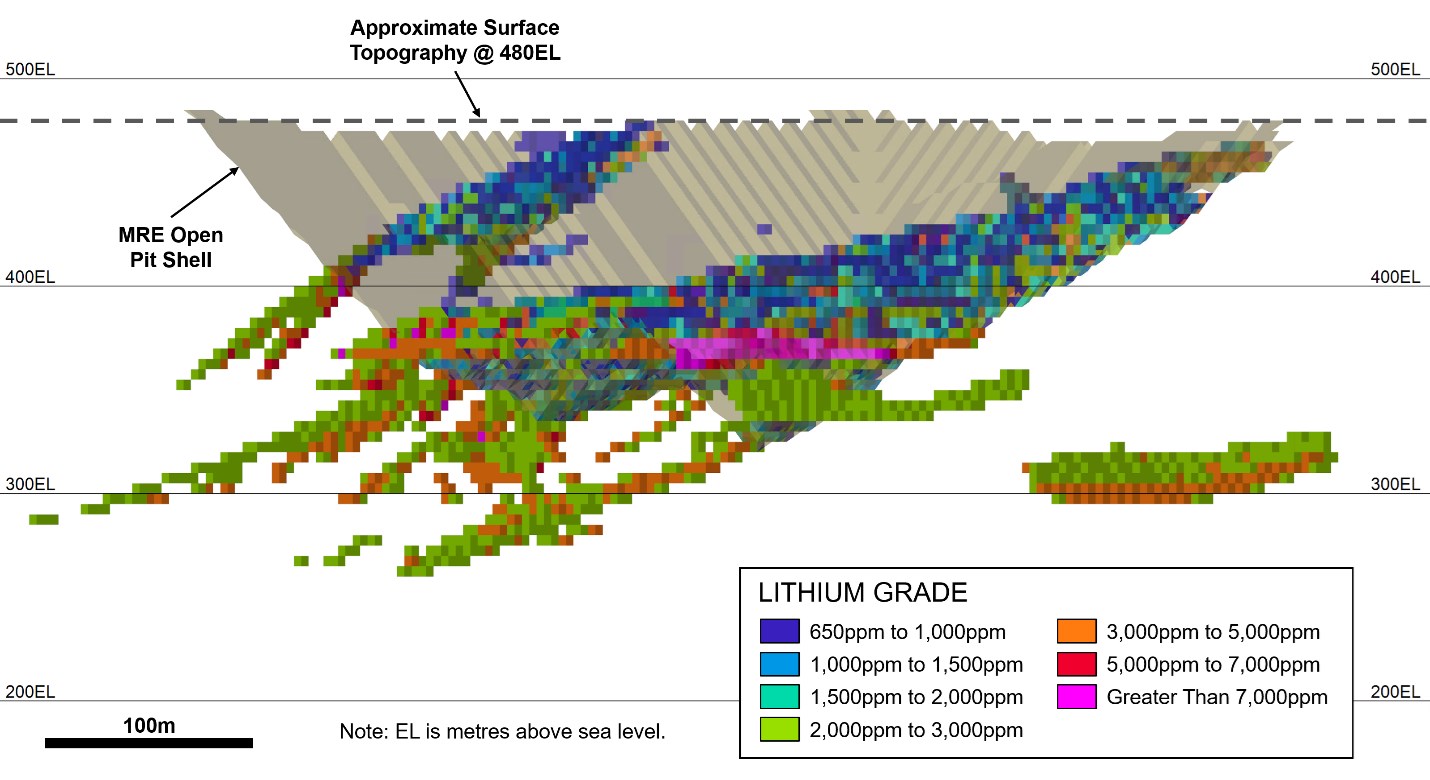

The lithium MRE for Lithium-Caesium-Tantalum (“LCT”) pegmatites of the Raleigh Lake pegmatite box is gifted in Desk 1 underneath. Lithium inside the Raleigh Lake deposit is hosted inside of spodumene laths which might be most often inexperienced in color and differ size-wise from lower than 1 cm to larger than 8 cm. Pegmatites inside the Deposit are weakly zoned and spodumene mineralization is rather homogenous all through. The open pit and underground MREs are constrained by way of optimized pit shell and minable form wireframes, respectively.

Rubidium MRE Abstract

The rubidium MRE is gifted in Desk 2 underneath. An unbiased MRE has been calculated for the rubidium contained inside of microcline zones of the LCT pegmatites. Rubidium additionally happens all through the LCT pegmatites inside the lithium-bearing spodumene at a decrease cutoff however isn’t integrated on this rubidium MRE. Rubidium reaches grades more than 4,000 ppm are attributed to wallet of excessive modal abundance of microcline (potassic feldspar). Rubidium has thus been constrained to the next cutoff to split it from the lithium useful resource, permitting rubidium and lithium to be mined and introduced one after the other. The open pit and underground MREs are constrained by way of optimized pit shell and minable form wireframes, respectively.

Geology & Mineralization

The Mission is positioned inside the Wabigoon Subprovince of the Canadian Defend’s Archean Awesome Province. The LCT pegmatites inside the Belongings happen in a zone putting south-southeast and are roughly 1.5 km extensive and a minimum of 4 km in period. Pegmatites inside the Deposit are contributors of the albite-spodumene sub-type of infrequent steel pegmatites. Underlying host rock of the Deposit are Archean supracrustal rocks of mafic metavolcanics and their metasedimentary equivalents, and bordering the pegmatites is the Revell Lake Batholith. Micaceous levels of the intrusives are interpreted to be the mother or father of the infrequent component bearing pegmatites of the Raleigh Lake pegmatite box.

The 2 dominant pegmatites inside the Mission are known as pegmatite #1 and #3, either one of which outcrop on floor and are uncovered at 200 m and 50 m in strike period, respectively. Diamond drilling has confirmed lateral continuity of roughly 800 m and varying in width from 3.9 m to eight.0 m for Pegmatite #1 and roughly 700 m with a median thickness of one.2 m for Pegmatite #3. Determine 3 underneath presentations the modelling of the pegmatites inside the Raleigh Lake pegmatite box in line with a grade cutoff of 500 ppm lithium in drillhole assays.

Pegmatites shape shallowly to quite dipping, north-northeasterly trending, undeformed sheets with vital possible for extra lateral continuity. The pegmatites are strongly fractionated and show total vulnerable zonation, suggesting that strongly enriched rare-metal zonation would possibly exist inside of extensions and untested spaces of the primary pegmatites. Crude zonation is clear in wider pegmatites with albite-rich bounding zones and ‘core’ zones of albite-quartz-muscovite or spodumene-potassium feldspar-albite. “Wallet” of a excessive modal abundance of microcline exist inside of Pegmatite #1 and which correspond to excessive grade rubidium focus. Occurrences of holmquistite (lithium-bearing mica) have additionally been famous inside of Pegmatite #2.

ILC has retained Nordmin Engineering Ltd. (“Nordmin”), based totally in Thunder Bay, Ontario, to arrange an unbiased lithium (spodumene-hosted) and rubidium (microcline-hosted) MRE for the Mission and to arrange a Technical File (the “File”) in line with the factors and tips set out by way of the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) and in keeping with Nationwide Device 43-101 – Requirements of Disclosure for Mineral Tasks.

In preparation of the MRE and File, Nordmin implemented processes that have been suitable for lithium pegmatite-style deposits. The File shall be to be had on SEDAR inside of 45 days. The efficient date for the useful resource estimation is February 16, 2023.

Notes on Mineral Sources

- The MRE used to be ready by way of Christian Ballard, P.Geo., of Nordmin, who’s the Certified Particular person (“QP”) as outlined by way of NI 43-101 and is unbiased of ILC.

- Mineral Sources, which aren’t Mineral Reserves, don’t have demonstrated financial viability. The above Inferred Mineral Sources are topic to possible improve to Indicated and Measured Mineral Sources with endured drilling. There’s no ensure that any a part of the Mineral Sources mentioned herein shall be transformed to every other class or to a Mineral Reserve someday. The estimate of Mineral Sources is also materially suffering from environmental, allowing, criminal, advertising and marketing, or different related problems.

- The Mineral Sources on this document have been estimated the usage of the Canadian Institute of Mining, Metallurgy and Petroleum requirements on Mineral Sources and reserves, definitions, and tips ready by way of the CIM status committee on reserve definitions and followed by way of the CIM council (CIM 2014 and 2019).

- The MRE is advanced with information from diamond drill holes totaling 13,821 m.

- The pit constrained mineral assets have been outlined the usage of a parented block type, inside of an optimized pit shell with reasonable pit slope angles of 45° in rock and 30° in overburden, a 9.8 strip ratio (waste subject material: mineralized subject material) and a income issue of one.0. The pit optimization shells have been created the usage of Deswik.AdvOPM instrument.

- The lithium useful resource pit optimization parameters come with: 5.5% Li2O spodumene listen; US$1,800 Li2O spodumene listen value; change charge of C$1.3/US$1; listen transportation and offsite fees of C$175/t, mining price of C$6/t, processing plus common and management price of C$41/t; and a procedure restoration of 75%. Simplest lithium worth used to be used to generate the useful resource optimized pit shell.

- Underground constrained mineral assets have been outlined inside of 5 x 5 x 5 m minable form optimization wireframes. The mineable form optimization constraining wireframes have been created the usage of Deswik.SO instrument.

- The lithium useful resource underground minable form optimization parameters come with: 5.5% Li2O spodumene listen; US$1,800 Li2O spodumene listen value; change charge of C$1.3/US$1; listen transportation and offsite fees of C$175/t, mining price of C$80/t, processing plus common and management price of C$50/t; and a procedure restoration of 75%.

- The rubidium useful resource used to be constrained above marketplace worth because of the present restricted global marketplace. A 4,000 ppm rubidium cut-off grade used to be decided on. The rubidium useful resource used to be excluded from (i.e. neither taken under consideration nor used as a credit score for) the underground and open pit lithium useful resource.

- A default density of two.668 g/cm3 used to be used for the mineralized zones.

- All figures are rounded to mirror the relative accuracy of the estimates; totals would possibly not upload appropriately.

- The efficient date of the MRE is February 16, 2023 and a technical document at the Mission shall be filed by way of the Corporate on SEDAR inside of 45 days of the date of this Information Unencumber.

Infrastructure and Possession Benefits of the Raleigh Lake Mission (Determine 4)

The Mission:

- Is 100% owned by way of ILC and isn’t topic to any off-take agreements, partnerships, or royalties.

- Is composed of 48,500 hectares (485 sq. kilometres) of adjacent mineral claims.

- Is positioned roughly 25 kilometers west of the Township of Ignace, Ontario.

- Distinguishes itself from different lithium initiatives in Canada by way of being rather well located as regards to primary public infrastructure, together with:

- The Trans-Canada Freeway, with direct get admission to to Thunder Bay on Lake Awesome, is lower than six kilometers north of the Mission;

- The Canadian Pacific Railway, herbal fuel pipelines, and Hydro One energy transmission strains (115 and 230 kV) are only a few kilometres from the Mission.

Govt Remark

John Wisbey, Chairman and CEO of ILC commented:

We’re very happy to announce our maiden Mineral Useful resource Estimate for the Raleigh Lake lithium deposit containing each open-pit and underground assets. This can be a nice credit score to our challenge and drilling groups that we’ve got advanced this estimate inside of eighteen months from the beginning of 2021-22 drilling to a degree that comes with 37% mineralized subject material contained inside the Measured and Indicated useful resource classes.

In addition to our number one focal point on lithium, we also are extremely inspired by way of the quantity of rubidium on the Raleigh Lake deposit and it’s pleasurable to notice that separate high-grade rubidium pods had been found out inside the open-pit lithium useful resource, in the community hosted inside of microcline-rich spaces which can be distinct from the lithium-rich spaces of the pegmatites. This rubidium has subsequently been reported as a separate useful resource. This gifts an exhilarating alternative.

The sector marketplace for rubidium is way smaller than that for lithium and buying and selling quantity is moderately opaque. The present marketplace value of rubidium carbonate (as for instance reported on www.steel.com) is USD 1,160 (RMB 8,000) according to kg, which is over 21 occasions the present lithium carbonate value of USD 53,400 according to metric tonne (RMB 368 according to kg). ILC’s rubidium at Raleigh Lake is subsequently vital and no longer a minor add-on – equipped all the time as for any commodity that global call for for rubidium is there and that the associated fee is to be had at projected manufacturing ranges. Those costs will have to no longer be taken as the costs that ILC will be capable to reach for promoting its lithium and rubidium, however to present details about present relative costs.

We stay up for a hectic 12 months as we advance to the following level of research and watch for liberating a Initial Financial Overview (“PEA”) across the heart of this 12 months, in line with this maiden Mineral Useful resource Estimate.

Certified Particular person

Mr. Christian Ballard, P.Geo., of Nordmin, is the QP for this liberate and for the MRE it discloses, as outlined by way of NI 43-101, and has reviewed and authorized the technical data on this liberate.

About Global Lithium Corp.

Global Lithium Corp. believes that the arena faces a vital turning level within the power marketplace’s dependence on oil and fuel and within the governmental and public view of local weather alternate. As well as, we have now noticed the transparent and an increasing number of pressing want by way of the United States and Canada to safeguard their provides of crucial battery metals and to grow to be extra self-sufficient. Our Canadian initiatives are strategic in that recognize.

Our key venture within the subsequent decade is to generate profits for our shareholders from lithium and infrequent metals whilst on the identical time serving to to create a greener, cleaner planet and not more polluted towns. This contains optimizing the worth of our current initiatives in Canada and Eire in addition to discovering, exploring and growing initiatives that experience the possible to grow to be global elegance lithium and infrequent steel deposits. We now have introduced one after the other that we regard Zimbabwe as crucial strategic audience for ILC, and we are hoping so as to make bulletins over the following few weeks and months.

A key purpose has been to grow to be a well-funded corporate to show our aspirations into truth, and following the disposal of the Mariana challenge in Argentina in 2021 and the Mavis Lake challenge in Canada in January 2022, the Board of the Corporate considers that ILC is now properly positioned in that recognize with a robust web money place.

The Corporate’s number one strategic focal point at this level is at the Raleigh Lake Mission’s lithium and rubidium challenge in Canada and on figuring out further homes in Canada and Zimbabwe.

The Raleigh Lake Mission is composed of 48,500 hectares (485 sq. kilometres) of mineral claims in Ontario and is ILC’s most vital challenge in Canada. Drilling has thus far been on lower than 1,000 hectares of our claims. The exploration effects there thus far, which can be on handiest about 8% of ILC’s present claims, have proven vital amounts of rubidium and caesium within the pegmatite in addition to lithium. Raleigh Lake is 100% owned by way of ILC, isn’t topic to any encumbrances, and is royalty loose.

With the expanding call for for top tech rechargeable batteries utilized in electrical automobiles and electric garage in addition to transportable electronics, lithium has been designated “the brand new oil”, and is a key a part of a inexperienced power sustainable economic system. Via positioning itself with initiatives with vital useful resource possible and with forged strategic companions, ILC targets to be one of the crucial lithium and infrequent metals useful resource builders of selection for buyers and to proceed to construct worth for its shareholders within the ’20s, the last decade of battery metals.

On behalf of the Corporate,

John Wisbey

Chairman and CEO

For additional data regarding this information liberate please touch +1 604-449-6520.

Neither TSX Project Trade nor its Legislation Services and products Supplier (as that time period is outlined within the insurance policies of the TSX Project Trade) accepts duty for the adequacy or accuracy of this liberate.

Cautionary Commentary Relating to Ahead-Taking a look Knowledge

Apart from for statements of ancient truth, this information liberate or different releases comprise positive “forward-looking data” inside the that means of appropriate securities regulation. Ahead-looking data or forward-looking statements on this or different information releases would possibly come with: the impact of result of expected manufacturing charges, the timing and/or expected result of drilling at the Raleigh Lake or Wolf Ridge or Avalonia initiatives, the expectancy of useful resource estimates, initial financial checks, feasibility research, lithium or rubidium or caesium recoveries, modeling of capital and working prices, result of research using more than a few applied sciences on the corporate’s initiatives, budgeted expenditures and deliberate exploration paintings at the Corporate’s initiatives, greater worth of shareholder investments, and assumptions about moral behaviour by way of our three way partnership companions or 3rd celebration operators of initiatives. Such forward-looking data is in line with assumptions and topic to various dangers and uncertainties, together with however no longer restricted to these mentioned within the sections entitled “Dangers” and “Ahead-Taking a look Statements” in the intervening time and annual Control’s Dialogue and Research which can be to be had at www.sedar.com. Whilst control believes that the assumptions made are affordable, there may also be no assurance that forward-looking statements will turn out to be correct. Will have to a number of of the hazards, uncertainties or different elements materialize, or will have to underlying assumptions turn out flawed, precise effects would possibly range materially from the ones described in forward-looking data. Ahead-looking data herein, and all next written and oral forward-looking data are in line with expectancies, estimates and reviews of control at the dates they’re made that, whilst regarded as affordable by way of the Corporate as of the time of such statements, are topic to vital trade, financial, legislative, and aggressive uncertainties and contingencies. Those estimates and assumptions would possibly turn out to be flawed and are expressly certified of their entirety by way of this cautionary commentary. Apart from as required by way of regulation, the Corporate assumes no legal responsibility to replace forward-looking data will have to instances or control’s estimates or reviews alternate.

Extra Data:

This information is printed at the Investorideas.com Newswire – an international virtual information supply for buyers and trade leaders

Disclaimer/Disclosure: Investorideas.com is a virtual writer of 3rd celebration sourced information, articles and fairness analysis in addition to creates authentic content material, together with video, interviews and articles. Authentic content material created by way of investorideas is secure by way of copyright rules rather than syndication rights. Our web page does no longer make suggestions for purchases or sale of shares, product or service. Not anything on our websites will have to be construed as an be offering or solicitation to shop for or promote merchandise or securities. All making an investment comes to chance and conceivable losses. This web page is lately compensated for information e-newsletter and distribution, social media and advertising and marketing, content material advent and extra. Disclosure is posted for every compensated information liberate, content material printed /created if required however another way the scoop used to be no longer compensated for and used to be printed for the only real hobby of our readers and fans. Touch control and IR of every corporate without delay referring to particular questions.

Extra disclaimer information: https://www.investorideas.com/About/Disclaimer.asp Be informed extra about publishing your information liberate and our different information products and services at the Investorideas.com newswire https://www.investorideas.com/Information-Add/ and tickertagstocknews.com

International buyers should adhere to rules of every nation. Please learn Investorideas.com privateness coverage: https://www.investorideas.com/About/Private_Policy.asp