How To Use A 529 Plan For Property Making plans

Supply: The School Investor

A 529 plan can also be an efficient property making plans device. However as a result of many households are ignorant of its advantages, only a few believe the usage of a 529 plan for property making plans.

Nonetheless, households would possibly wish to believe together with 529 plans as a part of their property plans as a result of attainable adjustments to loss of life taxes.

We give an explanation for why in additional element underneath and damage down the entire “how-tos” of the usage of a 529 plan for property making plans. Here is what you wish to have to grasp.

Imaginable Adjustments To Dying Taxes

In 2024, the unified lifetime present, property and generation-skipping switch tax exemption is $13.6 million ($27.2 million for married {couples}), up from $5.49 million in 2017.

Since 2010, the lifetime exemption has been moveable between spouses, permitting a surviving partner to get the unused portion in their partner’s lifetime exemption. This successfully supplies a married couple with two times the lifetime exemption of a unmarried individual. The deceased partner should were a U.S. citizen on the time of loss of life. The surviving partner should elect portability after they document a well timed Federal Property Tax Go back, IRS Shape 706, for the deceased partner. IRS Shape 706 should be filed inside 9 months plus extensions after the date of the decedent’s loss of life. IRS Shape 4768 is also filed to say an automated 6-month extension.

Then again, the way forward for the exemption from loss of life taxes is unsure. The Tax Cuts and Jobs Act of 2017 doubled the lifetime exemption. However this build up will sundown for tax years after 2025 until Congress acts to increase it. The lifetime exemption will revert again to $5 million plus an inflation adjustment for taxpayers who die in 2026 and later years.

As well as, President Biden has proposed slicing the lifetime exemptions to $3.5 million for estates and $1 million for presents (returning to the exemptions that have been in impact in 2009). His proposal additionally requires expanding the tax fee, which is these days 40%. He has additionally proposed getting rid of the stepped-up foundation for inherited belongings and to tax the unrealized capital good points at strange revenue tax charges (versus long-term capital good points tax charges).

Despite the fact that President Biden didn’t come with the proposed decreases within the lifetime exemptions within the American Households Plan, those cuts may well be incorporated in long term regulation.

Opposition To Property Tax Adjustments

Those proposals have generated bipartisan opposition from lawmakers for a number of causes:

The proposed adjustments additionally generate moderately little tax earnings. Fewer than 2,000 households pay federal property taxes every yr, yielding not up to $20 billion in tax earnings.

States That Levy Property Taxes

State property and inheritance taxes, which range via state, could have decrease exemptions than the federal ranges, inflicting smaller estates to be taxed. Households would possibly want to use 529 plans to cut back state property and inheritance taxes in those states.

Lately, 13 states have state property taxes: Connecticut, District of Columbia, Hawaii, Illinois, Maine, Maryland, Massachusetts, Minnesota, New York, Oregon, Rhode Island, Vermont and Washington. The state property tax exemption is $1 million in Massachusetts.

As of writing, 6 states have state inheritance taxes: Iowa, Kentucky, Maryland, Nebraska, New Jersey and Pennsylvania. Pennsylvania comprises out-of-state 529 plans within the account proprietor’s property, however now not in-state 529 plans.

Inheritance taxes would possibly rely at the dating of the inheritor to the decedent. In Pennsylvania, as an example, the inheritance tax fee is 0% for surviving spouses or folks of a minor kid, 4.5% for direct descendants, 12% for siblings, and 15% to different heirs (with the exception of for charitable organizations, exempt establishments and executive entities which can be exempt from tax).

Advantages Of The use of A 529 Plan For Property Making plans

The benefits of the usage of 529 plans for property making plans contain contributions, distributions, regulate and monetary assist affect. They are more practical, more straightforward to make use of and more economical to arrange than difficult trusts. In addition they have beneficiant and versatile contribution limits. There aren’t any revenue, age or cut-off dates.

Account homeowners retain regulate over the 529 plan account and will alternate the beneficiary. Income acquire on a tax-deferred foundation and distributions are tax-free if used to pay for certified instructional bills. Grandparents too can use 529 plans to go away a legacy for his or her descendants. And policymakers are not going to restrict those estate-planning advantages.

Contributions

Contributions are got rid of from the contributor’s property for federal property tax functions. Contributions are regarded as to be a finished present.

Despite the fact that there’s no annual contribution restrict for 529 plans, individuals can surrender to the once a year present tax exclusion, which is $18,000 according to yr in 2024, with out incurring present taxes or the usage of up a part of the lifetime present tax exemption.

There aren’t any present tax limits if the beneficiary is the account proprietor or the account proprietor’s partner. The partner should be a U.S. citizen. If the partner isn’t a U.S. citizen, the presents are capped at $157,000 a yr, as of 2000.

If the beneficiary is a grandchild, contributions would possibly lead to generation-skipping switch taxes, however the once a year and lifelong exemptions and tax charges are the similar as for present and property taxes. Era-skipping switch taxes follow if the beneficiary is 2 or extra generations more youthful than the contributor or if the beneficiary is a minimum of 37.5 years more youthful than the contributor. There may be an exception if the grandchild’s folks are deceased on the time of the switch.

Superfunding

5-year gift-tax averaging, often referred to as superfunding, permits a contributor to make a lump sum contribution of as much as 5 occasions the once a year present tax exclusion and feature it handled as thru it happens over a five-year duration.

The contributor is also not able to make further presents to the beneficiary all over the five-year duration, until the prorated present is not up to the once a year present tax exclusion quantity. If the contributor dies all over the 5-year duration, a part of the contribution is also incorporated within the contributor’s property.

As an example, if the contributor dies in yr 3, the rest 2 years of contributions will probably be incorporated within the contributor’s property. The contributor would possibly wish to document IRS Shape 709 to file the contribution, even supposing there aren’t any present taxes or aid within the lifetime exemption.

State Limits And Advantages

There are prime combination contribution limits, which range via state, starting from $235,000 in Georgia and Mississippi to $542,000 in New Hampshire. As soon as the account stability reaches the combination restrict, not more contributions are accredited, however the profits would possibly proceed to amass.

Households might be able to bypass the state’s combination contribution limits via opening 529 plans in a couple of states. However individuals will nonetheless be topic to the once a year present tax exclusion limits.

Contributions are eligible for a state revenue tax deduction or tax credit score on state revenue tax returns in two-thirds of the states. The quantity of the state revenue tax damage varies via state. There aren’t any revenue limits, age limits or cut-off dates on contributions. The beneficiary does now not wish to be of faculty age and will have already got a faculty level.

Distributions

Income in a 529 plan acquire on a tax-deferred foundation. And distributions are tax-free if used for certified instructional bills. The cash can be utilized to pay for basic and secondary faculty tuition, faculty prices, graduate or skilled faculty prices, and proceeding schooling.

Non-qualified distributions are topic to strange revenue taxes on the recipient’s tax fee and a ten% tax penalty. The penalty is best levied at the profits portion of the distribution, now not the whole quantity of the distribution.

Non-qualified distributions don’t seem to be topic to capital good points taxes, present taxes or property taxes. If the contributor up to now claimed a state revenue tax deduction or tax credit score, the state revenue tax damage is also topic to recapture if the account proprietor makes a non-qualified distribution.

There aren’t any revenue limits, age limits or cut-off dates on distributions. Account homeowners don’t seem to be required to make distributions when the beneficiary reaches a specific age. They are able to make a selection to go away the cash within the account, letting it proceed to amass profits.

Keep watch over

The account proprietor keeps regulate over the 529 plan account, in contrast to direct presents to the beneficiary or difficult believe price range. The account does now not switch to the beneficiary when the beneficiary reaches a specific age. As a substitute, the account proprietor will get to make a decision whether or not and when to make distributions.

The account proprietor can alternate the beneficiary to a member of the beneficiary’s circle of relatives, together with to the account proprietor. This successfully we could the account proprietor revoke the present, in the event that they make a selection, via converting the beneficiary to themselves.

Monetary Assist Affect

Grandparent-owned 529 plans don’t seem to be reported as an asset at the Unfastened Software for Federal Pupil Assist (FAFSA).

The Consolidated Appropriations Act, 2021, simplified the FAFSA beginning with the 2023-24 FAFSA (due to this fact not on time till the 2024-25 FAFSA via the U.S. Division of Schooling). Amongst different adjustments, the simplified FAFSA drops the money fortify query, so distributions will now not rely as untaxed revenue to the beneficiary at the beneficiary’s FAFSA.

This may increasingly do away with any affect from a grandparent-owned 529 plan on federal scholar assist eligibility.

Leaving A Legacy

Grandparents can open a 529 plan for every grandchild. If the grandparents have 3 kids and 9 grandchildren, they may open a complete of twelve 529 plans, one for every kid and grandchild.

With 5-year gift-tax averaging, they may make lump-sum contributions totaling $1.8 million as a pair (e.g., $150,000 according to beneficiary x 12 beneficiaries = $1.8 million). This yields a vital aid within the grandparents’ taxable property. Grandparents too can use a 529 plan to trace that they’d like their grandchildren to visit faculty.

529 plans are a good way of leaving a legacy on your heirs. If there’s leftover cash within the 529 plan after paying for school, the unused price range can keep growing and be handed directly to long term generations.

Leftover cash can be used for different bills via creating a non-qualified distribution. However the profits portion of the non-qualified distribution will probably be topic to strange revenue taxes and a tax penalty versus property and inheritance taxes.

Main 529 Plan Coverage Adjustments Are Not likely

Policymakers are not going to restrict the usage of a 529 plan for property making plans. When President Obama proposed taxing 529 plans in 2015, his proposal used to be met with fierce opposition from each Democrats and Republicans. In reality, the resistance used to be so adversarial and swift that he used to be compelled to drop the proposal only some days later.

Lifetime Exemption For Federal Reward Taxes

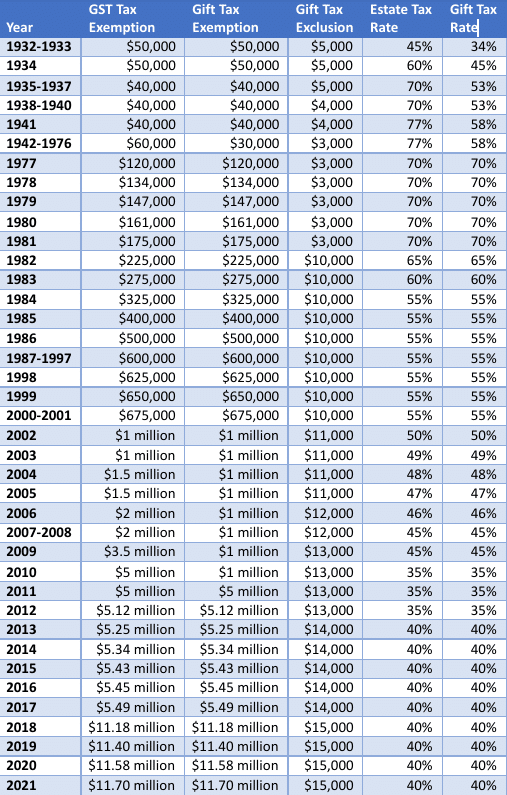

This desk underneath presentations the adjustments within the lifetime exemption for federal present, property and generation-skipping switch taxes over the past 9 a long time. Key adjustments have been made via the next items of regulation:

Historic Reward Tax Exemption. Supply: Mark Kantrowitz

Who Must Believe 529 Plans For Property Making plans?

If grandparents are as regards to the lifetime exclusions or are nervous about long term cuts within the lifetime exclusions, they must believe the usage of 529 plans for property making plans.

529 plans are in particular helpful when the grandparents are rich however the folks don’t seem to be. The favorable monetary assist remedy of 529 plans we could grandparents who’re rich lend a hand pay for basic, secondary and postsecondary schooling bills with out affecting the grandchild’s eligibility for need-based monetary assist.