Ancient Bond Transfer Has Killed This Loopy Portfolio Technique (for now…)

There’s a portfolio technique on steroids that some other folks mentioned.

The Hedgefundie’s Very good Journey.

Optimized Portfolio has a excellent abstract of the method.

Principally:

- You put money into two portfolios: A extremely leveraged fairness portfolio and A extremely leveraged bond portfolio.

- Make a decision upon an optimum asset allocation.

- Rebalance the portfolio at an optimum frequency.

The most well liked technique is to make use of a mix of:

- three times leveraged S&P 500 ETF

- three times leveraged 20-12 months US Treasury ETF

A rebalancing frequency that folks got here to used to be to do it per 30 days. If the portfolio weight deviates by way of greater than 5%, rebalancing may be caused.

A backtested outcome from 1987 to 2018 presentations that this technique has a compounded reasonable expansion of 16% p.a. in comparison to 9.8% p.a. for an S&P 500 ETF. The fascinating factor is that the worst drawdown for the method is very similar to the worst drawdown of the S&P 500 (-50%).

However this technique may be very risky.

2022 is a novel yr the place each shares and bonds don’t do smartly.

Bonds, particularly, had probably the most worst performances up to now 50 years a minimum of.

A 20-year US Treasury will undergo extra because of the lengthy period. The period, measures the sensitivity of bonds to adjustments to rate of interest. A rule of thumb (if we forget about the nuances) is a 1% up/down transfer in rate of interest yield will alternate the cost by way of its period.

So a 1% upward thrust in yield for a 20-year US Treasury will drop the cost by way of nearly 20%. So what occurs if rate of interest rises 4%?

Now not excellent.

I knew the cost efficiency of a 20-year Treasury ETF does now not glance excellent. I contemplated extra and questioned how would anyone who has carried out the Hedgefundie technique did.

So I made up our minds to simulate the portfolio efficiency.

Particular person Performances of the Leveraged ETFs

I questioned what could be a excellent period of time to simulate.

I made up our minds to simulate a portfolio that manages to seize the upside and the disadvantage.

Here’s the cost chart of TMF, the ticker for the Direxion Day-to-day 20+ 12 months Treasury Bull 3X Stocks ETF:

Nearly precisely 5 years in the past, the three times leveraged 20Y bond ETF went up an astounding 184% (!!!).

Then it got here down 90%.

Worth began round $16, went to $47 then got here backtrack, and went previous to $5!

Here’s the cost chart of UPRO, the ticker for ProShares UltraPro S&P500 ETF:

The associated fee went up 184% in a similar fashion however as of the day prior to this, solely got here down 46%.

If we make investments $100,000 of our cash in each and every of those ETFs, UPRO would have achieve $70,000 or 70% however the 100% TMF investor would have misplaced a minimum of 66%.

The Efficiency of an Implementation of the Hedgefundie Technique

Listed here are the parameters that I’ve carried out:

- 40% TMF

- 60% UPRO

- Rebalance each and every month

- Forget about any buying and selling prices.

- Forget about the dividend earned from the ETFs

- Get started with a portfolio price of $100,000 in 1st Oct 2018 and overview the efficiency 5 years afterward twenty ninth Sep 2023.

There are a couple of implementations and I would favor to make use of 60% UPRO however they may suppose the next leveraged bond allocation is extra optimum.

We examine the efficiency in opposition to a 40% Unleveraged S&P 500 and 60% Unleveraged 20-year Treasury Collecting ETF and a 100% S&P 500 ETF. We solely rebalance each and every half-yearly for the unleveraged portfolio.

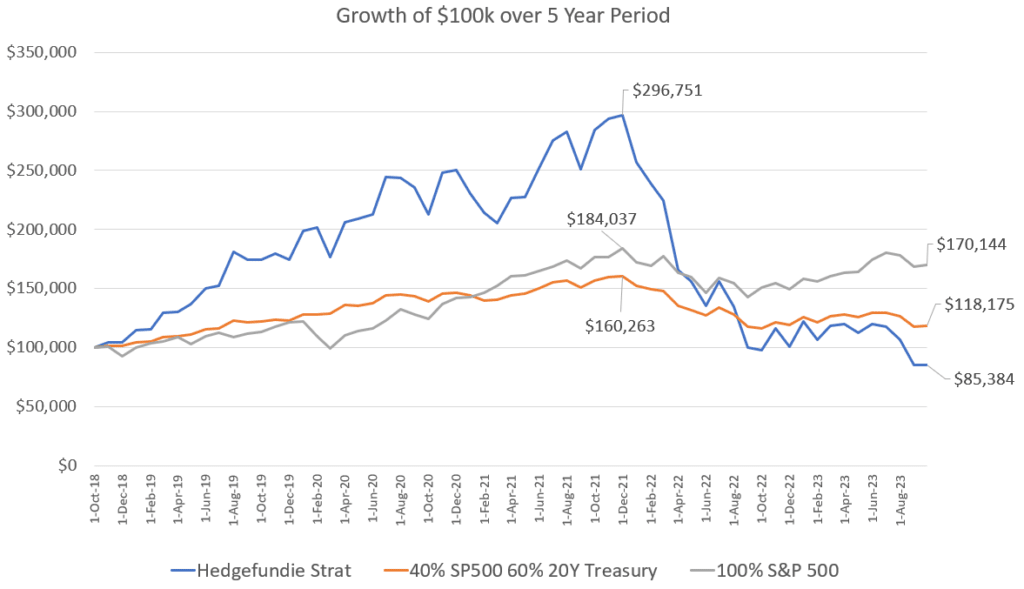

Listed here are the expansion of $100,000:

At one level, $100,000 within the Hedgefundie portfolio grew 200% to $296,751 earlier than giving the entirety again and happening to $85,384.

If we had use an 50/50 portfolio as an alternative, it will have ended with $100,000.

Having extra bonds occurs to paintings in opposition to the portfolio on this quite distinctive period of time.

Against this, the unleveraged portfolio grew to $118,175 in spite of the deficient 20-year US Treasury efficiency. The S&P 500 grew to $170,144.

Listed here are the compounded reasonable expansion:

- Hedgefundie: -3.1% p.a.

- S&P 500: 11.2% p.a.

- 40% S&P 500 60% 20Y US Treasury: 3.4% p.a.

My first affect is that it wasn’t so dangerous. The 70% upward thrust within the S&P 500 and rebalancing most probably gave the portfolio a good outcome.

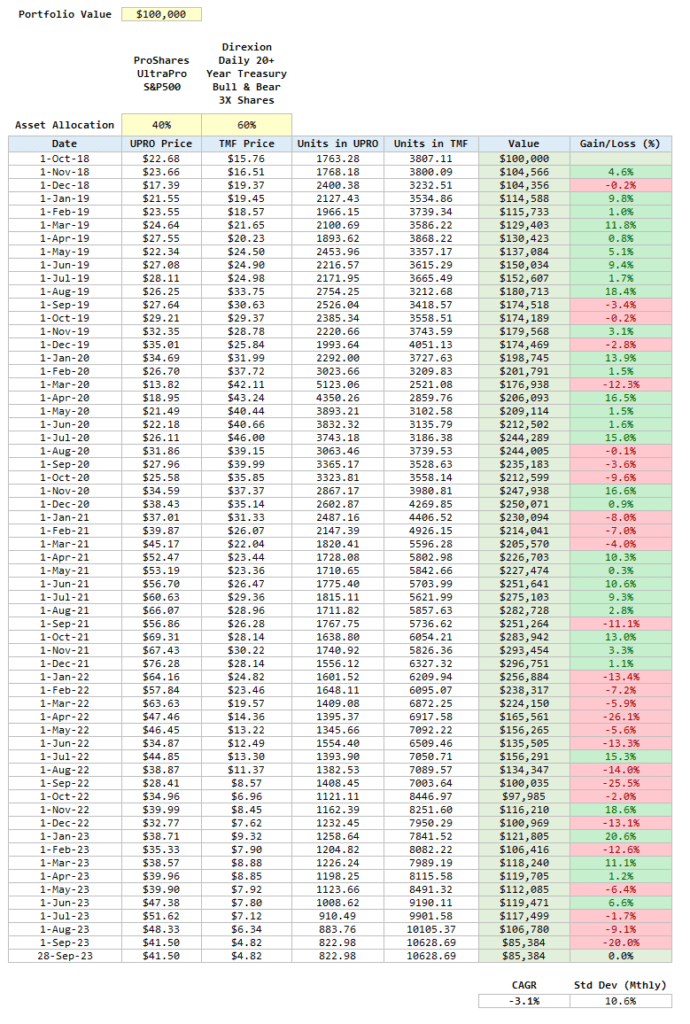

Here’s how the portfolio simulation appear to be on a play by way of play foundation:

Will You be Ready to Reside During the Adventure to Earn the Go back??

Many people make investments for the reason that efficiency glance sexy sufficient.

However we continuously disregard that to get to the outcome we need to reside during the enjoy.

To be able to execute this Hedgefundie technique, you need to:

- Keep invested

- Execute the rebalancing your self!

Which means that you need to concentrate sufficient to what the portfolio is doing, and be capable to execute the rebalancing.

I’m wondering what number of people can do this like a mechanical robotic.

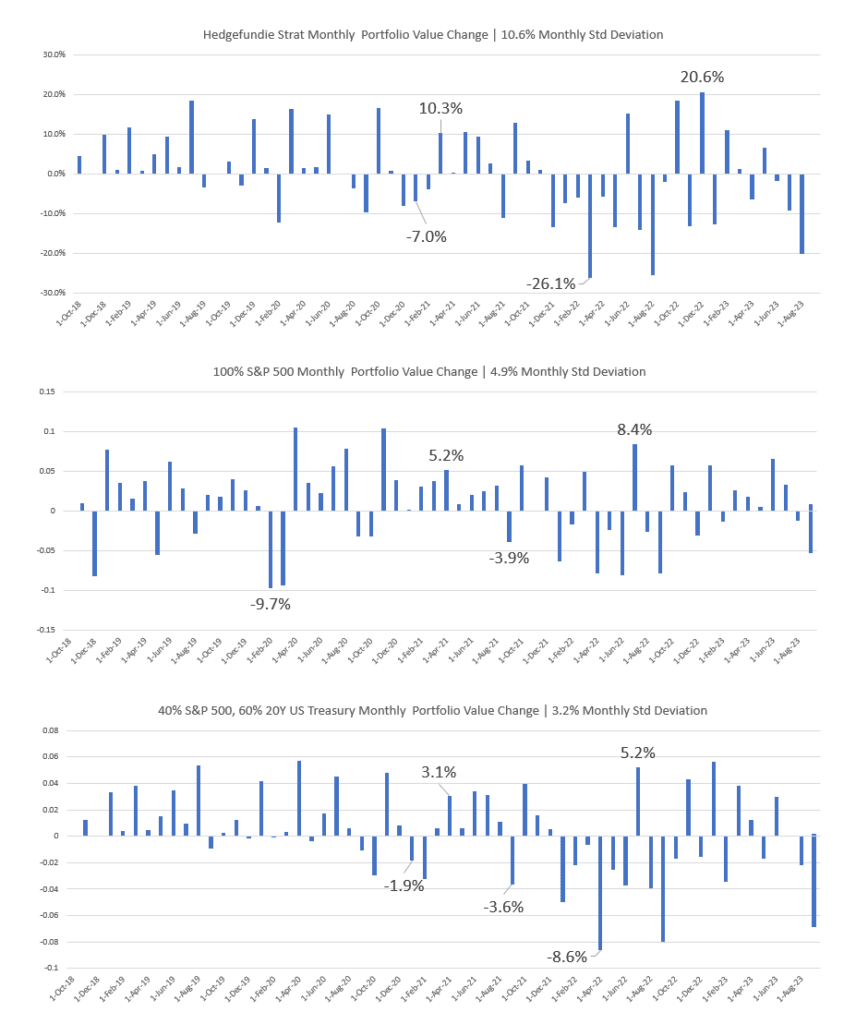

I stacked the per 30 days alternate in portfolio price within the following chart:

The shift in per 30 days portfolio price is within the 10% vary.

Against this, a 100% S&P 500 has half of the volatility.

I critically surprise what number of can routinely sit down thru rebalancing when the portfolio will get reduce from $296k to $135k in 7 months.

I want to suppose many can’t.

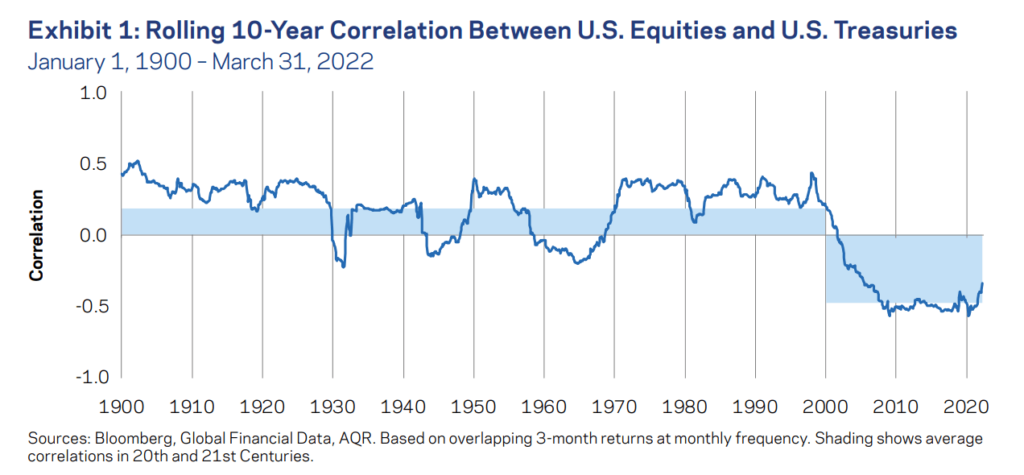

Sure Correlation between Bonds and Fairness is the Norm as an alternative of being Unusual

The chart under presentations the longer term 10-year correlation between bonds and fairness:

Over the last 120 years, bonds are definitely correlated with equities. The final two decades is extra of an unusual state of affairs.

Correlation isn’t all the time damaging. Bonds and equities can pass up on the identical time. However I wonder whether we factored in an extended period of time, would previous effects display us one thing that we’d now not encountered?

I think it will.

The Magic of Rebalancing Loopy Issues Over Time

What makes this technique distinctive is that in the event you rebalance very risky issues through the years, despite the fact that they might or would possibly not have certain anticipated go backs ultimately, you get certain anticipated returns.

Claude Shannon, an American mathematician, MIT professor, electric engineer, and Global Conflict II cryptographer, used to be in a position to turn us that that you must take a risky asset that by no means would earn any long-term go back (i.e., it simply randomly moved up and down through the years), and convert it right into a precious contributor to a wealth-generating portfolio during the easy technique of rebalancing.

This is named Shannon’s Demon.

You’ll be able to learn extra in regards to the Demon right here.

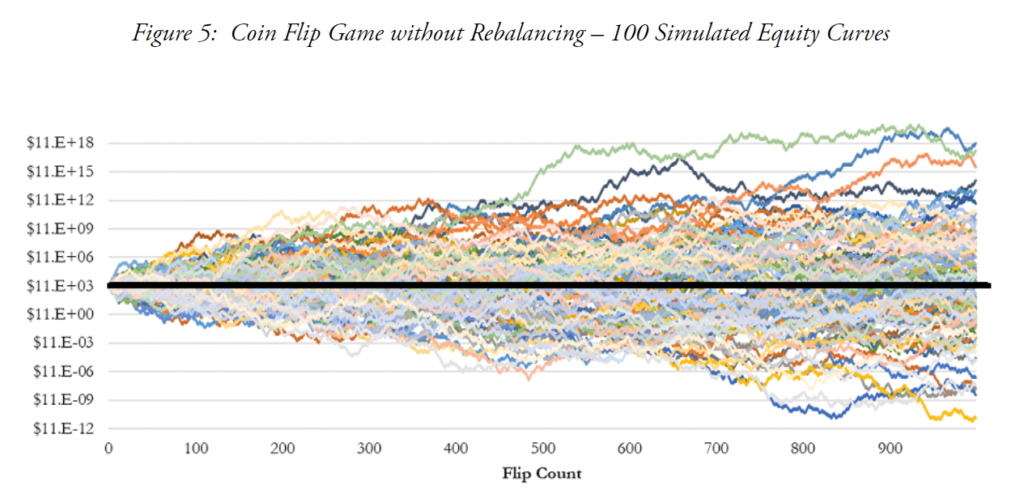

We will be able to create portfolios by way of flipping cash and if it finally ends up heads we win a undeniable sum and whether it is tails we lose a undeniable sum. If we stay doing this through the years, our effects are like a spectrum.

This isn’t too other from making an investment in shares and stuck source of revenue the place the long run is unsure.

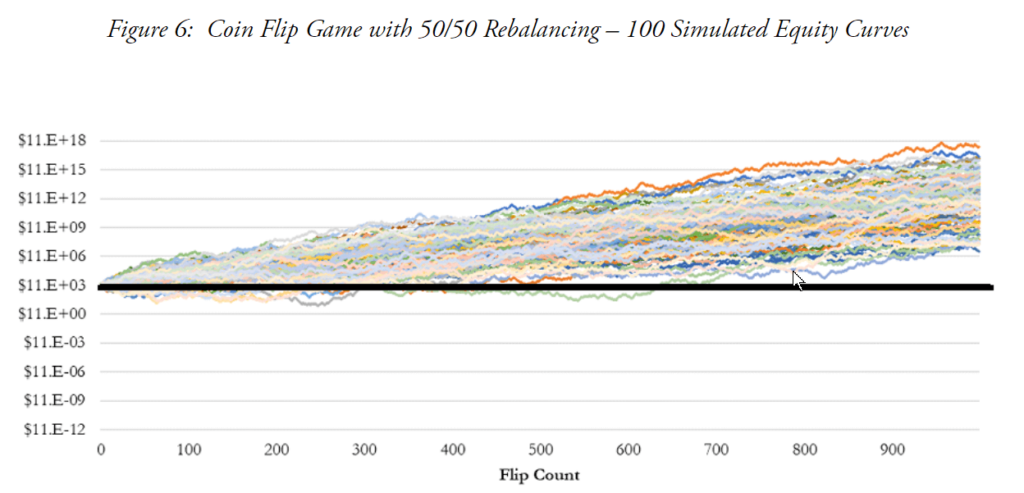

However what if we continuously rebalance those coin turn with 50% money holdings?

Technically, 50% of the portfolio is in result is unsure, and the opposite 50% is in one thing that has 0 anticipated go back. This will have to now not finish smartly.

However what occurs is if we do that lengthy sufficient (subjective), the fairness curves all change into certain through the years.

Coin turn portfolios, like our portfolios, are very risky and the extra risky the portfolio (like Hedgefundie’s Journey), the extra it reduces the long-term geometric go back (seek advice from the thing I posted at the beginning of this phase).

Rebalancing tries to carry the portfolio again to the mathematics go back, which is the certain reasonable go back.

The educational lesson is that in the event you don’t tame volatility, regardless of how excellent the returns, you would possibly not be capable to harvest it.

The consistent rebalance most probably stored the portfolio from worse effects.

The Result is Now not Concluded But

It’s simple to conclude at this level that this Hedgefundie’s Journey doesn’t figure out.

But if we make investments, we’re making an investment over an extended time period. I feel it’s going to be fascinating to revisit this portfolio from time to time to look if the portfolio phases a exceptional comeback.

We continuously wonder whether this technique in our heads will paintings in actual existence and having a backtested technique might solution some questions.

But when we don’t have lengthy sufficient information, throughout other eventualities, or poorly designed assessments, then we might make some error judgments.

However what I will conclude is that now not everybody would need a portfolio that they’ve to execute themselves, and put themselves within the loop. The device is mistaken since you are introducing a deeply mistaken part (you) that would a great deal jeopardize the device.

In the long run, the appropriate portfolio for you is person who you’ll reside with.

If you wish to business those shares I discussed, you’ll open an account with Interactive Agents. Interactive Agents is the main low cost and environment friendly dealer I exploit and believe to speculate & business my holdings in Singapore, the US, London Inventory Alternate and Hong Kong Inventory Alternate. They can help you business shares, ETFs, choices, futures, foreign exchange, bonds and price range international from a unmarried built-in account.

You’ll be able to learn extra about my ideas about Interactive Agents in this Interactive Agents Deep Dive Collection, beginning with find out how to create & fund your Interactive Agents account simply.