55% Of Pupil Mortgage Debtors Don’t seem to be In a position To Resume Bills

Pupil mortgage debtors are formally set to renew bills on Federal scholar loans in October 2023. By the point compensation restarts in October 2023, the cost pause and hobby waiver may have lasted a complete of 42 months (counting March 2020 as a complete month).

Throughout this time, the unique cost pause and hobby waiver used to be prolonged a complete of 8 occasions in an effort to permit scholar mortgage debtors to be extra financially able to renew bills after the results of the Covid-19 pandemic rippled in the course of the economic system.

However the true query is: are scholar mortgage debtors in point of fact financially ready to renew bills? And has this modified since our survey ultimate yr sooner than the cost pause used to be prolonged? Here is what we discovered.

Key Findings

We requested 1,200 scholar mortgage debtors about how their source of revenue and bills have modified since March 2020 (the beginning of the Covid-19 pandemic in the US) and the way able those debtors are to resume making scholar mortgage bills once they unpause in 2023.

Here is what we discovered:

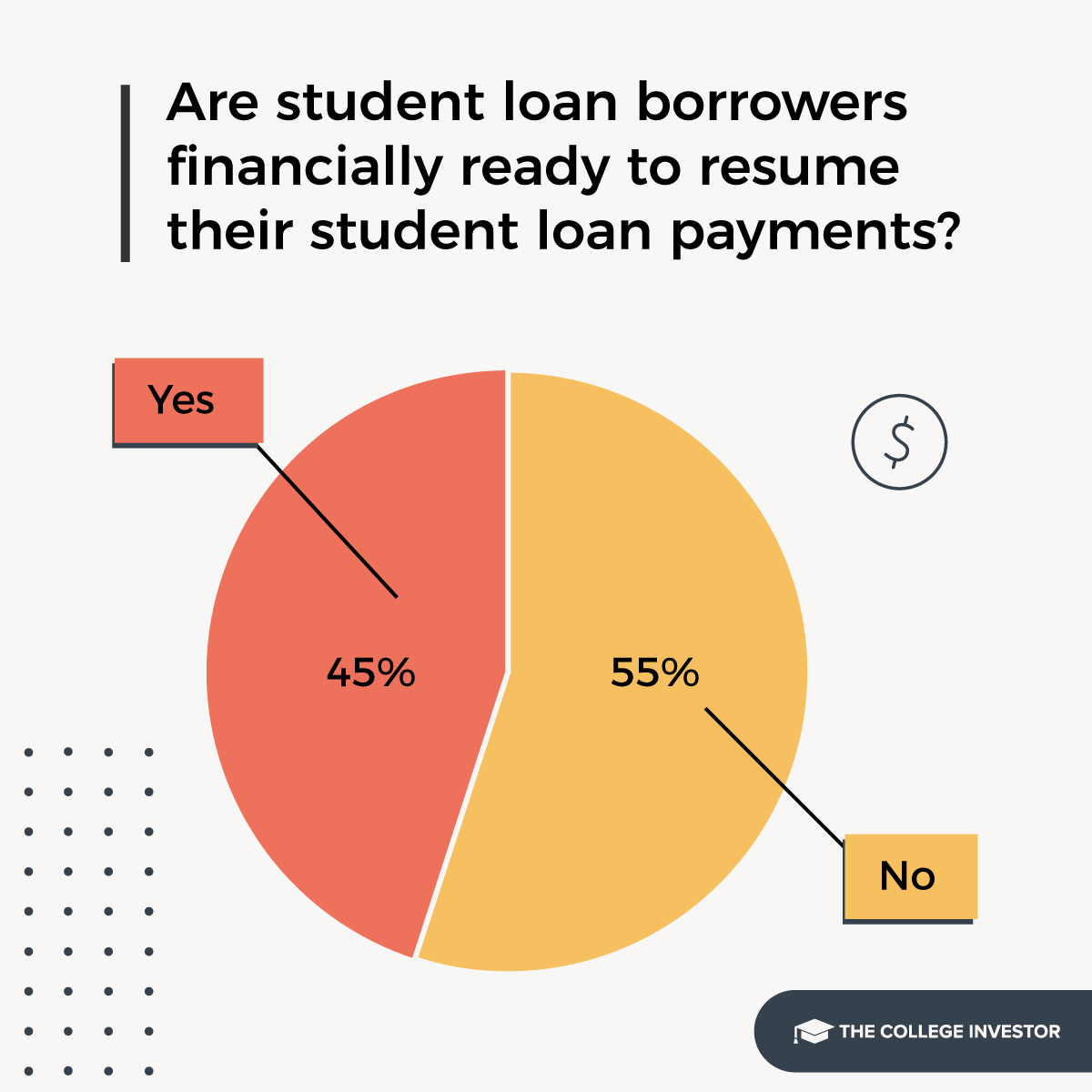

- 55% of scholar mortgage debtors do not really feel able to renew bills in 2023. It is a vital building up from 2022 when simplest 29% of debtors did not really feel financially able.

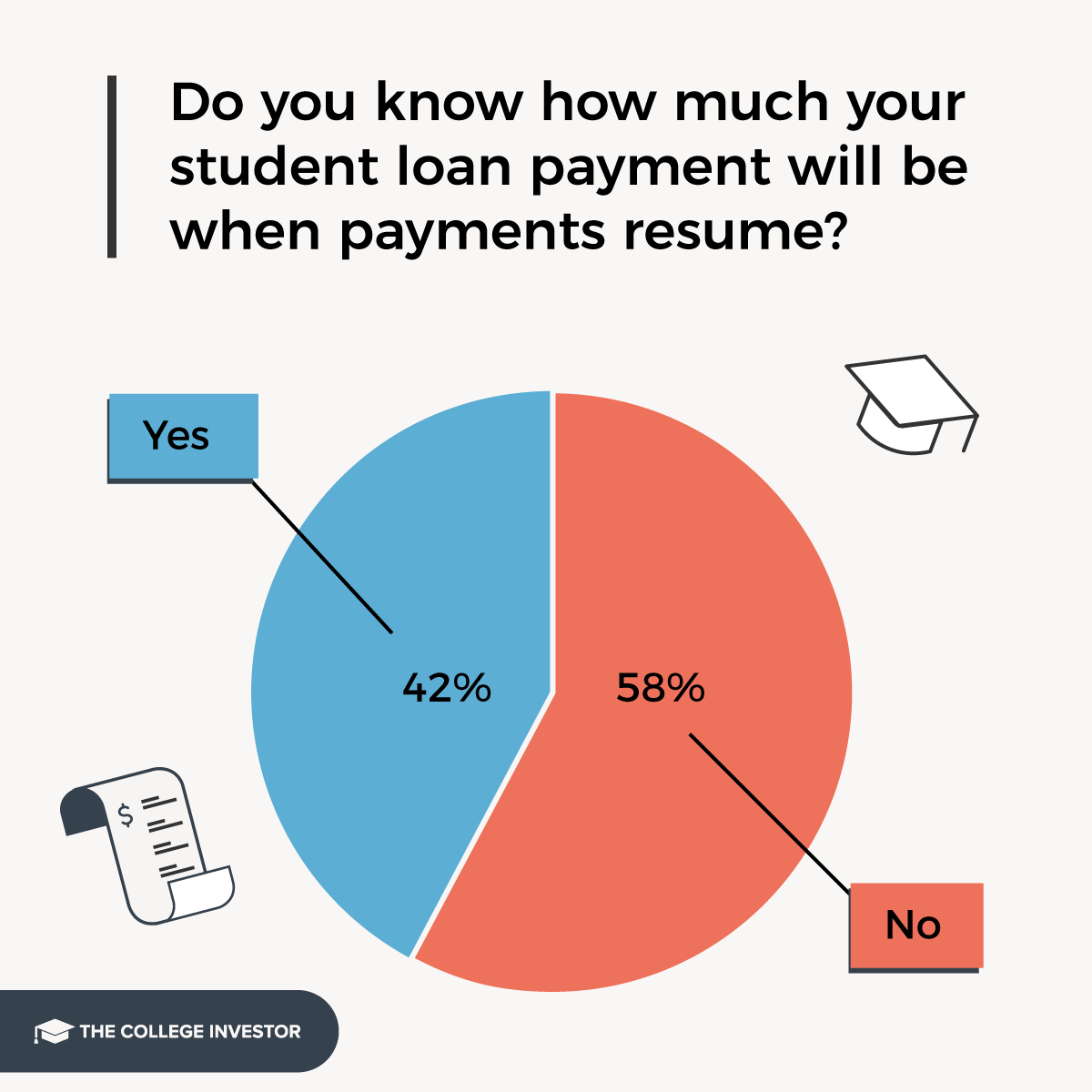

- Handiest 42% of debtors know precisely what their per month cost goes to be when compensation restarts. This highlights a large loss of verbal exchange between debtors and the Division of Training and the more than a few scholar mortgage servicers. It is also including to scholar mortgage borrower anxiousness.

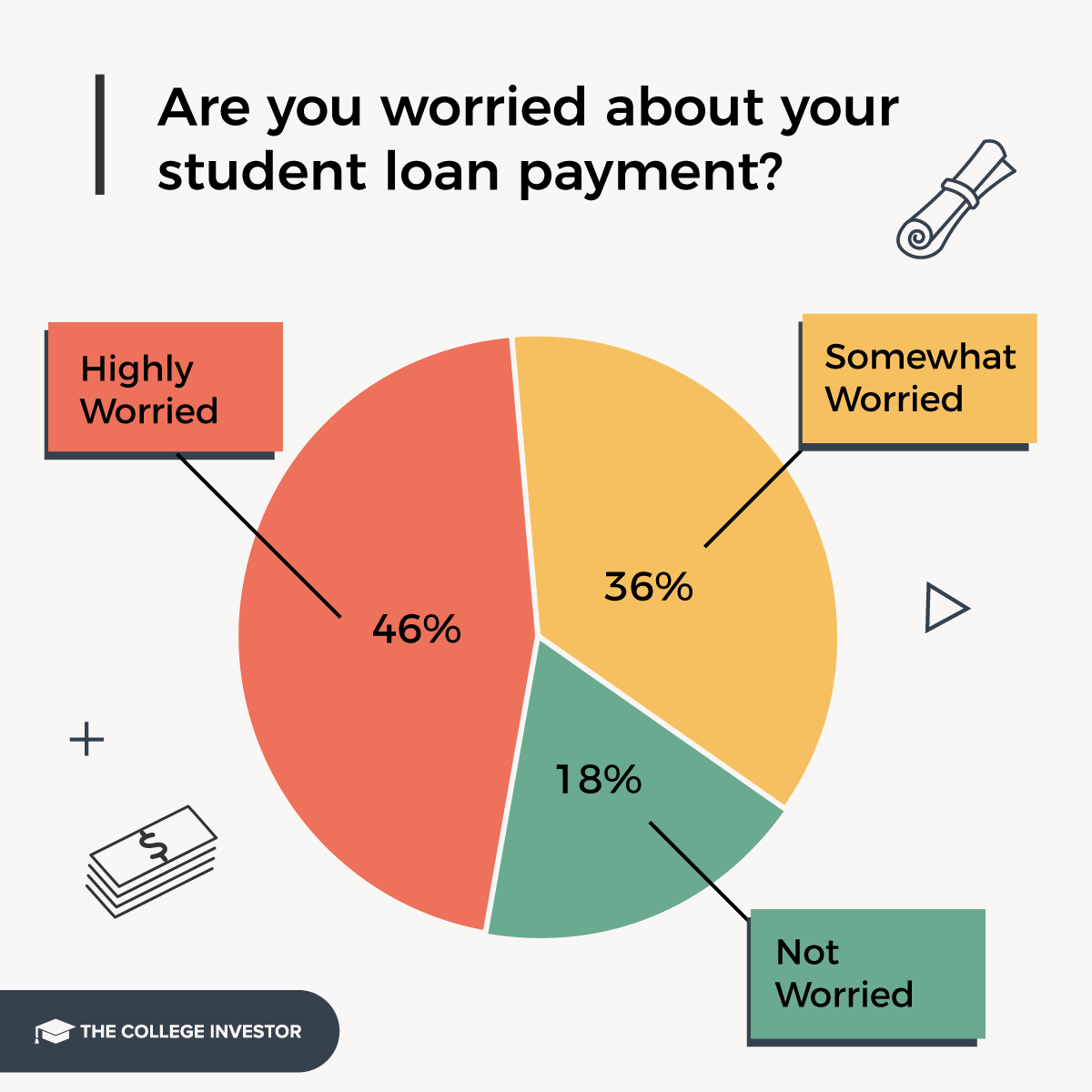

- Consequently, 82% of scholar mortgage debtors are frightened about their mortgage bills.

So what is modified for debtors since March 2020?

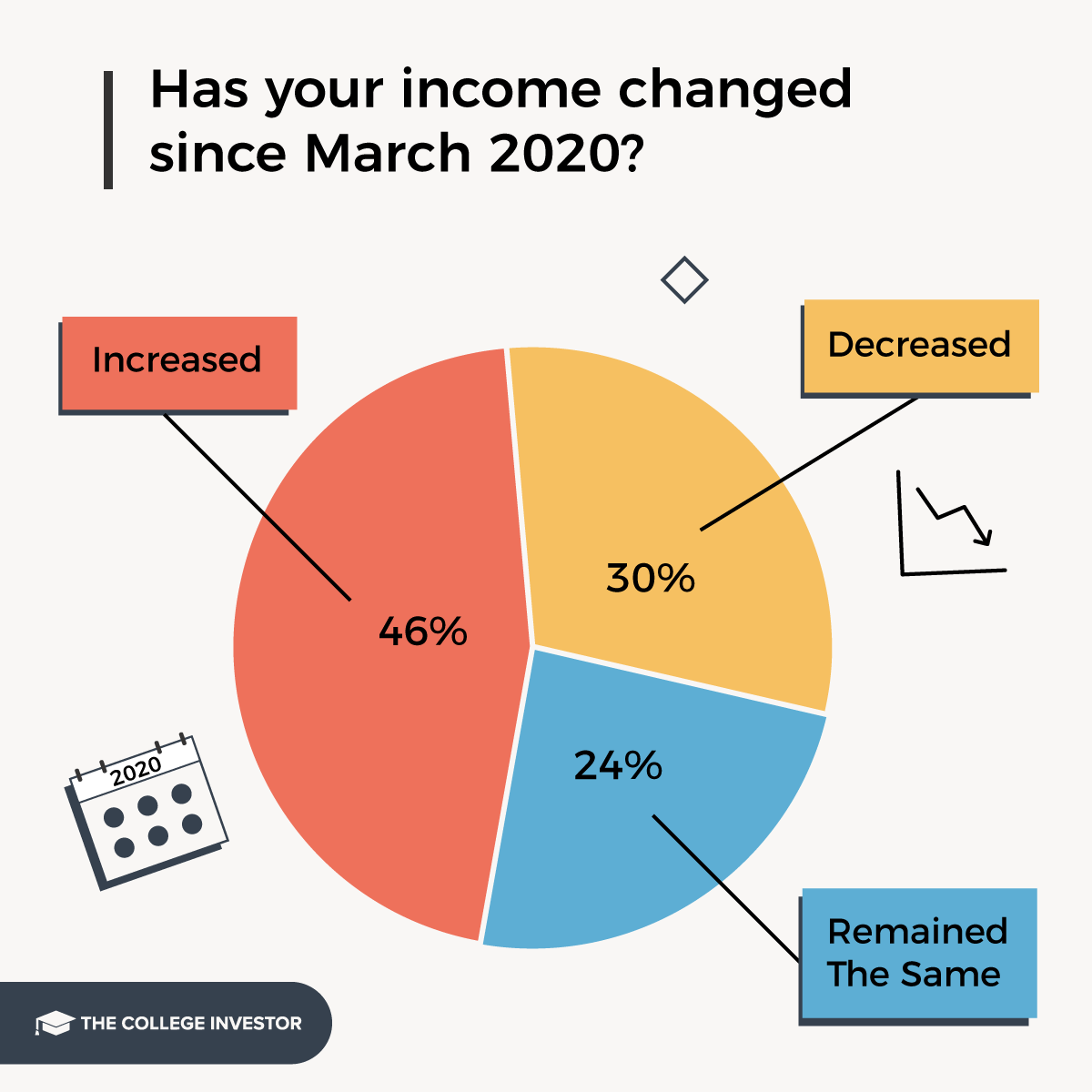

- 46% of scholar mortgage debtors reported their source of revenue larger, however the rest both had their source of revenue decline or keep the similar.

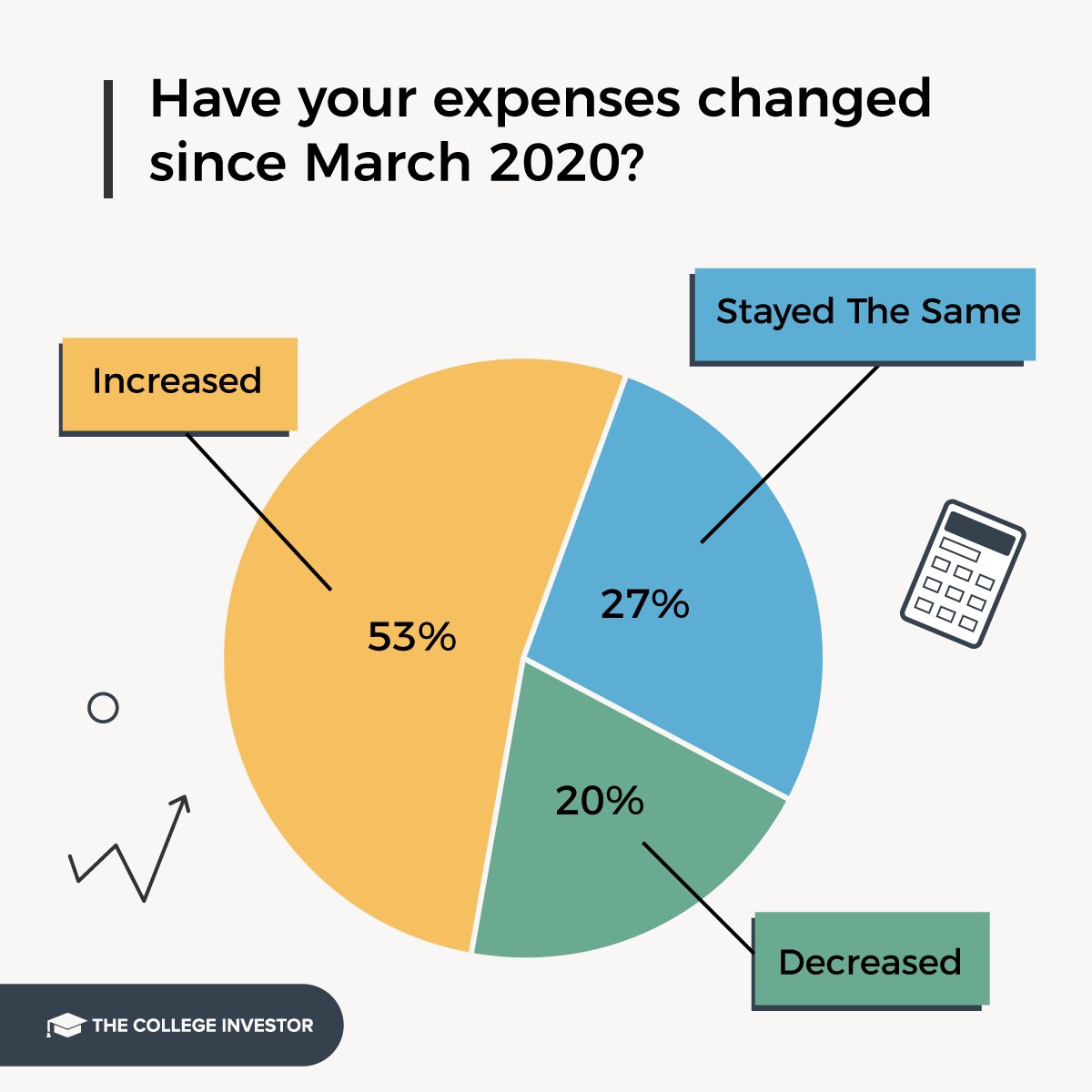

- On the identical time, 53% of scholar mortgage debtors have reported their per month bills expanding since March 2020.

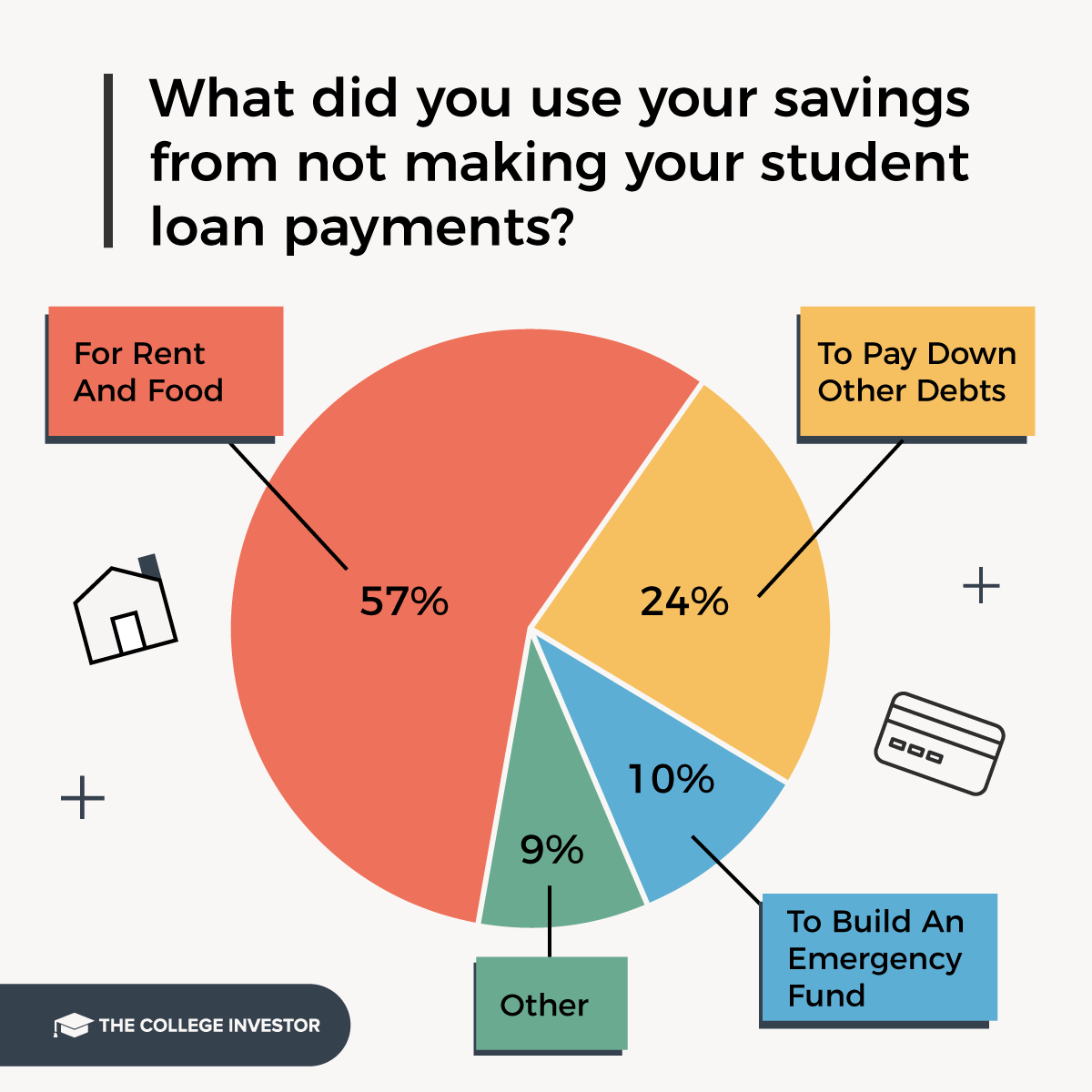

- Consequently, 57% of scholar mortgage debtors record the use of their financial savings from now not making scholar mortgage bills to easily quilt necessities like meals and housing prices.

Are Debtors In a position To Resume Pupil Mortgage Bills?

Pupil mortgage bills are set to renew in October 2023. Pastime on Federal scholar loans will probably be to accrue in September 2023. Given it is been over 3 years since debtors needed to make a scholar mortgage cost (and kind of 20% of all scholar mortgage debtors have by no means needed to make a mortgage cost because of graduating all over the pandemic cost pause), we would have liked to know the way debtors felt about resuming their mortgage bills.

Whilst no person needs to restart their mortgage bills, we discovered that 55% of scholar mortgage debtors do not really feel able financially to renew their scholar mortgage bills.

Borrower Wisdom About Their Pupil Loans

Past the person monetary problems dealing with debtors, we would have liked to know the way smartly debtors even knew what used to be going down with their scholar loans. We’ve got been listening to and studying about a large number of problems debtors are dealing with in relation to monitoring down their loans, discovering their scholar mortgage cost, and even figuring out what techniques they qualify for.

So in terms of restarting scholar mortgage bills q4, we would have liked to look what debtors knew about their loans (it used to be a little bit stunning).

First, simplest 42% of scholar mortgage debtors even know what their cost goes to be when scholar loans restart. That suggests 58% of debtors do not even know what their mortgage cost will probably be!

Consequently, 82% of scholar mortgage debtors are frightened about their mortgage bills.

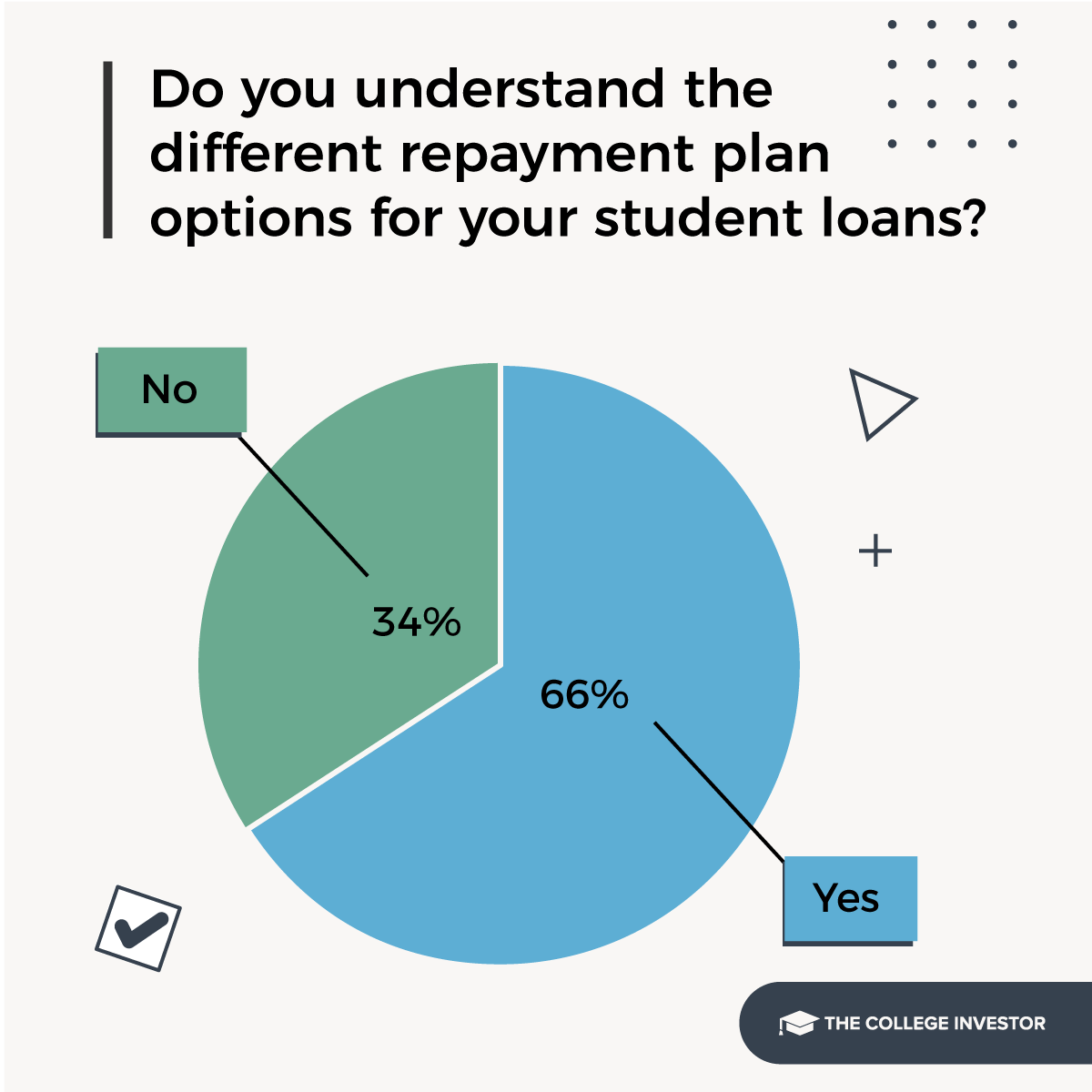

For the reason that the easiest way to control scholar mortgage compensation is to choose a scholar mortgage compensation plan you’ll find the money for, we would have liked to evaluate borrower wisdom of various compensation plans. We discovered that one-third of debtors did not know there have been other compensation plan choices for his or her scholar loans.

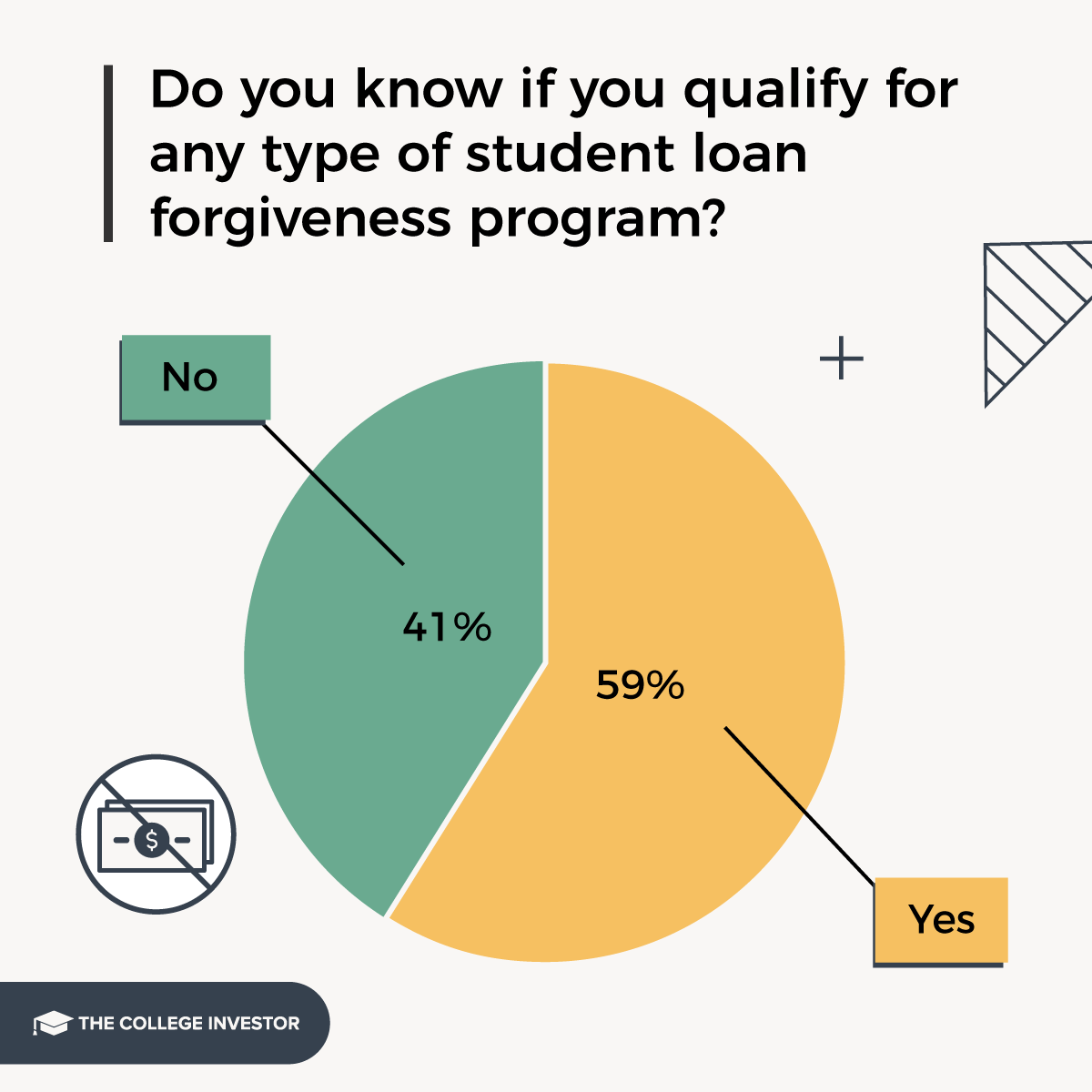

Alongside those self same traces, we would have liked to understand if debtors understood whether or not they will qualify for scholar mortgage forgiveness techniques to look if they are able to do away with their scholar loans. Shockingly, simplest 59% of scholar mortgage debtors knew in the event that they certified for any form of scholar mortgage forgiveness program.

How Have Debtors’ Budget Modified Throughout The Pandemic?

Repaying your scholar loans depends upon you with the ability to find the money for your scholar mortgage cost. Probably the most largest causes for the cost pause and hobby waiver used to be because of the hurt led to via the Covid-19 pandemic to a person’s source of revenue. And the extensions had been justified via the lasting harm achieved to folks’s source of revenue (and in recent years, bills because of emerging inflation).

Let’s get started with source of revenue. 46% of scholar mortgage debtors reported that their source of revenue has larger since March 2020. On the identical time, 30% of debtors reported their source of revenue lowering, whilst the remaining remained the similar.

In relation to bills, 53% of debtors reported that their per month bills have larger for the reason that get started of the pandemic.

Given that there have been vital financial savings because of the scholar mortgage cost pause, we had been curious how debtors had been spending that cash on the whole. We discovered that 57% of debtors had been the use of the financial savings to hide essential dwelling bills like hire and meals. The following class used to be 24% of debtors the use of the financial savings to pay down different money owed, like bank cards. The 1/3 maximum commonplace reaction used to be 10% the use of the cash to fund their emergency budget.

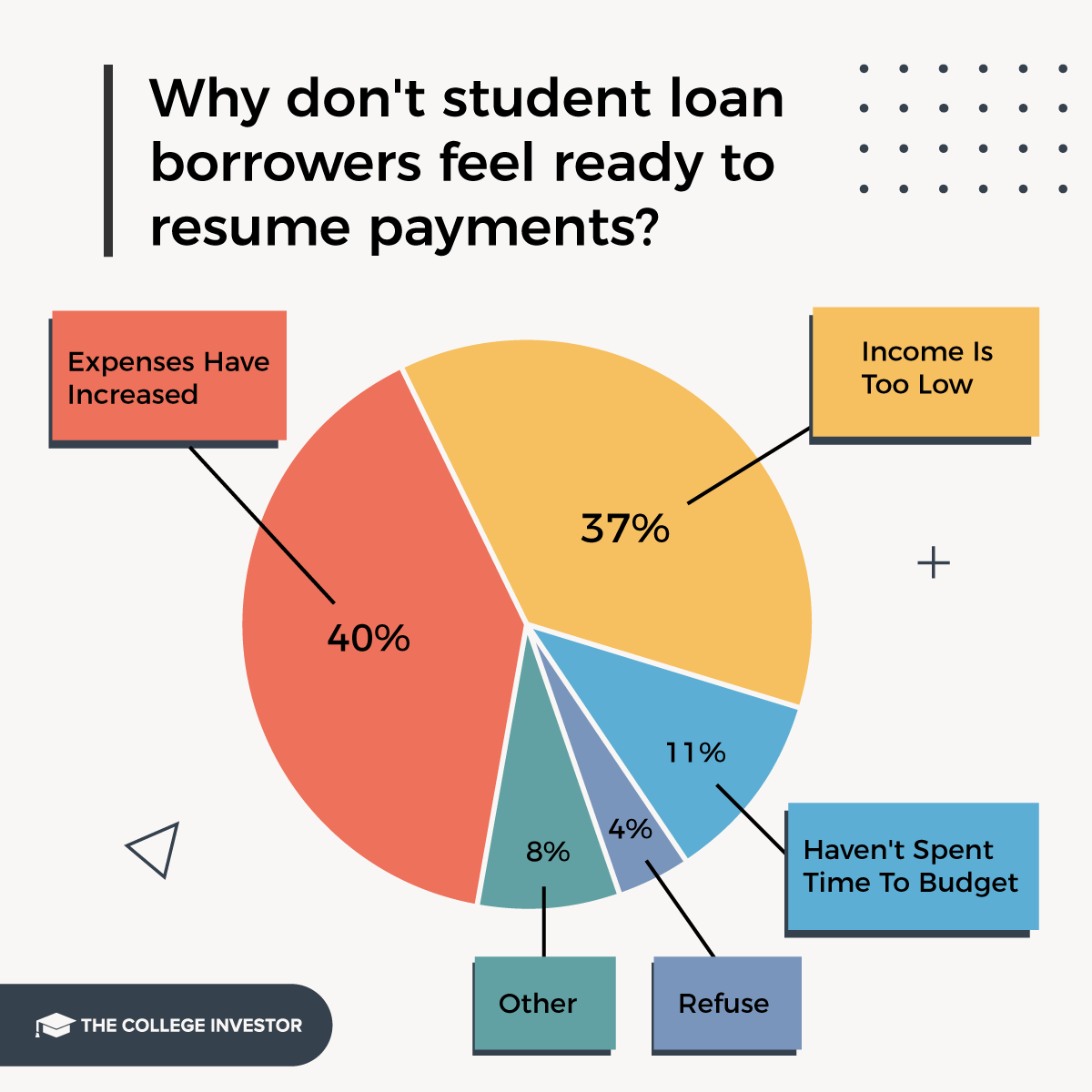

In spite of everything, we requested a extra subjective query as to why debtors do not really feel financially able to renew their scholar mortgage bills. It is extra subjective as a result of debtors would possibly not “need” to do one thing however are in fact ready to do it.

In relation to why debtors do not really feel financially able to renew bills, 40% mentioned their bills have larger, and including again in scholar mortgage bills is unaffordable. Every other 37% mentioned that even at the lowest per month cost compensation plan, their source of revenue is just too low.

Every other 11% mentioned they just have not spent the time to determine whether or not they are financially ready to renew their cost. And four% mentioned they only do not need to resume bills – there is no true monetary reason why as to why.

Ultimate Ideas

It used to be attention-grabbing to look a vital lower within the share of American citizens with scholar loans who really feel able to renew bills in 2023. Once we surveyed 1,200 debtors in 2022, 71% felt financially able to renew bills. That quantity has reduced to simply 45% feeling financially able.

Additionally it is relating to how few debtors perceive what their mortgage bills will probably be – with simplest 42% feeling assured in figuring out precisely what their cost will probably be. Moreover, one-third did not know that they had selection scholar mortgage compensation plan choices, and 41% did not find out about mortgage forgiveness choices. All of those indicators level to a failure in verbal exchange from the Division of Training and its mortgage servicers.

After all, debtors would possibly not really feel financially able when they do not know what to anticipate and what their choices are. It is most probably a large driving force as to why 82% of scholar mortgage debtors are frightened about their mortgage bills.

Method

The Faculty Investor commissioned Pollfish to habits a web-based survey of one,200 American citizens who had scholar mortgage debt as of the date of the survey. The survey used to be fielded June 16, 2023.