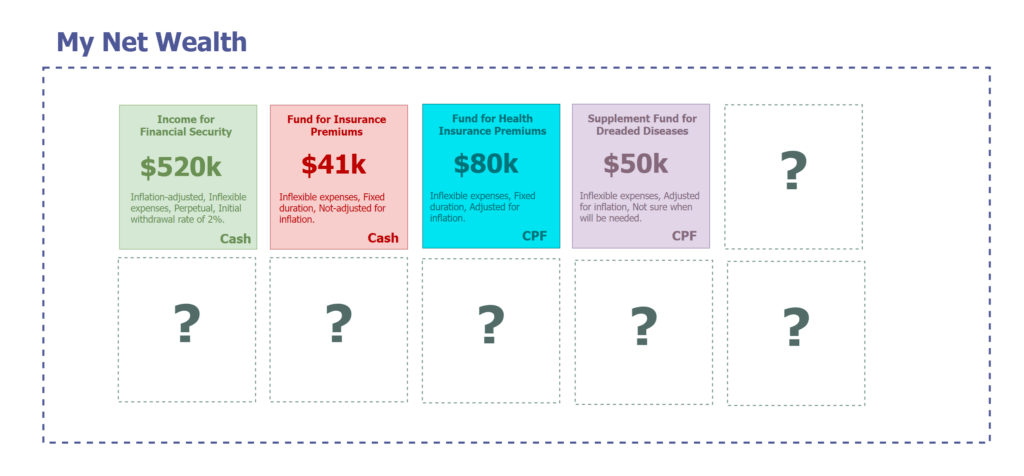

$50,000 Portfolio to Complement Lifetime Crucial Sickness Protection.

These days’s article is a continuation of my non-public notes collection, the place I will be able to percentage some fair takes on how I body some non-public monetary decision-making.

I recognized a lump sum put aside to pay for my medical insurance premiums (for Restructured A clinic) in my closing put up.

The following house to take into consideration is that this:

A lump sum fee for a serious dreaded illness that may happen at any level from 43 years onwards.

Some readers have thought of this subject, and it isn’t new. Certainly one of my readers requests to peer if I’ve a view on an concept he has:

What my reader is searching for is to self-insure his or her important sickness wishes however the query is whether or not is it viable, and if that is so, what’s a viable plan?

Be aware: Ahead of we proceed, do remember that what I’m going to give is very non-public. That is what I made up our minds, according to my psychological type. Individuals of my workforce are keen on insurance coverage analysis however those plans are my very own. A part of it’s going to be influenced by way of our analysis however my company don’t endorse my plans. In spite of everything, you must now not practice what I do blindly as a result of your scenario would most probably be other from mine.

The Monetary Downside we’re Looking to Remedy

We wish to:

- Put aside a lump sum in order that within the tournament of an important dreaded illness tournament, we will turn on this amount of money.

- We don’t know when it’s going to occur, however it’s most probably it’s going to occur someplace.

- Possibly, the possibilities of survival are not up to 50%

In insurance coverage, that is referred to as important sickness coverage.

Historically, important sickness coverage is to hide what internally in Providend is referred to as advanced-stage sickness. In most cases, the possibilities of survival are up within the air.

When I used to be more youthful, I used to suppose that the possibilities of survival have been top. As a man who has observed each his folks diagnose and cross away with most cancers, and larger schooling tells me that that is extra like… should you continue to exist… hope to are living 10 extra years. If now not, I will be able to are living when it comes to weeks or months.

Because the early days, we’ve progressed in scientific protection.

Now we have protection for:

- Early important sickness

- Multipay important sickness

- Time period until 99 protection for dying and demanding sickness

I added #3 in as a result of I believe after I went down this trail (2006), the time period until 99 is much less prevalent.

Early important sickness supplies a lump sum fee if you’re identified with an sickness that matches the early important sickness standards. Generally, that could be a most cancers this is in its early phases.

From what I understood, the possibilities of survival are top, nearly all of the fee can also be lined by way of medical insurance, does now not dissipate your financial savings and you’ll return to paintings speedy.

My ex-colleague’s dad used to be identified with one thing like that and used to be again up lovely speedy. We now have different instances of equivalent reviews. Some medical doctors we talked to marvel why the fuss over overlaying for early important sickness.

Multipay important sickness is getting common as a result of the marketed flexibility. You’ll be able to get thrice or six instances the sum confident, relying on what you be afflicted by in an entire life.

I believe the attraction is within the protection for relapse and a distinct more or less important sickness tournament. We’re afraid that during such an tournament, we don’t have the monies once we maximum wanted it.

The query is whether or not any person will continue to exist after which are living to need to take on every other tournament.

Certainly one of my excellent buddies instructed me the tale of an acquaintance of his who’s these days combating his THIRD most cancers. Each and every time in a distinct house.

Is {that a} uncommon case or a commonplace case? It’s not that i am in reality certain.

But it surely provides us an concept of what may just occur.

What does Crucial Sickness coverage assume to hide?

Crucial sickness coverage, generally, is to hide :

- Alternative source of revenue for the duration the place you get better out of your sickness. Possibly, you can not paintings or have to concentrate on recuperation.

- Lump sum to lend a hand within the therapeutic. In the event you require choice medicine to help your therapeutic, you must cater for it.

Generally, we might say 3 to five years of your source of revenue or bills plus choice remedy prices.

That is so subjective, however I believe why. Each and every folks has other healthcare philosophy and lives other lives.

Is it higher to hide source of revenue or simply the bills?

For many, I lean in opposition to overlaying the source of revenue as a result of you should still need to put aside cash in order that your long run monetary targets will stay unaffected.

In the event you continue to exist, there may be nonetheless paintings to be completed.

How a lot lump sum to hide for choice medicine?

Arising with a sum is difficult as it will depend on your healthcare philosophy. If you don’t believe western drugs and need to search choice care, then your price could also be upper.

My buddy Chris Tan used to inform me the tale that any person spend $400,000 on choice care years in the past.

This is conceivable however it’s tricky to pass judgement on.

Doesn’t your source of revenue alternative price and choice medicine price pass up through the years?

Realistically they do pass up through the years.

If this is the case do we’d like further CI protection as our source of revenue will increase and the other price of medicine will increase?

For my part, it must.

I believe it’s much less mentioned. You can be suspicious that your monetary planner desires to extend your protection however I believe there’s a legitimate case for that.

I stated it must, until you might be an outlier like the oldsters within the monetary independence neighborhood who has constructed up their web wealth to supply source of revenue impartial in their task.

Maximum don’t seem to be actively pursuing those actions and are reliant on their source of revenue from paintings to meet their conventional monetary targets and so naturally, the CI wishes must pass up through the years.

So possibly every now and then, a overview of whether or not you might be adequately lined is excellent.

How do I take into consideration this drawback?

Crucial sickness is extra than simply most cancers. Kidney failure, stroke and center illness this is serious sufficient are one of the issues that may hit us.

To take on this, we’d like a mix of:

- Lengthy-term medical insurance.

- Lengthy-term care.

- Lump-sum coins payout.

I’ve lined #1 however have now not mentioned #2.

I believe this is one thing to contemplate about and speak about in due time.

Lump-sum coins payout, the principle subject lately, is a part of the technique to take on this drawback.

My philosophy is that we wish to continue to exist the primary 12 months. If you can not continue to exist the primary 12 months, we don’t have a lot else to speak about.

My funds is to be sure that I thought to be sufficient for the primary 12 months of care.

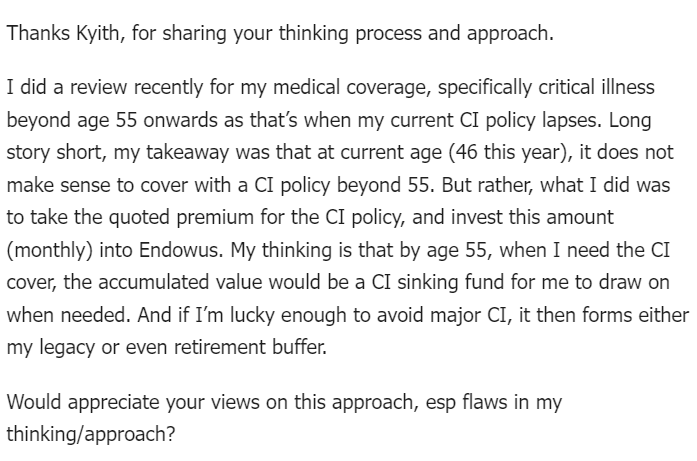

Listed here are my lump-sum funds attention:

The expense line pieces are in lately’s price. It really works out to a complete of $74,186.

Possibly they lean extra in opposition to my reviews coping with two most cancers instances and I’m open to higher refinement if there are readers with different reviews prepared to percentage.

I catered for a $400,000 inpatient primary surgical operation and the wish to pay a ten% co-insurance and a $3,500 deductible (as a result of It’s not that i am getting a rider). Whether it is much less serious, I’ve extra funds to paintings with.

I’m nonetheless at the fence if one thing like most cancers have been to hit me, whether or not I will be able to pass forward with the normal western remedy. You achieve a fxxking other point of view after coping with it now not simply two times however dunno how again and again should you come with kinfolk.

If I don’t, that $40k is ready $3,333 a month, which provides to the $800 in scientific consumables. Is that sufficient? I don’t know. Towards this isn’t even just about the $400,000 my boss Chris talks about.

I additionally cater funds for a caregiver, however in fact if I turn on the funds for my discretionary spending for this, I don’t want this $1,300 a month and thus that funds can pass to one thing else.

Do I wish to quilt for source of revenue substitute?

I’m financially impartial. Nearly all of the prices are deliberate for in a conservative approach. If we upload the source of revenue for very important, fundamental and the ones versatile way of life bills, it must be sufficient. Particularly with the aid in job.

There also are no dependents at the source of revenue apart from for myself.

Would my spending be upper because of the sickness? Sure, it could, which is why a part of this funds caters for upper prices.

Are we able to use our CPF Medisave to pay for this?

My enjoy tells me no.

We need to depend on out-of-pocket prices.

Adjusting this funds for inflation

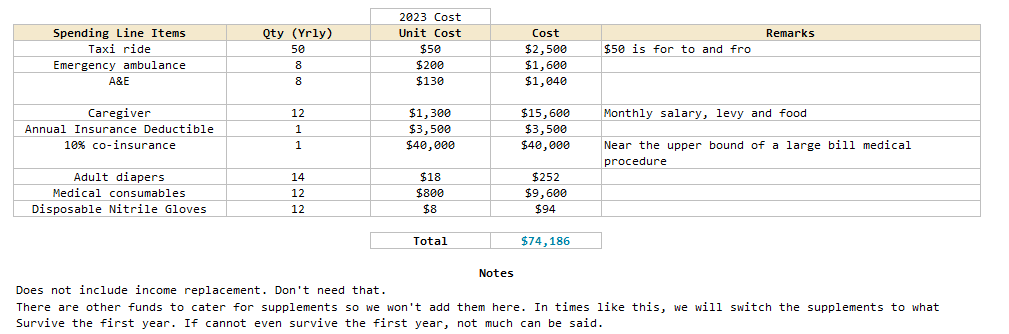

The $74,186 funds will wish to develop through the years with inflation.

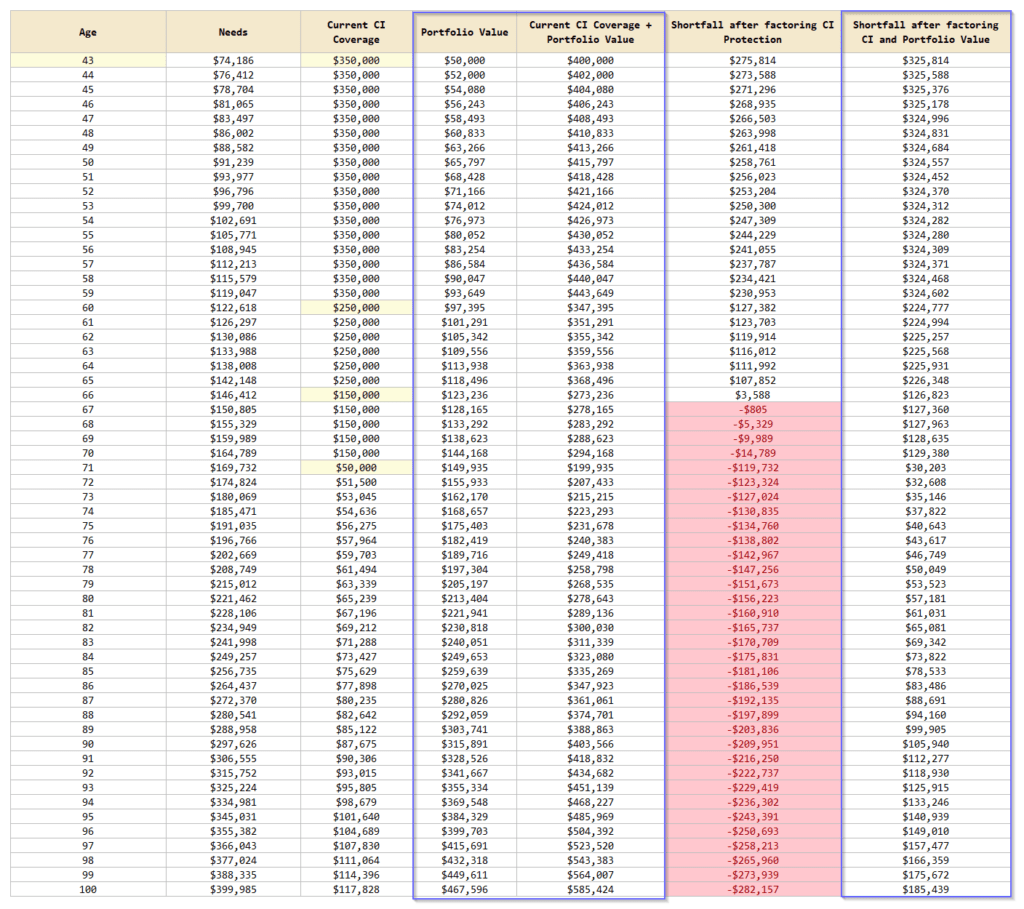

The desk under displays the funds had to develop at 3% a 12 months:

We have no idea when we can want it, however it’s most probably the wishes will pass up as scientific and way of life price is going up through the years. You could even debate with me whether or not the usage of 3% a 12 months is conservative sufficient!

A part of the long run monetary threat is roofed by way of advanced-stage important sickness insurance coverage.

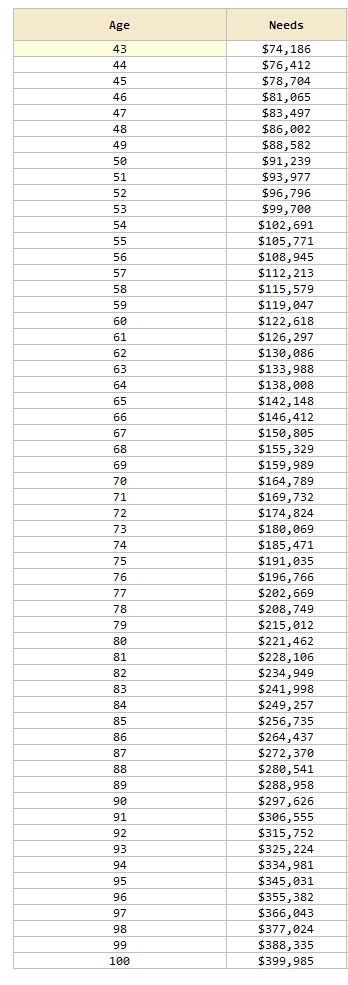

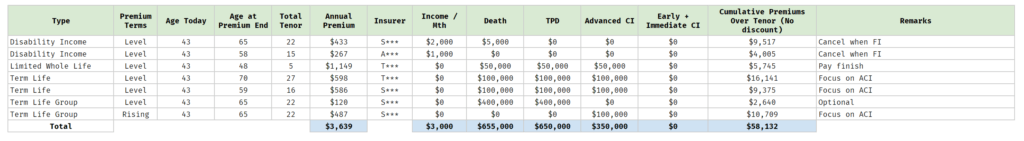

I’ve advanced-stage important sickness protection within the type of time period insurance coverage and a restricted total existence insurance coverage.

There may be $300,000 price of time period existence insurance plans, which is able to quilt until 55, 60, and 65 years outdated respectively. I’ve $50,000 price of restricted whole-life protection which must quilt for existence. The protection for restricted total existence must pass up through the years within the later years.

The protection used to be bought firstly to hide the three to five years of source of revenue substitute wishes however as I should not have it now, I will be able to leverage them to hide for the lump sum scientific wishes.

I added a column that displays my evolving important sickness protection (Present CI Protection) and the furthest column displays the shortfall when we think about CI Coverage protection, which is Present CI Protection minus my Wishes:

If the closing column is certain, it manner there are extra budget and no shortfall and whether it is destructive, there’s a significant shortfall.

Through and big, I must be neatly lined prior to the age of 67.

Past 67 years outdated, there can be a shortfall in protection.

So we would want a technique to quilt the shortfall.

A Portfolio to Complement the Shortfall in Crucial Sickness Protection after 67 Years Previous

My major plan is to make use of the similar idea as investment for my medical insurance premiums for the shortfall on this lump sum wanted.

- The investment will come from my CPF OA/SA monies.

- The allocation is a 75% fairness and 25% bond allocation.

- The budget and tools selected can be equivalent.

- We will be able to use a making plans go back of four% a 12 months, which leans in opposition to a extra pessimistic go back in comparison to the long-term go back of 6.4%. That is to make certain that within the tournament I’m unfortunate, my plan can be extra intact than out of wack.

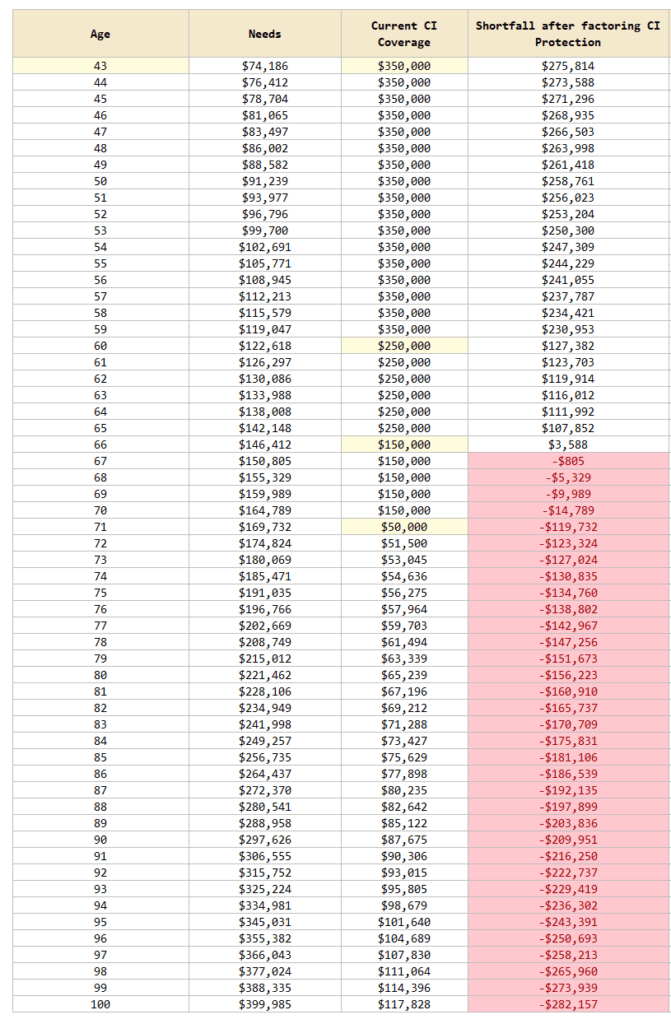

I added 3 columns to turn the portfolio to complement the important sickness coverage and whether or not the combo of CI protection & portfolio covers the shortfall. This column is taking Wishes minus (Present CI protection + Portfolio Worth):

A destructive price within the closing column manner the portfolio plus CI coverage may just now not cater to the CI Wishes and a good price displays that the portfolio plus CI coverage is in a position to pay out within the tournament that we’d like the cash.

If we fund it with a lump sum of $50,000, the portfolio price will develop through the years.

The closing column displays a good price in all years with the bottom extra to be $30,000 when age is 71 years outdated.

How did I arrive at a lumpsum preliminary portfolio price of $50,000?

I regulate the portfolio in order that the protection from 67 years outdated to 100 years outdated is certain, but now not excessively certain.

We now have in-built a margin of protection within the making plans returns, and due to this fact there is not any wish to have an over the top buffer.

There must be an extra in investment if issues pass in line with plan -We might be able to cancel one C.I coverage.

We apply that from age 43 to age 63, there are like $200,000 to $300,000 in extra protection.

It’s because aggregating the portfolio and CI coverage is a lot more than our wishes.

From 67 to 100, if funding efficiency isn’t too pessimistic, there must even be extra investment.

The excellent news here’s that I’ve the strategy to most likely eliminate two advanced-stage important sickness insurance policies.

The perfect applicants will be the insurance policies that can expire on the earliest. For the reason that I’m seeking to put aside cash to fund the insurance policies, this might doubtlessly save me $19,000 in premiums.

This implies net-net, I might wish to put aside simply $30,000 extra as a substitute of $50,000.

My Publicity to Unfavourable Collection of Returns Dangers and Shooting Returns

Unfavourable collection of returns threat is the danger that should you come upon a deficient collection because of:

- Decrease portfolio go back

- Upper than commonplace spending fee

- Aggregate of #1 and #2

This portfolio may have 23 years prior to we’d like the cash.

This must be a protracted sufficient runway not to solely ruin even. My information paintings does display that we would possibly want 25 to 30 years to totally seize the common go back however I don’t want moderate historic returns for the plan to figure out.

May just a CI Time period until 99 Be a Viable Resolution?

A time period coverage does now not develop in price through the years.

Which means to hide for more or less a $300,000 shortfall at 100 years outdated, I would possibly wish to purchase a time period and canopy to 99 years outdated.

I’ve now not run the premiums however to provide you with a gauge, a 12 months in the past we generated a time period until 99 for a 45-year-old male to hide for existence with $1 million protection. That is with out an sped up CI rider.

The premiums got here as much as about $5,810 a 12 months. Upper protection is inexpensive so if we have been to just quilt $300,000 it could figure out to be $3,000 a 12 months. However to hide CI, which normally is the pricey one it would deliver the premiums again above $6,000 a 12 months.

Now if I am getting it lately, I might wish to pay ongoing premiums for 57 years. If I’m identified with important sickness previous then it could be extra price it than atmosphere apart $50,000 extra.

But when it doesn’t how must I fund this $6,000 a 12 months in top rate?

I may desire a portfolio to conservatively pay for the premiums. Since this spending is somewhat rigid, and with any such lengthy runway we wish to pass with an preliminary protected withdrawal fee less than 3% (possibly 2.8%).

This may increasingly imply I would like an extra capital of $215,000 to generate $6,000 a 12 months, according to a 2.8% preliminary protected withdrawal fee.

This appears extra pricey than my unique plan.

What about Different Insurance coverage Plans? Would they have compatibility the Requirement?

For many who are sharper, you may be able to deduce that my plan is mainly:

- CI insurance coverage will sooner or later fall off, however the time period insurance policies haven’t any coins price.

- I’ve each monetary sources and sufficient time horizon.

- Develop a portfolio that can sooner or later be capable to guarantee the CI within the later years.

A conceivable answer is to unload my current time period plans, or in a much less drastic approach, take the cash put aside for long run CI premiums ($36,225 in general) and upload some extra capital in a cash-value insurance coverage plan, with a CI rider hooked up.

The money price plan will quilt my CI wishes for my total existence. It additionally has legacy attraction as neatly.

The important thing standards are:

- The price construction of the insurance coverage plan should make sense.

- The CI protection is according to the sum-at-risk type.

The sum-at-risk is the variation between the ease paid out and the worth collected of the coverage. The insurance coverage premiums charged is primarily based upon this sum-at-risk or this distinction.

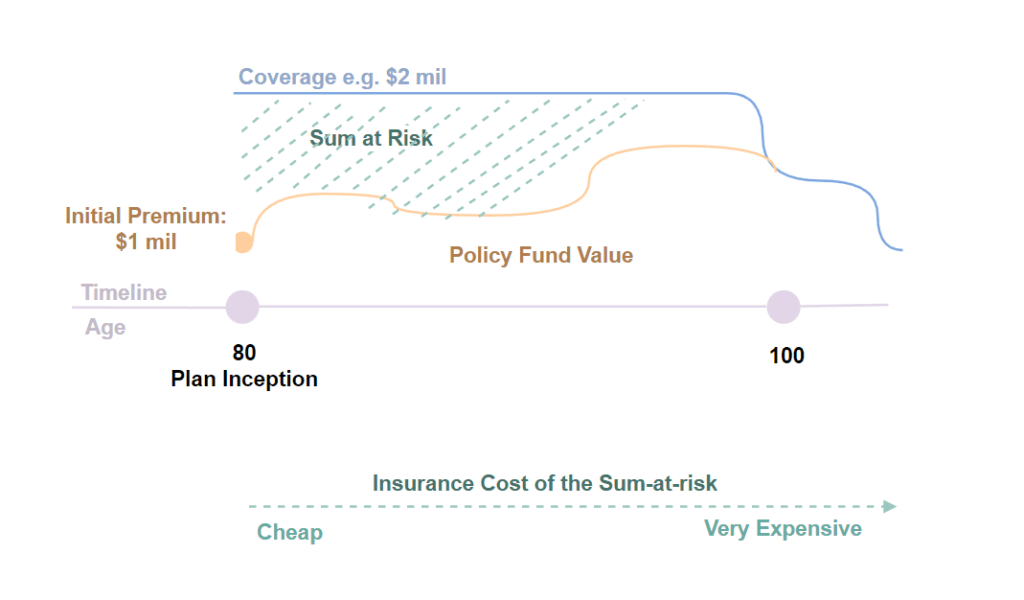

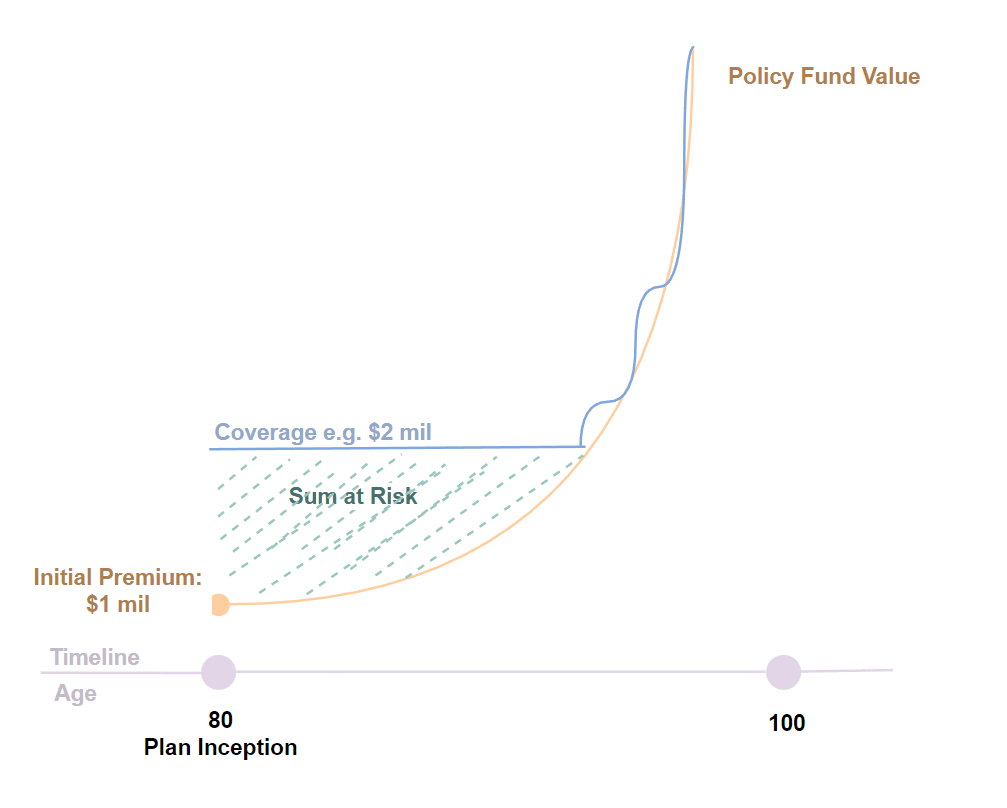

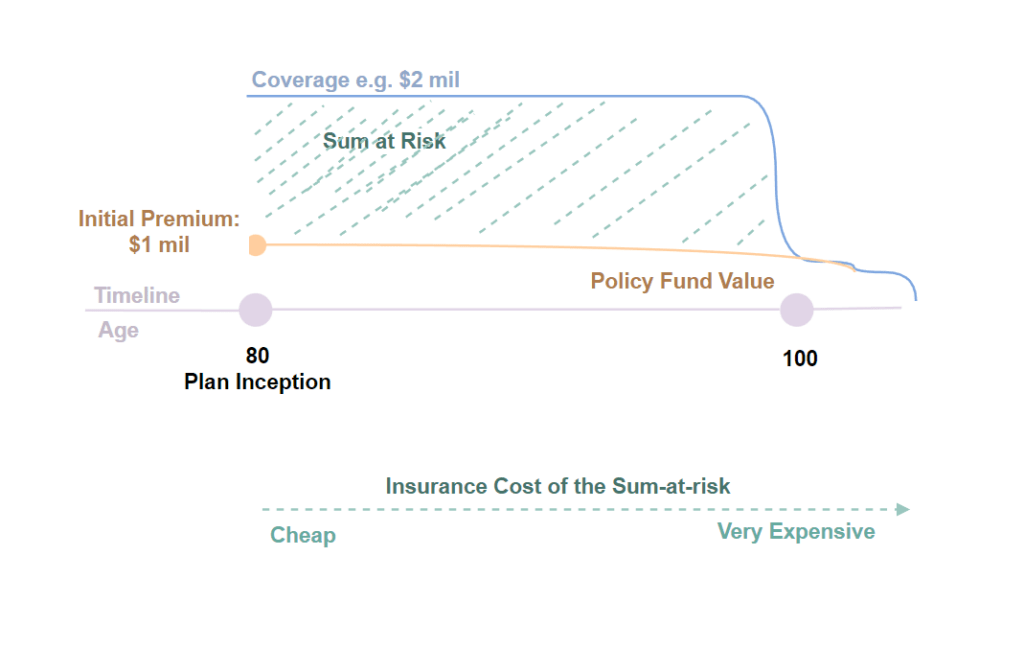

This diagram may can help you make sense:

Think you might be at 80 years outdated and buy a plan with an preliminary top rate, or price of $1 million. The plan has a protection advantage of $2 million. Which means anytime you passed on to the great beyond, you get $2 million.

Now, the $1 mil both can also be installed a fund that returns according to crediting fee (common existence coverage), or in unit believe investments (variable common existence or investment-linked coverage). The price will develop through the years.

If the worth of the coverage don’t develop till greater than the protection by way of a definite time (on this case 100 years outdated), then the protection will fall to the worth of the coverage which is could also be not up to $2 million.

The sum-at-risk is the variation in that shaded house, and the price of insurance coverage will depend on how large that house is.

Now assume within the excessive case your coverage invests in a fund that moons to this level. The price of your coverage a ways exceeds the protection previous than anticipated. The sum-at-risk is decreased and the price of insurance coverage additionally is going down.

However what if it doesn’t? Then your price of insurance coverage goes to be very top.

This type will paintings rather well should you spend money on essentially sound monetary securities, this is low price, that in the end can ship excellent result with top chance.

Alternatively, from what I perceive, variable common existence and investment-linked insurance policies can’t quilt important sickness on this approach.

So this promising house will get thrown out of the plan. (Hat-tip to my colleague Mike for clearing this phase up).

Conclusion

I will be able to select to fund this $50,000 portfolio the similar approach because the portfolio to pay for the medical insurance top rate with CPF monies, however that might imply that prior to 55, I can’t get get right of entry to to the cash.

This is positive if I nonetheless have sufficient CI protection. This plan, on the other hand, lets in me to cancel two of my CI insurance policies if I need to and cancelling the ones insurance policies will create the accessibility drawback I discussed.

I believe what I will be able to do is to fund the ones two existence insurance coverage with CI with my wage so long as I will be able to be hired and if It’s not that i am hired, I will be able to put aside the volume to pay for premiums until 55 years outdated. I will be able to now not have the ones insurance policies after 55 years outdated, supplied I take a look at that my portfolio plans (defined on this article) is progressing as deliberate.

I believe an excessive amount of morbid discussions for the closing 3 pot of cash. The following one most probably will return to commonplace bills.

If you wish to industry those shares I discussed, you’ll open an account with Interactive Agents. Interactive Agents is the main low cost and environment friendly dealer I exploit and believe to take a position & industry my holdings in Singapore, the USA, London Inventory Trade and Hong Kong Inventory Trade. They mean you can industry shares, ETFs, choices, futures, foreign exchange, bonds and budget international from a unmarried built-in account.

You’ll be able to learn extra about my ideas about Interactive Agents in this Interactive Agents Deep Dive Sequence, beginning with learn how to create & fund your Interactive Agents account simply.