40 Passive Source of revenue Concepts For 2023 To Construct Actual Wealth

If you are on the lookout for passive source of revenue concepts, you might imagine the entire thought is a delusion – there is no manner that you’ll make cash by means of doing not anything. It is why passive source of revenue is very wanted, but continuously misunderstood.

In fact, passive source of revenue streams require an prematurely funding and numerous nurturing at first. After a while and tough paintings those source of revenue streams begin to construct and are ready to deal with themselves, bringing you constant earnings with out a lot effort in your phase.

Talking from non-public enjoy, including passive source of revenue streams for your portfolio let you building up your income and boost up your monetary targets in super techniques. For instance, beginning a financial savings account and incomes hobby, or making an investment in dividend paying shares can all get started including source of revenue for your lifestyles with no need to paintings! Your cash is operating for you!

For instance, you’ll use passive source of revenue streams that will help you get out of debt or succeed in monetary independence quicker.

If you wish to get began incomes passive source of revenue right here’s what you must know first.

If you wish to skip immediately to the tips, right here you pass!

What It Takes To Earn Passive Source of revenue

Earlier than we get into the passive source of revenue concepts I feel it’s a good suggestion to first transparent up a few misconceptions. Even though the phrase “passive” makes it sound like it’s important to do not anything to usher in the source of revenue this simply isn’t true. All passive source of revenue streams would require no less than one of the crucial following two parts:

1) An prematurely financial funding, or

2) An prematurely time funding

You’ll be able to’t earn residual source of revenue with out being prepared to supply no less than this type of two. As a result of it is important to keep in mind what passive source of revenue is NOT. Passive source of revenue isn’t your activity, it is not freelancing, or running on-line. Passive source of revenue is doing one thing as soon as, then incomes rewards from it into the longer term.

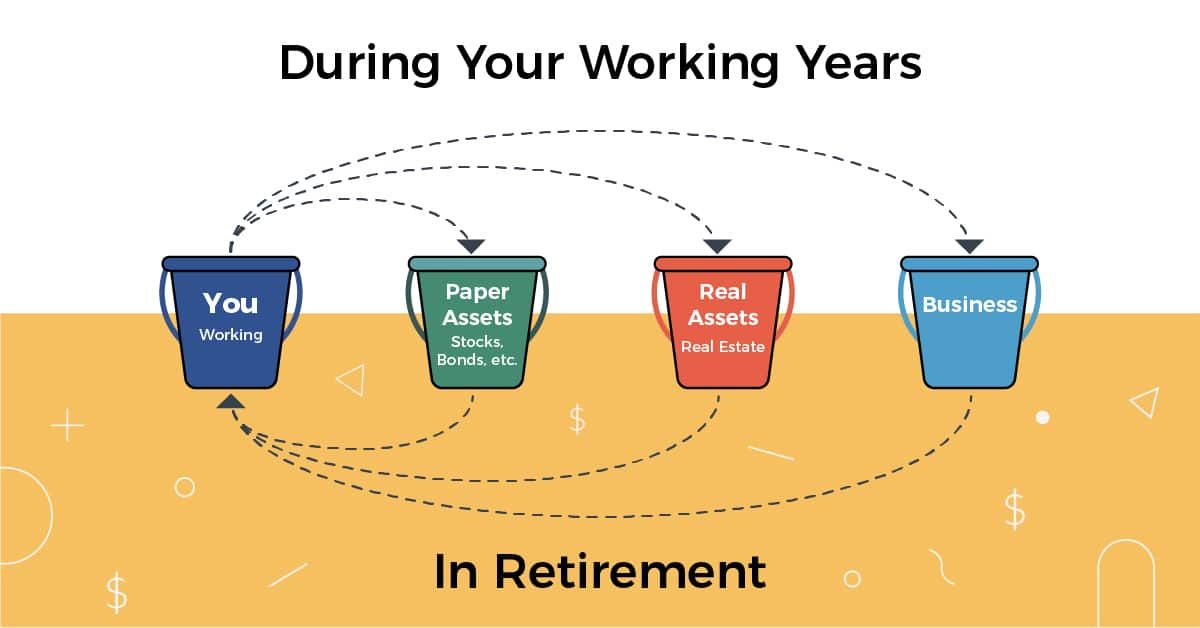

Here is a just right instance of ways I view passive source of revenue and the way it suits into your portfolio of belongings:

Learn our complete information to What Is Passive Source of revenue?

Lately, I’ve a large record of passive source of revenue concepts you’ll check out without reference to the class you fall in.

Take a look at the video on passive source of revenue concepts right here:

Passive Source of revenue Concepts Requiring an In advance Financial Funding

These kinds of passive source of revenue require you to speculate cash up entrance to generate the passive source of revenue later. Do not be alarmed even though – you’ll get started with as low as $5 with a few of these concepts, so it is achievable for everybody.

1. Dividend Shares

Dividend shares are attempted and true approach to earn passive source of revenue. You’ll have to do quite a few analysis to search out just right shares and make investments an important sum of money to obtain huge dividend tests. On the other hand, if you happen to persistently make investments cash into dividend shares you’ll amass a pleasing residual source of revenue through the years.

For any of those funding alternatives, be sure you open an account at the most productive on-line brokerage, and get rewards whilst doing it.

Our favourite position to speculate is M1 Finance. You may no longer have heard of M1 Finance, however it is a FREE making an investment platform that lets you construct a portfolio, and spend money on it at no cost.

That is superb for making an investment in dividend shares as a result of you’ll construct your portfolio of, say, 30 shares. Then, your investments will probably be auto-allocated to all of your portfolio each and every deposit – for FREE! You’ll be able to even auto-rebalance. Then, your dividends may also be reinvested. It is an out of this world platform, and it used to be made for this. Plus, M1 Finance used to be an honorable point out on the most productive puts to speculate for 2023!

Learn our complete enjoy with M1 Finance right here.

How To Select The Proper Dividend Shares

- Search for firms with a historical past of constant dividend bills

- Analysis dividend yield and payout ratios

- Diversify your portfolio to reduce menace

If you are unsure about opting for person shares, search for excessive dividend paying ETFs or mutual budget.

2. Unmarried-Circle of relatives Condo Homes

A coins flowing apartment belongings is an out of this world manner to usher in a per month source of revenue. To make this really passive you’ll outsource the working of the homes to a control corporate.

On the other hand, the web has made making an investment in apartment homes more uncomplicated than ever ahead of. There are numerous techniques you’ll spend money on apartment homes relying on what your targets and pursuits are. You’ll be able to be a restricted spouse in huge residential or business homes, or you’ll purchase houses and be a landlord – all on-line!

Make investments In Unmarried Circle of relatives Properties

If you are on the lookout for a extra conventional trail to actual property funding, take a look at Roofstock. This corporate means that you can purchase cash-flow certain unmarried relatives leases – on-line! You’ll be able to enroll and get started looking out homes nowadays. Take a look at Roofstock right here.

The wonderful thing about the use of a platform as opposed to doing it your self is that the source of revenue is much more passive. Take a look at our complete enjoy with Roofstock right here.

Guidelines For A hit Condo Assets Making an investment

- Select homes in high-demand spaces

- Be sure certain coins circulate

- Imagine the use of a belongings control corporate

3. Better Actual Property Traits

Do you no longer need to be a landlord, however nonetheless need actual property publicity and source of revenue? Then imagine being a restricted spouse in a big construction. With those choices, you’ll spend money on multi-family or business homes. You get the source of revenue and tax remedy identical to common actual property possession, however you do not do any of the paintings!

Our favourite platform for that is RealtyMogul since you get the versatility to speculate as low as $1,000, however too can take part in REITs and personal placements – in most cases no longer introduced to the general public. Buyers can fund actual property loans to realize passive source of revenue or purchase an fairness percentage in a belongings for possible appreciation. Their platform is open to each authorized and non-accredited buyers.

Learn our complete enjoy the use of RealtyMogul right here.

Advantages of Crowdfunded Actual Property

- Get right of entry to to actual property investments with decrease capital necessities

- Diversification throughout a couple of homes

- Skilled control of investments

For Authorised Buyers

One in every of my favourite techniques to get began with apartment homes is thru EquityMultiple. Very similar to LendingClub, you’ll get started making an investment in actual property for as low as $5,000 at platforms like EquityMultiple.

This platform has a pleasing mixture of smaller residential to combined use residential and business homes. Learn our complete EquityMultiple overview right here.

4. Make investments In Farmland

Farmland is not horny, however it has so much going for it in relation to actual property making an investment. It is sluggish, stable, can pay constant hire, and everybody must devour. Plus, in comparison to different varieties of actual property its a lot much less risky. There may be two main firms that help you spend money on farmland. FarmTogether and AcreTrader.

We just lately did a at the back of the scenes overview of our personal AcreTrader funding, and you’ll watch the AcreTrader overview video on YouTube.

Take a look at our evaluations and get began:

Advantages of Leasing Farmland

- Secure apartment source of revenue

- Land appreciation possible

- Minimum control obligations

5. Prime Yield Financial savings Accounts And Cash Marketplace Budget

If you do not need to suppose a lot about your cash, however need it to be just right for you, a fundamental position to position it’s in a excessive yield financial savings account or cash marketplace fund.

The adaptation is within the account kind and the place it is positioned. Generally, excessive yield financial savings accounts are positioned at banks, and are FDIC insured. Cash marketplace budget may also be positioned at each banks and funding firms, and are handiest once in a while FDIC insured.

Rates of interest were emerging, so striking extra money right into a financial savings account can generate a secure passive source of revenue circulation.

CIT Financial institution recently provides a forged yield at 4.60% APY with only a $100 minimal to open! Take a look at CIT Financial institution right here >>

Traits of Prime-Yield Financial savings Accounts

- Federally insured as much as FDIC Limits

- Obtainable and liquid

- Low-risk funding

If you wish to have the hottest charges on excessive yield financial savings accounts and cash markets, take a look at those lists that we replace the charges day by day on:

6. Crypto Passive Source of revenue Alternatives

During the last a number of years, crypto financial savings accounts have change into very talked-about – just because they give you the alternative for upper charges of go back in your cash. You have to be aware that those are not actually “financial savings accounts”. Those are funding and lending accounts that help you earn a excessive yield in your crypto “simply”. However they are no longer with out menace!

Some in style choices are Uphold and Nexo (handiest to be had out of doors the US). You’ll be able to earn upwards of 25% APY in your crypto at those firms, however there are dangers. Take a look at our complete information to Crypto Financial savings Accounts right here.

You’ll be able to additionally have a look at staking your crypto, lending your crypto, or even purchasing NFTs. There are numerous alternatives to earn passive source of revenue with crypto – we put in combination a complete information right here: How To Make Passive Source of revenue With Crypto.

Fashionable Cryptocurrencies for Staking

7. CD Ladders

Construction a CD Ladder calls for purchasing CDs (certificate of deposits) from banks in positive increments to be able to earn the next go back in your cash. CDs are introduced by means of banks and because they’re a low menace funding in addition they yield a low go back. It is a just right possibility for the chance averse to construct passive source of revenue streams.

For instance, what you do if you wish to have a five-year CD ladder is you do the next. Glance how the charges upward push over other time classes (those are estimated):

- 1 Yr CD – 4.00%

- 2 Yr CD – 4.250%

- 3 Yr CD – 4.50%

- 4 Yr CD – 5.00%

- 5 Yr CD – 5.25%

If development a CD Ladder sounds sophisticated, you’ll additionally stick with a conventional excessive yield financial savings account or cash marketplace fund. Whilst the returns are not as superb as different issues in this record, it is higher than not anything, and it is really passive source of revenue!

We advise development a CD Ladder at CIT Financial institution as a result of they’ve one of the crucial highest CD merchandise to be had. Prime charges or even a penalty-free CD possibility (which recently earns 4.90% APY). Take a look at CIT Financial institution right here.

You’ll be able to additionally have a look at CD choices like Save. Save is a hybrid product that probably means that you can earn manner above marketplace returns, however helps to keep your important secure in an FDIC-insured checking account. Take a look at Save right here >>

Take a look at those nice offers on the most productive excessive yield CDs on our complete record of the most productive CD charges that get up to date day by day.

Advantages of CD Ladders

- Upper rates of interest in comparison to financial savings accounts (in most cases)

- Common get admission to to budget

- Lowered menace of rate of interest fluctuations since you may have locked in a price

8. Annuities

Annuities are an insurance coverage product that you just pay for however can then supply you passive source of revenue for lifestyles within the type of per month bills. The phrases with annuities range and don’t seem to be at all times a really perfect deal so it’s highest to speak to a depended on monetary consultant if you happen to’re desirous about buying an annuity.

Those investments are not for everybody – they are able to include excessive charges, and no longer be price it. However when you have 0 menace tolerance for loss, and are on the lookout for a passive source of revenue circulation, this generally is a just right possible thought for you your portfolio.

Take a look at Blueprint Source of revenue for a market for non-public annuities.

Sorts of Annuities

- Mounted annuities

- Variable annuities

- Listed annuities

9. Make investments Robotically In The Inventory Marketplace

If you are no longer desirous about choosing dividend paying shares (and I will be able to needless to say), there are nonetheless techniques to speculate passively within the inventory marketplace. You’ll be able to mechanically spend money on more than a few techniques thru what is referred to as a robo-advisor.

A robo-advisor is rather like what it seems like – a robot monetary consultant. You spend about 10 mins answering a couple of questions and putting in your account, and the device will take it from there.

The most well liked robo-advisor is Wealthfront – which you’ll setup to mechanically spend money on and they are going to care for the remaining for you. What is nice about Wealthfront is they price one of the crucial lowest charges within the robo-advisor business, and so they make it actually simple to speculate mechanically.

Plus, Wealthfront used to be just lately named certainly one of our most sensible selections for the Absolute best Robo-Advisors For 2023. They provide a really perfect carrier plus you’ll get recommendation from an actual human, which is superior. Learn our complete enjoy with Wealthfront right here.

Join Wealthfront right here and get began making an investment for a passive source of revenue!

10. Make investments In A REIT (Actual Property Funding Accept as true with)

If you are curious about making an investment without delay in actual property, or possibly you are no longer but an authorized investor, that is ok. You’ll be able to nonetheless profit from actual property for your investments thru REITs – Actual Property Funding Trusts.

Those are funding cars that cling belongings inside them – and also you as the landlord get to get pleasure from the positive factors, refinances, sale, source of revenue (or loss) at the belongings.

Our favourite platform to spend money on a REIT is Fundrise¹. They just have a $500 minimal to get began and be offering a number of choices we like as nicely!

Take a look at our complete enjoy and overview of Fundrise right here.

11. Make investments In A Trade

In a different way to generate passive source of revenue is to speculate and be a silent spouse in a trade. That is very dangerous, however with menace comes the possibility of excessive returns. For instance, a number of years in the past each Lyft and Uber have been on the lookout for personal buyers to spend money on their firms. Lately, they’re price billions – however you as an investor would handiest reap that receive advantages in the event that they pass public by way of an IPO, or get obtained. So, it is dangerous.

However there are methods to scale back your menace. For instance, you’ll make investments small quantities in lots of firms thru lending them cash in small bonds.

There are actually gear to be had the place you’ll mortgage cash to a trade and receives a commission a forged go back for doing it!

Small Trade Loans

% is a corporation that help you lend cash to companies in more than a few techniques. They’re a market for lending, and so they be offering business loans, receivable loans, and extra. You will have to be an authorized investor, however if you are on the lookout for extra menace and praise, it might be an possibility. Learn our complete enjoy and % overview right here.

Income Sharing Notes

MainVest is a corporation that lets you spend money on a trade who concurs to percentage a share in their long term earnings till their buyers obtain a go back on funding. You’ll be able to get started making an investment in companies for as low as $100, and also you get repaid your important and hobby through the years. Learn our complete MainVest overview right here.

12. Make investments In Scholar Source of revenue-Percentage Agreements

An Source of revenue-Percentage Settlement (ISA) is an selection to scholar loans. Through the use of an ISA, a scholar’s tuition is paid for in alternate for a share in their long term source of revenue.

Who’s investment those ISAs? Personal buyers and universities fund them. Buyers mainly take a gamble on a scholar’s long term.

You spot those maximum repeatedly at coding academies and industry colleges, however they’re rising in reputation.

Edly is a corporation that lets you spend money on ISAs. They have got two choices – one you’ll make investments without delay in a be aware, and the opposite in a fund that they use for long term notes. Relying on timing, there will not be any open notes to be had in to speculate.

You will have to be an authorized investor to speculate, and there’s a $10,000 minimal. On the other hand, they’re concentrated on 8-14% returns, which is superior. Learn our complete Edly enjoy and overview right here.

13. Refinance Your Loan

This may increasingly sound unusual in a passive source of revenue article, however refinancing your loan may also be an effective way to liberate numerous source of revenue and prevent $100,000s over the lifetime of your mortgage. That is a beautiful just right acquire in my e book.

At this time, rates of interest are nonetheless close to ancient lows, and if you have not looked at your loan in recent times, now is a good time to buy round and examine charges. If you’ll save 0.50% or extra in your mortgage, you are probably including tens of hundreds of greenbacks again into your pocket. Now not many investments can beat that.

We love the use of products and services like LendingTree to check the most productive charges. You’ll be able to learn our complete LendingTree overview and enjoy right here.

14. Pay Off Or Scale back Debt

Alongside the similar strains as refinancing your loan, if you’ll repay or cut back your debt, you are making massive development in development source of revenue. However identical to different issues on this matter – it takes a financial funding to make that occur.

The wonderful thing about paying off debt is that it is a immediately go back. In case you have a bank card at 10% hobby, paying it off is a ten% go back in your cash! That is massive.

There may be two approaches you’ll take with debt: refinance or consolidate, or steadiness switch and pay down.

In case you have scholar mortgage debt, it would make numerous sense to refinance the debt. You’ll be able to see if it is smart in 2 mins at Credible

with out a exhausting credit score take a look at. If you make a decision to continue, Faculty Investor readers rise up to a $750 present card bonus once they refinance thru this hyperlink.

Learn our complete Credible overview and enjoy the use of the platform right here.

In case you have bank cards or different debt, it will probably make sense to consolidate with a non-public mortgage. That is in most cases the most suitable option when you’ll’t see your self paying off the debt in a yr, however need to decrease your hobby. Credible additionally means that you can examine non-public mortgage choices, so test it out right here and spot if it is smart.

In any case, you have to get a zero% steadiness switch card and use your 0% time to repay the debt. There are some bank cards presently that provide 15 months at 0% and not using a charges – that offers you over a yr to repay your debt. Be informed extra about those playing cards right here.

15. Peer to Peer Lending

P2P lending is the apply of loaning cash to debtors who in most cases don’t qualify for normal loans. Because the lender you may have the facility to select the debtors and are ready to unfold your funding quantity out to mitigate your menace.

At this time, PeerStreet is likely one of the highest lending platforms in the market. However those loans are going for use for actual property, so stay that during thoughts. Take a look at our complete PeerStreet overview right here.

What is nice about that is that you just lend your cash, and also you receives a commission again important and hobby on that mortgage.

The median go back on coins circulate is 4.1% – which is best than any cash marketplace fund you are going to to find nowadays. Take a look at different CD choices.

16. Onerous Cash Loans

Very similar to different varieties of peer to see lending, exhausting cash loans focal point on a particular area of interest – actual property loans. Those loans are in most cases used for repair and turn tasks, or quick time period bridge loans.

At this time, Groundfloor is likely one of the oldest platforms within the area that has been making a market for exhausting cash loans.

On the other hand, are aware of it’s no longer with out menace. In line with Groundfloor, there used to be been a 1% loss ratio since they began with their market.

If you are , you’ll get began on Groundfloor for as low as $10.

17. Develop into An Angel Investor

Have you ever ever watched the display Shark Tank, the place the 5 buyers concentrate to pitches from small firms after which make provides to speculate? That is referred to as angel making an investment – and for lots of buyers, it does not appear to be the display Shark Tank in any respect!

As a substitute, maximum firms pitch their concepts on-line by way of electronic mail introductions, zoom conferences, and small displays. And there are even some internet sites that “syndicate” offers in combination – the place a host of other folks get to in combination to spend money on a startup. And you’ll be part of that too!

You must understand that that is extraordinarily excessive menace, excessive praise – however it is completely passive making an investment. Maximum startups do fail, and if the corporate you spend money on fails, you have to lose your whole funding.

If you are taking a look to change into an angel investor, take a look at AngelList or Propel(x). AngelList most likely has the best quantity of deal circulate to be had, whilst Propel(x) makes a speciality of area of interest offers.

Guidelines for Making an investment in a Trade

- Select a trade with enlargement possible

- Assess the control group’s competence

- Perceive the go out possible and technique

18. Lend In opposition to NFTs

If you are into the NFT-space, there’s a actually fascinating manner that you’ll make passive source of revenue by means of merely lending to others with NFTs as collateral. What this implies in apply is that you just create a wise contract with anyone who owns an NFT, you compromise on an quantity to lend to them, a compensation duration, and also you each digitally signal this contract.

Remember the fact that maximum NFT lending is completed by way of Ethereum, so that you give you the budget in ETH, and so they pay off you in ETH. If the borrower does not pay off you in time (or in any respect), the good contract will switch you possession of the collateral NFT.

Take a look at this record of platforms the place you’ll do NFT lending.

19. Do not Overlook Your Matching Contributions

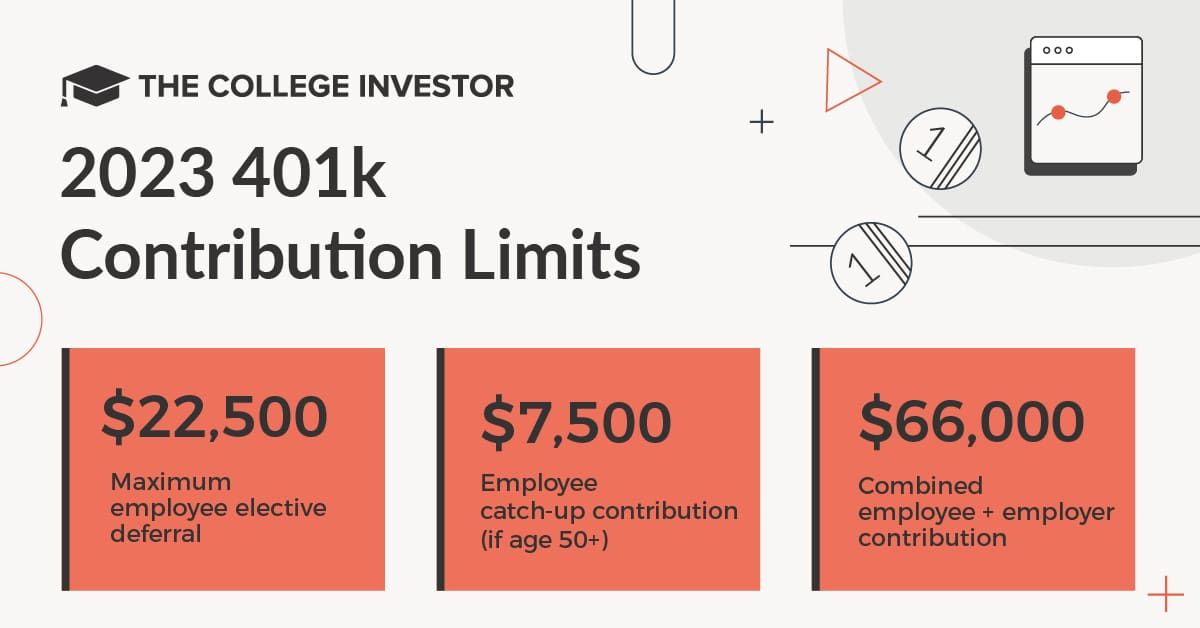

That is certainly one of my favourite passive source of revenue concepts, as a result of it is so simple, but such a lot of other folks fail at it. It is easy – profit from matching contributions in your 401k or HSA.

That is actually loose cash for merely contributing for your personal retirement accounts. Through no longer making the most of the fit, you are leaving loose cash at the desk.

All it’s important to do is make sure that you are contributing sufficient for your 401k or HSA in order that you get the whole matching contribution. On your HSA, your employer additionally would possibly require you to do so – like taking a well being evaluation or getting a bodily. However all that loose cash can upload up!

Passive Source of revenue Concepts Requiring an In advance Time Funding

The following phase of passive source of revenue concepts require a time funding. As a substitute of the use of cash, you wish to have to position in sweat fairness to make those occur.

Nearly all of those concepts require beginning a non-public weblog or web site. However the beauty of this is that it is extremely affordable to do. We advise the use of Bluehost to get began. You get a loose area title and webhosting begins at simply $2.95 per thirty days – a deal that you will not to find many different puts on-line! You’ll be able to manage to pay for that to begin development a passive source of revenue circulation.

20. Promote an eBook On-line

Self Publishing is mainstream nowadays. Whilst you acquire an eBook off of Amazon there’s a beautiful just right likelihood you’re purchasing a self-published e book. Self-publishing may be ridiculously simple. I attempted this a couple of years in the past and couldn’t consider how easy the method used to be.

To self-publish a e book you’ll first want to write and edit it, create a canopy, after which add to a program akin to Amazon’s Kindle Direct Publishing. Don’t be expecting rapid good fortune even though. There’ll want to be numerous prematurely advertising and marketing ahead of you’ll flip this right into a passive source of revenue circulation.

A identical possibility is to create printables that you’ll promote on-line. Printables are not as in-depth as a complete eBook, so they’re more uncomplicated to create and you’ll nonetheless earn a passive source of revenue in your gross sales! Discover ways to create on-line pieces to promote on Fiverr and Etsy for your first day of this on-line direction that teaches you what to do: The E-Printables Promoting Direction.

Guidelines for A hit eBook Publishing

- Determine a winning area of interest or matter

- Create attractive, well-written content material

- Advertise your e book thru more than a few channels

21. Create an On-line Direction on Udemy

Udemy is an internet platform that we could its consumer take video lessons on a big selection of topics. As a substitute of being a shopper on Udemy you’ll as an alternative be a manufacturer, create your personal video direction, and make allowance customers to buy it. That is an out of this world possibility in case you are extremely an expert in a particular subject material. This may also be an effective way to show conventional tutoring right into a passive source of revenue circulation!

Very similar to Udemy, you’ll get started a YouTube channel the place you train excessive call for topics, and you’ll monetize by way of advertisements. You do the paintings up-front to create the movies, and then you definitely benefit from the passive source of revenue steams from the advertisements for future years!

Take a look at Udemy right here to get began >>

Guidelines for Making a A hit On-line Direction

- Determine a high-demand topic

- Create attractive and informative content material

- Marketplace your direction successfully

22. Promoting Inventory Footage

Do you ever marvel the place your favourite internet sites, blogs, and once in a while even magazines get their footage? Those are in most cases purchased from inventory photograph internet sites. If you happen to revel in pictures you’ll put up your footage to inventory photograph websites and obtain a fee each and every time anyone purchases certainly one of them.

One of the vital greatest marketplaces to promote inventory footage is DepositPhotos. You’ll be able to add your footage are make cash on every occasion anyone makes use of them.

Actually, take a look at this superior tale of certainly one of our scholarship contestants who became pictures right into a inventory photograph trade.

23. Licensing Tune

Similar to inventory footage you’ll license and earn a royalty off of your track when anyone chooses to make use of it. Tune is continuously authorized for YouTube Movies, advertisements, and extra.

With the volume of YouTube movies and podcasts which are being created, there may be extra call for than ever for track – and individuals are prepared to pay for it.

The important thing approach to do it’s to get your track in a library that folks can seek. Take a look at this information on the right way to license your track.

If you have already got a license and need to promote it for coins, or if you are taking a look to shop for track licenses to earn source of revenue, take a look at Royalty Change. This platform connects artists with the ones taking a look to construct a royalty earnings steam.

Fashionable Inventory Audio Platforms

- AudioJungle

- Pond5

- PremiumBeat

24. Create an App

If you happen to personal a smartphone or pill then it’s secure to think you may have a number of apps downloaded. However have you ever ever had an important thought for an app? If that is so, you have to imagine hiring a programmer to create your app for you. It’s good to then promote it at the App retailer for residual source of revenue.

Simply have a look at what came about with Wordle! A man evolved the app in a weekend, and began sharing it together with his family and friends – after which it used to be obtained by means of the New York Occasions.

Guidelines for A hit App Construction

- Determine a novel and winning app thought

- Be sure a user-friendly interface

- Marketplace your app successfully

25. Associate Advertising

Internet affiliate marketing is the apply of partnering with an organization (changing into their associate) to obtain a fee on a product. This system of producing source of revenue works the most productive for the ones with blogs and internet sites. Even then, it takes a very long time to increase ahead of it turns into passive.

Larry Ludwig is a 25 yr skilled on advertising and marketing and he constructed (and retired early) by means of developing internet sites that earned passive source of revenue with internet online affiliate marketing. We are identified Larry for a very long time and for sure is aware of what he is speaking about.

If you wish to get began with internet online affiliate marketing take a look at this direction on internet online affiliate marketing and the right way to change into a complete time blogger.

Tips on how to Achieve Associate Advertising

- Select a distinct segment with a robust target market

- Advertise merchandise related for your target market

- Construct accept as true with and credibility thru high quality content material

26. Community Advertising

Community advertising and marketing, or multi-level advertising and marketing, appears to be on the upward thrust. Firms akin to Younger Dwelling Oils, Avon, Pampered Chef, and AdvoCare are all multi-level advertising and marketing firms. You’ll be able to earn passive source of revenue thru community advertising and marketing by means of development a group beneath you (continuously known as a down line.) After getting a big group you’ll earn commissions off in their gross sales with no need to do a lot.

27. Design T-Shirts

Websites like Cafe Press permit customers to customized design pieces like T-shirts. In case your design turns into in style and makes gross sales you’ll be capable to earn royalties. Plus, the passive source of revenue circulation of that is that you’ll setup print on call for products and services in order that you wouldn’t have to have any stock and orders merely get fulfilled when consumers organize them.

Even Amazon has gotten into this trade of print on call for. Amazon has a brand new carrier referred to as Amazon Merch, the place you merely add your designs and Amazon looks after the remaining (making it, packing it, and transport it).

Fashionable Products Platforms

28. Promote Virtual Information on Etsy

I’ve been into house décor in recent times and I needed to flip to Etsy to search out precisely what I sought after. I stopped up buying virtual recordsdata of the paintings I sought after revealed out! The vendor had made a host of wall artwork, digitized, and indexed it on Etsy for immediate obtain. There are different in style virtual recordsdata on Etsy as nicely akin to per month planners. If you happen to’re into graphic design this might be an important passive source of revenue thought for you.

Adrian Brambilia is an internet marketer that has evolved an enormous quantity of passive source of revenue streams over the previous few years. If that is one thing you are enthusiastic about, take a look at this direction by means of Adrian Brambila that let you get began.

Semi-Passive Small Trade Concepts

I name those semi-passive source of revenue as a result of they’re extra like a trade, much less like the tips above. All of them additionally require a small aggregate of money and time funding. However whenever you make investments, you’ll earn extra source of revenue and in most cases accomplish that passively.

On the other hand, those all do require some ongoing time funding, so they don’t seem to be 100% passive like having a financial savings account.

29. Record Your Position On Airbnb

In case you have a space, condominium, spare room, and even yard, imagine record your own home on AirBNB and get started getting cash while you get your home booked. Join your home nowadays.

AirBNB is excellent as a result of you’ll make cash on an area you already personal. It does require a bit of paintings up entrance to prep your home, record it, and blank up after visitors, however it is beautiful passive in a different way.

30. Hire Out Your Area

Possibly you wouldn’t have a room to spare, or a complete different space (who can manage to pay for it)? However possibly you may have area that you’ll hire for other folks wanting garage. That is the place Neighbor is available in.

With Neighbor, you’ll hire area you are no longer the use of to others to retailer their stuff. Some commonplace issues that folks hire are driveway area or parking lot for automotive or RV garage, storage cupboard space, and trade cupboard space.

Take a look at the Neighbor app right here and get started incomes passive source of revenue from renting out random area you may have. You’ll be able to additionally take a look at our overview and enjoy with Neighbor.

Guidelines for Renting Out Garage Area

- Be sure a protected and blank garage surroundings

- Set a aggressive apartment price

- Promote it your area on native platforms

31. Automobile Wash

It’s at all times been a dream of mine to possess a automotive wash. This turns out like the sort of nice approach to earn a semi-passive source of revenue. Whilst common upkeep will probably be wanted at a automotive wash it’s one thing you’ll both rent out or carry out as soon as per week.

As an aspect be aware, I am speaking concerning the actually fundamental automotive wash this is cinderblocks, a drive washing machine, and coin operated. If you are going to run a force thru automotive wash, it is for sure a trade vs. a passive source of revenue circulation.

32. Hire Out Your Automobile

Very similar to record your home for hire, you’ll additionally record your automotive for hire. This may also be really passive as a result of whenever you record your automotive, it will probably earn you source of revenue when you are no longer the use of it!

Our favourite spouse to hire your automotive is Turo. Turo means that you can put your automotive out for hire, and when other folks hire it, Turo handles the remaining!

The cool factor with Turo is that, relying in your location and what sort of automotive you may have, you’ll make a good passive source of revenue!

Take a look at Turo right here and get began incomes passive source of revenue together with your automotive! Take a look at our record of alternative techniques to earn a living together with your automotive as nicely (lots of the others are not passive even though).

Fashionable Automobile-Sharing Platforms

33. Merchandising Machines

Merchandising machines are every other nice low upkeep small trade thought. I’ve a pal who has merchandising machines all over the place neighboring cities. He replenishes and cashes them out as soon as each and every two weeks. His merchandising device trade is a part of his retirement plan.

Guidelines for a A hit Merchandising Gadget Trade

- Select winning merchandise

- Make a selection high-traffic places

- Steadily deal with and restock machines

34. Garage Leases

My cousin owns a suite of garage leases and receives per month tests for letting consumers hire those out. The one time she turns out to do any paintings for those is when she has a gap for one of the crucial garage gadgets.

If you are no longer positive about entering this area, you’ll additionally spend money on garage leases by way of a REIT (actual property funding accept as true with).

35. Laundromat

I debated on record this one right here as a result of whilst in idea it kind of feels like proudly owning a laundromat can be semi-passive I wait for there can be numerous ongoing upkeep wanted. You be the pass judgement on in this one.

Simple Passive Source of revenue Concepts

Final at the record I sought after to show a few simple passive source of revenue concepts. Those require no cash and no prematurely paintings. Whilst the income are menial you continue to can’t beat simple passive source of revenue!

36. Cashback Rewards Playing cards

If you happen to pay your expenses with a bank card be sure it provides coins again rewards. You’ll be able to let your rewards accrue for some time and perhaps put the straightforward cash you earned towards every other passive source of revenue mission! (Ensure that the cardboard you choose doesn’t have an annual charge otherwise you could be cancelling out your rewards). Take a look at this record of the most productive Cashback Rewards Playing cards.

37. Cashback Websites

Similar to cashback rewards playing cards you must decide to make use of a cashback website when buying groceries on-line. If you happen to don’t you’re giving up loose cash that calls for little to no paintings! We simply in comparison the 2 hottest websites – Rakuten as opposed to TopCashBack.

All it’s important to do is login to those websites ahead of you are making a purchase order, click on the hyperlink, and you’ll be able to earn the proportion cash-back the website provides.

If you wish to know which websites are providing the best cashback, take a look at Cashback Track – a loose comparability website that unearths you the most productive cashback offers in the market.

38. Get Paid To Have An App On Your Telephone

What if you have to set up an app in your telephone, and receives a commission for it? Sure, this app tracks what you are doing and it sells your information – however what is extra passive than that?

If you do not need to do anything else out of the norm, take a look at Neilson Virtual. You merely obtain the app and do what you in most cases do. The app runs within the background and you’re entered to win rewards. Easy, simple approach to get cash for not anything! Obtain the app right here.

Cell Expression is an identical app for iPad. You’ll be able to earn rewards for putting in it and leaving it in your software for a minimum of 90 days. And increase! You receives a commission!

Fashionable Marketplace Analysis Platforms

39. Use Cashback Apps

Past bank cards and internet sites, there also are cashback apps that let you get passive source of revenue from the buying groceries you are already doing.

Dosh, as an example, works with 10,000 outlets and all it’s important to do is obtain the app and store. Learn our Dosh overview right here to be informed extra.

Honey is a browser extension that may to find coupon codes and different reductions for any merchandise you are purchasing. Learn our complete Honey overview right here.

40. Save On Your Utilities

Let’s mark this one as passive saving as opposed to passive source of revenue, however each and every little bit is helping when you are taking a look at your base line.

RocketMoney is an app that is helping you get monetary savings by means of figuring out routine subscriptions and different expenses and serving to you narrow prices by means of negotiating higher charges and charges. One in every of their partnerships is with Acradia Energy, which has the possible to save lots of you as much as 30% in your electrical invoice. It searches for higher energy charges in spaces the place festival is authorized, and it locks within the higher costs for you.

Learn our complete enjoy the use of RocketMoney and our overview right here.

Take a look at RocketMoney right here and spot how a lot you’ll save.

Tips on how to Get Began

Whilst it may be tempting to need to pick out 5 passive source of revenue concepts to get began with I’d actually inspire you to pick out one at first. You want time and the facility to focal point to actually a develop a passive source of revenue circulation. Grasp something ahead of shifting directly to the opposite.

It’s going to take a great deal of time or cash at first however I promise incomes passive source of revenue is the whole thing it’s cracked as much as be! Pick out an concept, make a plan, and devote your self till that source of revenue circulation involves fruition.

Often Requested Questions

How do I generate passive source of revenue?

Passive source of revenue is the concept you deploy time and/or cash and obtain source of revenue and not using a additional paintings. You must do one thing to generate passive source of revenue up entrance, however then you’ll depend on that source of revenue into the longer term.

What are some examples of passive source of revenue?

Making an investment is a brilliant instance of a passive source of revenue circulation. You make investments cash in an organization inventory, and also you obtain a dividend fee and appreciation at the funding. Some other in style instance is actual property. You purchase a belongings, and also you benefit from the hire as passive source of revenue.

Does passive source of revenue actually paintings?

Sure! Passive source of revenue is how the wealthy proceed to construct wealth. Whilst you don’t have cash, you’ll leverage your effort and time to create source of revenue streams that may develop into the longer term. As you gather cash, you’ll deploy that cash (or even mix it together with your time) to generate an increasing number of passive source of revenue.

The place can I make investments to have passive source of revenue?

If you wish to make investments to generate passive source of revenue, dividend shares and mutual budget are nice techniques to do it. You’ll be able to additionally spend money on debt tools, like bonds. If you wish to have a more secure manner, you’ll spend money on a cash marketplace account or CD to get a risk-free go back in your cash.

What are the preferred passive source of revenue concepts?

There are many in style passive source of revenue concepts. The most well liked come with making an investment within the inventory marketplace, proudly owning actual property, making an investment in a trade, or even merely maintaining your cash in a excessive yield financial savings account. All of those approaches generate passive source of revenue, however they do require up entrance capital.

Does passive source of revenue actually require “no paintings”?

It is a delusion. Passive source of revenue at all times calls for one thing up entrance: time or cash. On the other hand, the concept it turns into passive after you do the paintings is what’s alluring about it. For instance, you spend 6 months writing a e book, and you’ll benefit from the royalty source of revenue out of your e book for the remainder of your lifestyles with out any longer paintings. That’s to not say that doing extra paintings gained’t spice up your source of revenue, however there is a component that calls for not anything extra to earn.

How do taxes on passive source of revenue paintings?

The Inner Income Carrier (IRS) classifies passive source of revenue as “unearned source of revenue”, and the way it is taxed varies according to the kind. For instance, strange dividends and hobby are taxed at your strange source of revenue price, however certified dividends are taxed at long-term capital positive factors charges. Source of revenue streams like apartment source of revenue or actual property funding trusts is also taxed in a number of techniques, together with strange source of revenue, capital positive factors, and extra. However with apartment belongings, you get numerous tax advantages with depreciation and different deductions. You must seek the advice of a tax skilled when you have questions.

What are a few of your favourite passive source of revenue concepts?

¹ The ideas contained herein neither constitutes an be offering for nor a solicitation of hobby in any securities providing; then again, if a sign of hobby is equipped, it can be withdrawn or revoked, with out legal responsibility or dedication of any sort previous to being permitted following the qualification or effectiveness of the acceptable providing file, and any be offering, solicitation or sale of any securities will probably be made handiest by way of an providing round, personal placement memorandum, or prospectus. No cash or different attention is hereby being solicited, and might not be permitted with out such possible investor having been supplied the acceptable providing file. Becoming a member of the Fundrise Platform neither constitutes a sign of hobby in any providing nor comes to any legal responsibility or dedication of any sort.

The publicly filed providing circulars of the issuers backed by means of Upward push Firms Corp., no longer all of that could be recently certified by means of the Securities and Change Fee, is also discovered at www.fundrise.com/oc.

The Faculty Investor receives coins repayment from Wealthfront Advisers LLC (“Wealthfront Advisers”) for every new consumer that applies for a Wealthfront Computerized Making an investment Account thru our hyperlinks. This may increasingly create an incentive that leads to a subject matter warfare of hobby. The Faculty Investor isn’t a Wealthfront Advisers consumer. Additional information is to be had by way of our hyperlinks to Wealthfront Advisers.