What Intel and AMD Are Reporting – R Weblog

Complex Micro Units Inc. (NASDAQ: AMD) and Intel Company (NASDAQ: INTC), two of the main firms within the semiconductor sector, have shared their first-quarter effects and outlook for the second one quarter. Lately, we will be able to check out the statistics they introduced, in finding out which segments in their industry are winning, and analyse the semiconductor sector.

AMD document: 139 million USD loss

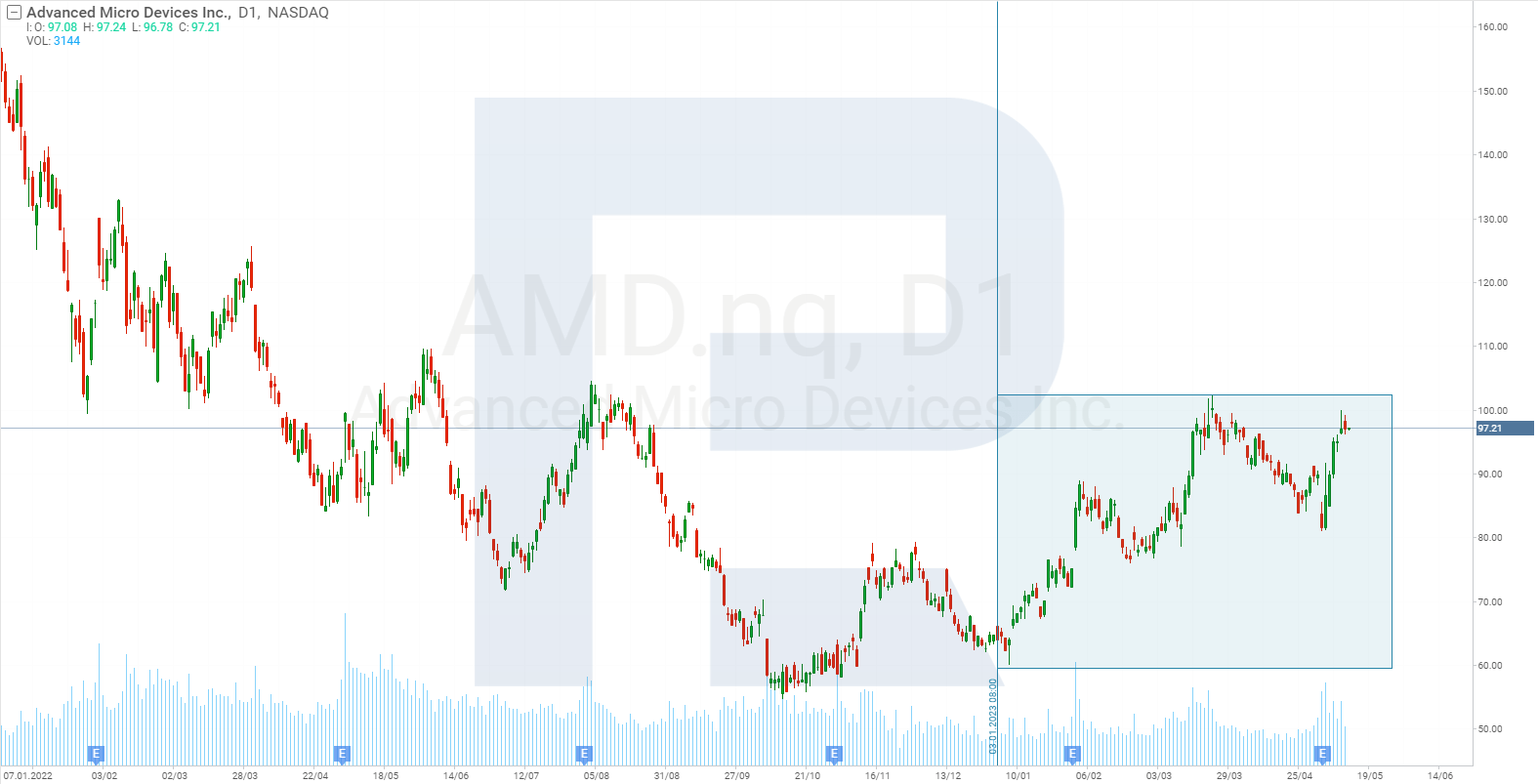

Complex Micro Units Inc. reported its effects for January – March 2023 on 2 Would possibly. Revenues fell 9% to five.4 billion USD from the similar length in 2022. The corporate reported a benefit in all quarters ultimate yr, and this yr it recorded a lack of 139 million USD or 0.09 USD in line with percentage.

Income within the buyer section fell 65% to 739 million USD, and within the gaming section, it dropped 6% to at least one.8 billion USD. Probably the most primary causes for AMD’s general earnings decline used to be decrease gross sales of processors and graphics playing cards for PCs and notebooks, in addition to the cheapening of a few merchandise to stay aggressive.

As well as, the company confronted provide problems and larger prices for elements and logistics. Working bills rose to two.51 billion USD from 1.95 billion USD a yr previous.

Which segments confirmed enlargement?

The Knowledge Heart and Embedded segments, liable for gross sales of server processors, chips, embedded and graphics processors, FPGAs, and adaptive SoC merchandise, posted sure effects. Knowledge Heart section revenues rose simply 0.2% to at least one.3 billion USD, whilst Embedded section revenues larger 99% to at least one.6 billion USD. As well as, the corporate reported robust call for for EPYC server processors, particularly from cloud carrier suppliers.

Complex Micro Units Inc.’s Q1 2023 financials had been definitely impacted by way of larger manufacturing of chips for PlayStation 5 and Xbox Collection X/S1 sport consoles. Recall that Sony Crew Corp. (NYSE: SONY) not too long ago reported gross sales of a report 6.3 million PS5 gadgets in January – March this yr.

AMD’s Q2 2023 forecast

Complex Micro Units Inc. control expects Q2 2023 earnings to develop to five.3 billion USD. Enlargement is projected in its Knowledge Heart and Consumer industry segments.

Word that AMD is going through temporary demanding situations within the buyer section, corresponding to robust pageant, lowered call for, and provide disruptions. On the other hand, we will be able to suppose that the variety and high quality of goods, technique, and marketplace place will create stipulations for the corporate to report a benefit already in the second one part of the yr. Recall that because the starting of the yr, the corporate’s stocks have risen by way of 46%.

Intel document: 2.8 billion USD loss

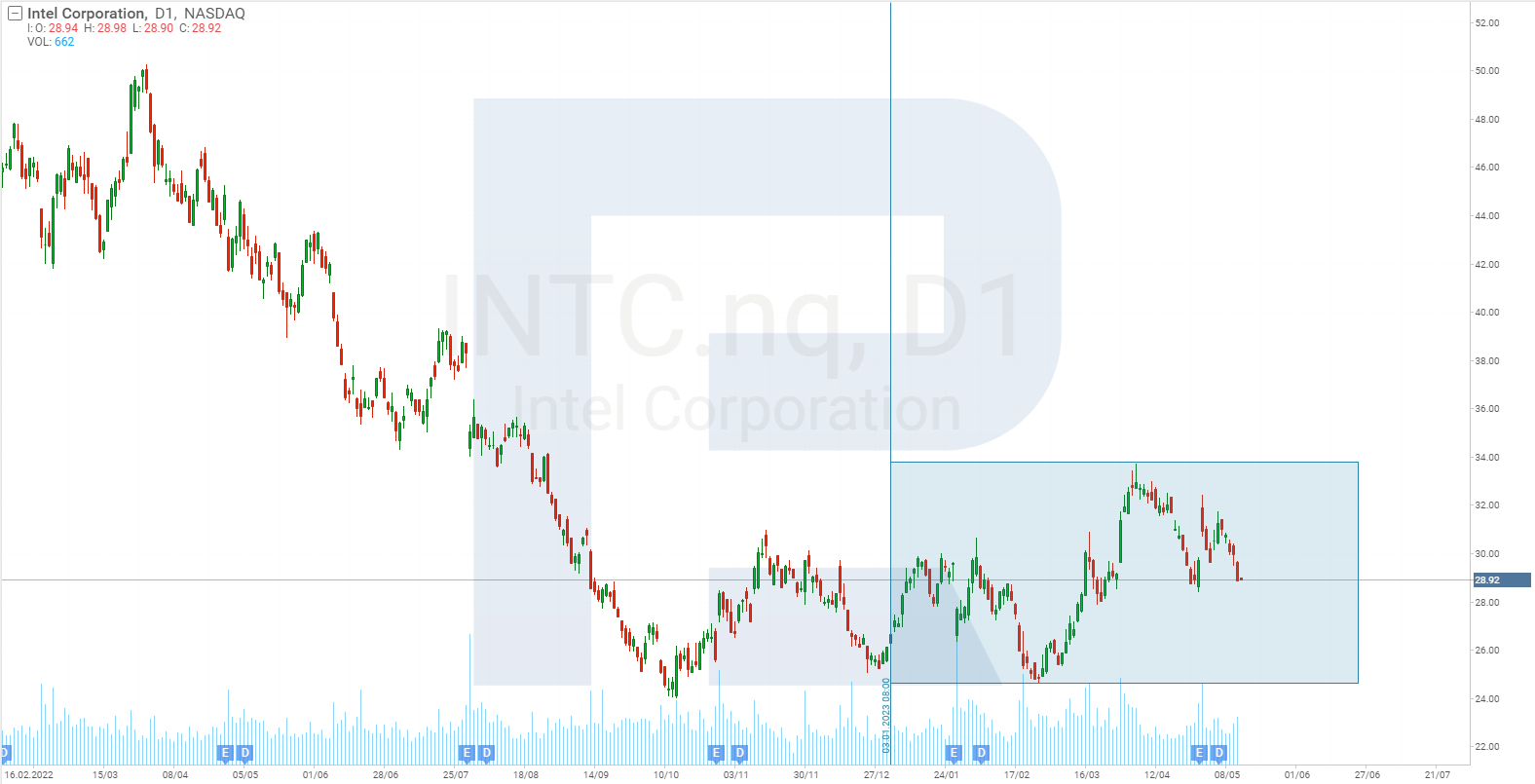

On 27 April, Intel reported a 36% year-on-year decline in first-quarter revenues to 11.7 billion USD. The web loss amounted to two.8bn USD and zero.66 USD in line with percentage. Recall {that a} yr previous the corporate reported a benefit of 8.1 billion USD or 1.98 USD in line with percentage.

Intel recorded declines in maximum segments as follows: Consumer Computing Crew (CCG) by way of 38% to five.8 billion USD, Knowledge Heart and AI (DCAI) by way of 39% to three.7 billion USD, Community and Edge (NEX) by way of 30% to at least one.5 billion USD, and Intel Foundry Products and services (IFS) by way of 24% to 118 million USD.

The one section that confirmed earnings enlargement used to be Mobileye: +16%, to 458 million USD.

Intel reported vulnerable call for for server processors in January – March, particularly from company and executive shoppers. They most certainly sought to scale back their prices amid financial uncertainty. As well as, the corporate confronted provide disruptions and larger prices for elements and logistics.

Intel’s Q2 2023 forecast

Intel’s control predicts that earnings in the second one quarter will achieve 11.9 billion USD, down 23% from ultimate yr’s end result. Enlargement is anticipated within the PC-focused section.

It may be assumed that the corporate is experiencing critical issues in its core markets, thereby dropping flooring. It’s most likely that competition have extra complex merchandise and applied sciences. As an example, with the rising reputation of man-made intelligence services and products that require computing energy, Intel’s AI section revenues have proven a decline. On the similar time, a equivalent AMD section recorded earnings enlargement. For the reason that starting of the yr, the price of Intel’s securities has declined by way of 7%.

Conclusion

Given the vulnerable quarterly experiences from Complex Micro Units and Intel Company, we will be able to suppose that world call for for semiconductor merchandise is declining. The previous corporate’s revenues are down 9%, whilst the latter is down 36%. AMD’s quarterly internet loss reached 139 million USD, and Intel’s used to be down 2.8 billion USD.

Will NVIDIA’s quarterly monetary experiences, which shall be revealed on 24 Would possibly, fortify this development? Word that the corporate’s inventory has risen 91% since January. This enlargement coincided with the booming approval for the GhatGPT carrier.