What Bond Marketplace Tells Us – R Weblog

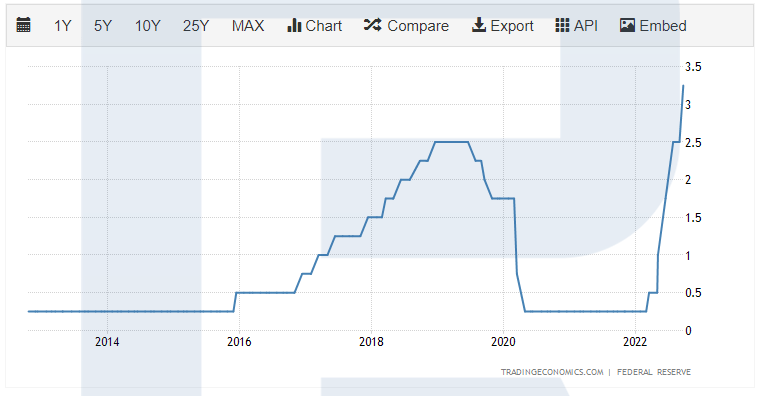

On 21 September, the United States Federal Reserve Machine had a gathering at which they determined to boost the rate of interest through 0.75% to a few.25%. This was once no longer an surprising tournament: after the most recent inflation record, it become transparent that the Fed would take competitive measures.

Some extra essential data marketplace contributors were given from the feedback of the Fed’s head Jerome Powell at the subsequent movements of the regulator. From his speech, it become transparent that through the top of 2022, the rate of interest may develop through 1.25% extra.

Obviously, inventory indices reacted to the development through a decline. When the price of crediting grows and the Federal Reserve Machine carries out the QT coverage, it turns into extraordinarily exhausting for companies to stay enlargement of income sure. Because of this, shares of businesses are prone to proceed detrimental dynamics till the QT cycle ends.

What to do in such instances? Which monetary tools do marketplace gamers keep watch over? To place it brief, check out bonds.

Why does enlargement of rate of interest have an effect on inventory indices adversely

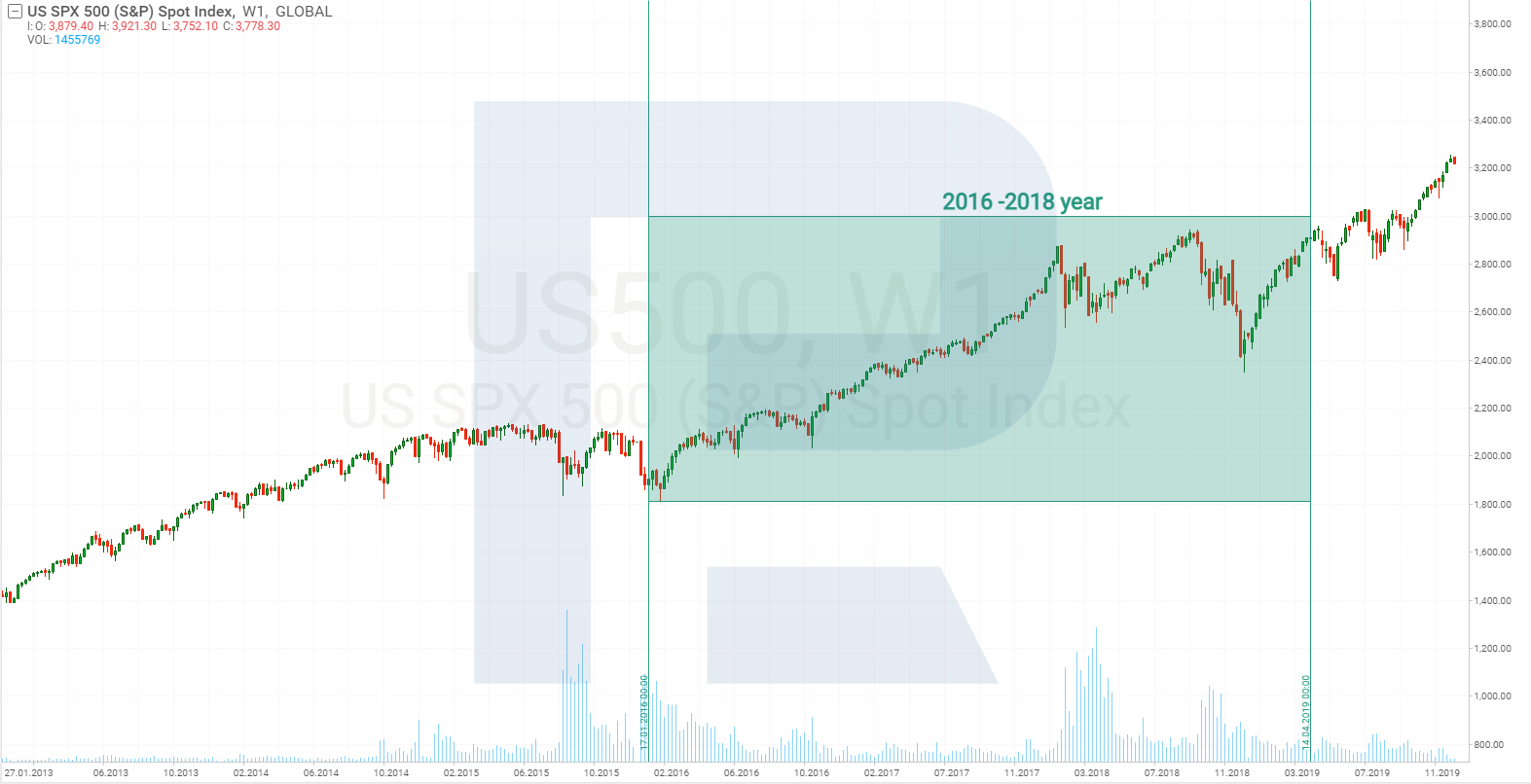

Allow us to find out about this factor at the instance of the S&P 500 index. It must be stated from the beginning that the correlation of the index and the rate of interest isn’t 100%: the quotes of the S&P 500 used to develop even if the speed was once additionally rising.

The inventory index typically falls on the turning issues when the Fed begins a cycle of toughening the credit score and fiscal coverage. At such second, loans for industry develop into costlier, and industry wishes time to conform to new stipulations.

Alternatively, when the Fed will increase the speed at each and every assembly, and the dimensions of every build up is tricky to forecast, industry can not plan bills for an extended time. Corporations do not know of ways large the rate of interest will probably be in a yr, and beneath which passion they will draw in finance.

Additionally, the expansion of the rate of interest depletes the buying energy of shoppers, which, in flip, negatively impacts the patron call for. This, once more, drops the source of revenue of businesses, finally frightening a lower of their inventory costs.

When the Fed indicators the top of the cycle of accelerating the rate of interest, companies and customers get started assessing their spending and source of revenue, in search of techniques to save lots of up and techniques to extend income. In different phrases, at such moments, firms protected their place available in the market and find out about views for enlargement.

As for now, there is not any figuring out of ways lengthy the cycle will take and what sort of the rate of interest would possibly develop. The location turns into much more sophisticated as a result of the need to take care of the sort of parameter as Quantitative Easing (QE) vs Quantitative Tightening (QT).

How QE and QT affect inventory markets

Allow us to to find out what are Quantitative Easing and Quantitative Tightening and the way those two forms of financial coverage affect the inventory marketplace.

Quantitative Easing

The Central Financial institution buys bonds, frightening larger call for for them. When the call for is top, the passion on bonds is minimum. In any case, firms get reasonable cash that they are able to use for construction.

And now consider that an organization offered some bonds and made 1 million USD in this. This cash can also be spent on wages for staff, new manufacturing powers, and so on.

In different phrases, the corporate creates call for for items and products and services of alternative enterprises. All through QE, income of businesses begin to develop, quarterly experiences are sturdy, and buyers purchase shares.

Quantitative Tightening

QT deteriorates monetary efficiency of businesses since the CB asks for bills for the bonds purchased up to now and considerably cuts down at the sums supposed for getting new money owed. Because of this, firms must power cash out of turnover or take new loans to pay again previous ones.

And so long as the principle purchaser of bonds – the CB – has significantly reduced the volumes of latest bonds purchased, the passion on bonds begins rising. This makes firms lower down at the bills on modernisation, analysis, and workers. As previous the CB had no particular necessities to the issuers of bonds, unreliable firms may just simply make money owed. So, in QT they could declare default or even pass bankrupt.

At the one hand, this cleans out the marketplace in order that simplest the most powerful firms continue to exist; alternatively, the selection of firms that create call for for items and products and services decreases, which negatively have an effect on income of alternative issuers.

Recently, the marketplace is initially of a QT cycle along additional enlargement of the rate of interest, which is of course slightly a troublesome time for companies.

What marketplace contributors are thinking about

For marketplace gamers, this can be very essential to grasp the overall dimension of the rate of interest and the duration of the QT cycle. For now, the passion ate is forecast to succeed in 4.6% in 2023. As , up to now the top of four.4% was once forecast for 2022.

A lower in stability, i.e. the QT, began in Would possibly and remains to be on, however the very gross sales of bonds through the CB started in September. In the past, the Fed was once extra subtle. It stopped pouring new cash within the gadget, nonetheless purchasing bonds however in smaller volumes, taking cash from the coupon source of revenue from the already held securities and from previous bonds being paid off.

Expectancies of buyers and profitability of bonds

If all the way through QT the go back on bonds grows, why no longer believe making an investment in bonds and making a discount source of revenue? Additionally, if their value grows, one may just generate profits on promoting bonds as smartly.

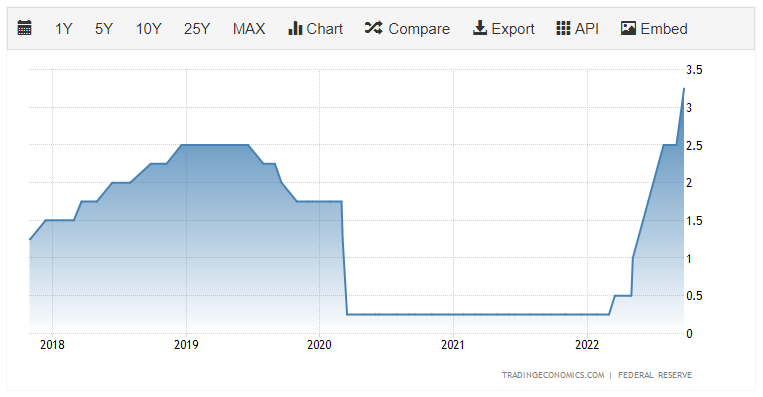

Sadly, the most efficient time for paintings with bonds was once the start of the QT cycle. Recently, marketplace gamers are busy seeking to forecast when and the place the expansion of the rate of interest will finish. After that, their expectancies will come with financial stimulation and a lower within the price.

This season is nowhere shut; allow us to see, alternatively, when up to now the marketplace began accounting for the lower within the rate of interest. For instance, allow us to take 10-year treasury bonds. The most recent build up within the price came about in December 2018, and it began declining in July 2019.

Bonds reached the very best profitability in November 2018, after which it began declining. This implies, marketplace gamers began performing 9 months ahead of the Fed’s determination.

As was once stated above, the rate of interest is forecast to succeed in the top in 2023 however the precise month stays unknown. Alternatively, after one or two extra conferences of the regulator the forecasts will develop into extra precise; therefore, it’s time to get ready for adjustments within the financial coverage.

What may occur when the top of the QT cycle will develop into recognized? At the beginning, the S&P 500 will most definitely prevent the decline, attaining the ground from which it’ll get started rising. Secondly, the go back on bonds will get started falling, analysts say.

Why go back on bonds may fall

Almost definitely, buyers will attempt to take most income from bonds, i.e. the call for for them will develop. And when the call for grows, the go back on bonds typically falls.

Right here is an easy instance. The similar hypothetical corporate wishes to draw 1 million USD through promoting bonds. According to marketplace stipulations, it provides buyers 4% yearly. Trades get started, and the control sees that there are too many attainable consumers, and reduces the speed. Why pay extra if the corporate can mortgage cash beneath smaller passion since the selection of the ones keen to let the cash exceeds expectancies.

Out of all stated above, two making an investment concepts emerge: the primary one is to put money into the S&P 500 and the second is to put money into tools hooked up with go back on bonds.

ETF on US treasury bonds

The arena’s maximum liquid bonds are US treasury bonds. Within the inventory marketplace, there are ETFs that observe the making an investment result of the index consisting of treasury bonds.

Such ETFs are iShares 1-3 12 months Treasury Bond ETF (NASDAQ: SHY), iShares 3-7 12 months Treasury Bond ETF (NASDAQ: IEI), iShares 10-20 12 months Treasury Bond ETF (NYSE: TLH), iShares 20+ 12 months Treasury Bond ETF (NASDAQ: TLT), and extra.

What’s the peculiarity of such tools? For instance, making an investment in iShares 10-20 12 months Treasury Bond ETF, an investor receives per thirty days coupon source of revenue within the type of dividends. The most recent fee of the fund came about on 5 September and amounted to 0.28 USD according to inventory.

The inventory value of the fund has an inverted correlation with the bond yield, which is slightly obtrusive at the chart beneath.

If the go back on bonds begins to fall, the cost of the shares above will probably be rising. Now we need to make a decision concerning the toughest section: specifically, as to when the QT cycle ends.

And whilst the rate of interest is rising, ProShares Brief 7-10 12 months Treasury ETF (NYSE: TBX) appears price consideration as it correlates with the go back on bonds. Alternatively, first check out the profitability chart of 10 yr treasury bonds (US10Y) and the rate of interest values.

At the chart, you spot the rate of interest top over a definite time frame and the bonds yield over the similar time. For instance allow us to take the moments when the speed reached the top after which began falling.

Out of five instances, simplest in 1989 the rate of interest was once upper than the go back on bonds. If the rate of interest is forecast to succeed in the top of four.6% in 2023, the profitability of US10Y may upward thrust from the present 3.72% to 4.6%. And so long as ProShares Brief 7-10 12 months Treasury stocks correlate with US10Y, they even have a attainable for enlargement.

Final analysis

Marketplace contributors continue to exist expectancies, therefore volatility grows sharply when actual effects don’t meet forecasts. All eyes at the moment are glued to the credit score and fiscal coverage since the melancholy of indices relies on it.

No person is aware of when the turning level occurs. But if it does, you will need to perceive which tools are price consideration first hand.

Spend money on American shares with RoboForex on favorable phrases! Actual stocks can also be traded at the R StocksTrader platform from $ 0.0045 according to percentage, with a minimal buying and selling rate of $ 0.5. You’ll additionally take a look at your buying and selling abilities within the R StocksTrader platform on a demo account, simply sign in on RoboForex and open a buying and selling account.