Weekly Pivot Move Sign the Forex market Buying and selling Technique

Improve and resistance are key ideas that buyers will have to be informed when they’re doing technical research. It is because main helps and resistances are spaces the place worth motion might be able to make a fascinating transfer. Worth may both soar off, smash via, or stutter with indecisiveness as worth reaches those main ranges.

Buyers who understand how to spot those key give a boost to and resistance ranges may make some huge cash buying and selling according to both reversals or breakouts happening on those ranges. Buyers who do not know the place the important thing give a boost to and resistance ranges are run the chance of buying and selling in opposition to such ranges which might lead to a dropping industry.

Improve and resistance ranges are essential. On the other hand, figuring out those main give a boost to and resistance ranges may be very tricky for brand new buyers. The quite a lot of sorts of give a boost to and resistance ranges on my own could cause such a lot confusion. Buyers may well be having a look at horizontal give a boost to and resistance ranges according to swing issues or diagonal helps and resistances that shape channels. Then, there are the dynamic give a boost to and resistance ranges according to technical signs. So, how can we objectively establish key give a boost to and resistance ranges with out the added bet paintings?

Weekly Pivot Move Sign the Forex market Buying and selling Technique, we’d be having a look at how shall we use Pivot Issues as an function foundation for give a boost to and resistance ranges.

Weekly Pivot Issues or Pivot Weekly

Pivot Level is a key technical indicator which {many professional} and institutional buyers are keen on the use of. Pivot Issues are worth ranges that buyers use to spot key give a boost to and resistance ranges.

Pivot Level signs most often plot 5 traces, which act as give a boost to and resistance ranges. Some diversifications plot seven. The principle line is known as the Pivot Level (PP), the 2 give a boost to ranges are referred to as Improve 1 (S1) and Improve 2 (S2), whilst the 2 resistance ranges are referred to as Resistance (R1) and Resistance 2 (R2).

The principle Pivot Level (PP) line is mainly the common of the top low and shut of the former era. The opposite give a boost to and resistance ranges are derived principally from the PP.

Pivot Issues are distinctive as a result of those ranges are objectively plotted via a trademark, but on the identical time it’s static. Chances are high that buyers are having a look on the identical stage since the top, low and shut of the former era will have to no longer vary an excessive amount of. This creates give a boost to and resistance ranges which many buyers would agree on.

The Weekly Pivot Level is a fascinating pivot level stage. It’s merely a pivot level which is according to the top, low and shut of the former week. That is particularly helpful in foreign currency trading. It is because quite a lot of agents, relying on their open and shut time, can have numerous top, low and shut ranges the use of the Day by day Pivot Level since the foreign exchange marketplace is open 24 hours an afternoon with agents stationed in quite a lot of time zones. The Weekly Pivot Level alternatively wouldn’t have this drawback. This permits buyers to make use of the similar give a boost to and resistance ranges as the opposite large gamers are the use of, making it extra dependable.

The Weekly Pivot Level indicator is particularly helpful when traded in an afternoon buying and selling or swing buying and selling technique.

This model of the Weekly Pivot Level plots blue traces to constitute the resistance ranges, purple traces to constitute the give a boost to ranges, and a goldenrod line to constitute the pivot level.

EMA Crossover Sign

EMA Crossover Sign is a development reversal sign indicator which is according to transferring reasonable crossovers.

Probably the most fashionable development reversal ways that buyers use is buying and selling as two transferring reasonable traces crossover. This incessantly indicates the reversal of a development. The methodology is to look forward to a shorter-period transferring reasonable line to move over a longer-period transferring reasonable line and industry within the path the place the speedier transferring reasonable line is transferring to.

The EMA Crossover Sign indicator is according to the similar transferring reasonable crossover thought. It’s according to the Exponential Transferring Moderate (EMA) line, which is an excessively efficient transferring reasonable line. The EMA is characteristically clean and responsive. This permits for a line that doesn’t produce an excessive amount of false alerts but on the identical time isn’t too lagging.

This indicator merely plots an arrow pointing the path of the brand new development because it detects a crossover of its underlying transferring reasonable traces. Buyers can merely use those arrows as a development reversal access sign.

Buying and selling Technique

This buying and selling technique is an afternoon buying and selling technique which trades at the reversals coming shape the give a boost to and resistance ranges of the Weekly Pivot Issues.

Trades are taken as the cost motion begins to turn indicators of reversal after rejecting a give a boost to or resistance stage according to the Weekly Pivot Issues. Industry entries are showed according to the sign equipped via the EMA Crossover Sign indicator.

Signs:

- EMA Crossover Sign

- Sooner EMA: 7

- Slower EMA: 21

- PivotWeekly

Most popular Time Frames: 5-minute chart handiest

Forex Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York classes

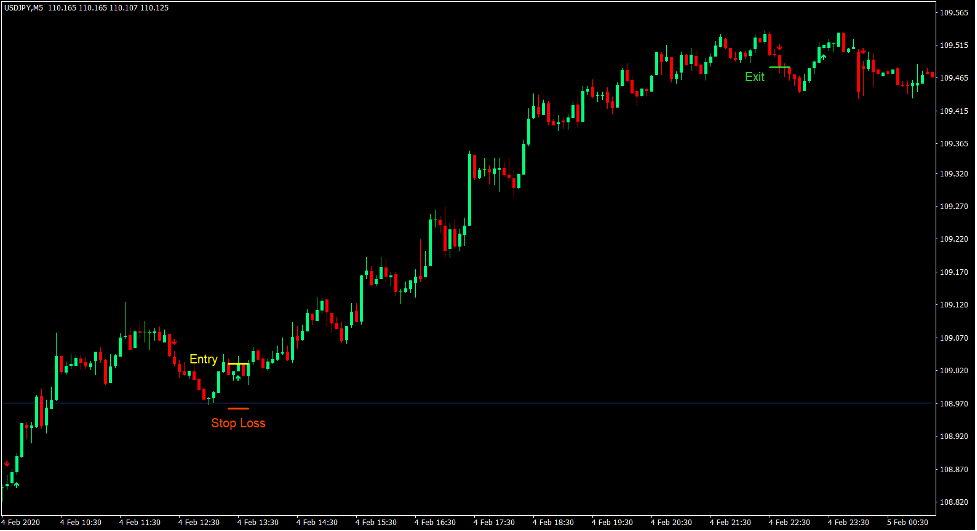

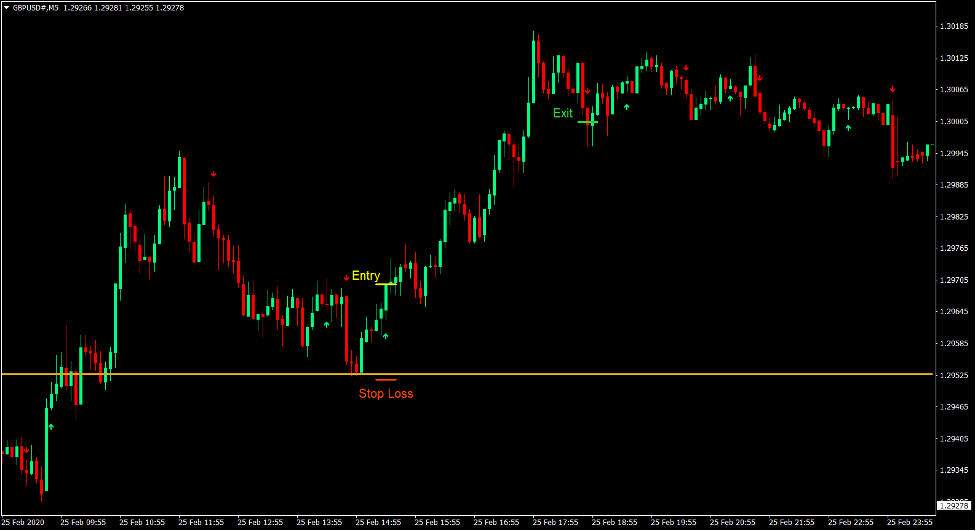

Purchase Industry Setup

Access

- Worth motion will have to reject a pivot level stage, give a boost to stage or resistance stage that grew to become give a boost to from under.

- Input a purchase order as quickly because the EMA Crossover Sign indicator plots an arrow pointing up.

Prevent Loss

- Set the prevent loss on a give a boost to under the access candle.

Go out

- Shut the industry as quickly because the EMA Crossover Sign indicator plots an arrow pointing down.

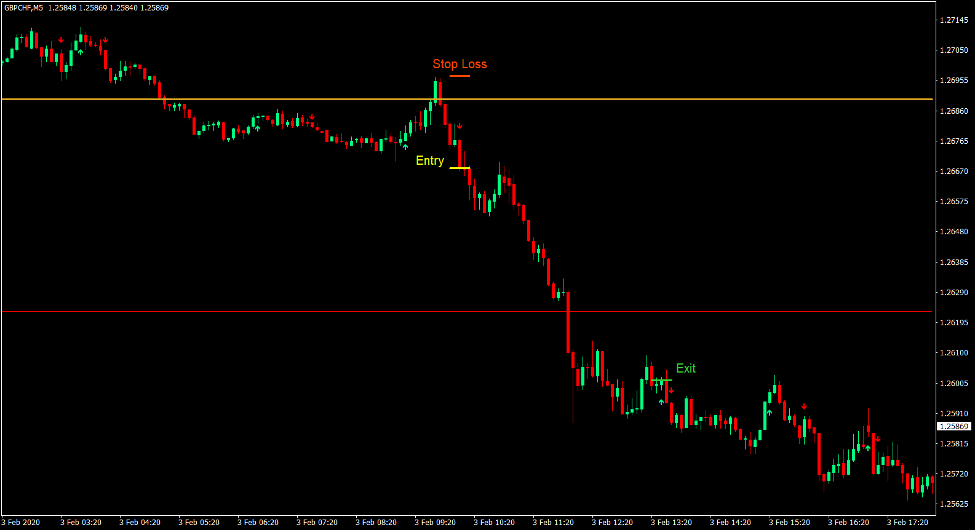

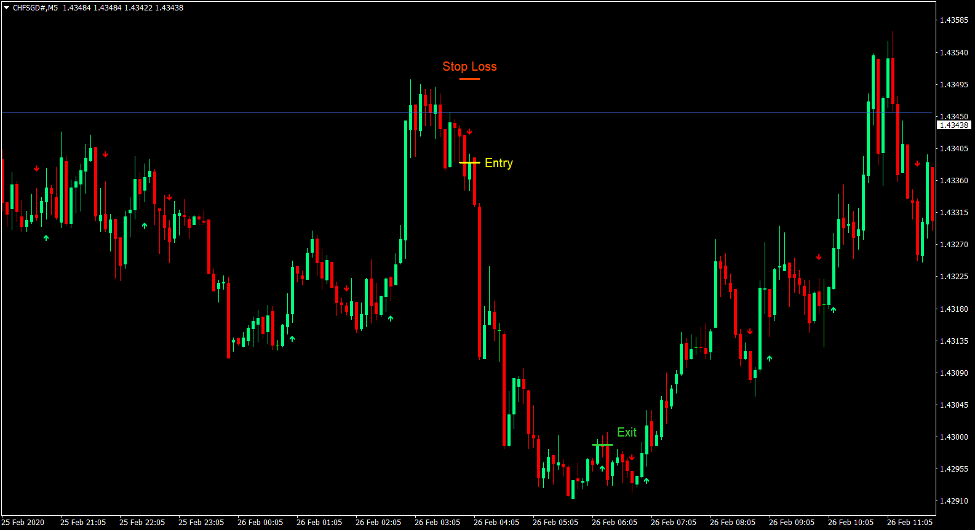

Promote Industry Setup

Access

- Worth motion will have to reject a pivot level stage, resistance stage or give a boost to stage that grew to become resistance from above.

- Input a promote order as quickly because the EMA Crossover Sign indicator plots an arrow pointing down.

Prevent Loss

- Set the prevent loss on a resistance above the access candle.

Go out

- Shut the industry as quickly because the EMA Crossover Sign indicator plots an arrow pointing up.

Conclusion

This buying and selling technique is a simplistic manner of buying and selling give a boost to and resistances according to Pivot Issues.

It’s no secret that worth does have a tendency to appreciate Pivot Level ranges as give a boost to and resistance ranges. On the other hand, the query is which amongst those ranges will worth soar off from. Some buyers like to bet or wait for. This technique alternatively waits for a sign after a soar from any of those ranges. If the soar is robust, buyers would possibly in finding themselves buying and selling within the path of the rage according to the decrease time frame. That is the place buyers can make cash out of this kind of technique.

the Forex market Buying and selling Methods Set up Directions

Weekly Pivot Move Sign the Forex market Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to become the collected historical past knowledge and buying and selling alerts.

Weekly Pivot Move Sign the Forex market Buying and selling Technique supplies a possibility to locate quite a lot of peculiarities and patterns in worth dynamics which can be invisible to the bare eye.

According to this data, buyers can suppose additional worth motion and alter this technique accordingly.

Really useful the Forex market MetaTrader 4 Buying and selling Platform

- Unfastened $50 To Get started Buying and selling Immediately! (Withdrawable Benefit)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable the Forex market Dealer

- Further Unique Bonuses Right through The 12 months

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By means of-Step XM Dealer Account Opening Information

Really useful Choices Buying and selling Platform

- Unfastened +50% Bonus To Get started Buying and selling Immediately

- 9.6 General Ranking!

- Robotically Credited To Your Account

- No Hidden Phrases

- Settle for USA Citizens

Easy methods to set up Weekly Pivot Move Sign the Forex market Buying and selling Technique?

- Obtain Weekly Pivot Move Sign the Forex market Buying and selling Technique.zip

- *Replica mq4 and ex4 information for your Metatrader Listing / mavens / signs /

- Replica tpl record (Template) for your Metatrader Listing / templates /

- Get started or restart your Metatrader Consumer

- Choose Chart and Time-frame the place you wish to have to check your foreign exchange technique

- Proper click on to your buying and selling chart and hover on “Template”

- Transfer proper to make a choice Weekly Pivot Move Sign the Forex market Buying and selling Technique

- You’re going to see Weekly Pivot Move Sign the Forex market Buying and selling Technique is to be had to your Chart

*Be aware: No longer all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Signs from the MetaTrader Platform.

Click on right here under to obtain:

<p taste=”text-align: left;”><span magnificence=”td_btn td_btn_lg td_round_btn” taste=”background-color: #e30000;”><a href=”https://www.forexmt4indicators.com/improve/”><span taste=”shade: #ffffff;”>Get Obtain Get admission to</span></a>

</span></p>