USD/JPY Worth Stalls Underneath 146.0, Focal point Shifts on FOMC

- The USD/JPY worth may just drop anytime if it remains beneath the downtrend line.

- The FOMC will have to deliver excessive volatility.

- A hawkish speech will have to raise the buck.

The USD/JPY worth ended its minor retreat and is now preventing onerous to put up a significant restoration. The pair is buying and selling at 145.81 on the time of writing, a long way above the day before today’s low of 144.72.

–Are you to be informed extra about ECN agents? Test our detailed guide-

Basically, the buck turns out decided to take complete regulate as america reported upper inflation in November. The Shopper Worth Index registered a nil.1% enlargement as opposed to the 0.0% enlargement estimated, whilst Core CPI introduced a nil.3% enlargement, matching expectancies.

As of late, the Eastern Tankan Production Index and Tankan Non-Production Index got here in higher than anticipated, however the JPY stays gradual within the brief time period.

Later, america will unlock the PPI, which is anticipated to file a nil.0% enlargement after the 0.5% drop within the earlier reporting duration, and the Core PPI indicator.

Nonetheless, the week’s maximum vital match is the FOMC fee resolution. The Fed is anticipated to stay the Federal Budget Fee at 5.50%.

Nonetheless, the FOMC Financial Projections, FOMC Commentary, and FOMC Press Convention constitute high-impact occasions. A hawkish speech on upper inflation in america may just spice up the buck.

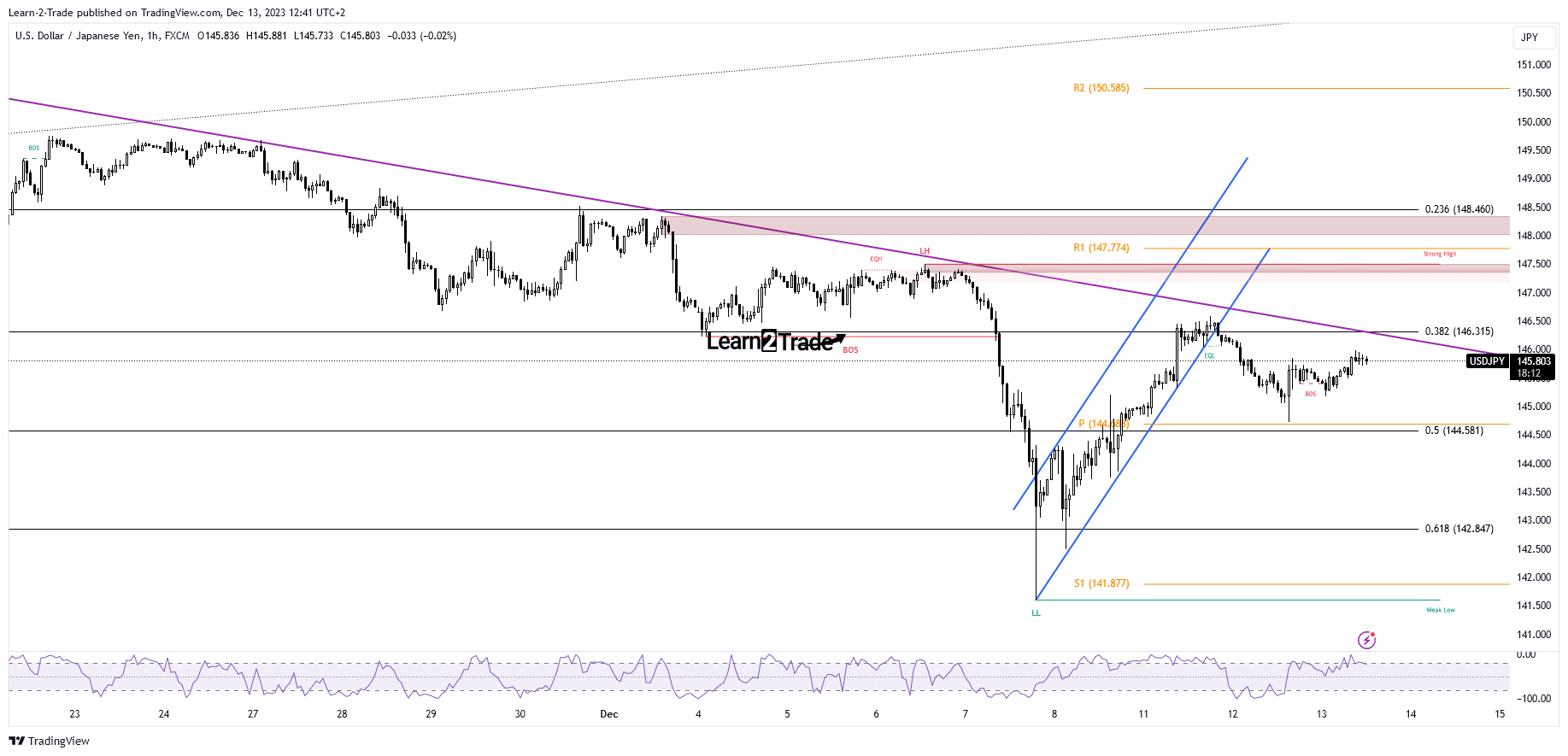

USD/JPY Worth Technical Research: Close to Key Resistance

Technically, the foreign money pair rebounded inside an up-channel trend. It has failed to succeed in the downtrend line. Now it has escaped from this chart formation. The fee failed to stick above the 38.2% (146.31) retracement stage, signaling exhausted patrons.

–Are you to be informed extra about day buying and selling agents? Test our detailed guide-

Now, it has became to the upside after registering just a false breakdown with nice separation beneath the 145.00 mental stage. Nonetheless, the fee may just drop once more if it remains beneath the downtrend line. Most effective taking away this dynamic resistance would possibly announce a bigger enlargement. Alternatively, a broader drawback motion might be caused by way of a brand new decrease low.

Taking a look to business foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to imagine whether or not you’ll have the funds for to take the excessive possibility of shedding your cash.