USD/JPY Worth Aiming at 145.90, All Eyes on the USA NFP Knowledge

- The United States financial figures may carry sharp actions lately.

- The present vary represents an upside continuation development.

- Just a new decrease low invalidates extra beneficial properties.

The USD/JPY value continues to transport sideways within the quick time period. The pair retreated as the USA buck used to be in a corrective segment, and the Yen registered a short lived rebound.

–Are you to be informed extra about AI buying and selling agents? Take a look at our detailed guide-

Basically, the pair stays bullish even supposing the USA Unemployment Claims got here in worse than anticipated. The industrial indicator used to be reported at 219K as opposed to 190K within the earlier reporting duration.

You understand the USD gained a serving to hand from the ADP Non-Farm Employment Exchange and ISM Services and products PMI, which got here in higher than anticipated on Wednesday.

Nowadays, the Eastern Main Signs indicator used to be reported at 100.9% above the 99.2% anticipated. Family Spending reported a 5.1% expansion much less as opposed to the 6.8% anticipated, whilst Moderate Money Income surged by means of 1.7%, beating the 1.4% forecast.

Later, the USA knowledge might be decisive and may carry sharp actions. The NFP is predicted at 248K in September. Unemployment Claims may stay at 3.7%, whilst the Moderate Hourly Income might document a zero.3% expansion.

Don’t omit that the Canadian Employment Exchange and Unemployment Price may even have an have an effect on. Higher than anticipated, knowledge may assist the USD to dominate the foreign money marketplace.

USD/JPY value technical research: Sideways motion

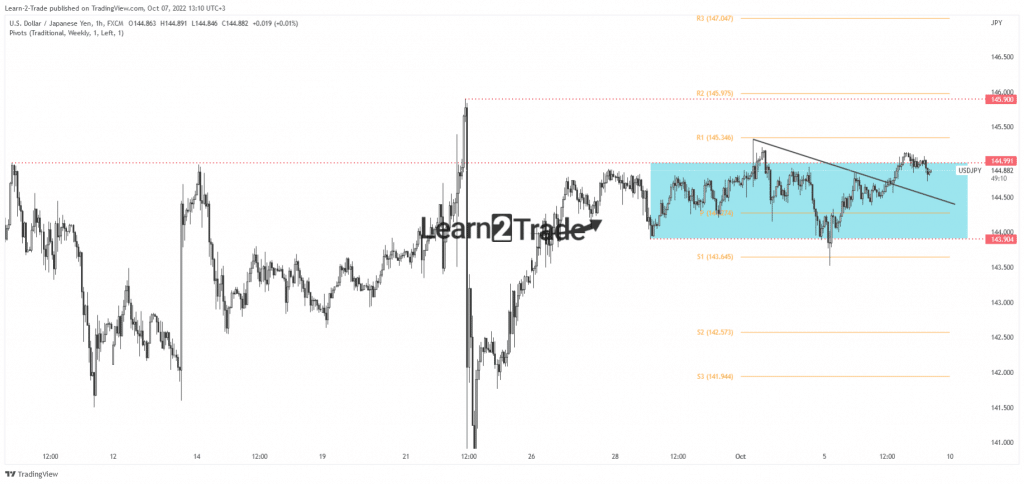

As you’ll see at the hourly chart, the cost continues to transport sideways between the 143.90 and 144.99 ranges. It has registered false breakouts on all sides. The USD/JPY pair prolonged its vary. Alternatively, perhaps, it’s going to check in sharp actions after the Non-Farm Payrolls newsletter. The unfairness stays bullish, regardless that it stays to peer how it’s going to react across the 144.99 key resistance. The 145.90 is noticed as a big upside goal.

–Are you to be informed extra about Canada foreign exchange agents? Take a look at our detailed guide-

From the technical standpoint, the present accumulation may constitute an upside continuation development. Just a new decrease low, losing and shutting under 143.52, may turn on a bigger drop and invalidate an upside continuation.

Having a look to industry foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to believe whether or not you’ll find the money for to take the top possibility of dropping your cash.