USD/JPY Weekly Forecast: Japan-US Charge Hole Weighs on Yen

- The yen reached a brand new 38-year low and raised intervention issues.

- An building up in Tokyo’s inflation greater the possibilities of a BoJ hike in July.

- The United States core PCE index was once softer, confirming the new decline in value pressures.

The USD/JPY weekly forecast is bullish because the rate of interest differential between Japan and the USA weighs at the yen.

Ups and downs of USD/JPY

USD/JPY had a bullish week, with the yen achieving a brand new 38-year low and elevating intervention issues. The decline within the yen closing week got here as traders targeted at the hole in charges between the USA and Japan. Due to this fact, there was once little focal point on financial knowledge, which led to many warnings from Eastern government.

–Are you curious about studying extra about foreign exchange conventions? Take a look at our detailed guide-

Information confirmed an building up in Tokyo’s inflation, which greater the possibilities of a BoJ hike in July. In the meantime, in the USA, the core PCE index got here in softer, confirming the new decline in value pressures. As a result, bets for a Fed reduce in September rose. Then again, none of those reviews may just forestall the yen’s plunge.

Subsequent week’s key occasions for USD/JPY

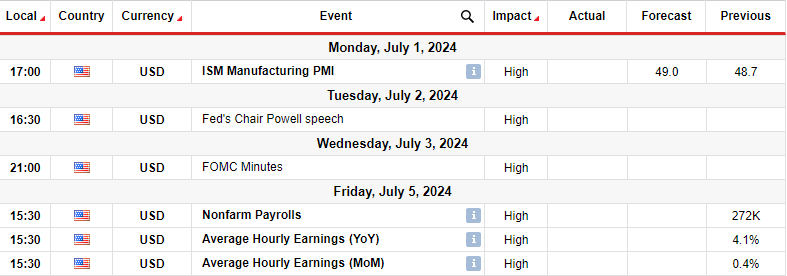

Subsequent week, traders will focal point on US knowledge, corresponding to nonfarm payrolls and the producing PMI. They’re going to additionally be aware of Powell’s speech and the FOMC mins for clues at the Fed’s coverage outlook.

On the closing Fed assembly, policymakers assumed a relatively hawkish tone, forecasting only one fee reduce this yr. Then again, buyers have maintained a extra dovish outlook for 2 cuts this yr because of softer inflation figures. Due to this fact, they are going to pay shut consideration to Powell’s speech to look whether or not his tone will alternate.

In the meantime, the employment record will form expectancies for fee cuts. A larger-than-expected quantity would decrease expectancies for fee cuts. Alternatively, a smaller-than-expected determine would building up bets for the primary reduce in September.

USD/JPY weekly forecast: Worth exceeds 160.00 resistance to set a brand new top

At the technical aspect, the USD/JPY value lately broke above the 160.00 key resistance stage to make a brand new top within the bullish pattern. The fee has constantly risen with upper lows and highs, indicating a forged uptrend. Additionally, it has most commonly stayed above the 22-SMA with the RSI above 50, supporting forged bullish momentum.

–Are you curious about studying extra about Ethereum value prediction? Take a look at our detailed guide-

Then again, with the new new top, bulls have grown weaker. The RSI has made a bearish divergence with the associated fee, an indication of exhaustion within the bullish transfer. If this divergence performs out, the associated fee may revisit the enhance trendline earlier than both breaking underneath or emerging upper.

Taking a look to business foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must believe whether or not you’ll be able to come up with the money for to take the top possibility of dropping your cash.