USD/CAD Weekly Forecast: Resilient Financial system Boosts Buck

- Information published a bigger-than-expected drop in Canada’s inflation.

- The buck to begin with weakened after a dovish FOMC assembly.

- Subsequent week, buyers gets to evaluate GDP information from america and Canada.

The USD/CAD weekly forecast stays constructive, fueled by way of the relentless energy of america financial system showcased in the newest information.

Ups and downs of USD/CAD

After fluctuating within the week, USD/CAD ended up, with the buck remaining the week at the entrance foot. Because the week started, information published a bigger-than-expected drop in Canada’s inflation, resulting in greater bets for a price lower. In consequence, the Canadian buck weakened.

-Are you interested by finding out in regards to the very best AI buying and selling foreign exchange agents? Click on right here for details-

In the meantime, the buck to begin with weakened after a dovish FOMC assembly the place Powell maintained that inflation used to be declining. Then again, because the week ended, it recovered amid upbeat US financial information, permitting USD/CAD to near on a bullish candle.

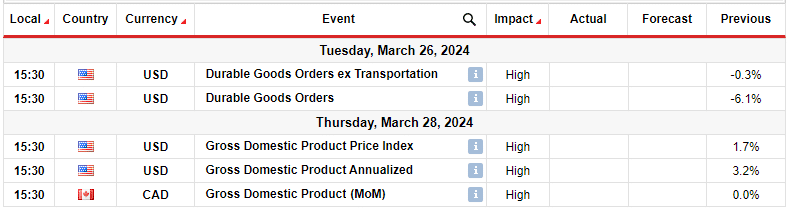

Subsequent week’s key occasions for USD/CAD

Subsequent week, buyers gets to evaluate GDP information from america and Canada. Additionally, there might be a document from america on sturdy items orders. The GDP stories for each nations could have a large have an effect on on USD/CAD as they’ll disclose the have an effect on of upper rates of interest. Due to this fact, lower-than-expected readings may just put power at the Fed and the Financial institution of Canada to chop rates of interest. Alternatively, upbeat readings would permit the central banks to stay upper rates of interest for longer.

In the meantime, america sturdy items orders document will display the state of producing and client spending within the nation. Those will even display whether or not upper rates of interest are having an have an effect on at the financial system. Due to this fact, the consequences will impact rate-cut bets.

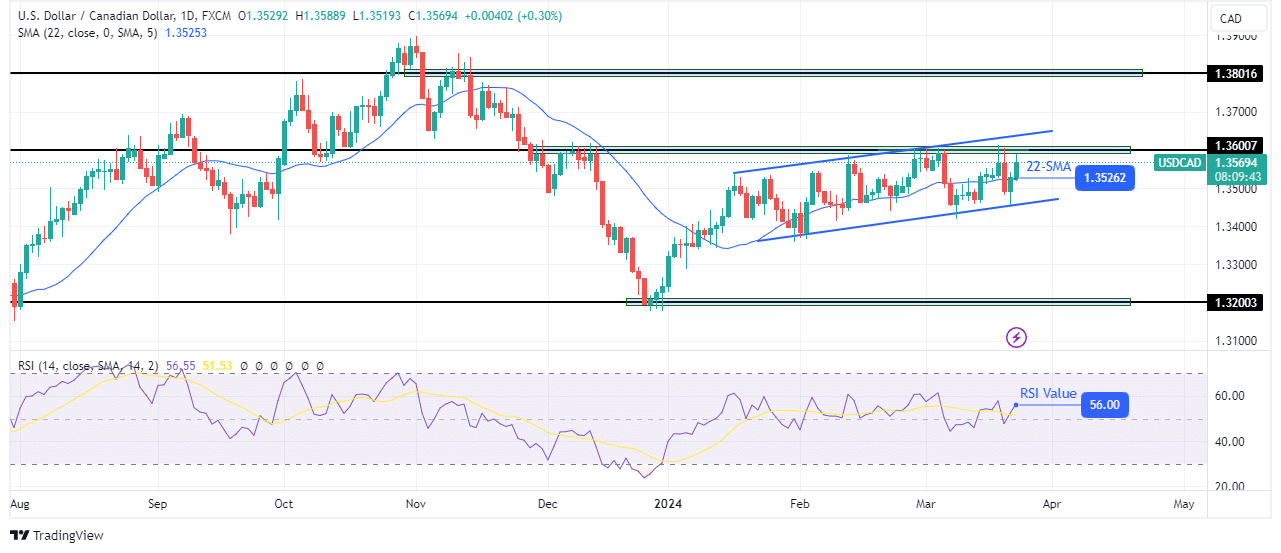

USD/CAD weekly technical forecast: Susceptible bullish momentum faces 1.3600 barrier

At the technical facet, USD/CAD has traded in a shallow and tight bullish channel since mid-January. Even supposing bulls have attempted to make upper highs, the fee is sticking just about the 22-SMA. On the identical time, the RSI has stayed close to 50 and has no longer touched the overbought area. It is a signal that even if bulls are in keep watch over, they have got vulnerable momentum.

-Are you interested by finding out in regards to the foreign exchange signs? Click on right here for details-

The shallow, bullish transfer is now going through sturdy resistance on the 1.3600 key stage. Given the vulnerable bullish momentum, the fee would possibly fail to wreck above. This is able to permit bears to take over by way of breaking out of the channel. If bears take keep watch over, the fee will most likely drop to one.3200.

Taking a look to business foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must imagine whether or not you’ll have enough money to take the prime chance of shedding your cash.