US Inflation Stays Stubbornly Top

- Export costs in america larger through 0.8% once a year.

- weekly unemployment get advantages claims have been not up to anticipated

- BoC’s Macklem warned that Canada’s task marketplace was once too tight.

The USD/CAD weekly forecast is bullish as traders wager on a extra competitive Fed amid sure knowledge from america.

Ups and downs of USD/CAD

The pair had a bullish week as American financial knowledge sparked bets on how aggressively the Federal Reserve will building up rates of interest.

–Are you interested by studying extra about STP agents? Take a look at our detailed guide-

A US record launched on Friday confirmed an annual building up in export costs of 0.8% versus expectancies for a nil.2% decline. In step with figures launched on Thursday, weekly unemployment get advantages claims have been not up to anticipated, whilst manufacturer costs rose per thirty days in January. Retail gross sales figures launched on Wednesday confirmed a substantial building up, whilst CPI knowledge from Tuesday indicated consistently emerging inflation.

There have been additionally hawkish feedback from two Fed officers on Thursday and forecasts for 3 further Fed price will increase this yr from Goldman Sachs and Financial institution of The united states.

On Thursday, BoC’s Tiff Macklem warned that the roles marketplace stays too tight and the financial system continues to be too sizzling as he left the door open to additional price hikes.

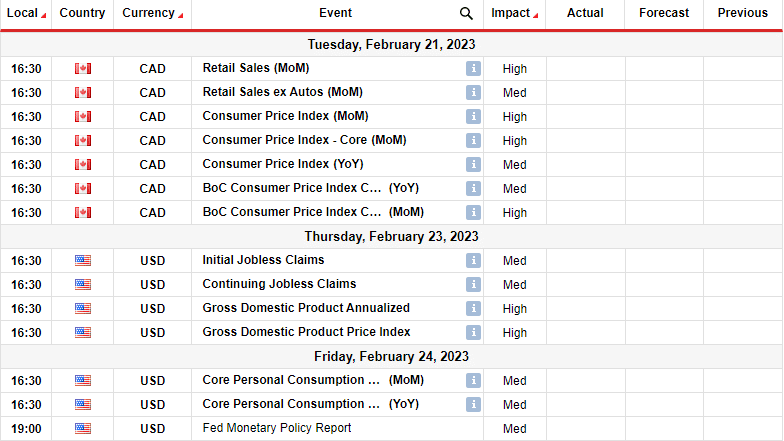

Subsequent week’s key occasions for USD/CAD

Traders will take note of inflation knowledge from Canada subsequent week that may display whether or not the financial system continues to be sizzling. Focal point can be on GDP knowledge from america that may proceed the rage of sure knowledge from the rustic.

USD/CAD weekly technical forecast: Patrons face a key resistance zone

The day-to-day chart displays USD/CAD in a bullish transfer as the fee trades above the 22-SMA and the RSI above 50. This follows a jump from 1.3300, a robust strengthen stage. The former transfer was once bearish as the fee revered the 22-SMA as resistance, and the RSI stayed underneath 50.

–Are you interested by studying extra about making a living with foreign exchange? Take a look at our detailed guide-

On the other hand, contemporary USD/CAD value actions were relatively uneven. The fee has stayed with regards to the SMA and the RSI with regards to the 50-mark. Neither bears nor bulls have dedicated to pushing the fee to excessive ranges of overbought or oversold. It is a signal that the fee is consolidating on a bigger time frame.

Lately, bulls are in keep watch over however face the 1.3450-1.3500 resistance zone. A smash above this stage will most probably building up the fee to at least one.3701. Differently, it’ll retest the 1.3300 strengthen.

Having a look to business foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to imagine whether or not you’ll be able to come up with the money for to take the top possibility of shedding your cash