Traders Look ahead to Fed, ECB Fee Hikes

- The ECB is extensively expected to hike charges for a 7th consecutive assembly.

- The Fed is predicted to spice up rates of interest subsequent week.

- Traders are expecting america nonfarm payroll record.

The EUR/USD weekly forecast is flat as buyers be expecting fee hikes from the ECB and the Fed. Then again, the buck turns out more likely to dangle robust.

Ups and downs of EUR/USD

Even supposing the economic system of the Eurozone is just increasing, the extent of inflation within the area remains to be excessive. It leaves the Ecu Central Financial institution with out a selection however to boost charges to cut back costs additional.

–Are you to be informed extra about Islamic foreign exchange agents? Take a look at our detailed guide-

Within the first quarter of the yr, financial output within the Eurozone higher through simply 0.1%. Many economies’ home intake stagnated.

On Would possibly 4, it’s extensively expected that the ECB will hike charges for a 7th consecutive assembly.

The Fed is predicted to spice up rates of interest subsequent week. That is in spite of america economic system rising lower than expected within the first quarter. Then again, the GDP record confirmed emerging quarterly inflation figures. In Q1, costs for core private intake expenditures higher through 4.9%.

Core PCE information indicated that inflation rose in March. Then again, it was once slower than in February.

Subsequent week’s key occasions for EUR/USD

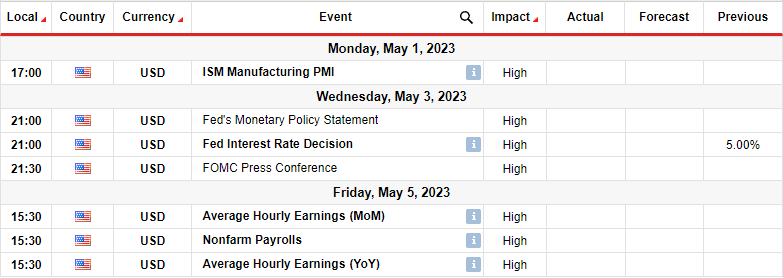

Traders will focal point at the FOMC assembly and the nonfarm payrolls. On the assembly, the Fed is predicted to boost charges through 25bps. It’s nonetheless preventing to tame inflation and convey it right down to its 2% goal.

The nonfarm payrolls will display whether or not high-interest charges are having an affect at the heated hard work marketplace.

EUR/USD weekly technical forecast: Bulls weakening

The prejudice for EUR/USD within the day-to-day chart is bullish. The associated fee is buying and selling above the 22-SMA and the use of it as strengthen. On the identical time, the RSI is buying and selling above 50, supporting bullish momentum. The associated fee has paused on the 1.1052 resistance stage.

–Are you to be informed extra about Thailand foreign exchange agents? Take a look at our detailed guide-

It has pulled again to retest the SMA and appears in a position to take out the resistance. A damage above would make the next excessive and proceed the uptrend.

Then again, the bullish bias is vulnerable. The associated fee remains just about the SMA, indicating that bulls aren’t totally dedicated. On the identical time, the RSI is transferring sideways as the fee strikes up. If this doesn’t trade, we would possibly see bears go back to opposite the fad. A reversal would additionally see the fee damage underneath the 1.0925 strengthen stage.

Having a look to business foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to imagine whether or not you’ll come up with the money for to take the excessive chance of shedding your cash.