TMA Momentum Pass the Forex market Buying and selling Technique

Maximum buyers desire buying and selling within the route of a longtime development. They’d steadily attempt to establish the route of the existing development and discriminately business handiest within the route of that development. This kind of buying and selling technique is named a development following technique. Maximum buyers desire this taste as it signifies that they’re buying and selling with the glide of the marketplace and now not towards it.

On the other hand, there are different buyers preferring to business handiest when the marketplace reverses and bureaucracy a brand new development. So, they’d business a buying and selling technique which must lend a hand them establish imaginable development reversals. Buying and selling on this method is steadily thought to be dangerous as it manner that you’re buying and selling towards the former glide of the marketplace and are steadily the brand new marketplace development route isn’t but obviously established. On the other hand, it additionally permits buyers to maximise their income when buying and selling on this method. It is because they’re steadily buying and selling initially of the craze and exiting on the finish of a development.

Crossover methods are one of the maximum commonplace form of development reversal methods. This can be a easy means of buying and selling development reversals according to the crossing over of shifting moderate strains. On the other hand, in spite of its simplicity, many buyers nonetheless fail when buying and selling crossover methods. That is in most cases as a result of they blindly observe crossover methods with out taking into account the traits and behaviour of the present marketplace situation.

TMA Momentum Pass the Forex market Buying and selling Technique is helping buyers establish and make sure possible development reversals according to a algorithm the usage of extremely dependable technical signs. It additionally considers the habits of value motion in addition to the candlesticks itself.

3 Colour MA

3 Colour MA is a customized technical indicator according to shifting averages.

Transferring averages have two commonplace disadvantages. One is that the majority shifting averages are lagging. Which means that maximum shifting averages reply very overdue to value actions. At the different finish of the spectrum are shifting averages that transfer too inconsistently. Those shifting averages generally tend to transport even with the slightest fluctuation in value.

3 Colour MA is a changed shifting moderate which smoothens out its shifting moderate line making it much less liable to false indicators found in uneven markets, whilst on the identical time making it extra aware of contemporary value adjustments.

The road plotted by means of the Thee Colour MA indicator additionally adjustments. This permits buyers to extra simply establish the cycles of the marketplace.

TMA Slope

TMA Slope is every other customized technical indicator which is evolved according to shifting averages. It’s also an oscillator form of indicator which plots bars and dots on a separate window.

The TMA Slope indicator is computed by means of figuring out the slope of a Triangulated Transferring Reasonable (TMA) line. That is according to the adaptation between a fast-moving TMA line and a slower shifting TMA line. The indicator then plots the adaptation on a separate window as histogram bars. Certain inexperienced bars point out a bullish development bias whilst adverse coral bars point out bearish development bias.

The indicator additionally plots dots connected to the histogram bars. It plots aqua dots to signify a bullish momentum and crimson dots to signify a bearish momentum. Certain aqua dots point out a strengthening bullish development whilst certain crimson dots point out a weakening bearish development. Alternatively, adverse crimson dots point out a strengthening bearish development whilst adverse aqua dots point out a weakening bearish development.

Buying and selling Technique

This buying and selling technique is a crossover buying and selling technique which uses 30-period Exponential Transferring Reasonable (EMA) line and the 3 Colour MA line as a foundation for its crossover buying and selling sign.

On the other hand, as a substitute of buying and selling each sign that shall we come throughout, we will be able to filter out trades according to the confluence of the crossover and the TMA Slope indicator. The crossover of the 30 EMA line and the 3 Colour MA line must be in confluence with the craze route indicated by means of the TMA Slope indicator.

Then, we must establish prime likelihood business setups according to the traits of value motion. As an alternative of taking the business proper after the crossover of the 2 strains, we will be able to stay up for value to retrace in opposition to the realm of the shifting moderate strains. Then, we must stay up for a momentum candle to transport within the route of the craze indicating that value is much more likely to transport in opposition to the route of the brand new development being evolved.

Signs:

- Three_Color_MA

- 30 EMA

- Tma_slope_nrp_alerts

Most popular Time Frames: 30-minute, 1-hour, 4-hour and day by day charts

Foreign money Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York periods

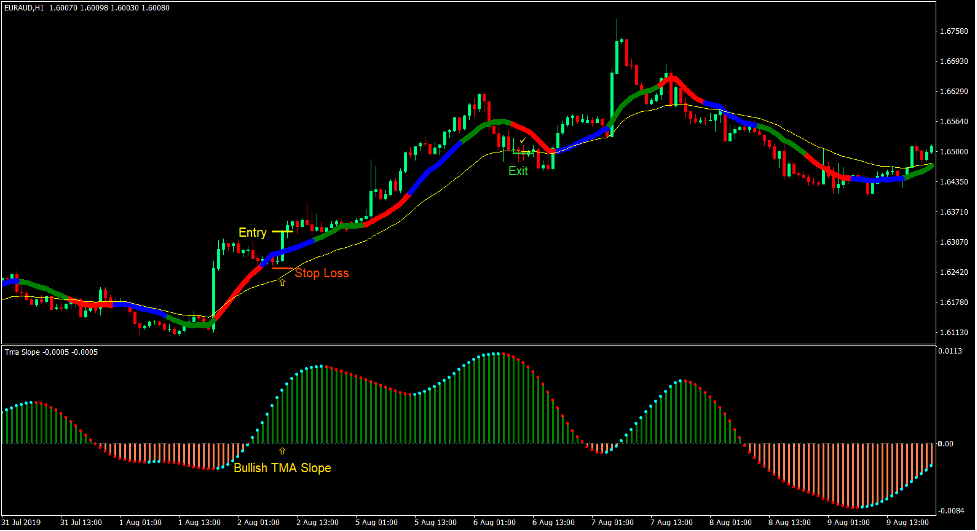

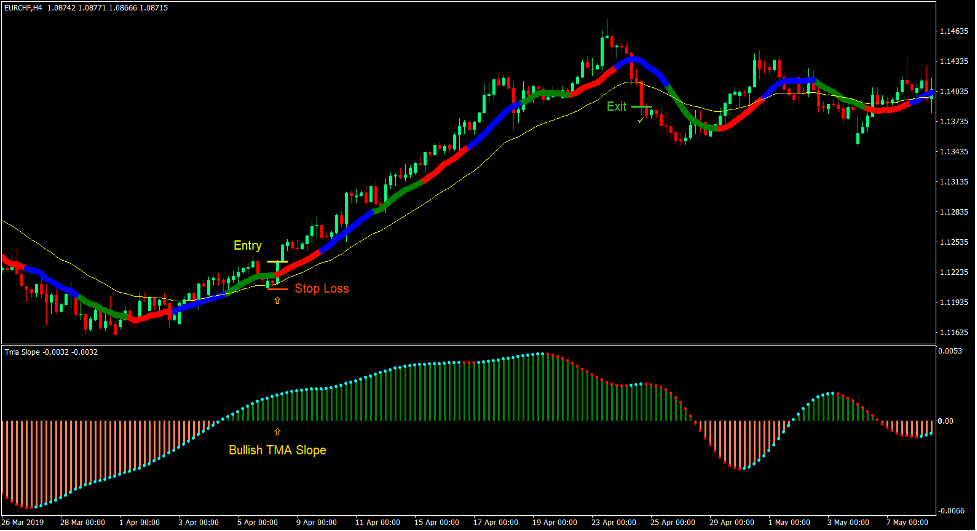

Purchase Industry Setup

Access

- Value motion must go above the 30 EMA line and the 3 Colour MA line.

- The TMA Slope line must develop into certain.

- The 3 Colour MA line must go above the 30 EMA line.

- Value motion must retrace in opposition to the realm of the shifting moderate strains.

- A bullish momentum candle must be shaped as value motion rejects the realm of the shifting moderate strains.

- Input a purchase order at the affirmation of those stipulations.

Forestall Loss

- Set the prevent loss at the give a boost to under the access candle.

Go out

- Shut the business once value closes under the 30 EMA line.

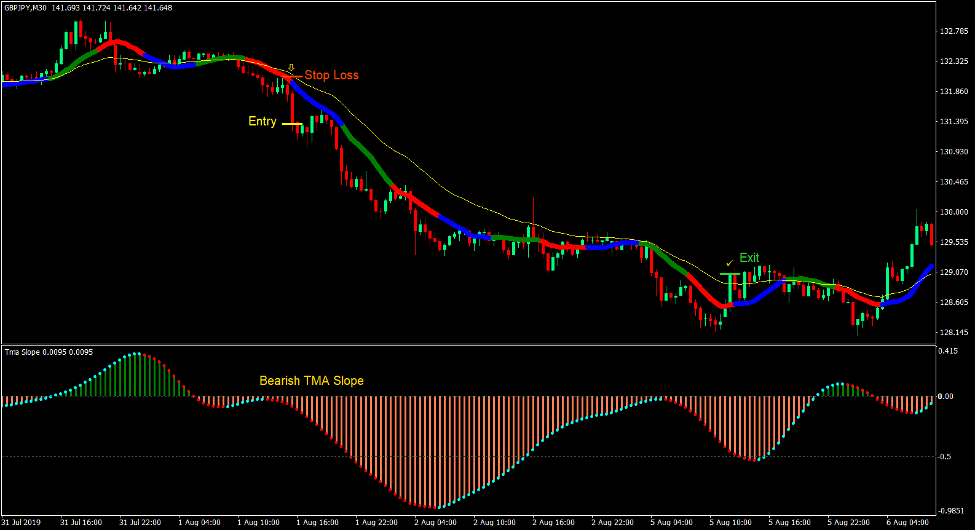

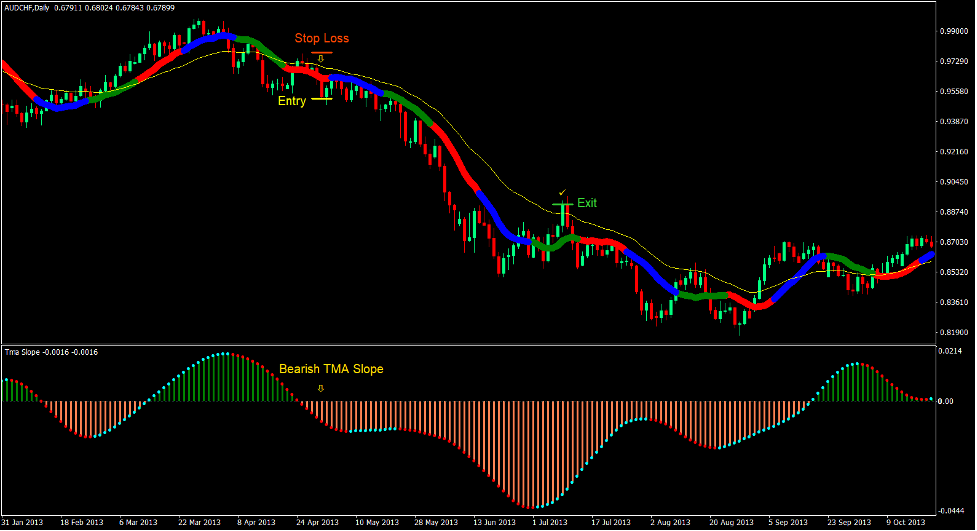

Promote Industry Setup

Access

- Value motion must go under the 30 EMA line and the 3 Colour MA line.

- The TMA Slope line must develop into adverse.

- The 3 Colour MA line must go beow the 30 EMA line.

- Value motion must retrace in opposition to the realm of the shifting moderate strains.

- A bearish momentum candle must be shaped as value motion rejects the realm of the shifting moderate strains.

- Input a promote order at the affirmation of those stipulations.

Forestall Loss

- Set the prevent loss at the resistance above the access candle.

Go out

- Shut the business once value closes above the 30 EMA line.

Conclusion

This technique uses a number of ideas which buyers use to spot development reversals. First is the crossover of the shifting moderate strains. Then, value motion, which is known according to how value motion has a tendency to create upper highs in an uptrend and decrease lows in a downtrend. This comes hand in hand with value motion rejecting the realm of the shifting moderate strains. Finally, the slope of shifting moderate strains. The TMA Slope indicator merely is helping us objectively establish the slope of the shifting moderate strains.

Through combining all 3 ideas, we get to have business setups that have upper possibilities. If utilized in the suitable marketplace situation, those business setups would generally tend to supply certain effects.

the Forex market Buying and selling Methods Set up Directions

TMA Momentum Pass the Forex market Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to turn into the collected historical past information and buying and selling indicators.

TMA Momentum Pass the Forex market Buying and selling Technique supplies a possibility to stumble on quite a lot of peculiarities and patterns in value dynamics which can be invisible to the bare eye.

According to this data, buyers can suppose additional value motion and regulate this technique accordingly.

Really helpful the Forex market MetaTrader 4 Buying and selling Platform

- Loose $50 To Get started Buying and selling Immediately! (Withdrawable Benefit)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable the Forex market Dealer

- Further Unique Bonuses All the way through The 12 months

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-Through-Step XM Dealer Account Opening Information

Really helpful Choices Buying and selling Platform

- Loose +50% Bonus To Get started Buying and selling Immediately

- 9.6 Total Score!

- Robotically Credited To Your Account

- No Hidden Phrases

- Settle for USA Citizens

How one can set up TMA Momentum Pass the Forex market Buying and selling Technique?

- Obtain TMA Momentum Pass the Forex market Buying and selling Technique.zip

- *Replica mq4 and ex4 recordsdata in your Metatrader Listing / professionals / signs /

- Replica tpl record (Template) in your Metatrader Listing / templates /

- Get started or restart your Metatrader Consumer

- Choose Chart and Time frame the place you wish to have to check your foreign exchange technique

- Proper click on to your buying and selling chart and hover on “Template”

- Transfer proper to make a choice TMA Momentum Pass the Forex market Buying and selling Technique

- You are going to see TMA Momentum Pass the Forex market Buying and selling Technique is to be had to your Chart

*Word: No longer all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Signs from the MetaTrader Platform.