Technical Research & Forecast for June 16, 2023 – R Weblog

Brent Poised for Prolonged Expansion, EUR, GBP, JPY, CHF, AUD, Gold, and S&P 500 Index Evaluation

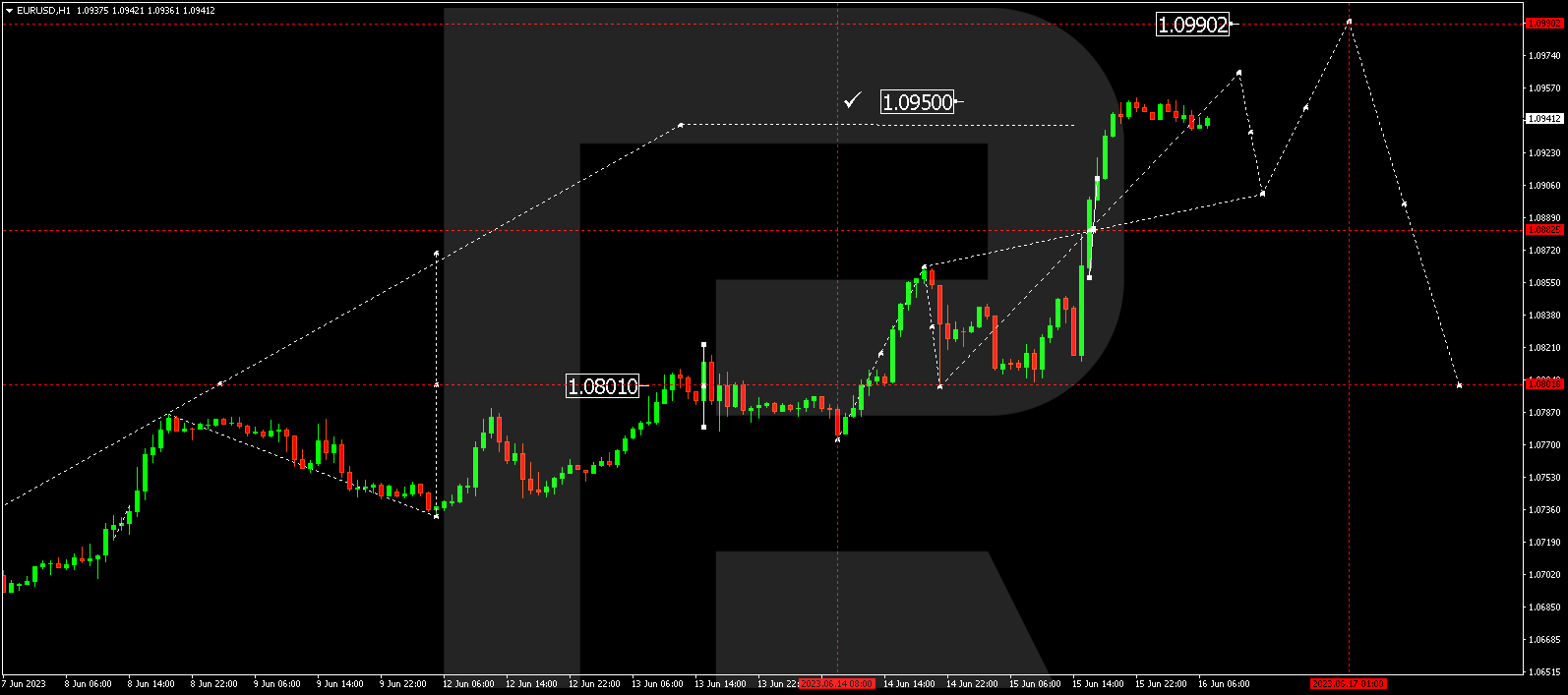

EUR/USD – Euro vs US Buck

The EUR/USD pair failed to damage underneath the 1.0800 stage and located enhance, starting up a brand new wave of expansion in opposition to 1.0990. Nowadays, a possible upward thrust to at least one.0960 is most probably, adopted by way of a decline to at least one.0900. Therefore, an building up to at least one.1000 is expected, probably proceeding the upward development to at least one.1000.

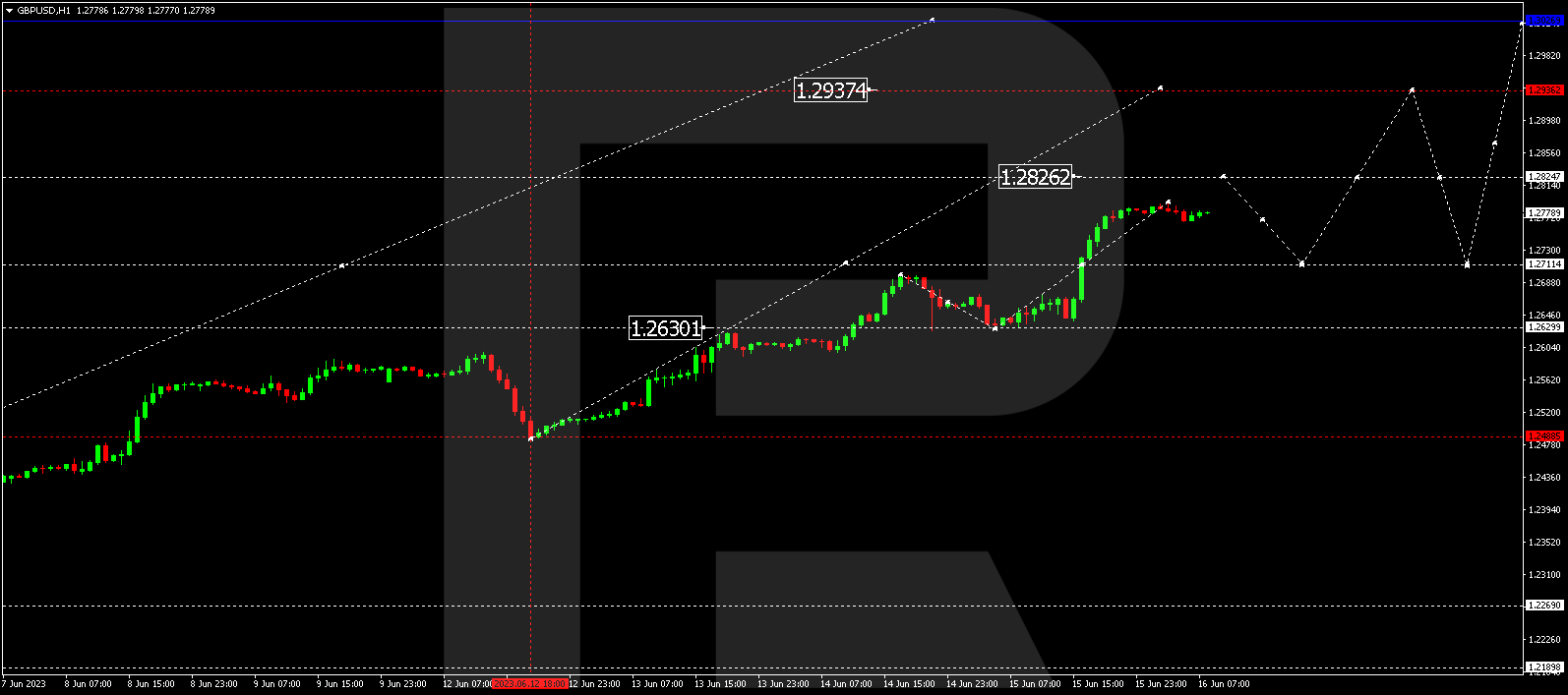

GBP/USD – Nice Britain Pound vs US Buck

The GBP/USD pair discovered enhance at 1.2630 and would possibly upward thrust in opposition to 1.2826. A correction to at least one.2711 is conceivable ahead of an additional building up to at least one.2935.

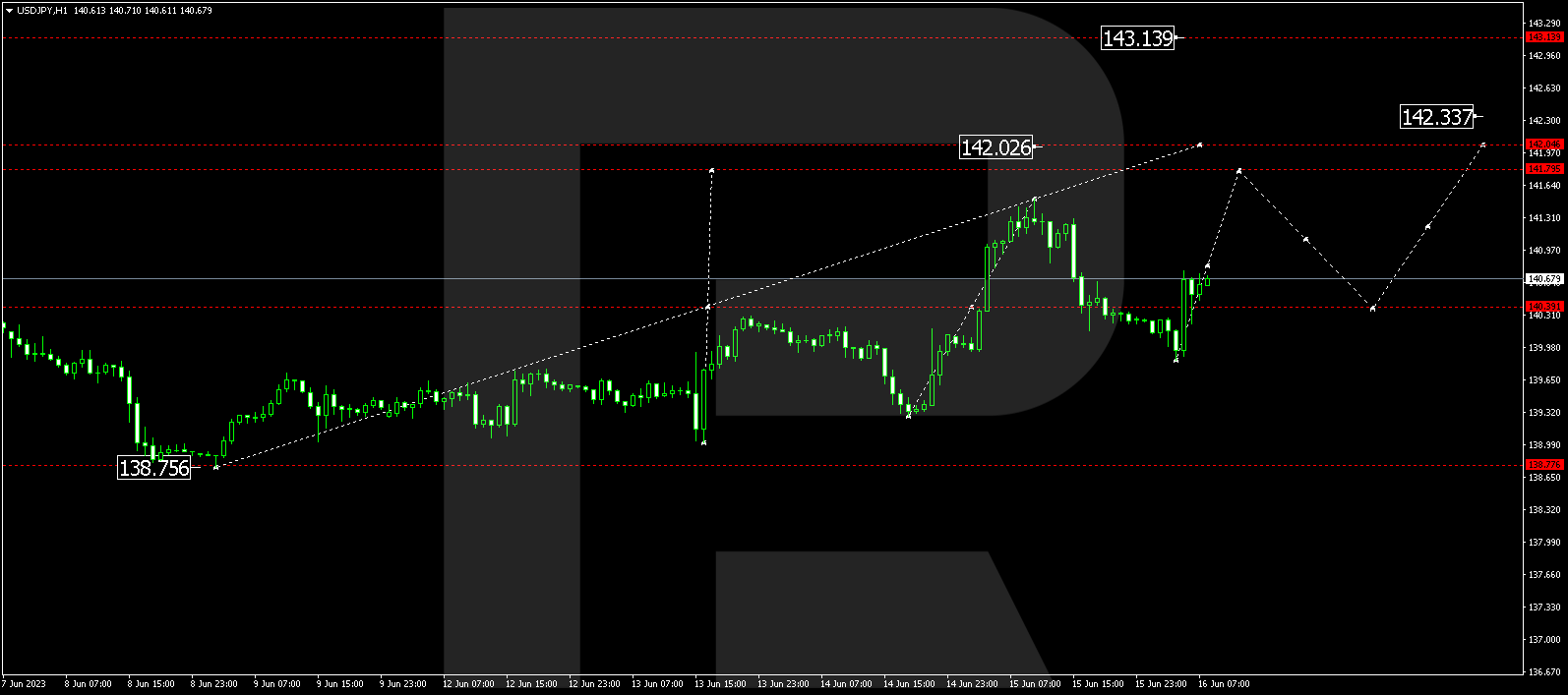

USD/JPY – US Buck vs Eastern Yen

After a correction to 139.88, the USD/JPY pair is forming a brand new upward construction, focused on 141.77. As soon as this stage is reached, a corrective segment to 140.40 would possibly happen, adopted by way of a upward thrust to 142.00.

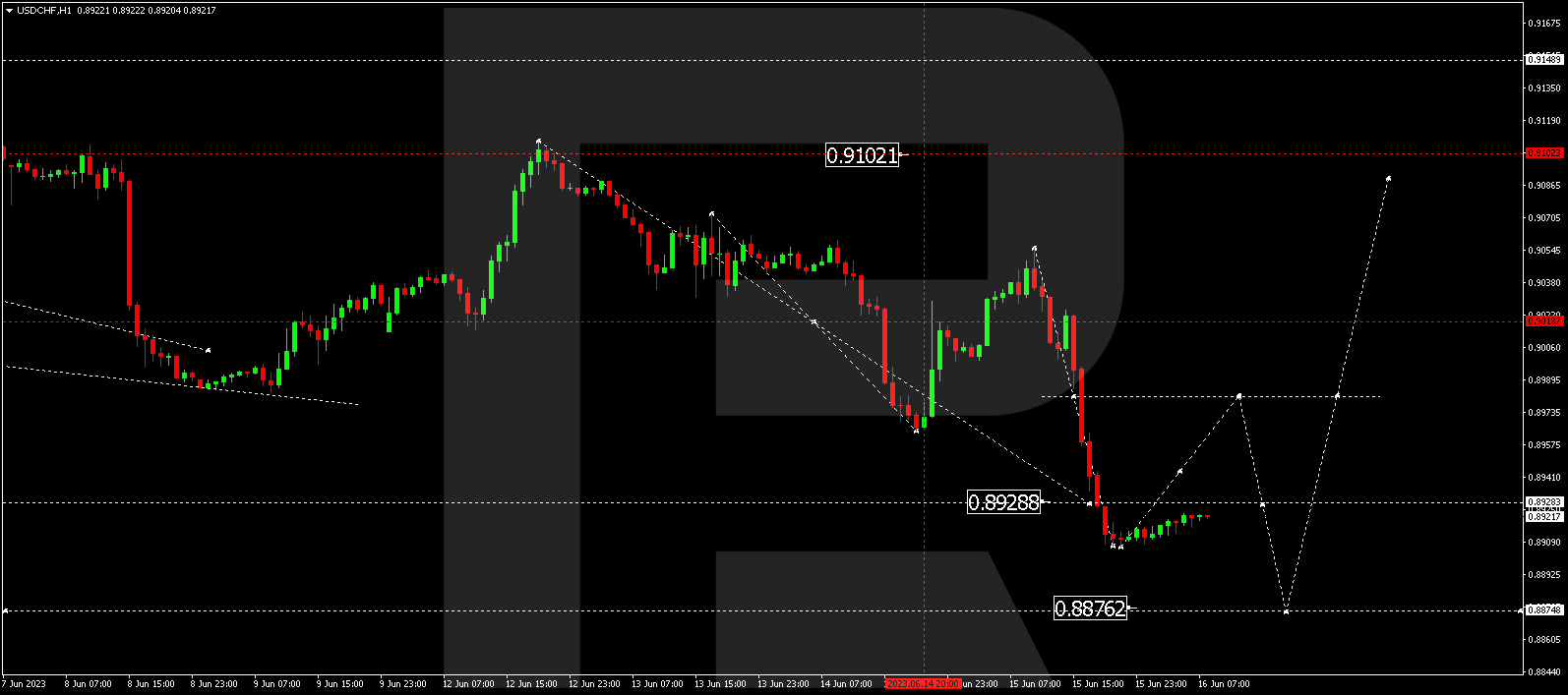

USD/CHF – US Buck vs Swiss Franc

Having finished a downward wave to 0.8922, the USD/CHF pair is recently consolidating underneath this stage. There’s a chance of a downward breakout, extending the decline to 0.8877, adopted by way of an upward transfer to 0.9090.

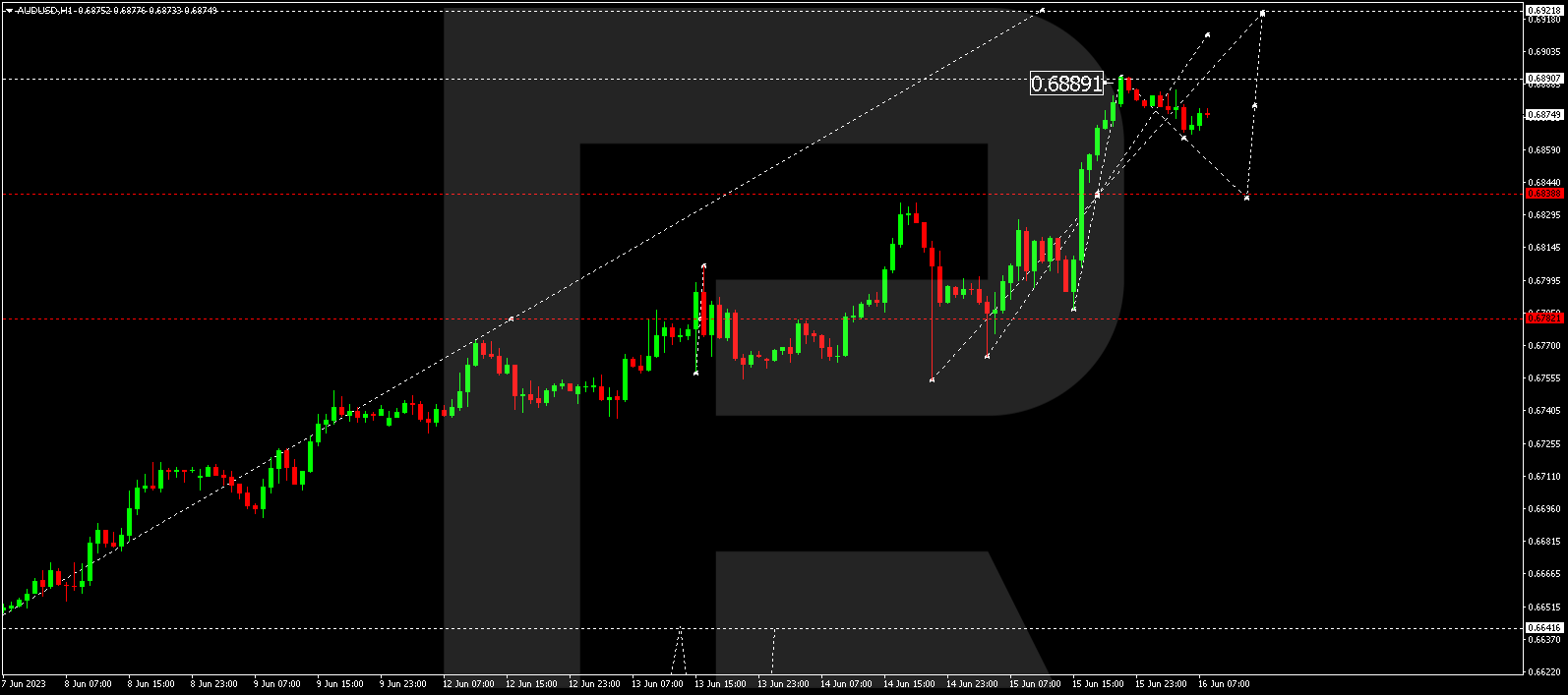

AUD/USD – Australian Buck vs US Buck

The AUD/USD pair has skilled a expansion segment in opposition to 0.6888. A correction to 0.6840 is conceivable ahead of some other upward wave develops in opposition to 0.6922.

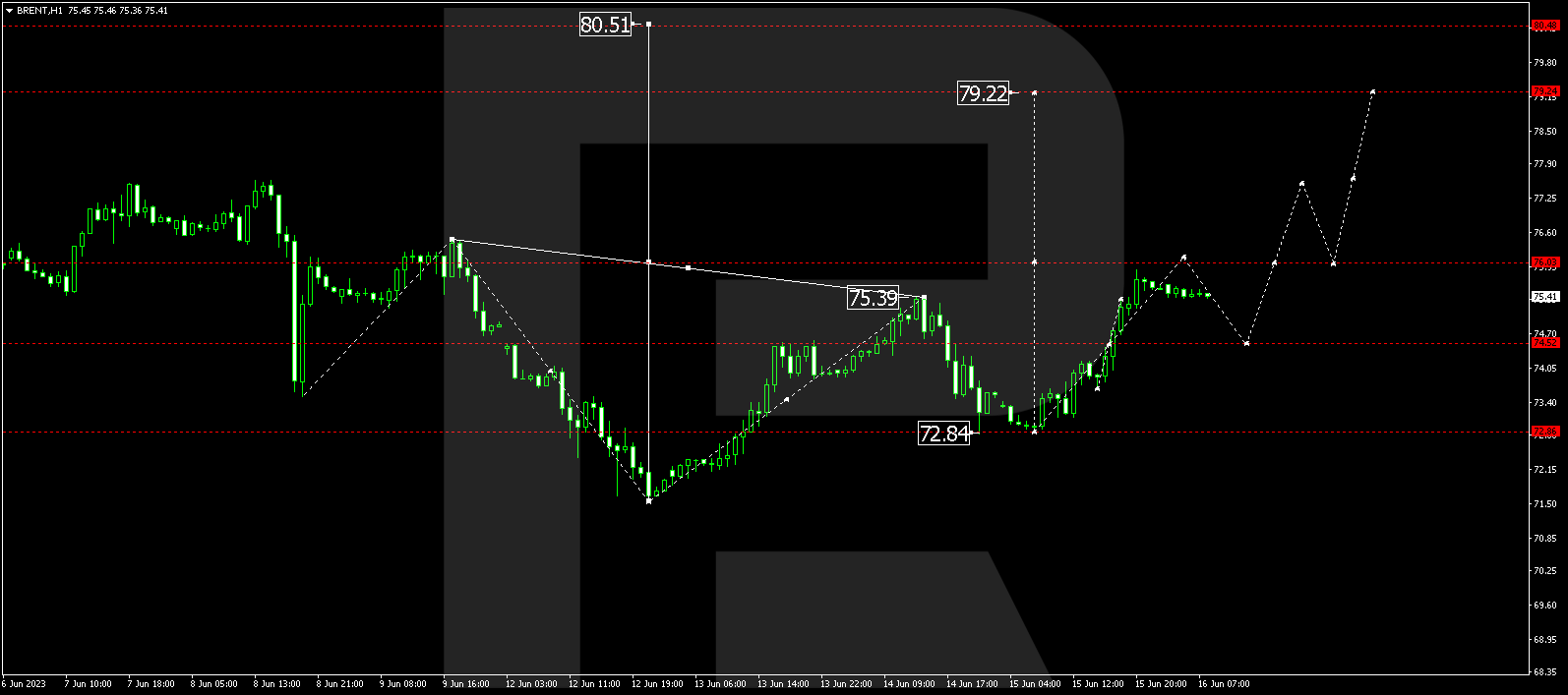

BRENT

Brent crude has finished a correction to 72.85 and is recently proceeding its ascent in opposition to 76.10. After attaining this stage, a consolidation vary would possibly shape. A breakout above the variability may just open up the possibility of additional expansion to 79.22, with a next building up to 80.50 because the preliminary goal.

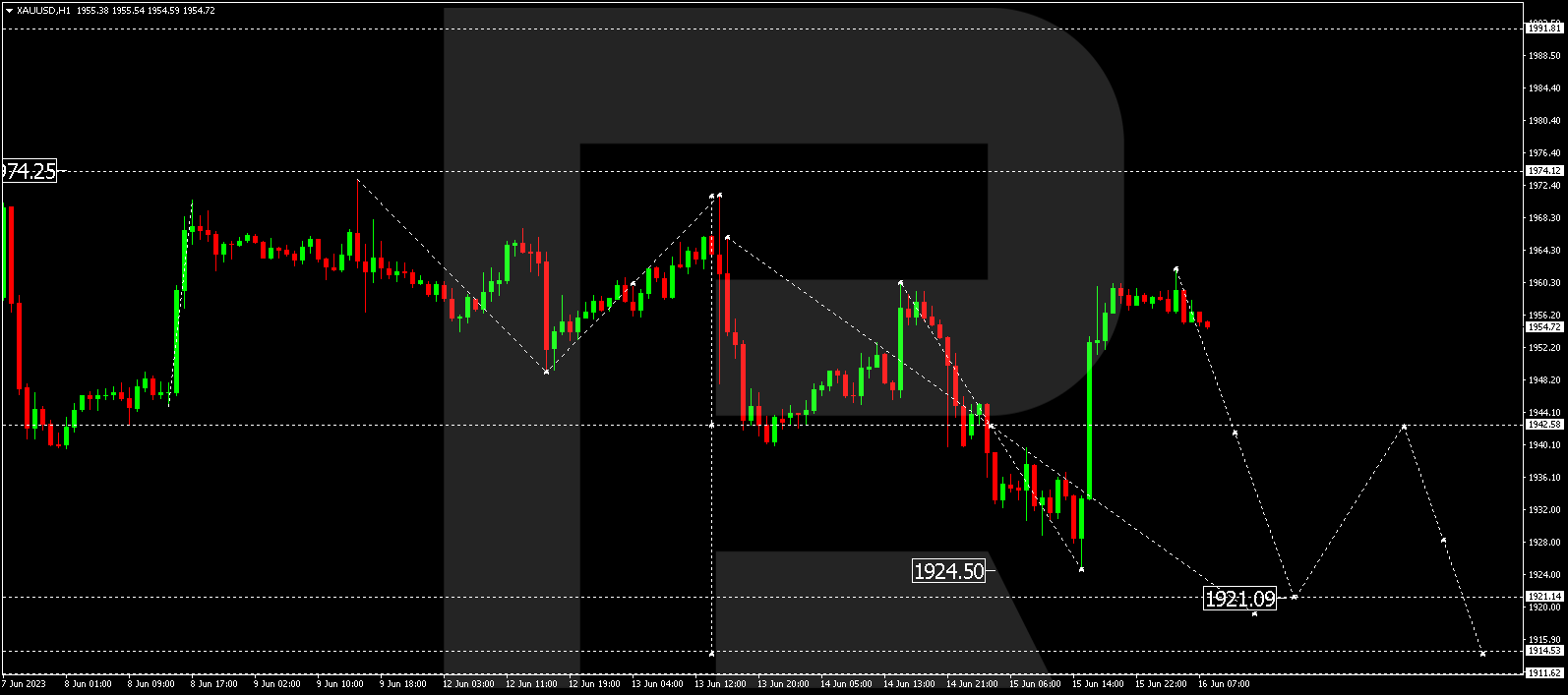

XAU/USD – Gold vs US Buck

Gold has finished a downward wave to 1924.50, adopted by way of a correction in opposition to 1960.00. The marketplace is recently in a consolidation segment round this stage. A downward breakout may just result in additional decline in opposition to 1921.10. Conversely, an upward breakout may just power the associated fee in opposition to 1974.10, adopted by way of a drop to 1921.00.

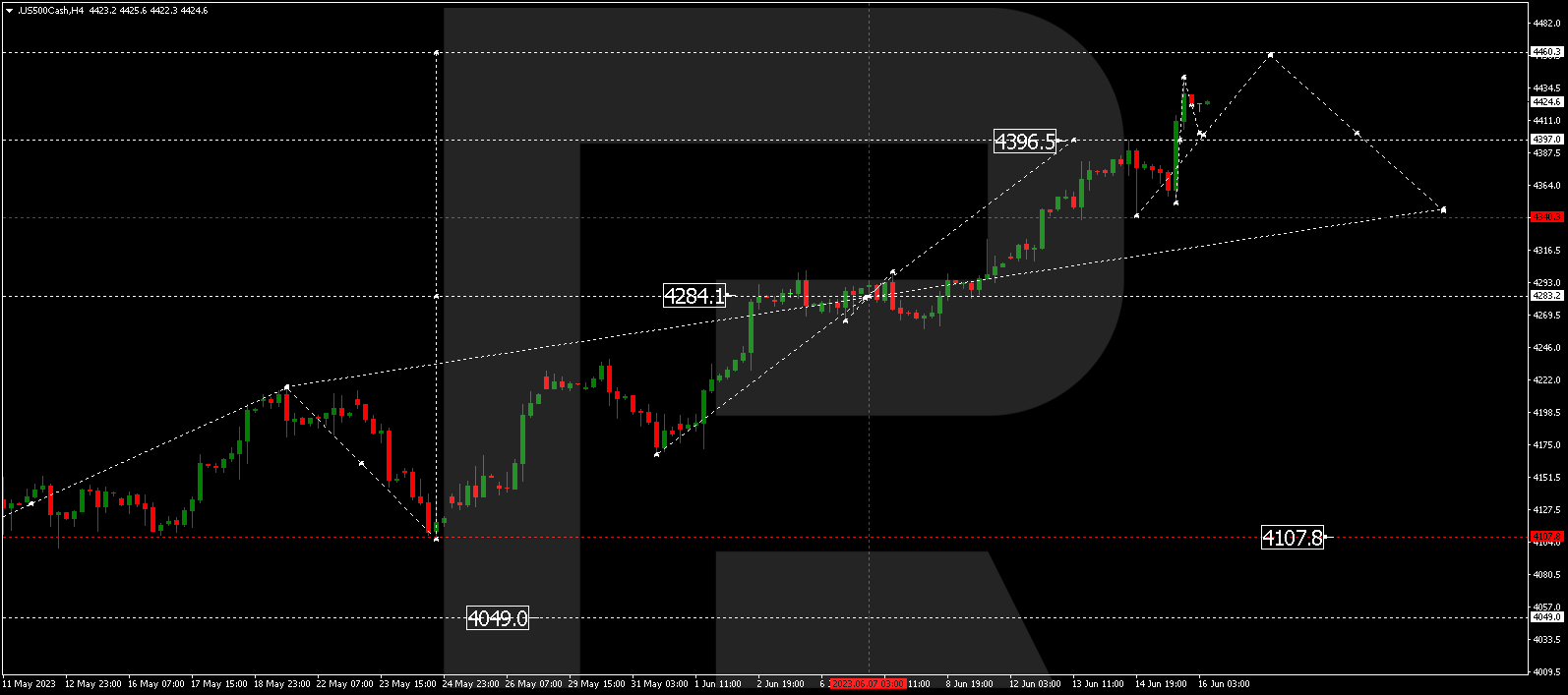

S&P 500

The S&P 500 index is continuous its upward wave in opposition to 4460.0. As soon as this stage is reached, a downward correction to 4340.0 would possibly ensue, serving as the primary goal.