Technical Research & Forecast February 08, 2024 – R Weblog

Brent might lengthen its upward momentum. The review additionally encompasses the dynamics of EUR, GBP, JPY, CHF, AUD, Gold, and the S&P 500 index.

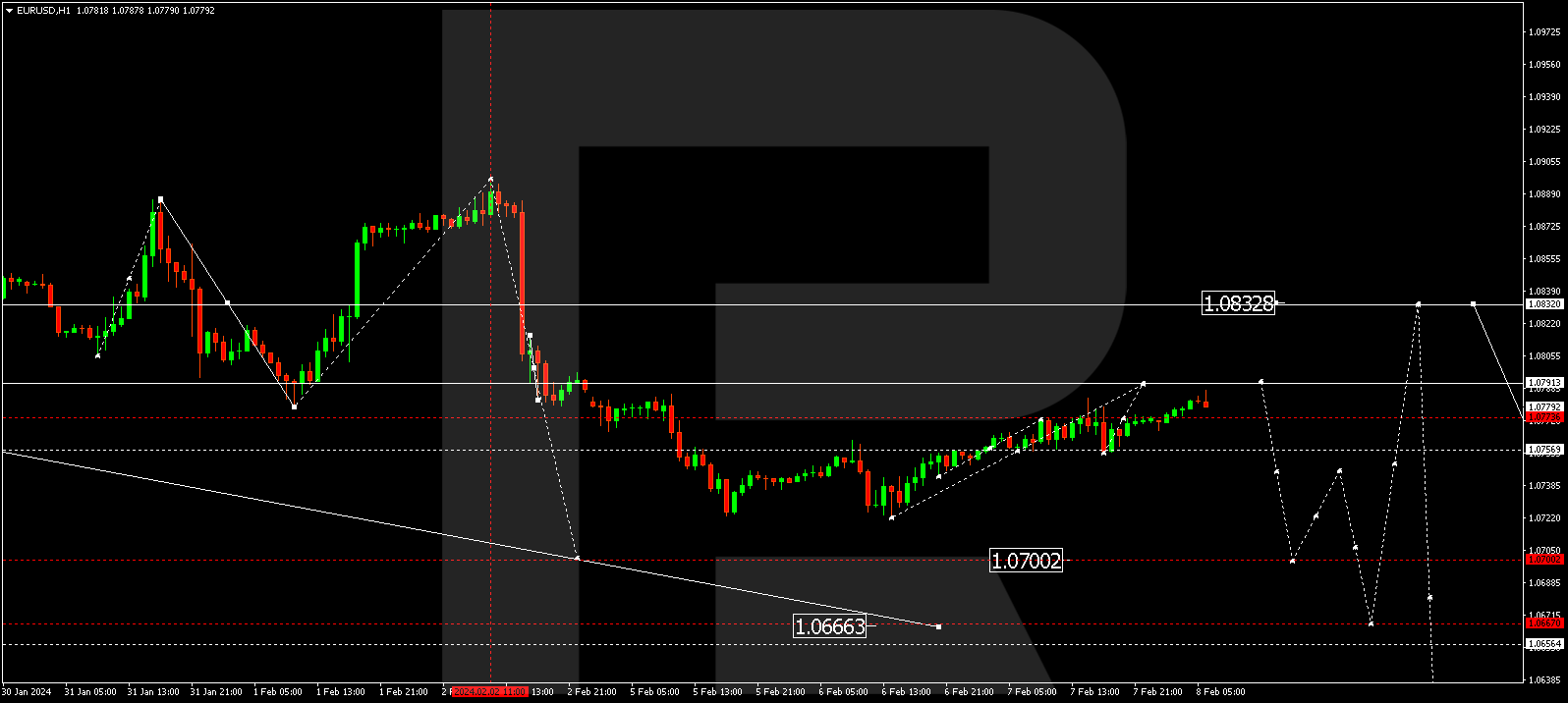

EUR/USD (Euro vs US Buck)

The EUR/USD pair discovered toughen on the 1.0767 degree and is these days present process a correction. Nowadays, the correction may lengthen to at least one.0791. As soon as finished, a downward wave to at least one.0700 is predicted. If this degree is breached, the opportunity of an extra decline to at least one.0666 may spread. This represents the preliminary goal of a brand new downtrend wave.

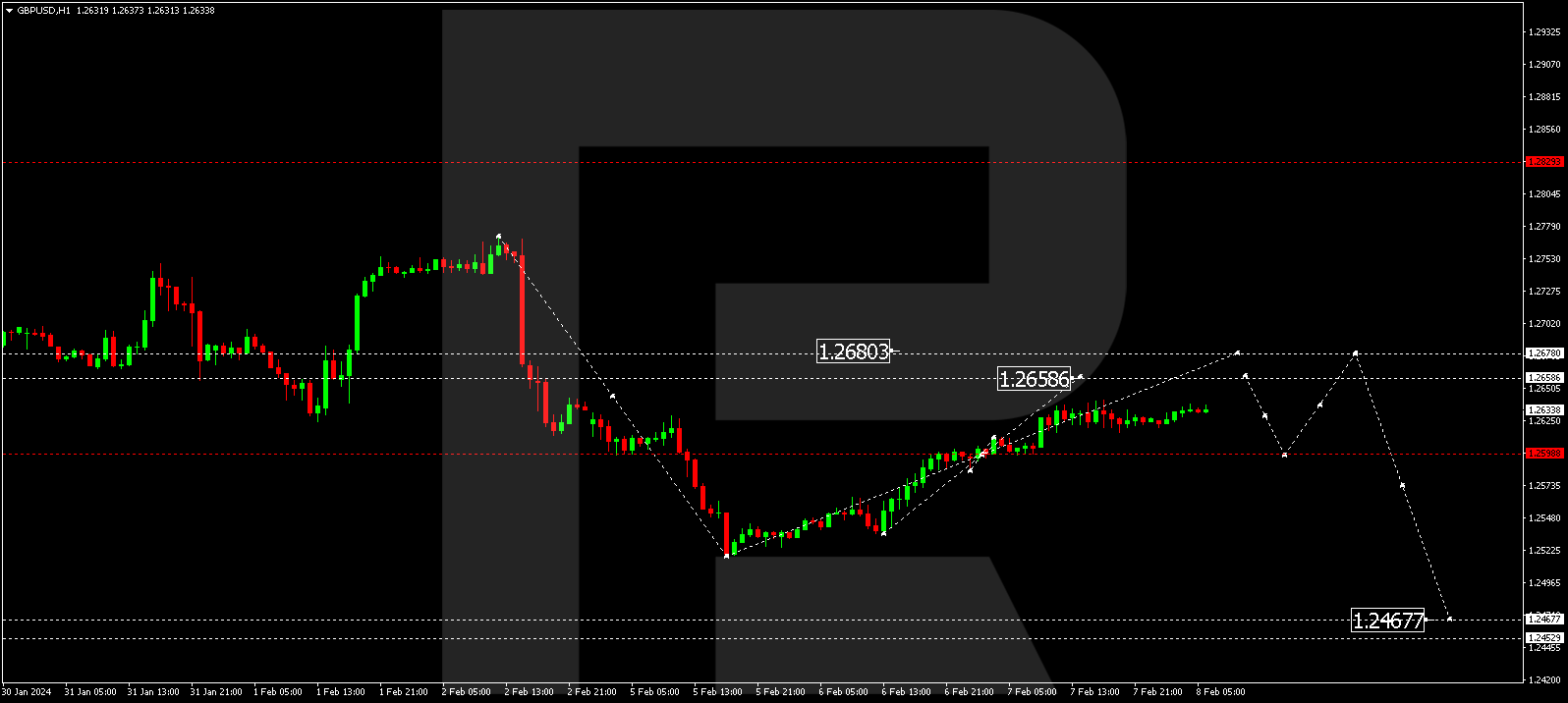

GBP/USD (Nice Britain Pound vs US Buck)

The GBP/USD pair is in the middle of a longer correction wave, trying out the 1.2658 degree from under. Following the crowning glory of the correction, a brand new downward wave to at least one.2470 may start up. This marks the principle goal of a decline throughout the current downtrend.

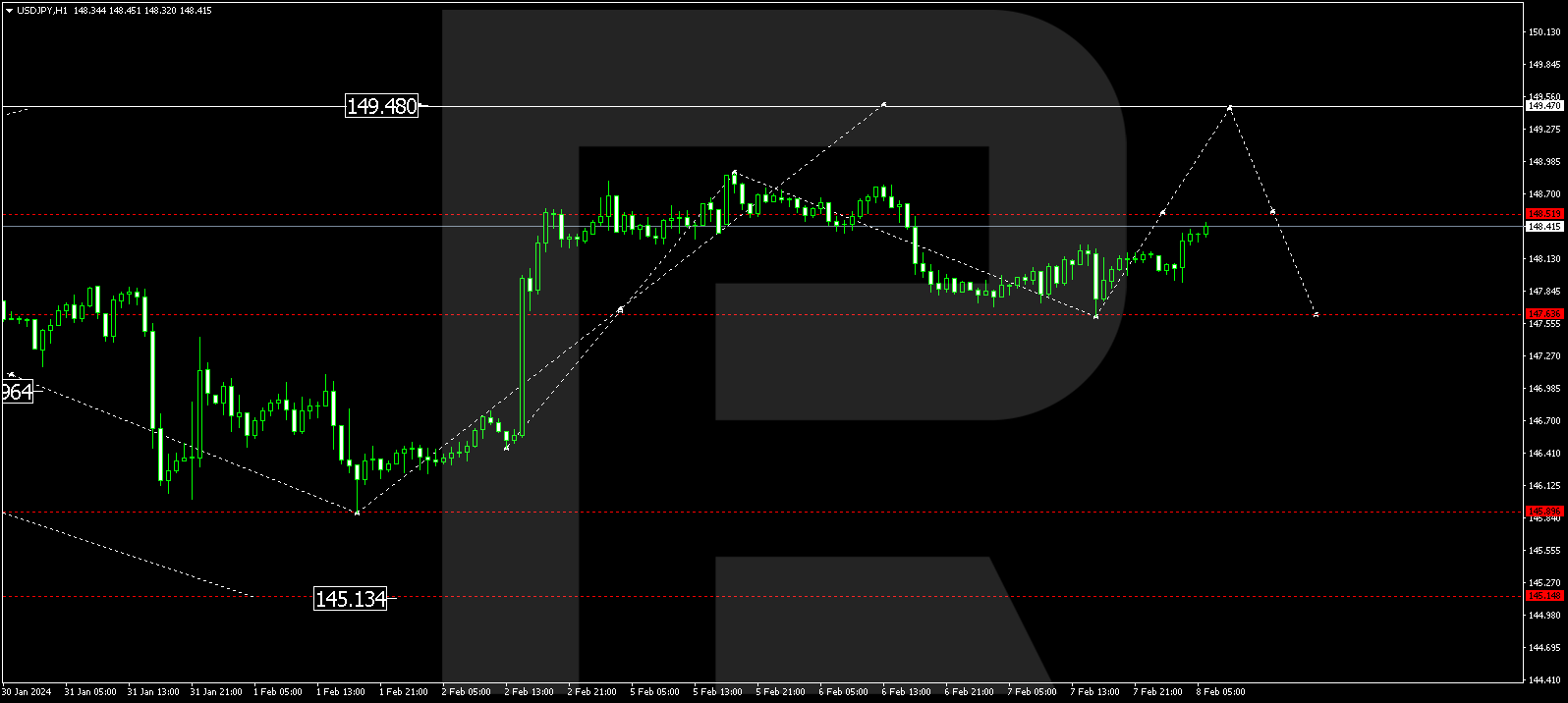

USD/JPY (US Buck vs Eastern Yen)

The USD/JPY pair is ongoing within the construction of an upward wave to 149.47. As soon as this degree is attained, a brand new downward wave to 147.64 is predicted to begin, doubtlessly proceeding the rage to 145.15.

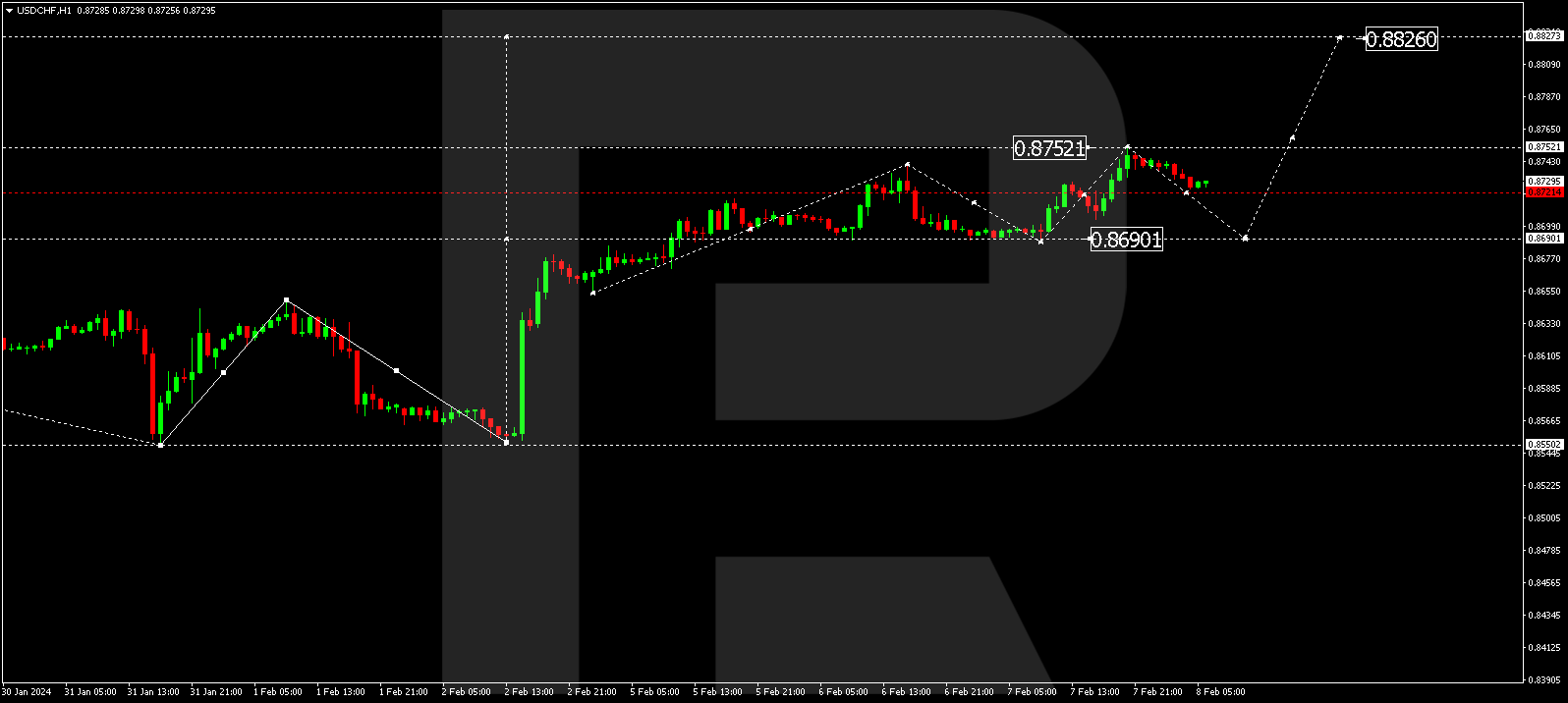

USD/CHF (US Buck vs Swiss Franc)

The USD/CHF pair has concluded an upward wave, attaining 0.8752. Lately forming a corrective segment to 0.8690, a brand new upward construction to 0.8826 may begin as soon as the correction concludes. This indicates the preliminary goal throughout the uptrend wave construction.

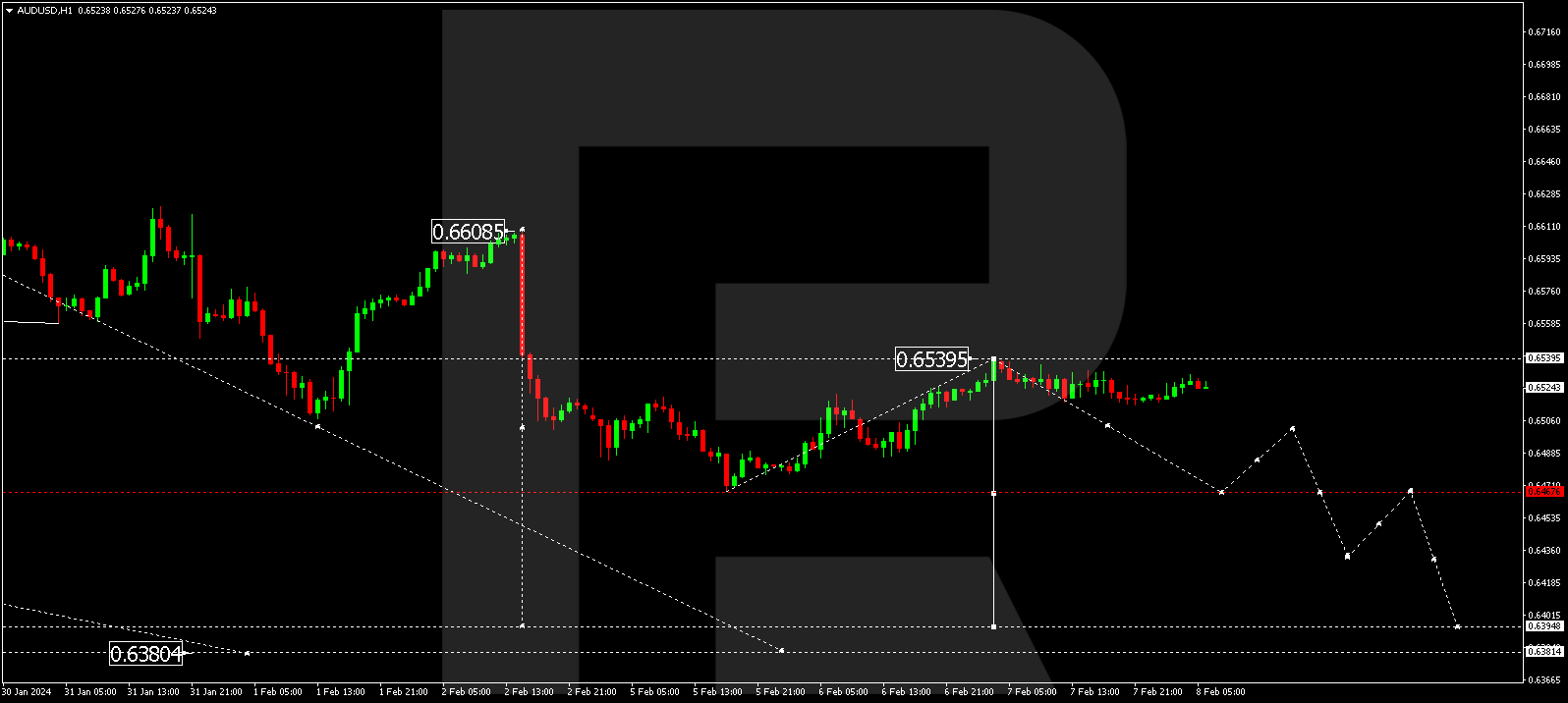

AUD/USD (Australian Buck vs US Buck)

The AUD/USD pair is persisting in a consolidation vary under the 0.6539 degree. An expected downward breakout from the variability to 0.6467 may result in an extension of the wave to 0.6395. This represents the primary goal within the declining construction throughout the current downtrend.

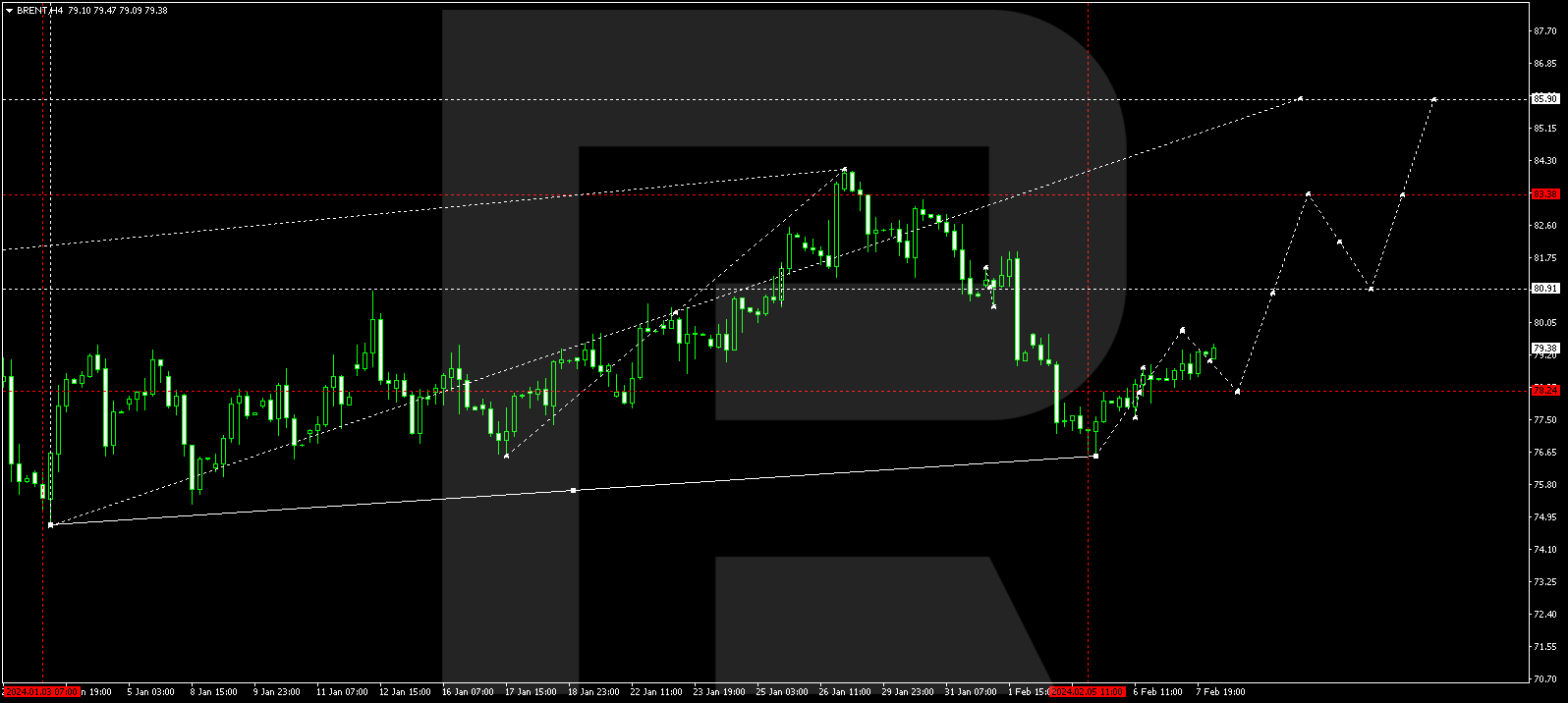

BRENT

Brent continues to be within the strategy of creating an upward wave to 79.85. Upon attaining this degree, a possible correction to 78.25 isn’t dominated out, appearing as a take a look at from above. Following the correction, a brand new upward wave to 80.90 may begin. If this degree is surpassed, the opportunity of an build up to 83.38 may spread. This indicates a neighborhood goal.

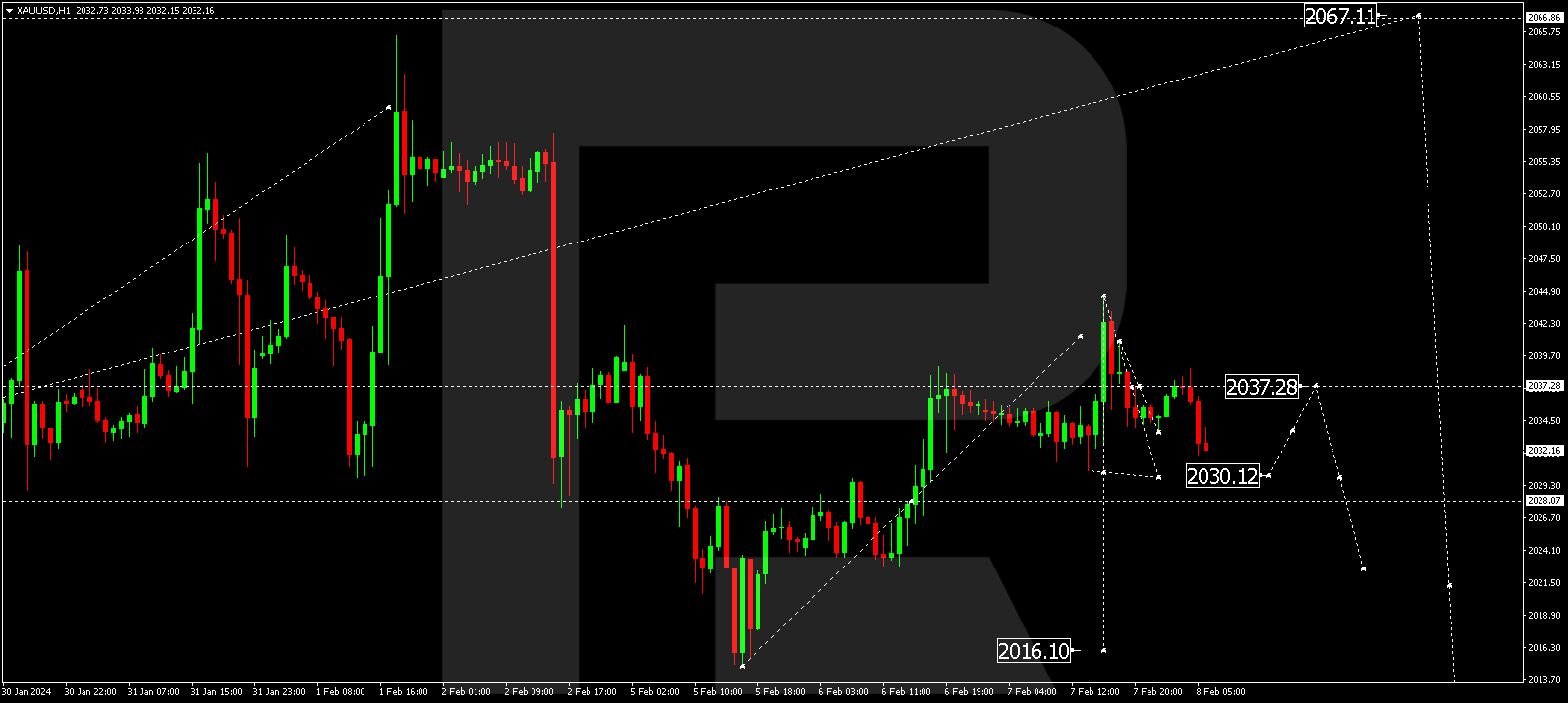

XAU/USD (Gold vs US Buck)

Gold is these days forming a construction for a declining wave to 2030.10. As soon as this degree is reached, a correction to 2037.30 may happen. Therefore, a brand new declining construction to 2022.20 may spread, with the opportunity of the wave to proceed to 2016.10. This marks a neighborhood goal.

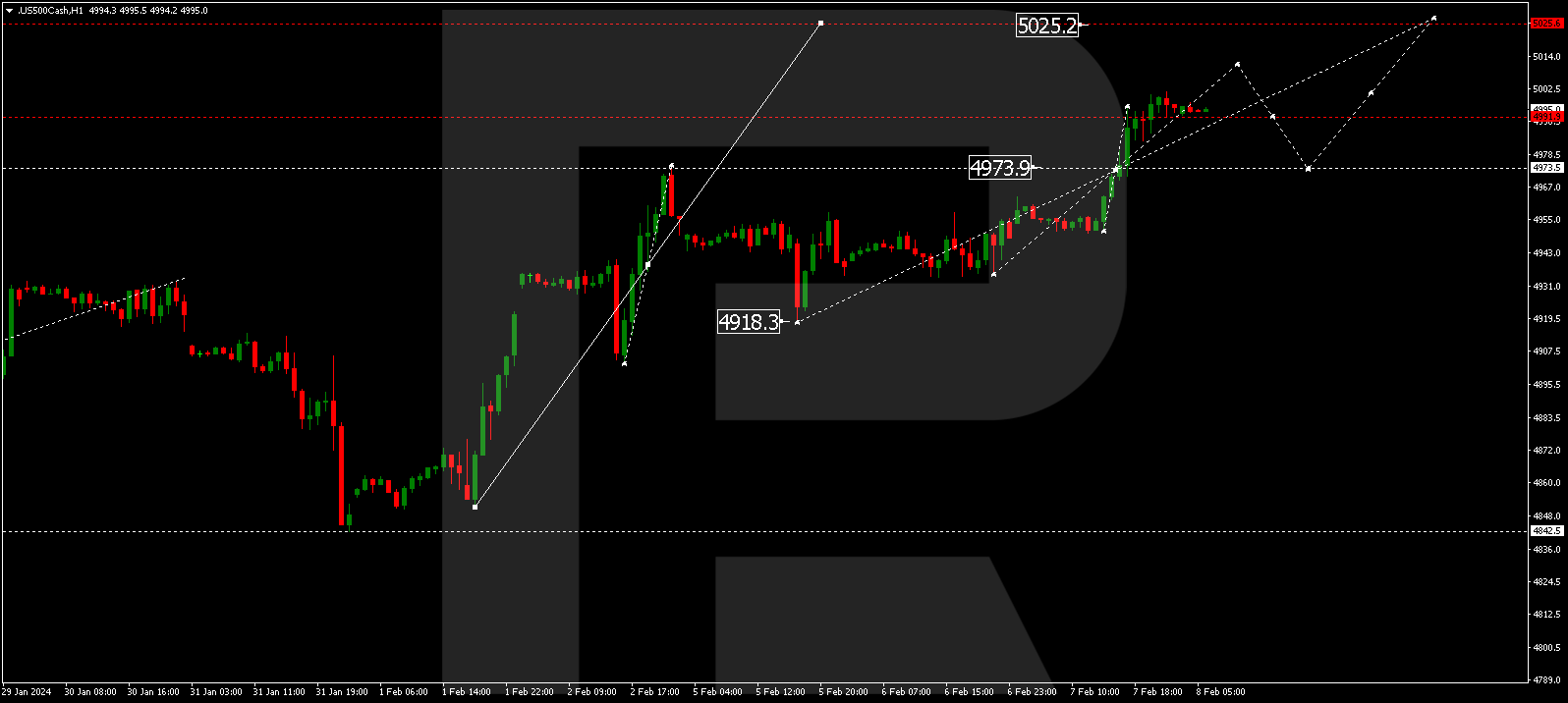

S&P 500

The inventory index has surpassed the 4973.5 degree upwards, suggesting a continuation of the expansion wave to 5011.0. Following this, a possible correction to 4973.5 (a take a look at from above) may transpire. Next to the correction, an expected enlargement hyperlink to 5025.0 is predicted.