Research of Possibilities for 2024

The USA Buck Index (DXY) displays the dynamics of adjustments within the price of the United States forex within the international monetary markets. On this article, we can find out how the index is calculated, discover its ancient developments, read about the criteria influencing its actions, and provide imaginable methods for research and funding.

What’s DXY?

DXY or USDX tickers denote the index of the United States greenback, which is the reputable forex of the United States and serves as the worldwide reserve forex in world business and fiscal markets.

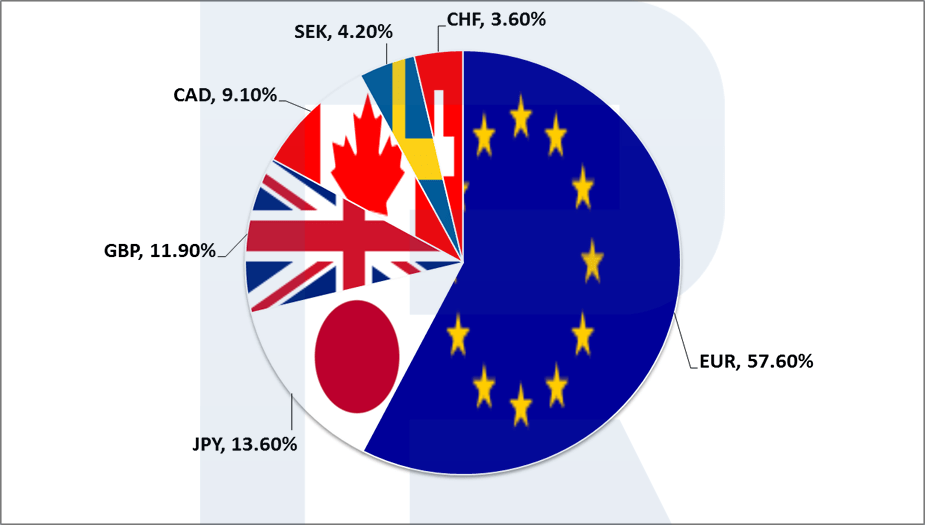

This is a composite measure of the worth of the USD relative to a basket of six primary currencies of vital US buying and selling companions, specifically the Euro (EUR), Eastern Yen (JPY), British Pound (GBP), Canadian Buck (CAD), Swedish Krona (SEK), and Swiss Franc (CHF). The DXY has a base price of 100.00.

How the DXY index is calculated

The worth of the United States Buck Index is made up our minds by means of calculating a weighted geometric imply of the USD alternate price towards the basket of foreign currency, with every having a distinct weight:

- EUR – 57.6%

- JPY – 13.6%

- GBP – 11.9%

- CAD – 9.1%

- SEK – 4.2%

- CHF – 3.6%

The DXY index will increase when the USD alternate price rises in comparison to different currencies, and it decreases when the United States forex alternate price drops.

DXY ancient point of view and knowledge

Figuring out the trajectory and nuances of the DXY calls for a deep dive into its previous. Via analysing the ancient context of the Buck Index, we will be able to acquire insights into its present positioning and possible long term course.

Starting place and evolution of the DXY

The USA Buck Index, popularly referred to as the DXY, is a measure that represents the worth of the United States greenback in comparison to a basket of six vital international currencies. Established in 1973, the DXY has since grow to be a benchmark for gauging the world price of the United States greenback.

The beginning of the DXY coincided with the breakdown of the Bretton Woods machine, a framework that were in position because the finish of International Conflict II and pegged primary international currencies to the USD (with the United States greenback itself pegged to gold). With the cave in of the program, there used to be an drawing close want for a metric that might successfully gauge the energy or weak spot of the greenback towards different primary currencies, which resulted in the advent of the DXY.

The index began with a base of 100, that means that if the DXY reads 120 these days, the USD’s price has liked by means of 20% since its initiation in 1973. Conversely, a studying of 80 would point out a 20% depreciation.

All the way through its lifestyles, the DXY has passed through periodic critiques and adjustments when it comes to the weightage of the constituent currencies, even though the core set of currencies has remained in large part constant.

Vital ancient shifts and their reasons

The trajectory of the DXY over time is a testomony to the quite a lot of financial, political, and fiscal occasions that experience formed the worldwide financial panorama. One of the crucial maximum notable shifts within the DXY price had been:

- Mid-Nineteen Eighties appreciation: the Plaza Accord in 1985 used to be a big settlement some of the G5 countries (France, Germany, Japan, the United Kingdom, and the United States) to depreciate the United States greenback towards the Eastern Yen and the German Deutsche Mark. The reason in the back of this settlement used to be the huge business deficit of the United States. This intervention resulted in a vital dip within the DXY

- Overdue Nineties surge: this period noticed the United States financial system thriving, with speedy technological developments and expansion within the tech sector resulting in the dot-com increase. The powerful financial efficiency and capital inflows made the DXY contact new highs

- 2008 financial crisis: the worldwide monetary meltdown caused by means of the housing bubble burst in the United States had vital ramifications for the DXY. First of all, there used to be a flight to protection, inflicting the greenback to realize. Then again, because the severity of the disaster changed into obvious, and central banks international began slashing rates of interest, the DXY skilled really extensive volatility

- Publish-2015 depreciation: within the aftermath of the 2008 disaster, the Federal Reserve launched into a sequence of quantitative easing programmes. It used to be best round 2015 that the Fed started to normalise its insurance policies, resulting in a relative weakening of the United States greenback in anticipation

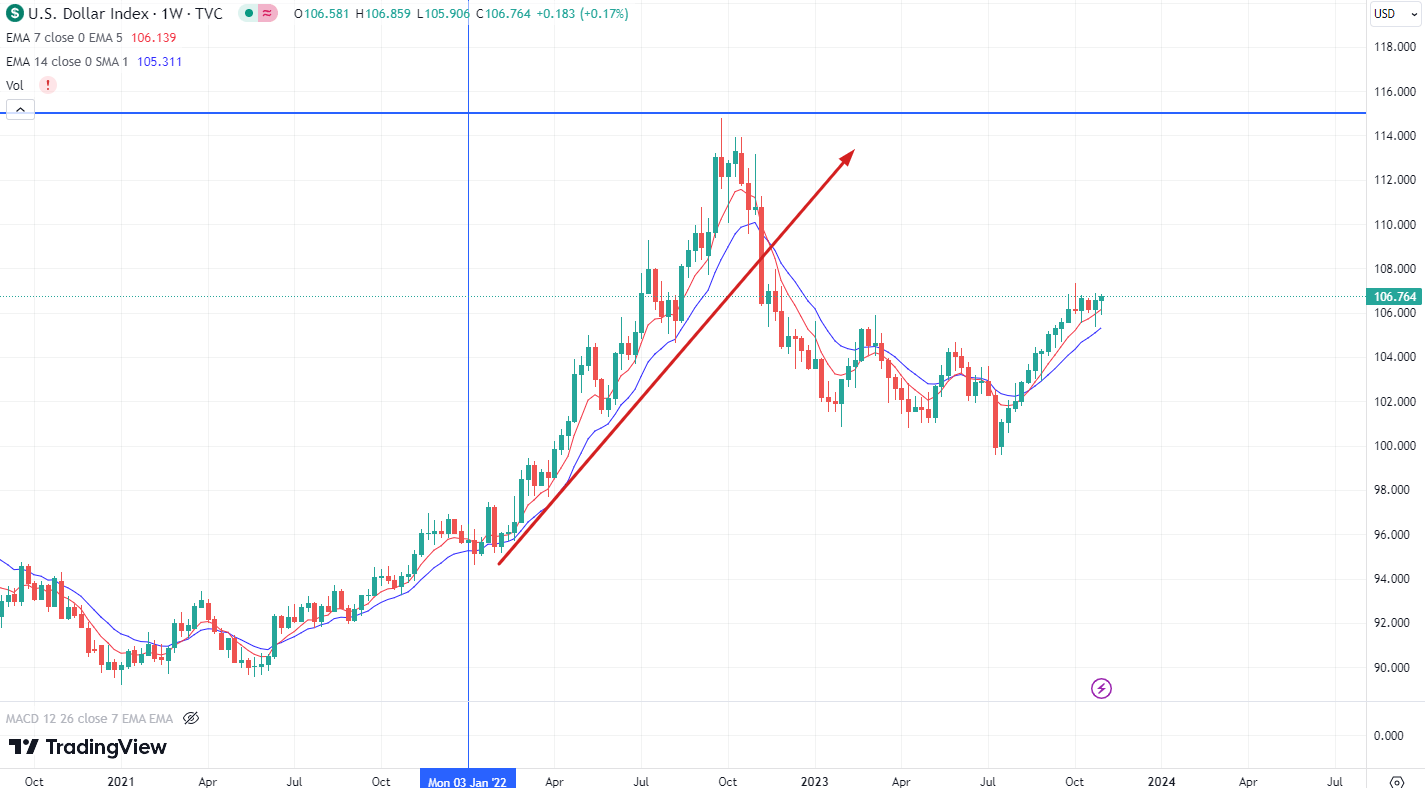

- 2022 surge: because the starting of 2022, the Federal Reserve has initiated a financial tightening coverage amid the tip of the Covid-19 pandemic. Moreover, the Russian invasion of Ukraine and the power disaster performed a job within the strengthening of the USD

Elements influencing the DXY

Financial signs

Political eventualities

- Presidential and congressional elections

- Speeches and feedback from political leaders

- Speeches and feedback from Federal Reserve officers

- Debates and choices at the nationwide debt ceiling

- Political scandals

International crises and their have an effect on

The USA greenback, as the worldwide reserve forex, has a tendency to beef up right through disaster traits and inventory marketplace declines. Due to this fact, the DXY index additionally strengthens when rates of interest upward thrust, as world traders understand the USD as a safe-haven asset for keeping and lengthening their capital right through difficult occasions.

Methodologies for DXY forecasting

The USA Buck Index can be utilized each for momentary DXY buying and selling and long-term making an investment. It’s unattainable to shop for or promote the index without delay since that is only a calculated price, however it may possibly function steering when buying and selling quite a lot of monetary tools. Elementary research, technical research, or indicator research can be utilized to make a buying and selling choice.

Elementary research

When making buying and selling choices, this way addresses basics such because the Fed’s coverage, financial statistics, and the present state of affairs in international monetary markets. This can be each momentary buying and selling on vital information and long-term making an investment in accordance with adjustments in the United States regulator’s financial coverage.

Instance:

- The USA Federal Reserve has been tightening its financial coverage since 2022 to fight emerging inflation. With rate of interest hikes being a favorable issue for the United States greenback, the DXY confirmed vital expansion in 2022, hiking from about 95.00 to 115.00

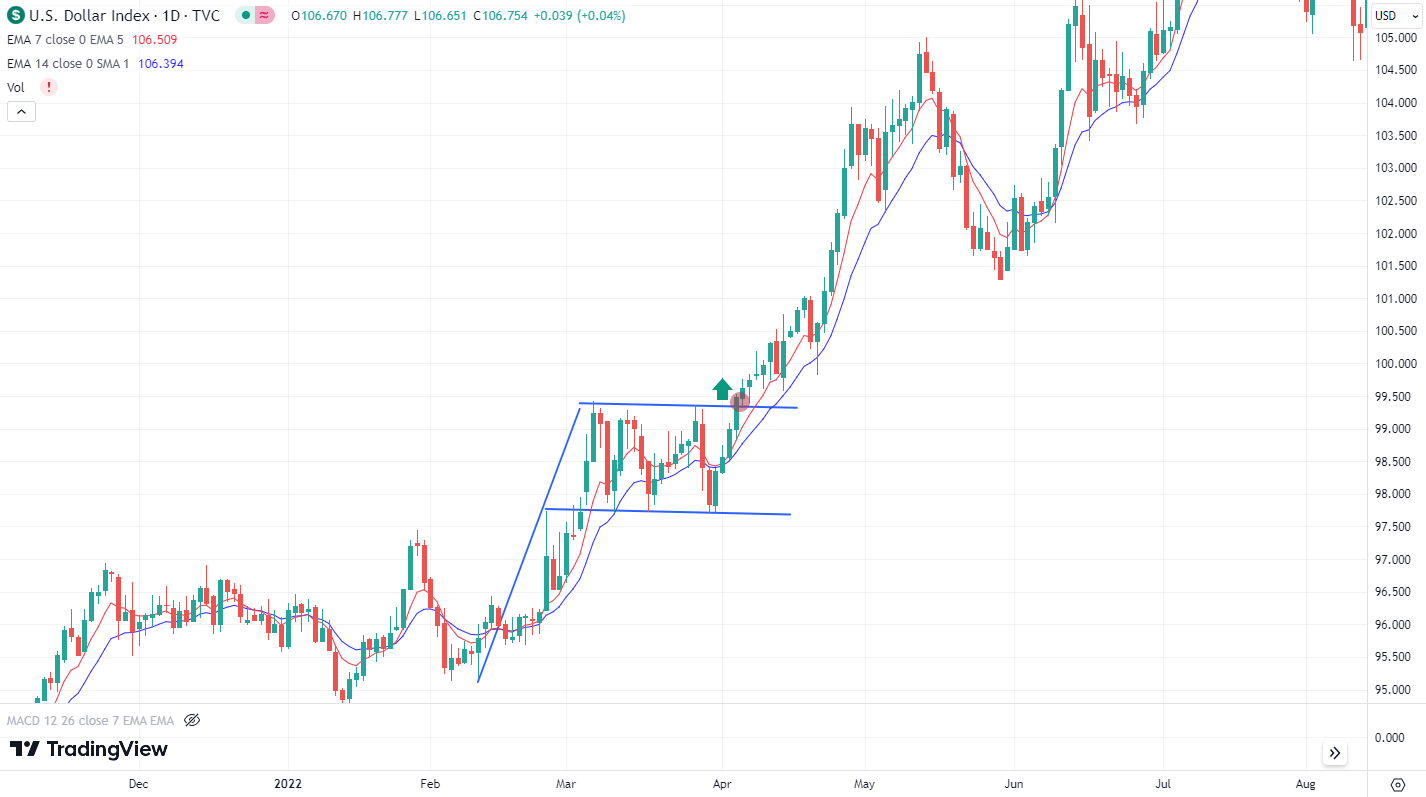

Technical research

Technical research comes to assessing ancient marketplace information, essentially costs and transaction volumes, to forecast long term worth actions. This technique means that the fee displays the overall present marketplace data, which is why it focuses principally on a worth motion, now not at the causes in the back of any adjustments.

Offers are in accordance with the DXY chart research. For this objective, classical technical research is used at the side of quite a lot of proprietary tactics such because the Elliott wave idea and techniques of Linda Raschke, Invoice Williams, and different well-known investors. Worth patterns, candlestick combos, and Worth Motion patterns can also be used for buying and selling.

Instance:

- In March-April 2022, right through an energetic upward thrust within the index, a Flag continuation worth trend shaped at the day by day chart

- When the fee closed above the higher trend line, this used to be a sign to shop for, which used to be showed by means of additional worth expansion

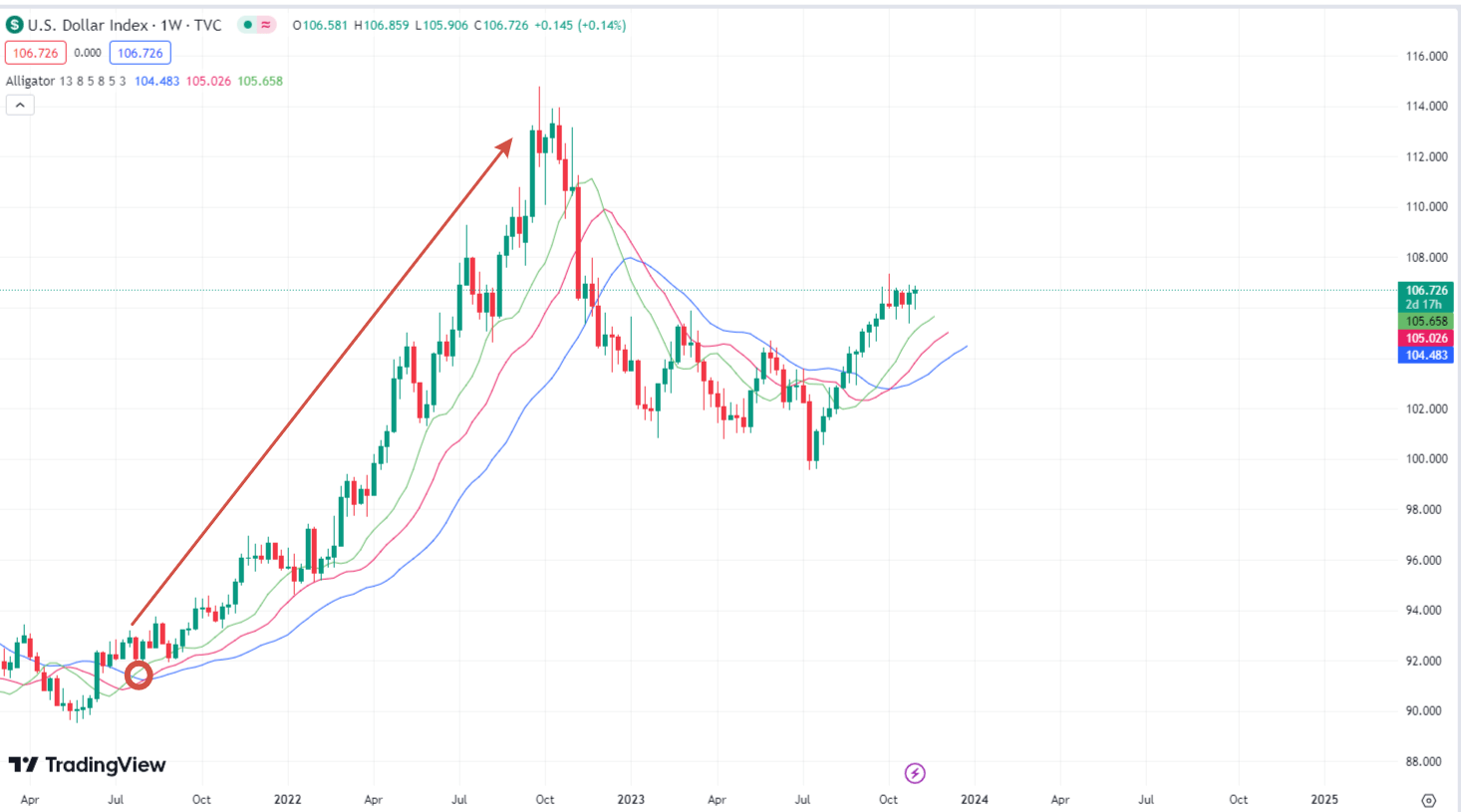

Indicator research

Various buying and selling signs can be utilized to analyse and seek for buying and selling answers involving the DXY. The average follow is to take one compound built-in indicator or a number of easy signs. They are able to even assist automate buying and selling, developing particular algorithms – buying and selling advisors.

Instance:

- We use a well-liked Alligator pattern indicator

- Amid a getting better financial system, in 2021 the W1 chart shaped a sign to shop for an asset by means of the index: the indicator strains crossed every different and reversed upwards

- At some point, the index quotes persisted to upward thrust

DXY index efficiency: the energy of the USD displays the Federal Reserve’s price hike cycle

The USA Federal Reserve has been taking energetic measures lately to fight inflation by means of tightening financial insurance policies. Since 2022, the rate of interest has steadily risen from 0.25% to five.5%, the absolute best price for 22 years. The rate of interest hike cycle had a vital have an effect on on the United States Buck Index, which skilled constant expansion in 2022, emerging from about 95.00 to 115.00.

In 2023, the DXY displays combined sideways efficiency. It began the 12 months close to the 103.50 mark, hit a prime of 105.88 later, after which corrected downwards, pushed by means of considerations over a possible recession in the United States. When drafting this text on 31 October 2023, the quotes have been on the upward thrust, soaring round 106.71. In case of additional rate of interest hikes in the United States and no indicators of a recession, the index quotes in 2024 might achieve the 2022 prime of 115.00.

DXY reside chart

DXY forecast for 2024

Within the quick run, DXY forecasting is dependent upon upcoming financial occasions, international sentiments, and adjustments in financial insurance policies altogether. For the reason that the monetary panorama can alternate abruptly right through the 12 months, underneath are some ideas and forecasts for the DXY for the following three hundred and sixty five days.

- Consultants on the Economic system Forecast Company (EFA) be expecting the DXY price to be 101.34 by means of the tip of 2024

- The Pockets Investor portal predicts that the index might upward thrust to 113.51 by means of the tip of 2024

- In keeping with the forecast of knowledge aggregator Buying and selling Economics, the index will achieve 111.74 by means of the tip of 2024

How one can use DXY forecasting

The DXY forecast isn’t simply a speculative instrument however holds vital pragmatic price for quite a lot of stakeholders within the monetary global. Figuring out the prospective trajectory of the USD in comparison to a gaggle of alternative primary currencies can tell choices starting from funding methods to financial coverage. Let’s discover how other entities can utilise DXY forecasting.

For Buyers

Portfolio Diversification: Via predicting the energy or weak spot of the USD, traders could make knowledgeable choices on asset allocation, making sure they have got a mixture of belongings that may resist possible forex fluctuations.

Overseas Investments: If the DXY is predicted to weaken, investments in international belongings may be offering higher returns when transformed again to USD. Conversely, a strengthening DXY would possibly favour home investments or the ones in dollar-denominated belongings.

Hedging Methods: Predicting the motion of the DXY can assist traders hedge their portfolios towards forex dangers. For example, if the DXY is forecasted to say no, traders would possibly believe making an investment in belongings which might be inversely correlated to the greenback.

For Buyers

Foreign money Buying and selling: the Forex market investors can utilise DXY forecasts without delay to business the USD towards different currencies. Predictions at the index’s motion can information purchase or promote choices.

Commodities Buying and selling: Many international commodities, like oil, are priced in bucks. A forecasted upward thrust within the DXY would possibly trace at possible declines in commodity costs and vice versa.

Technical Methods: Quick-term investors, particularly those that depend on technical research, can use DXY forecasts to substantiate or problem their chart-based predictions, incorporating elementary insights into their methods.

Possibility Control: Via maintaining a tally of the anticipated trajectory of the DXY, investors can position prevent losses, take income, and organize their leverage extra successfully, protective their positions from sudden shifts.

FAQ

The DXY, often referred to as the United States Buck Index, is a measure of the worth of the USD relative to a gaggle of six primary global currencies: the Euro (EUR), Eastern Yen (JPY), British Pound (GBP), Canadian Buck (CAD), Swedish Krona (SEK), and Swiss Franc (CHF). The significance of the DXY lies in its illustration of the United States greenback’s energy and general status within the international financial system. Tracking the DXY can give insights into international financial well being, business balances, and possible shifts in world capital flows.

The DXY index is a weighted geometric imply of the USD’s price towards the six primary global currencies discussed previous. Each and every forex is assigned a particular weight in accordance with its significance and relevance in world business and finance. The biggest weight is given to the Euro, adopted by means of the Yen, Pound, and so forth. The index used to be to start with set to 100.000 in its base 12 months of 1973, and its price fluctuates in accordance with the relative energy of the United States greenback towards the basket of currencies.

The DXY serves as a benchmark for the USD’s energy. When the DXY rises, this is a sign that the USD is strengthening in comparison to the opposite primary currencies within the basket. Conversely, when it falls, it suggests a weaker USD. As many commodities (like oil and gold) are priced in US bucks, a more potent greenback can imply upper commodity costs for international locations the usage of different currencies.

You’ll be able to in finding detailed details about it within the article. In brief, a number of elements can affect the DXY: rates of interest, primary financial signs (GDP, employment, and inflation charges), political problems, marketplace volatility, and business balances.

Sure, the DXY is usually a precious instrument for the Forex market investors. Because it displays the USD’s energy towards a basket of primary currencies, it may give investors insights into broader marketplace developments.

* – The TradingView platform provides the charts on this article, providing a flexible set of gear for inspecting monetary markets. Serving as a state of the art on-line marketplace information charting provider, TradingView lets in customers to interact in technical research, discover monetary information, and connect to different investors and traders. Moreover, it supplies precious steering on the best way to learn foreign exchange financial calendar successfully and provides insights into different monetary belongings.