NVIDIA and Teradyne Inventory Research: The Results of Cathie Wooden’s Investments – R Weblog

The hot growth in information round synthetic intelligence has caused a vital build up within the inventory costs of generation corporations. On the other hand, Cathie Wooden, the CEO of ARK Funding Control LLC, who won popularity in 2020 for her daring investments in generation corporations, has selected to divest stocks of one of the most number one beneficiaries of AI building, NVIDIA Company (NASDAQ: NVDA). She is now striking her bets on any other participant on this sector, specifically Teradyne Inc. (NASDAQ: TER).

On this article, we will be able to analyse Cathie Wooden’s funding in NVIDIA Company and check out to give an explanation for the explanations in the back of her determination to promote stocks of the company. We can additionally have a look at Teradyne Inc. and discover the the reason why it stuck the eye of the CEO of ARK Funding Control LLC. As well as, we will be able to proportion the most recent inventory research of the 2 companies.

Take part within the RoboForex spouse promotion with a complete prize pool of one million USD! Click on at the banner to be informed concerning the participation prerequisites and sign up for the money prize attracts.

Cathie Wooden’s funding in NVIDIA

Cathie Wooden, the founder and CEO of ARK Funding Control LLC, leads a gaggle of 9 budget below her corporate’s umbrella. Let’s read about their blended investments in NVIDIA Company.

The stocks of NVIDIA, a number one American developer and producer of graphics processing devices and microchips, were constantly provide within the portfolios of Cathie Wooden’s budget since their inception in 2014. On the other hand, by means of the tip of 2020, the choice of those stocks within the portfolio had considerably reduced from 1 million to only 16 thousand devices. In spite of this, the worth of those stocks had surged by means of an outstanding 3500% throughout that length.

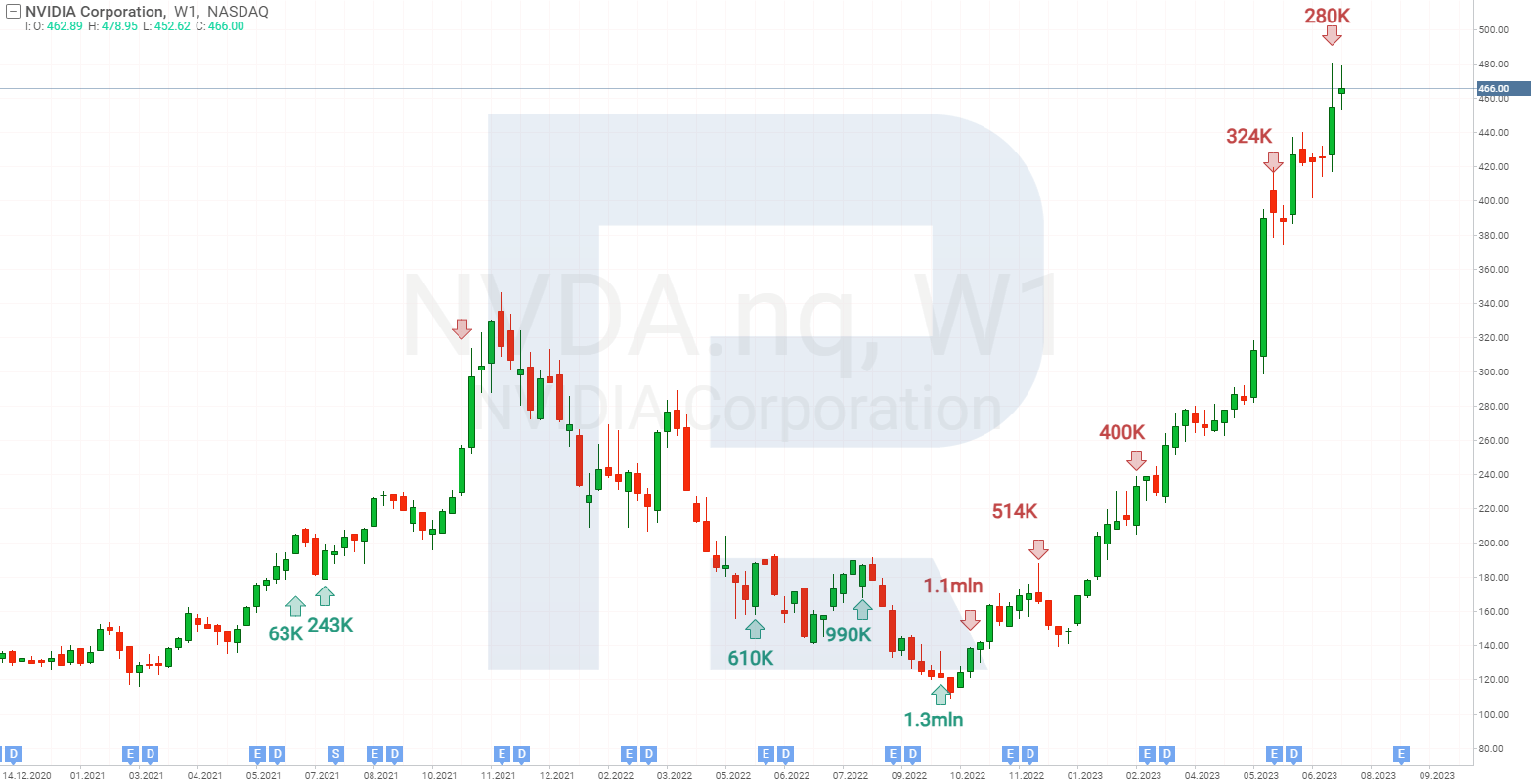

In June 2021, ARK Funding Control LLC budget resumed their investments in NVIDIA Company by means of obtaining roughly 47 thousand stocks. In July 2021, the location grew to 243 thousand stocks. A notable match befell on July 20, 2021, when a inventory break up of the generation company at a 1:4 ratio resulted in an build up within the choice of stocks within the budget’ portfolios to 972 thousand.

In August 2021, the inventory worth of NVIDIA Company hit an all-time excessive of 208 USD and endured to develop. On the similar time, the budget started promoting those stocks, decreasing the volume to 470 thousand by means of November 2021. The IT corporate’s inventory reached the extent of 330 USD according to unit in November 2021, and then they skilled a continual decline lasting till October 2022.

Cathie Wooden returned to making an investment in NVIDIA Company in Would possibly 2022, expanding the choice of stocks within the portfolio to 610 thousand. They have been valued at roughly 180 USD according to unit at the moment. Because the inventory worth reduced, the budget of ARK Funding Control LLC began amassing stocks, with the portfolio attaining 1.3 million stocks of the generation company by means of 4 October 2022. This used to be the height of Cathie Wooden’s funding within the corporate. It’s value noting that on 14 October, the quotes of NVIDIA Company hit a low of 108 USD.

Later, as soon as the worth of the IT corporate inventory started to upward thrust, the budget set about promoting the rest stocks abruptly. Via the start of 2023, simplest about 500 thousand stocks remained within the portfolio. Taking a look on the chart, we will be able to suppose that Cathie Wooden bought greater than part of the stocks at or close to their reasonable purchasing worth, leading to little to no benefit.

NVIDIA’s quotes surged 231% from January to July 2023. On the other hand, ARK Innovation ETF (NYSE: ARKK), which is intently monitored by means of mass media and traders, bought all NVIDIA Company stocks as early as the start of the 12 months. Which means that the fund overlooked a superb opportunity to generate excessive income, which led to a powerful wave of discontent amongst traders.

As costs of NVIDIA Company inventory went up, Cathie Wooden endured to promote the rest choice of stocks. In Would possibly 2023, gross sales was extra in depth, with the choice of the corporate’s stocks within the budget’ portfolios falling to 280 thousand by means of July.

As seen, Cathie Wooden used to be actively decreasing her holdings in NVIDIA Company inventory right through 2023, whilst its worth skyrocketed. In February, she defined that such movements have been pushed by means of the tech company’s overvaluation, which used to be 50 instances upper than its attainable long term benefit.

In July, the CEO of the funding corporate mentioned that NVIDIA Company is certainly a vital funding in synthetic intelligence, with its valuation being 25 instances upper than the prospective long term benefit. On the other hand, she additionally emphasized that her budget most well-liked to put money into extra promising AI-related corporations that have not but stuck the eye of quite a lot of traders. One such notable discovery used to be Teradyne Inc.

Participate within the RoboForex spouse promotion with a prize pool of one million USD. 60 winners obtain money prizes every month! Click on at the banner to be informed concerning the participation prerequisites and sign up for the promotion.

Cathie Wooden’s funding in Teradyne

Right through an interview with Bloomberg Radio on 17 July 2023, Cathie Wooden known as Teradyne Inc. inventory the most efficient new AI funding thought. In her opinion, america developer and producer of check and high quality regulate apparatus for cutting edge and complicated applied sciences has nice attainable for enlargement.

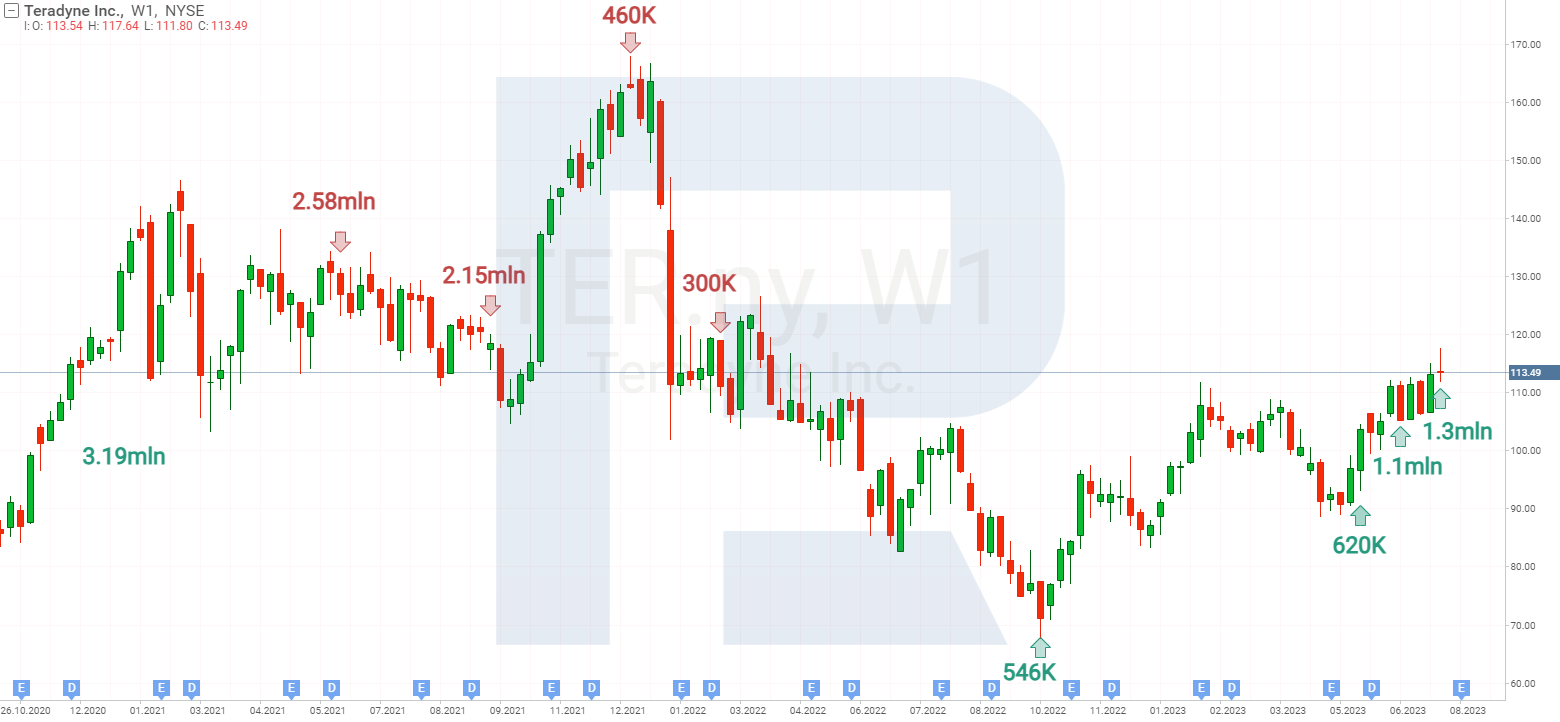

The budget of ARK Funding Control LLC have lengthy invested in Teradyne Inc. inventory. Via 2021, they’d roughly 3 million stocks of the generation corporate of their portfolio, with this quantity losing to 300 thousand by means of early 2022.

ARK Self reliant Era & Robotics ETF (NYSE: ARKQ) and ARK House Exploration and Innovation ETF (NYSE: ARKX) have been the one ones to have Teradyne Inc. inventory of their portfolios till early June. Later, the stocks have been added to the portfolio of the flagship ARK Innovation ETF, which right away attracted investor consideration.

Via the tip of June, the full portfolio of ARK Funding Control LLC already had 1.09 million stocks of the IT corporate, with their quantity rising to one.3 million by means of 20 July. The typical purchasing worth amounted to about 100 USD, with the present worth exceeding 110 USD.

Teradyne briefly

The primary benefits of Teradyne

- A large portfolio of services and products. Teradyne Inc. operations quilt quite a lot of marketplace segments akin to semiconductor merchandise, wi-fi generation, information garage, complicated electronics, robotics, aerospace, and defence trade. This permits the corporate to diversify its resources of source of revenue and cut back dependence on one sector

- Main place in semiconductor trying out. This line of industrial guarantees a big a part of Teradyne Inc.’s earnings. It’s in sturdy call for and has possibilities for enlargement amid an atmosphere of creating AI merchandise, 5G applied sciences, cloud computing, and automobile digital techniques

- Potentialities within the robotics sector. This trade is a superb alternative for Teradyne Inc.’s enlargement and marketplace growth. The corporate obtained robotic builders akin to Common Robots, Energid Applied sciences, and AutoGuide Cellular Robots. Teradyne Inc. now manufactures robots that may collaborate seamlessly with people on manufacturing traces, in addition to totally self sufficient cellular robots able to navigating via warehouses and logistics centres independently

Dangers of making an investment in Teradyne

- Cyclical and risky call for. The corporate’s services and products rely on fluctuations in call for within the semiconductor and electronics trade and on adjustments in generation traits and client personal tastes

- Intense festival. The corporate is competing for a marketplace proportion towards Advantest Company, Cohu Inc., Nationwide Tools Company, and different primary providers of generation check apparatus

Revel in buying and selling within the high-tech R StocksTrader terminal! Actual shares, complicated charts, and a loose buying and selling technique builder. Click on at the banner and open an account!

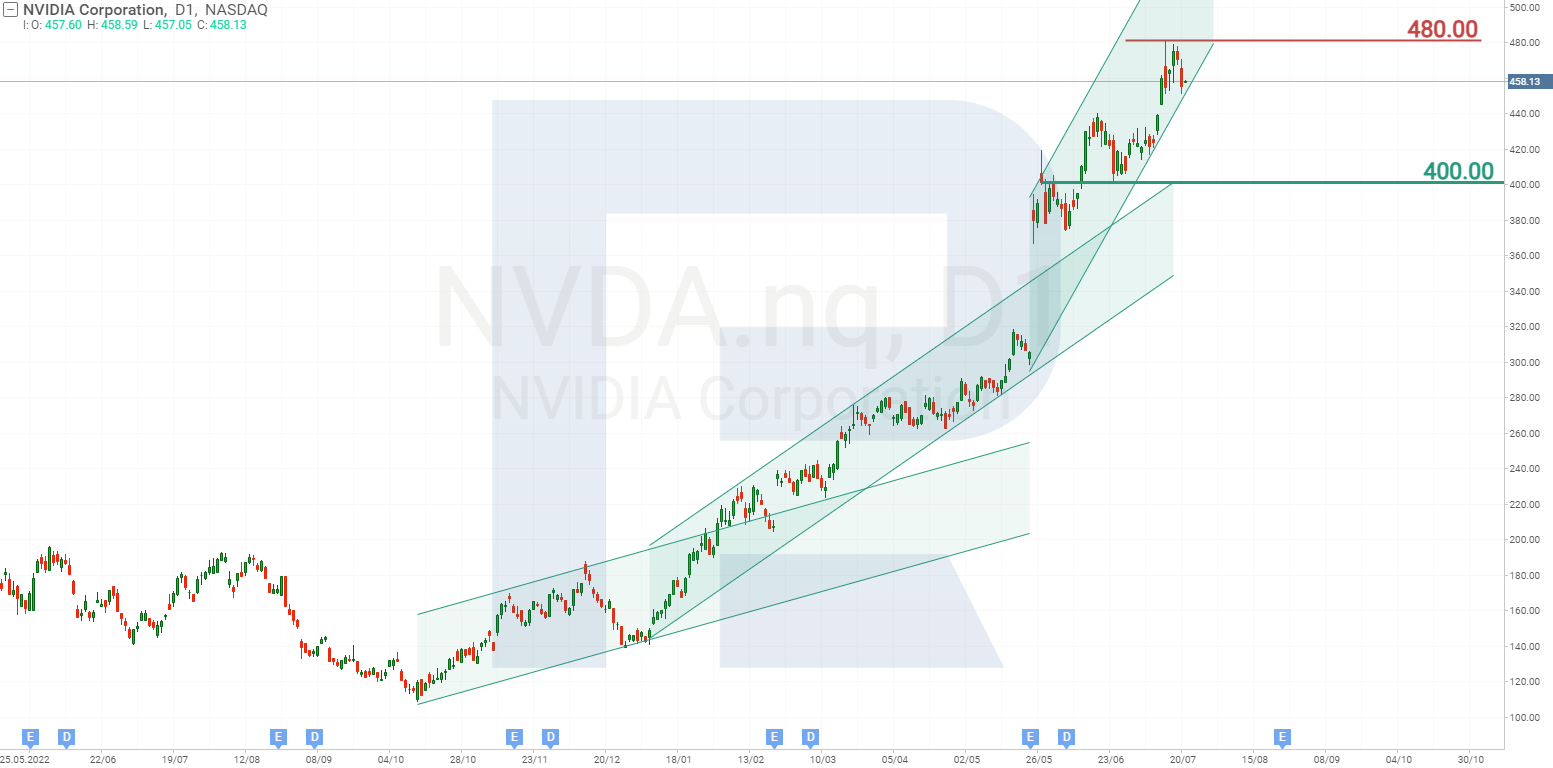

Research of NVIDIA’s inventory worth

NVIDIA Company inventory used to be buying and selling in an ascending channel from October 2022 to February 2023, and then its higher boundary used to be damaged, and the fee surged additional. On 18 Would possibly, the inventory quotes reached an all-time excessive of 316 USD, and they’ve since endured to business in a brand new ascending channel.

Seven days later, the corporate launched a quarterly document that boosted its stocks and resulted in any other breakout of the higher channel line. This time, the quotes have hit an all-time excessive at 480 USD and proceed to business within the 3rd ascending channel.

On the time of writing, the quotes are trying out the pattern line. A breakout of this line could make the fee fall to the closest give a boost to on the stage of 400 USD. If the scoop panorama is sure, the fee may just wreck the resistance at 480 USD and keep growing.

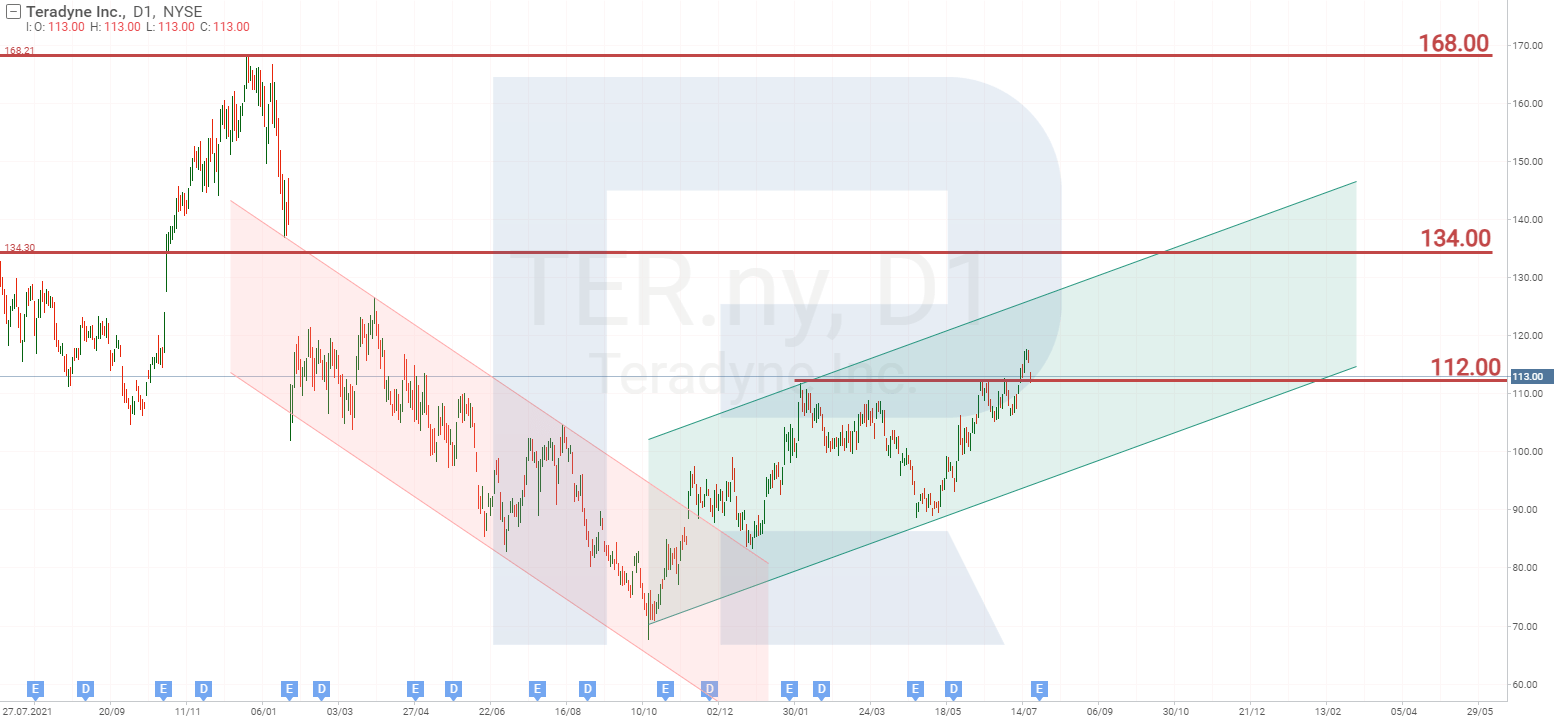

Research of Teradyne’s inventory worth

Teradyne Inc. inventory rose in worth now not as actively as NVIDIA Company inventory and won simplest 30% for the reason that starting of 2023. It’s buying and selling in an ascending channel and has already risen above the resistance at 112 USD, which opens alternatives for additional worth enlargement to 134 USD. If the quotes go back underneath the extent of 112 USD, this may occasionally point out the improvement of a corrective inventory decline, which might force the fee right down to the fad line at 100 USD.

Abstract

The research of Cathie Wooden’s funding in NVIDIA Company confirmed that since 2014, she has taken phase in the primary motion of the inventory, which resulted within the stocks skyrocketing greater than 3500%. The fee enlargement of 230% that used to be partly overlooked out for the reason that starting of 2023 is not any fit for this motion, and due to this fact it could be a mistake to mention that the investments of ARK Funding Control LLC budget within the generation company have been useless.

Now the funding corporate is having a bet on Teradyne Inc. inventory, and that continues to be observed whether or not this funding will usher in benefit. It’s value noting that the yearly earnings of NVIDIA Company used to be 4.5 billion USD in 2014, when Cathie Wooden started to shop for its stocks, and reached 28 billion USD in 2022. The earnings of Teradyne Inc. amounted to three.15 billion USD in 2022, and it’s attention-grabbing how this determine will trade over the following few years.