Marubozu Candlestick Trend: What Is and Tips on how to Business

On this article, you’re going to be informed concerning the Jap Marubozu candlestick and what indicators it offers to consumers and dealers.

Translated from Jap, the identify of the development way “close-cropped” or “shaven-head”. This development is very similar to Jap candlesticks reminiscent of bullish or bearish counterattack and belt dangle. All of them have a big actual frame that has quick or no shadows.

After learning the object, it is possible for you to to spot this determine at the chart and observe it in buying and selling.

The thing covers the next topics:

What Is Marubozu Trend?

The Marubozu development is an extended candle with a big frame, without a or very quick shadows. There are 3 forms of Marubozu candlesticks on value charts:

Marubozu open candle has a complete frame without a shadow at the aspect of the hole value and a small shadow at the aspect of the final value.

Marubozu shut candle has no shadow at the final value aspect and has a small wick at the opening value aspect.

- Marubozu complete candle has just a frame and no shadows.

Tips on how to To find the Marubozu Candlestick Trend?

It’s laborious to omit this candle, as it’s massive in dimension. Its look at the chart signifies a robust motion in any explicit course. There are two forms of Marubozu candlestick patterns:

bullish Marubozu;

bearish Marubozu.

Bullish Marubozu

A bullish Marubozu is a white (or inexperienced) candlestick with a big frame that has no or very small shadows.

The illusion of this development at the value chart signifies that consumers keep watch over the marketplace, and the uptrend is more likely to proceed. This candlestick is also known as the white Marubozu.

Bearish Marubozu

The bearish Marubozu candle is very similar to the bullish Marubozu. It has the similar lengthy frame and no shadows. The one distinction is the colour of the candlestick. It may be crimson or black.

Skilled investors name this development black Marubozu. It signifies the continuation of the downtrend.

Affirmation of Marubozu Candlestick Trend

Most of the time, the “Marubozu brothers” are shaped on larger buying and selling volumes. Due to this fact, to spot Marubozu, upload a quantity indicator, MA Move device, and MACD to the chart.

The crossing of the 0 zone by means of MACD and transferring averages serves as an extra affirmation of the Marubozu candlestick. Due to this fact, it’s winning to open a purchase or a promote business on the intersection of those signs.

Different more potent reversal candlestick patterns, reminiscent of bullish hammer, placing guy, inverted hammer, and others, can function further affirmation of the Marubozu candle’s look on the backside or on the most sensible.

You’ll be able to be informed extra about learn how to learn a candlestick chart on this article.

Will have to You Believe the Marubozu Trend?

There are lots of equipment for technical marketplace research, together with candlestick patterns. Then again, you will have to no longer totally believe patterns and signs, as they simply point out a conceivable end result however don’t ensure it.

Guidelines for buying and selling at the candlestick chart, together with the Marubozu development:

don’t business in opposition to the craze; open trades within the course of its motion;

set quit losses and practice threat control laws with the risk-reward ratio of one:3;

business candlestick patterns entered at ranges;

find out about the peculiarities of a traded tool, as a few of them might forget about the degrees.

Tips on how to Business Marubozu Candlesticks

The main of buying and selling Marubozu candlesticks and different candlestick patterns is similar. Let’s take USCrude for example.

The 15-minute chart displays the formation of a bullish Marubozu development as a part of the morning megastar reversal development. Earlier than that, a hammer reversal development was once shaped, which warned investors that costs have been in a position to upward thrust and the asset reached an area backside.

The mix of those patterns served as the primary sign for the bulls. Then any other closed Marubozu candle was once shaped. At this level, in keeping with the MACD technical indicator, there’s an upward crossing of the 0 line. This issue in spite of everything showed the native uptrend.

After cautious research, I made up our minds to open a minimal lengthy business of 0.01 loads. Prevent-loss was once set at 115.320. A while later, the business was once closed intraday with a benefit of $12.41.

Buying and selling with Bullish Marubozu

Set of rules for buying and selling bullish white Marubozu:

search for a bullish Marubozu candle within the zone of low costs after a downtrend, or in an uptrend when the resistance degree is damaged out;

input purchases after a temporary downward correction or throughout an additional value enlargement above the utmost value of the Marubozu candle;

set a quit loss reasonably beneath the minimal value of the Marubozu candle development;

position take benefit orders on the nearest robust resistance degree, in case of a worth reversal.

Buying and selling with Bearish Marubozu

The set of rules for buying and selling the bearish Marubozu candle development is the other of the bullish development:

the development is shaped in a bullish pattern after attaining a robust resistance degree within the zone of prime costs, or in a downtrend when the strengthen degree is damaged;

it’s conceivable to open a quick business after a quick upward correction or beneath the low of the candlestick development;

set quit loss simply above the prime of the Marubozu candlestick;

take income when a strengthen degree is reached or when indicators of a reversal seem.

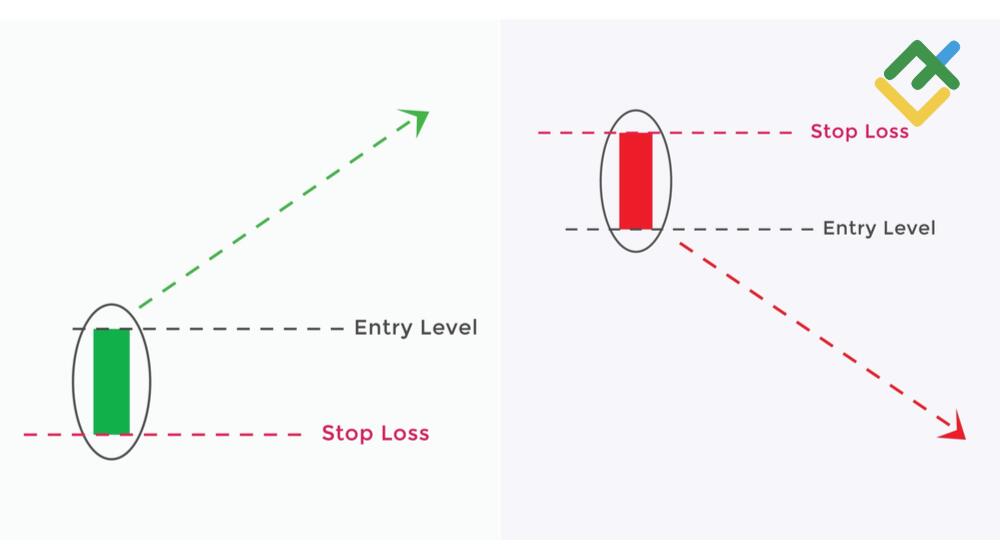

Marubozu indicators and environment stop-loss

A purchase or promote business is opened after the Marubozu candle development is showed by means of technical signs or different candlestick patterns.

When a bearish Marubozu seems, set the quit loss reasonably above the prime of the lengthy crimson candlestick. If a bullish Marubozu seems within the chart, set the quit loss slightly under the golf green candle’s low.

Trend Examples

There are 3 various kinds of Marubozu candles. The development seems in any monetary markets, reminiscent of securities, foreign money, cryptocurrency, and commodity markets.

Beneath is an instance of a Marubozu development on an Apple inventory chart. After the semblance of a black open bozu, one of the crucial forms of Marubozu development, the asset hastily declined, overcoming native strengthen ranges and forming different black Marubozu patterns.

A bearish open Marubozu candle signifies robust power by means of dealers at the value from above. In consequence, the asset declines, the place the bulls’ quit losses are caused. This makes the bears even more potent.

The bullish Marubozu patterns at the BTCUSD chart are proven beneath.

The day by day chart displays that the asset continues to upward thrust after a bullish Marubozu final development seems. A protracted white Marubozu final development warned investors of an drawing close bullish rally and value enlargement.

Marubozu and Engulfing Trend

Marubozu and engulfing are reversal patterns in candlestick research. Beneath are the variations between those two patterns:

Marubozu is a unmarried candlestick development;

the engulfing development is composed of 2 candles, the place the second one candle engulfs the former one;

the engulfing candle may also be prime or low, since crucial factor is the engulfing of the primary candle’s frame;

after the semblance of a Marubozu within the chart, the fee starts a large downward or upward power, with virtually no corrections;

the frame of the Marubozu candle is greater than the frame of the engulfing candle.

For each patterns, shadows don’t seem to be in particular essential. Then again, the vintage Marubozu and engulfing patterns shouldn’t have shadows in any respect. This means the prevalence of one of the crucial buying and selling events, which results in a worth reversal up or down.

Conclusion

It will have to be wired that bullish and bearish Marubozu are reversal patterns in candlestick research that seem in quite a lot of monetary markets and time frames.

As well as, the Marubozu development indicators marketplace individuals’ rising process, whilst larger marketplace volatility supplies a possibility to open winning trades.

This text lined the next sides:

traits of the Marubozu development;

forms of the Marubozu development;

rules of buying and selling the Marubozu development;

variations between engulfing and Marubozu;

an instance of are living buying and selling this development.

To increase your wisdom concerning the Marubozu development, use the handy and practical LiteFinance on-line platform. You’ll be able to take a look at your hand at a unfastened demo account with out the danger of shedding finances.

Marubozu Candlestick FAQs

The content material of this newsletter displays the writer’s opinion and does no longer essentially replicate the authentic place of LiteFinance. The fabric revealed in this web page is supplied for informational functions most effective and will have to no longer be thought to be as the availability of funding recommendation for the needs of Directive 2004/39/EC.