Managing $960,000 With The5ers Prop Company After Most effective 8 Days

Complex the Forex market Weblog

September 29, 2022 | 3:33 pm | Complex the Forex market Weblog

September 29, 2022 | 3:33 pm

Complex the Forex market Weblog

Brandon R, 28 years previous, from the US.

Brandon is a Stage 4 Funded Dealer. He has effectively handed 3 ranges with 3 other accounts. He’s now managing $960,000.

His subsequent undertaking is to succeed in a ten% benefit to double his finances to $1,920,000.

We spoke with Brandon about his buying and selling plan, insights, and classes received whilst buying and selling in Forex and our platform as a funded dealer.

Click on right here for extra Inspirational classes and interviews from our skilled funded investors.

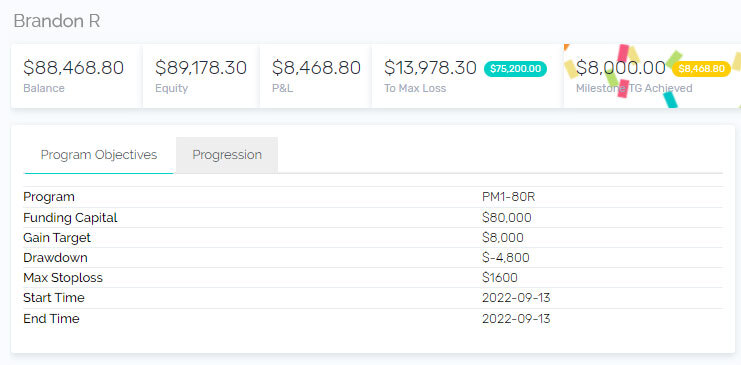

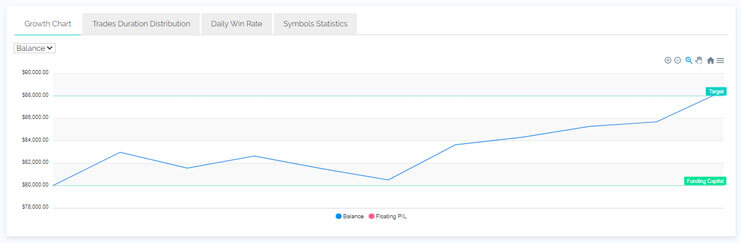

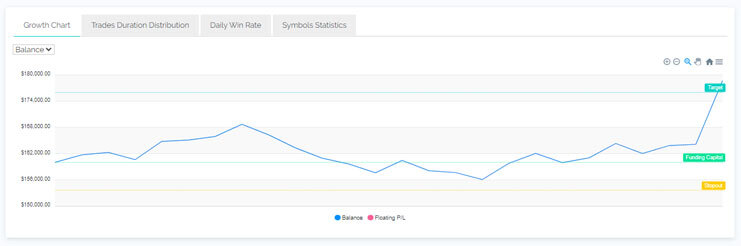

Stage 2 Low-Possibility $80k Account

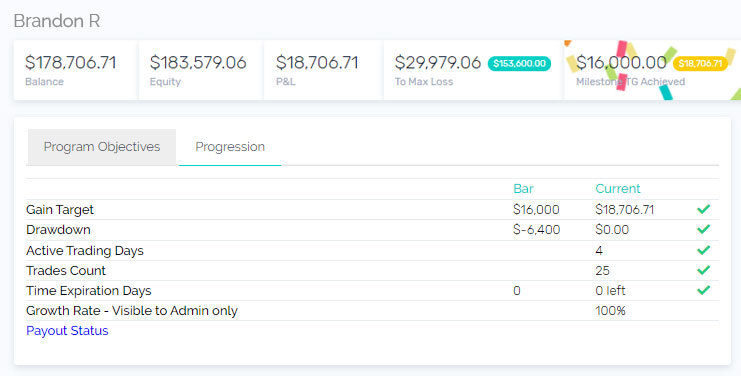

Stage 3 Low-Possibility $160K Account

A 12 months in the past, Brandon controlled greater than part 1,000,000 bucks. Watch his earlier interview.

- Let us know just a little about you and How lengthy you might have been buying and selling?

Hi. I’m 28yrs previous and from Chicago, IL. At the beginning was once offered to buying and selling in 2016/2017 via other people promoting indicators and holy grail programs. I briefly stuck on that those other people weren’t if truth be told a hit and sought out a mentor to show me.

From there, I traded on and off, switching between indicators and seeking to “turn” my very own accounts and at all times blowing them. After taking a step clear of buying and selling after I joined the army, I made up our minds to return again to buying and selling.

I now had a gradual source of revenue move and may just focal point on long-term enlargement as a substitute of having wealthy briefly and quitting my Barista activity. This helped my mindset, however I nonetheless had some mental boundaries to triumph over when it got here to managing actual, massive quantities of cash. I’ve conquer the ones and now these days managing about 1 million with The5ers!

- Why, as an revel in prop dealer you select The5ers?

Smartly, unquestionably the reality you get a refund and no time crunch to cross the trial. 30-day trials on demo accounts are designed to be misplaced. Whilst I’ve remodeled 20% this month, doing that beneath out of doors force is a distinct mental combat. One that almost all fail. The5ers don’t do this and if truth be told need investors to win.

Additionally, The5ers dealer is fantastic. Execution is spot on, and no loopy slippage at entries. Additionally, a large number of agents have loopy unfold widening ahead of information occasions and at all times say (it’s our liquidity suppliers) when actually, they’re unregulated offshore agents doing shady industry. With The5ers, whilst buying and selling the FOMC, I nonetheless had not up to 1 pip unfold.

- It’s the second one time you might have reached a big account. What’s your secret?

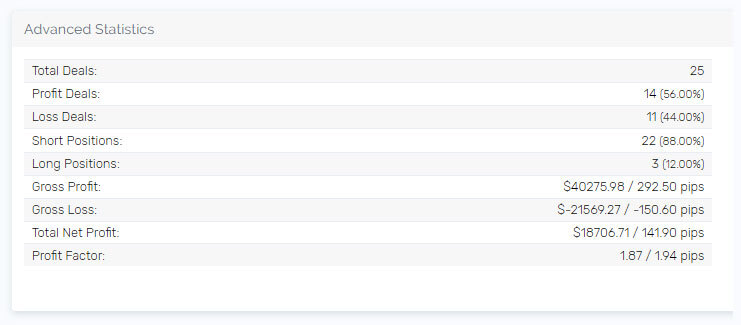

Possibility praise ratios actually lend a hand. I exploit lovely tight stops aiming for 5-7 occasions my menace. So I will be able to manage to pay for a couple of losers in a row. Additionally, I lock in benefit lovely briefly, so generally, that tight forestall is going to breakeven, so I’m working risk-free trades.

- In brief describe the way you get ready your self for the buying and selling day.

You understand, at this time, I if truth be told paintings full-time. Normally, even though, I keep up-to-the-minute with my institutional research. I’ve get entry to to investigate from the buying and selling desks of a few very massive, not unusual banks that almost all aren’t aware of. I exploit that to provide me a tight total macro image – which particularly is helping buying and selling information.

That edge dissipates the decrease time frame I industry, and I do a large number of buying and selling at the 5min – 1hr chart. It’s nonetheless a dependancy I’m rising in, however for the ones, I cherish to do a handy guide a rough meditation ahead of I open the charts, pay attention to my instinct first, then perform a little technical research in keeping with that.

- How did you modify menace control with better accounts?

I will be able to admit at first levels. I push the pace slightly, upper menace in keeping with industry, hoping to overcome the objective briefly. As I’m now buying and selling a big account, even though, there’s much more at the line. Whilst I imagine myself a discretionary dealer, I’ve set some laws now that I’ve simply hit the 1 million mark.

I’m most effective reentering trades that I’ve misplaced as soon as, and if I’ve a breakeven industry or small winner that has moved 30-40 pips in my route, I don’t industry that development anymore.

Up to now, I steadily would reenter trades, seeking to catch a development, now not in need of to leave out out. On my ultimate account, this led me into some lovely avoidable drawdown. I’m now changing into just a little extra affected person and k with lacking that transfer and stepping clear of the chart.

Along side that – I’m now not going to make use of my complete leverage anymore. Whilst I typically have an excessively prime hit price, even the most productive methods may have unhealthy classes. For this reason, I’m going to be buying and selling the similar lot sizes as my ultimate account measurement and decrease my publicity.

- What’s your psychological/mental energy, and the way did you increase it?

Hypnotherapy! This will sound loopy to a couple, however I’ve transform very conscious of my feelings via meditating. Impatience is an fearful response to seeing unfavorable value motion, worry of lacking out, and infrequently worry of letting a just right industry cross unhealthy. I labored on these items with a hypnotherapist, and I child you now not, I noticed rapid advantages.

- What would you counsel to anyone who is solely beginning with us?

There are such a large amount of issues. However I might say to get began. A demo account can’t mirror the psychology of buying and selling actual cash. A $50k account isn’t similar to a $20k eval. Beginning buying and selling and get started small however now not your feelings; regrets about losers, now not sticking in your technique (in case you are systematic) and taking earnings early or have a technique that labored in back-test and ahead check and now it’s now not. You doubt it and alter issues.

This can be a psychological sport. You don’t essentially want hypnotherapy (even though I like to recommend it) however continuously remind your self that this sport is in regards to the procedure over the result. That mindset on my own will lend a hand so much. You’re going to then transform calmer on this surroundings, which is able to steadily make other people boil over.