Li Auto Inventory Forecast – LI Technical Research

The inventory of Chinese language hybrid automotive and electrical automobile producer Li Auto Inc. (NYSE: LI) reached an all-time prime of 47 USD in August 2023. On the time of writing on 4 December 2023, the stocks had been buying and selling 31% underneath this mark, at 36 USD.

What distinguishes Li Auto Inc., and why do traders want to shop for stocks on this sector consultant? We purpose to reply to those questions, read about the company’s monetary stories, and proportion professionals’ forecasts for its shares in 2024.

Shift within the automobile business: decreased focal point on natural electrical cars

Automakers are regularly scaling again investments of their electrical automobile manufacturing, more than likely because of considerations a couple of doable decline in call for. As an example, on 26 October 2023, Ford Motor Corporate (NYSE: F) introduced a suspension of 12 billion USD in investments in electrical cars and a halt in developing a battery manufacturing unit.

Consistent with Reuters, Common Motors Corporate (NYSE: GM) and Honda Motor Corporate Ltd (NYSE: HMC) have deserted plans to supply finances electrical cars. As Bloomberg stories, Volkswagen Crew (XETRA: VOWG) is forsaking plans to construct an electrical automobile manufacturing plant. It’s price noting that the finances for this challenge was once 2 billion EUR.

Creating and mass-producing this kind of transportation incurs considerable bills, resulting in a prime ultimate automobile price that might not be reasonably priced for the typical client. On the similar time, with environmental care nonetheless trending, there’s an alternate for consumers in quest of an environmentally pleasant automotive however not able to have the funds for a pricey electrical automobile – hybrid automobiles. Those are supplied with an inside combustion engine and an electrical motor powered through a battery. In addition they function a novel machine that harnesses the power generated right through braking to price the battery.

The principle varieties of hybrid automobiles come with FHEV (Complete Hybrid Electrical Automobile) and PHEV (Plug-in Hybrid Electrical Automobile). The FHEV fees the battery the use of power launched whilst the automobile is in movement and right through braking (be aware that an exterior energy supply can not price those batteries). The PHEB boasts better batteries, which an exterior energy supply can price, and an extended riding distance in keeping with one battery price.

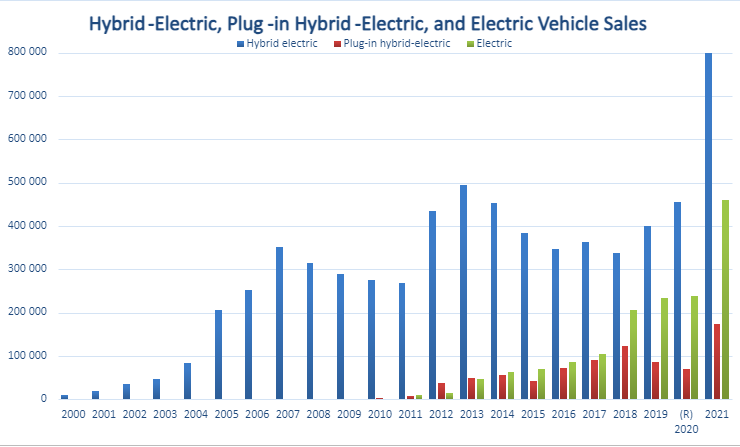

Consistent with the Bureau of Transportation Statistics and the US Power Knowledge Management, gross sales of full-hybrid electrical cars outperform the electrical automobile statistics in the United States and globally.

Li Auto’s automobile portfolio

Li Auto Inc. is a Chinese language corporate specialising in electrical and hybrid automotive manufacturing. It was once based in 2015, with its headquarters in Beijing.

The automaker’s web site recently items knowledge on hybrid Li L7, Li L8, Li L9, and electrical Li Mega. The primary 3 fashions show an SUV frame kind, whilst the latter options an MPV frame kind.

Li Mega is the primary electrical automobile in Li Auto’s line-up. A seven-seater minivan was once unveiled on the Circle of relatives Tech Day on 17 June 2023. A Qilin battery through CATL allows it to hide 500 km in keeping with 12 mins of price, with a riding vary of 700 km. Moreover, the type is provided with the Lixiang Tongxue voice assistant in response to the Thoughts GPT synthetic intelligence.

Li Auto as opposed to competition: marketplace place and profitability

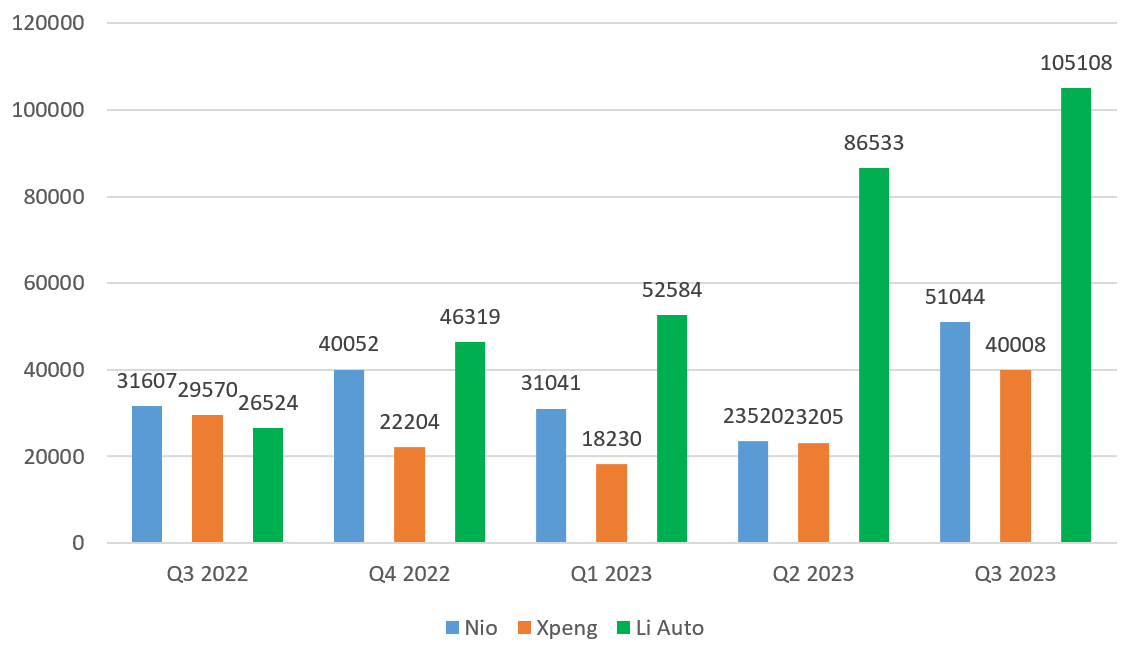

From January to September 2023, Xpeng Inc., NIO Inc., and Li Auto Inc. bought 126,067, 81,443, and 244,225 automobiles, respectively. The chart depicts the distribution of gross sales through quarter.

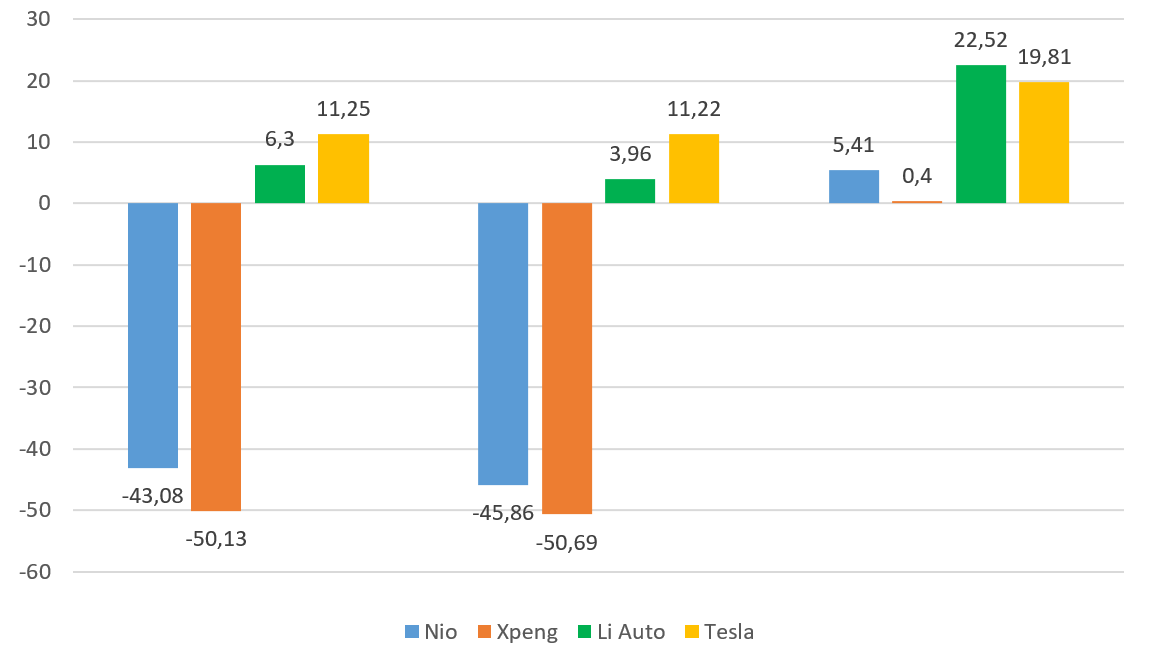

Having a look on the margins of those firms and Tesla Inc. from Q3 2022 to Q3 2023 inclusive, you will need to be aware that:

- The gross margin presentations the proportion of income after protecting manufacturing prices

- The working margin is the source of revenue generated from the corporate’s number one operations, apart from pastime on loans and taxes

- The benefit margin presentations the share of source of revenue retained as web benefit after taking into consideration all prices

The chart presentations that Li Auto Inc. and Tesla Inc. accomplished sure trade profitability. Alternatively, the United States automaker boasts the next benefit margin, additional permitting flexibility in decreasing its electrical automobile costs. Moreover, it must be famous that the Chinese language logo has a bonus within the riding vary of its automobiles.

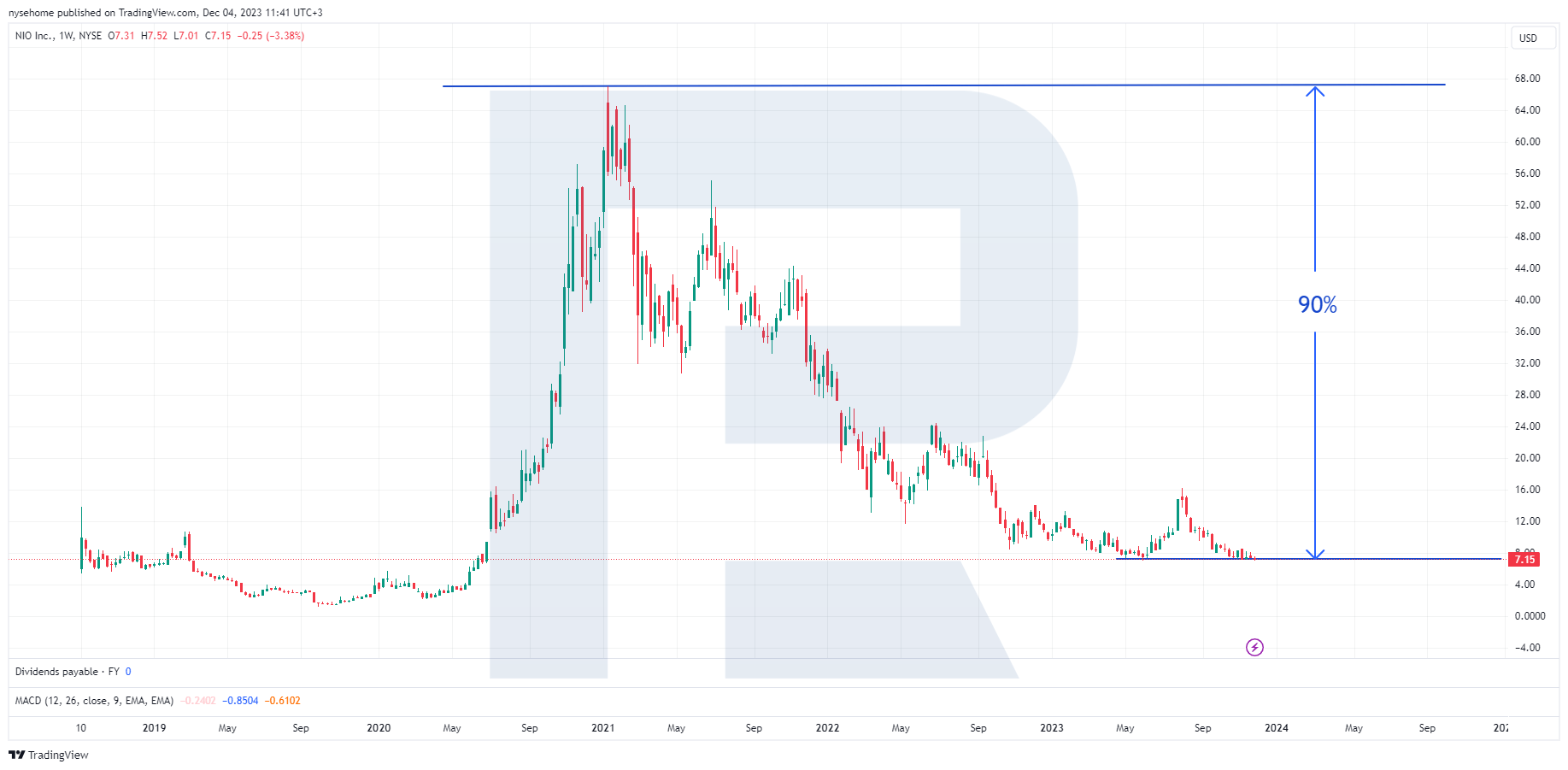

Inventory marketplace reaction: competition vs. Li Auto

In 2020, NIO Inc., Li Auto Inc., and Xpeng Inc. shares reached document values of 67, 48, and 74 USD, respectively. Tesla Inc.’s stocks surged concurrently, hitting their prime of 415 USD on 4 November 2021. Due to this fact, Chinese language automakers’ stocks underwent a correction, with NIO Inc. inventory shedding greater than others and shedding 90% from the utmost price on the time of writing. The quotes proceed to drop, indicating this asset’s loss of investor pastime.

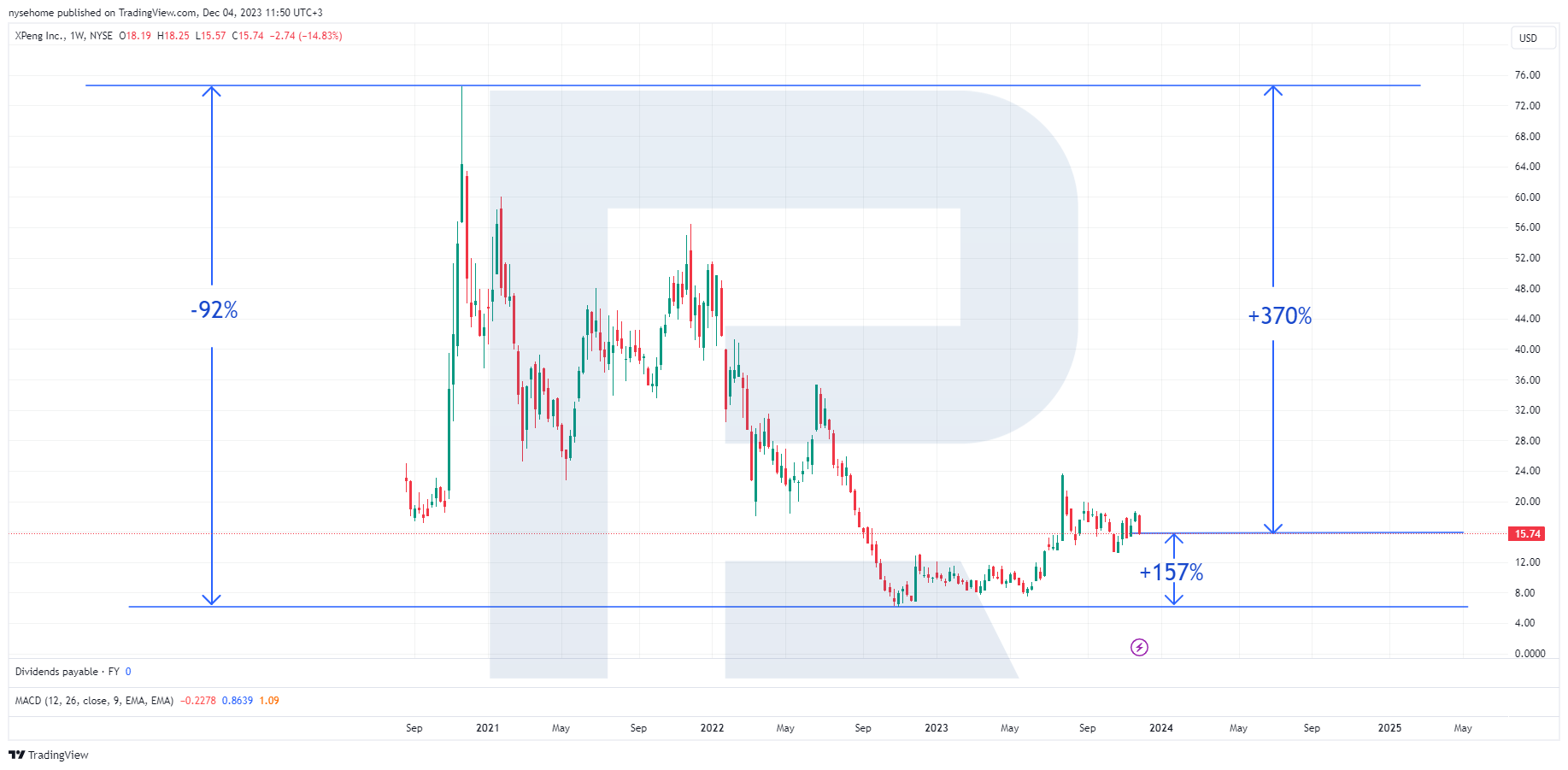

On 31 October 2022, Xpeng Inc. inventory hit a low of 6 USD, marking a 92% decline from the utmost value. Alternatively, the stocks have soared 157% through 4 December 2023. Their price would want to surge through any other 370% to reach a brand new prime.

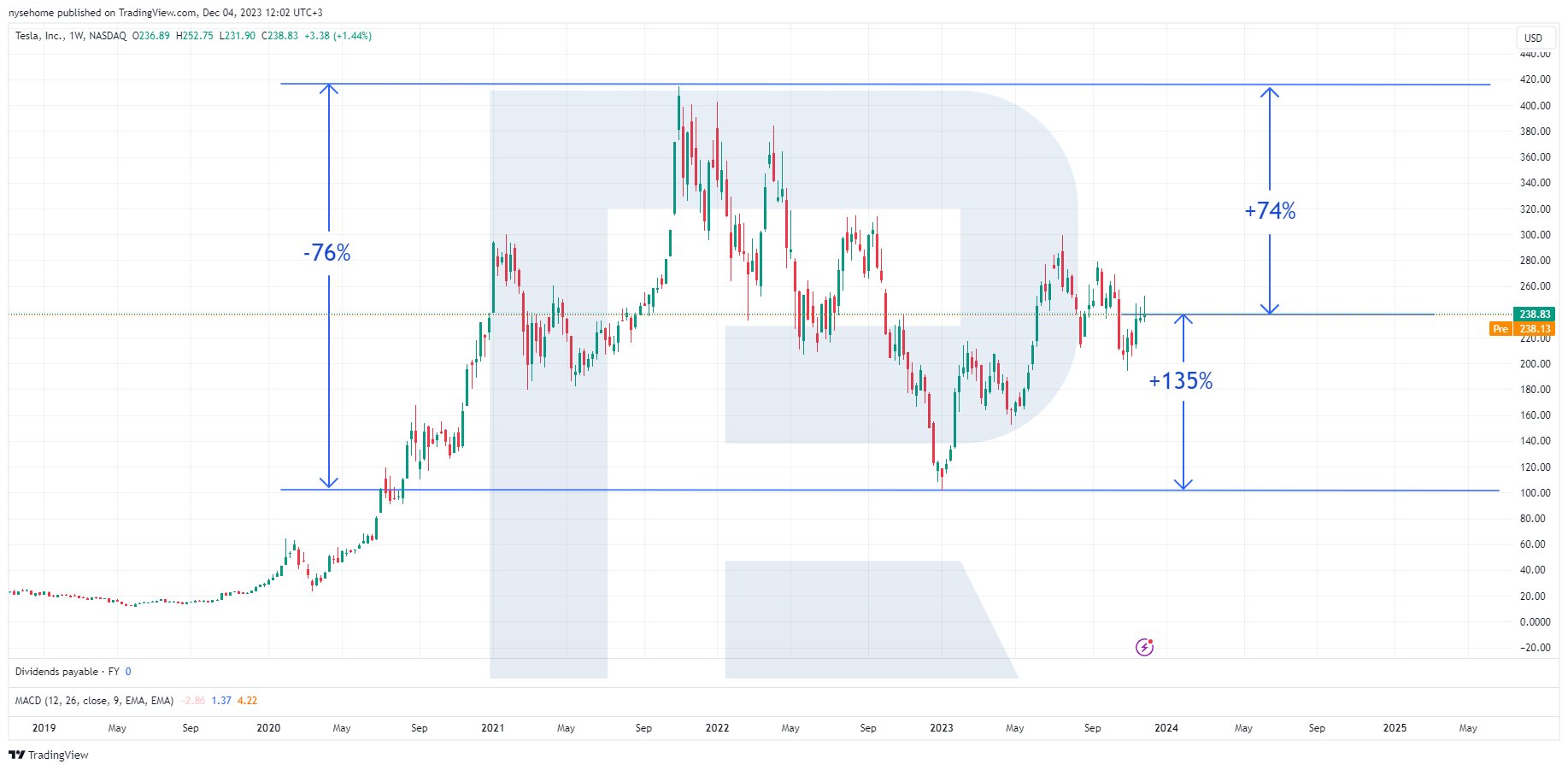

Tesla Inc. stocks reached their lowest price of 102 USD on 3 January 2023, marking a 76% value decline from the document stage. On the time of writing, the quotes have surged through 137% and want to achieve any other 74% to succeed in an all-time prime.

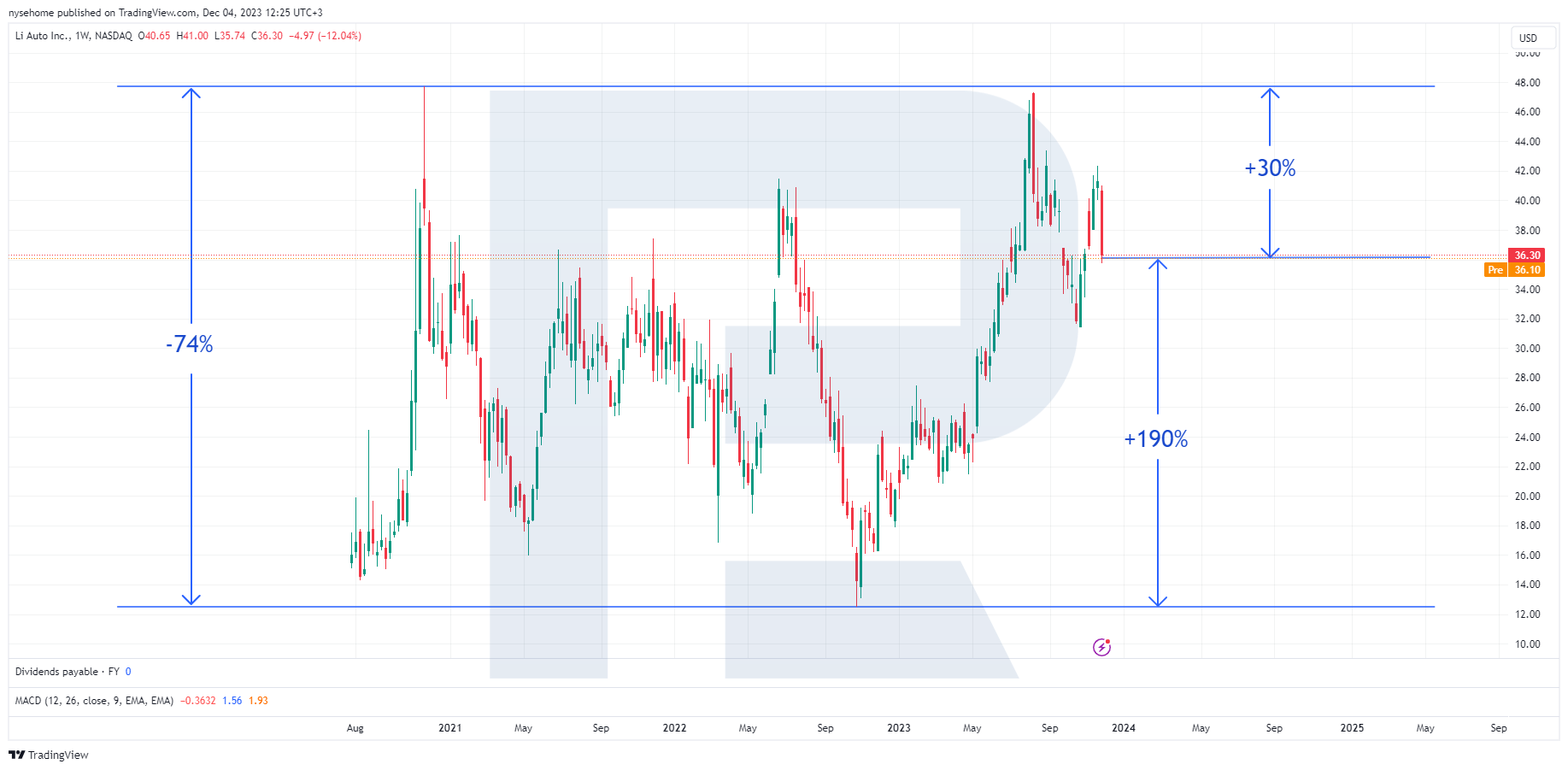

Li Auto Inc. stocks hit a low of 12.50 USD on 24 October 2022, tumbling 74% from their height price. By way of 7 August 2023, the inventory had skyrocketed 278%, with lower than 1 USD final to succeed in the all time prime. Alternatively, on 8 August, following the discharge of a powerful quarterly document, traders gave the impression keen to fasten in income, leading to a downturn within the inventory. As at 4 December, the stocks had been buying and selling 30% underneath their all-time prime, presenting essentially the most beneficial consequence in comparison to the above firms’ efficiency.

Li Auto’s monetary well being and gross sales efficiency

Li Auto Inc. launched its Q3 2023 document on 9 November. Earnings surged through 271.2% in comparison to the statistics for the corresponding duration in 2022, achieving 4.75 billion USD. Internet benefit amounted to 385.5 million USD or 0.46 USD in keeping with proportion, whilst a 12 months in the past, the corporate posted a lack of 232.7 million USD or 0.18 USD in keeping with proportion. General deliveries greater through 296.3%, as much as 105,108 automobiles.

Li Auto Inc. has reported a web benefit for the fourth consecutive quarter. With a long-term debt ratio of 0.08, considerably underneath 1, it may be thought to be an impressive end result.

In September 2023, MSCI ESG Analysis raised Li Auto Inc.’s ESG ranking from AA to AAA, signifying the corporate’s adherence to sustainable construction rules in environmental, social, and control spaces. As mentioned within the control’s document, the company was the primary Chinese language automaker to reach 500,000 deliveries of cars powered through choice power resources. Every Li L-series type has surpassed 10,000 per month deliveries for 3 consecutive months.

In-depth research of Li Auto inventory

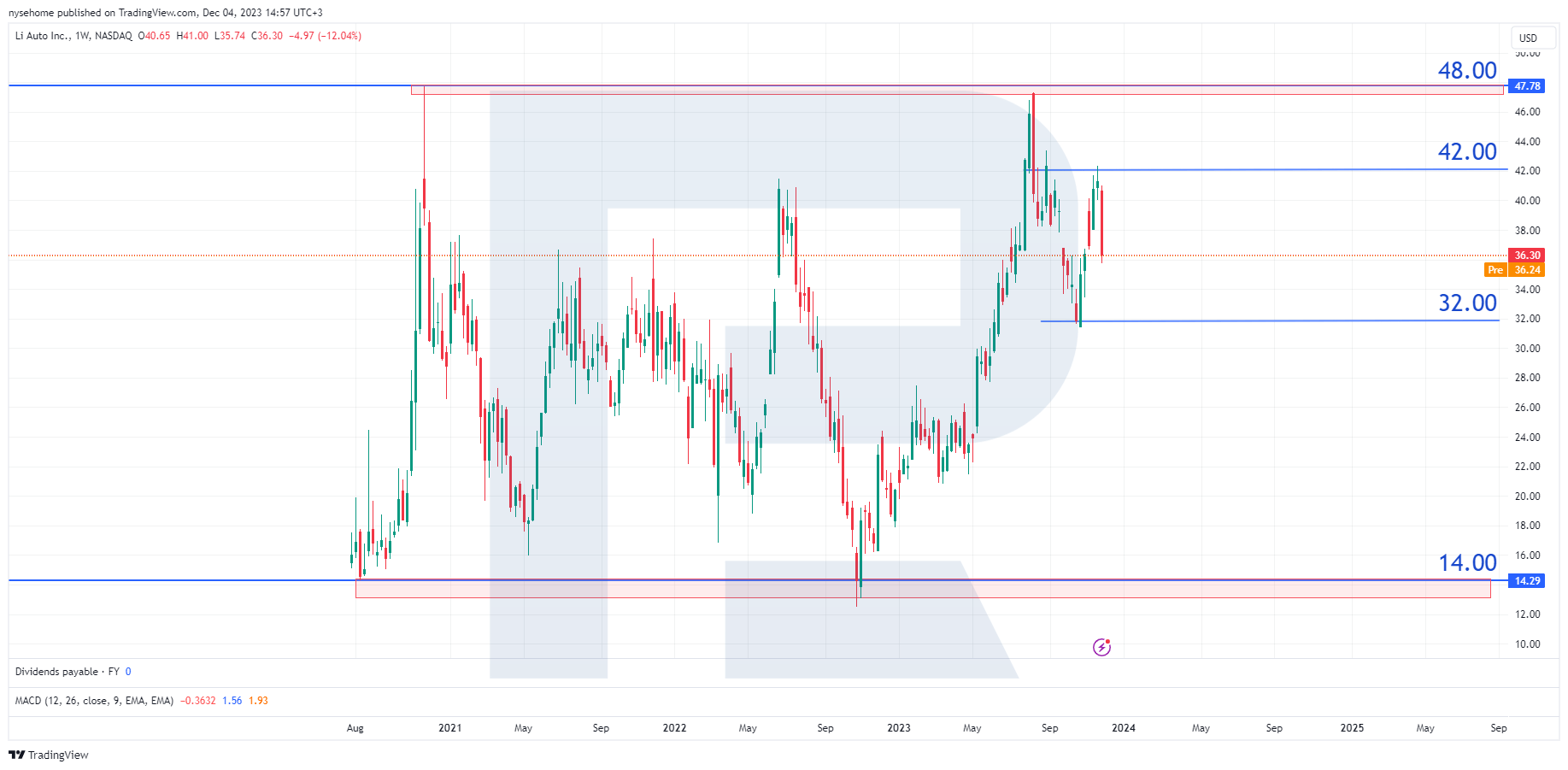

On a weekly time frame, Li Auto Inc. inventory has been buying and selling throughout the 14-48 USD vary since its IPO. In August 2023, the quotes examined the higher vary boundary and, failing to breach it, underwent a correction to 31 USD. In October 2023, bulls made any other try to take a look at the resistance stage of 48 USD, however the quotes may just best upward push to 42 USD. Following this, they headed downwards once more and had been soaring at 36 USD on the time of writing. The inventory has an extra impediment on its strategy to an all-time prime – the resistance stage of 42 USD.

Li Auto Inc. inventory research*

On a day by day time frame, Li Auto Inc. stocks proceed to industry inside of an ascending pattern, correcting to the trendline on the time of writing. A 32.00 USD mark and a trendline of 34 USD function give a boost to ranges for the associated fee. Because the quotes transfer against those values, investor call for might get better, doubtlessly riding the associated fee to the primary resistance stage of 42 USD. If the quotes spoil it, they will succeed in an all-time prime of 48 USD.

In a detrimental state of affairs, the Chinese language company’s stocks may just most probably breach the give a boost to stage of 32 USD, with the inventory in all probability declining to 27 USD in keeping with unit.

Professional predictions for Li Auto’s inventory and business outlook

- Consistent with Barchart, 4 out of 5 analysts rated Li Auto Inc.’s inventory as Robust Purchase, and one professional gave it a Reasonable Purchase ranking. The common value goal reached 53.47 USD in keeping with unit

- According to the MarketBeat knowledge, 4 out of 4 analysts rated the automaker’s inventory as Purchase with a worth goal of 78.72 USD

- Consistent with TipRanks, 4 of 4 analysts assigned a Robust Purchase ranking to Li Auto Inc.’s inventory. The common 12-month value forecast is 53.75 USD in keeping with proportion, with the best value of 62 USD and the bottom of fifty USD

- As Inventory Research informs, the typical 12-month value forecast for the automaker’s stocks is 43.79 USD with a Robust Purchase ranking

- Merely Wall St predicts that Li Auto Inc.’s income and income will build up through 34.8% and 29.5% in keeping with annum, respectively. EPS is anticipated to extend through 27.4% in keeping with annum, and go back on fairness is forecast to be 20.6% in 3 years. Consistent with the web site analysts, an even inventory price is 57.67 USD

According to a document through Mordor Intelligence, the hybrid automobile marketplace was once valued at 231.77 billion USD in 2023, with the possible to succeed in 478.33 billion USD through 2028 at a compound annual enlargement fee of 12.83%. Consistent with the World Power Company (IEA), world gross sales of environmentally pleasant automobiles will build up through 35% in 2023, exceeding 40 million devices.

Li Auto’s long term plans and doable enlargement spaces

- Increasing the line-up to 11 fashions through 2025

- Growing and launching a proprietary self sustaining riding machine Li AD Max 3.0

- Construction over 300 rapid charging stations alongside highways through the tip of 2023 and over 3,000 stations through 2025

- Making an investment in analysis and construction, advertising and marketing, and trade scaling to create leading edge era, toughen product high quality, and build up logo popularity and buyer loyalty

- Coming into overseas markets

- Making plans to release an electrical automobile priced at 29,700 USD this 12 months, which might definitely have an effect on the collection of the corporate’s shoppers

Conclusion

Li Auto Inc. turns out to make a choice a extra wary trade type, beginning its operations with hybrid automotive construction and manufacturing. The corporate embarked at the manufacturing of electrical cars best after it all started to generate web benefit. Moreover, it created beneficial stipulations for promoting electrical cars, which can be costlier than hybrid automobiles, through shooting a marketplace proportion and making its logo recognisable.

Given the equipped knowledge, it can be concluded that Li Auto Inc. has strong monetary place, with the corporate’s inventory being well-liked amongst traders and automotive gross sales expanding each and every quarter. It’s going to practice from analysts’ forecasts that the company’s stocks could be a beautiful possibility for long-term investments as professionals be expecting their additional enlargement.

* – The charts featured on this article originate from the TradingView platform, famend for its in depth set of equipment designed for monetary marketplace research. Functioning as a user-friendly and complicated on-line marketplace information charting provider, TradingView permits customers to accomplish technical research, discover monetary information, and hook up with fellow buyers and traders. Moreover, it provides treasured steering on successfully figuring out the best way to learn foreign exchange financial calendar, along with offering insights into more than a few different monetary property.