Lengthy Shedding Streak Ends Amid Chance-on

- A survey indicated a slower expansion charge in Britain’s non-public sector in July.

- Speculators have established their most beneficial bullish guess on sterling since 2014.

- Economists be expecting the USA Federal Reserve to lift its benchmark in a single day rate of interest through 25bps.

These days’s GBP/USD value research is relatively bullish. After a seven-session shedding streak, the pound recorded its first day of features. Significantly, the pound weakened in opposition to the buck on Monday because of a survey indicating a slower expansion charge in Britain’s non-public sector all the way through July.

–Are you interested by finding out extra about Canadian foreign exchange agents? Take a look at our detailed guide-

The S&P World/CIPS composite Buying Managers’ Index published a initial studying of fifty.7. On the other hand, this was once an important drop from June’s 52.8, representing the most important month-on-month decline in 11 months.

Regardless of this prolonged shedding streak, speculators have established their most beneficial bullish guess on sterling since 2014. That is in line with the USA marketplace regulator’s weekly knowledge.

One contributing issue to the influx of price range into the pound this yr has been its yield merit over US Treasuries. Simply 3 weeks in the past, two-year gilt yields have been buying and selling at their best top class in comparison to two-year Treasuries since mid-2011, at 45 foundation issues. On the other hand, that hole has now narrowed to parity.

In other places, economists be expecting the USA Federal Reserve to lift its benchmark in a single day rate of interest through 25bps. As a result, it could carry it to the 5.25%-5.50% vary. Some of these economists additionally imagine this would be the ultimate building up all the way through the continuing tightening cycle.

Analysts and buyers had been frequently stunned through the resilient economic system and traditionally low unemployment. This has continued for over a yr for the reason that Fed initiated considered one of its maximum competitive rate-hiking campaigns.

GBP/USD key occasions nowadays

Buyers are watching for the CB shopper self belief document from the USA. This document will display the extent of self belief in the USA economic system.

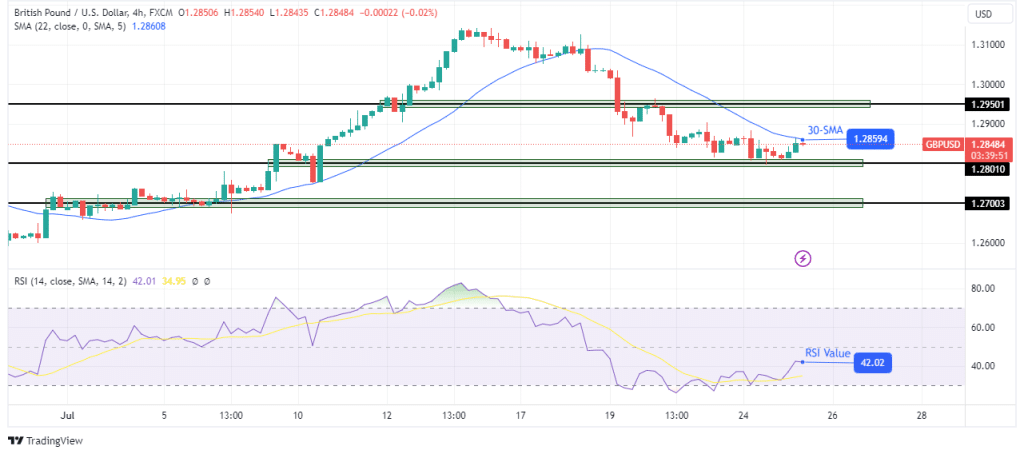

GBP/USD technical value research: Looming reversal on the 30-SMA resistance.

The pound has discovered improve on the 1.2801 stage at the charts and has rebounded to retest the 30-SMA. On the other hand, the unfairness stays bearish, with the fee nonetheless relatively underneath the SMA and the RSI underneath 50. In a bearish pattern, the 30-SMA will have to act as resistance.

–Are you interested by finding out extra about prime leveraged agents? Take a look at our detailed guide-

Subsequently, the fee will most probably jump decrease to retest the 1.2801 improve. A damage underneath this improve will most probably result in a drop in the fee to the 1.2700 improve.

Taking a look to industry foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to imagine whether or not you’ll manage to pay for to take the prime possibility of shedding your cash