How the Rebalancing of the NASDAQ-100 Impacts the Index’s Newcomer Shares – R Weblog

On this article, we can give an explanation for how the NASDAQ-100 index modified on 19 December, attempt to analyse what occurs to the worth of the newbies, and give an explanation for the factors used to make the decisions.

Abstract of the NASDAQ-100 Index

The NASDAQ-100 (NAS100) is an American inventory index comprising the 100 greatest corporations through capitalisation, representing more than a few sectors of the financial system rather than finance. Its historical past started in 1985.

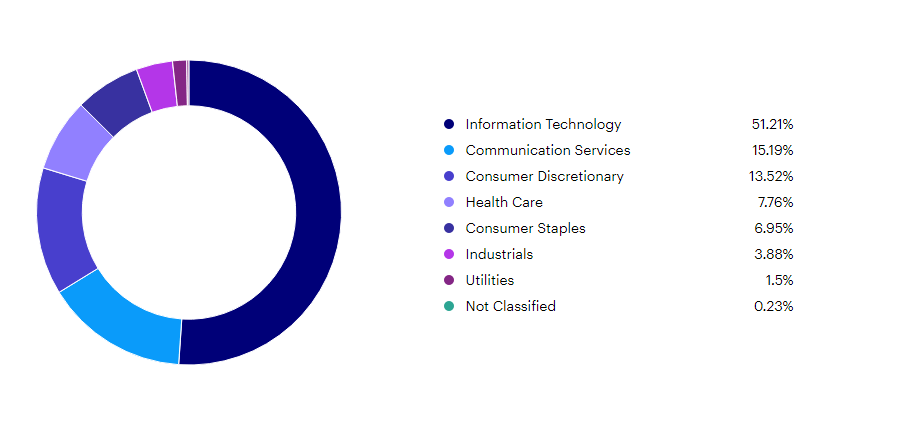

The index is damaged down as follows: the era sector accounts for 51.2%, the communications services and products sector for 15.2%, the shopper sector for 13.5%, and the others don’t exceed 10%.

Standards for settling on corporations

- Indexed at the NASDAQ trade.

- 100 greatest corporations through capitalisation.

- The common day by day buying and selling quantity over the past 3 months exceeds 200,000 shares.

- If the issuer is integrated out of doors america, the choices on its shares should be traded on a US trade.

- The choice procedure produces an inventory of 125 corporations out of which 100 are incorporated within the index, whilst the remainder are at the ready listing.

- Firms from the monetary sector aren’t incorporated.

- Firms that experience filed for chapter aren’t incorporated.

NASDAQ-100 replace in 2022

The index is rebalanced once a year in December. If at any level an issuer turns into ineligible – as an example, in case of a merger or acquisition, delisting from NASDAQ, or chapter – its inventory is got rid of from the index and changed with some other corporate from the ready listing with out ready till the top of the 12 months.

The NASDAQ-100 had 101 corporations in 2022 with Constellation Power Corp (NASDAQ: CEG) splitting from Exelon Company (NASDAQ: EXC) and ultimate within the index. Seven issuers – VeriSign Inc. (NASDAQ: VRSN), Skyworks Answers Inc. (NASDAQ: SWKS), Splunk Inc. (NASDAQ: SPLK), Baidu Inc. (NASDAQ: BIDU), Fit Team Inc. (NASDAQ: MTCH), DocuSign Inc. (NASDAQ: DOCU) and NetEase Inc. (NASDAQ: NTES) – left the listing on 19 December.

They have been changed through six corporations – CoStar Team Inc. (NASDAQ: CSGP), Rivian Automobile Inc. (NASDAQ: RIVN), Warner Bros. Discovery Inc. (NASDAQ: WBD), GlobalFoundries Inc. (NASDAQ: GFS), Baker Hughes Corporate (NASDAQ: BKR) and Diamondback Power Inc. (NASDAQ: FANG).

Marketplace individuals’ response to the rebalancing of the NASDAQ-100

When new corporations are added to the index, index finances are obliged to shop for their shares. If we take a look at NASDAQ-100 newcomer shares charts, we will be able to see an build up within the buying and selling quantity in their shares all over the rebalancing length.

NASDAQ-100 rebalancing in 2018

Returns for 2019 of shares added to the index corporations:

- Complicated Micro Units Inc. (NASDAQ: AMD): +141%.

- Lululemon Athletica Inc. (NASDAQ: LULU): +104%.

- NetApp Inc. (NASDAQ: NTAP:- +5%.

- United Continental Holdings Inc. (NASDAQ: UAL): +9%.

- VeriSign Inc. (NASDAQ: VRSN): +34%.

- Willis Towers Watson Public Restricted Corporate (NASDAQ: WTW): +37%.

The go back on funding in all six corporations for 2019 is 55%, which is 10% upper than the go back at the NASDAQ-100 index over the similar length.

NASDAQ-100 rebalancing in 2019

Returns for 2020 on shares of businesses added to the index:

- ANSYS Inc. (NASDAQ: ANSS): +40%.

- CDW Company (NASDAQ: CDW): -4%.

- Copart Inc. (NASDAQ: CPRT) : +37%.

- CoStar Team Inc. (NASDAQ: CSGP): +54%.

- Seattle Genetics Inc. (NASDAQ: SGEN): +76%.

- Splunk Inc. (NASDAQ: SPLK): +11%.

For 2020, the go back on funding in those corporations reached 35%, whilst within the NASDAQ-100 it was once 45%.

NASDAQ-100 rebalancing in 2020

Returns for 2021 on shares of businesses added to the index:

- American Electrical Energy Corporate Inc. (NASDAQ: AEP): +7%.

- Marvell Generation Team Ltd (NASDAQ: MRVL): +100%.

- Fit Team Inc. (NASDAQ: MTCH): -19%.

- Okta Inc. (NASDAQ: OKTA): -19%.

- Peloton Interactive Inc. (NASDAQ: PTON): -70%.

- Atlassian Company Plc (NASDAQ: TEAM): +50%.

For 2021, the go back on funding in those corporations reached 7%, whilst within the NASDAQ-100 it was once 27%.

NASDAQ-100 rebalancing in 2021

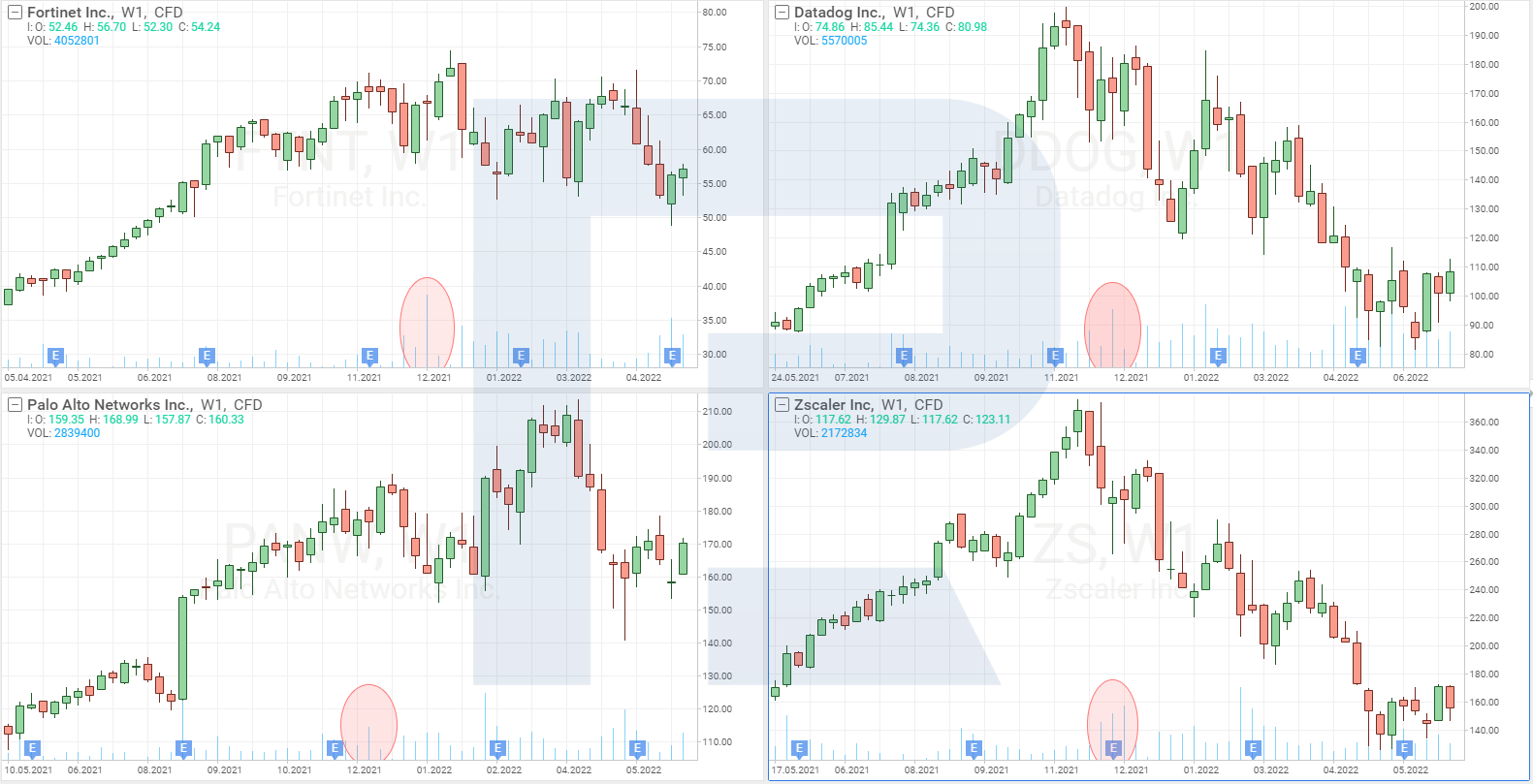

Yield for 2022 on shares of businesses added to the index:

- Airbnb Inc. (NASDAQ: ABNB)” -49%.

- Fortinet Inc. (NASDAQ: FTNT): -22%.

- Palo Alto Networks Inc. (NASDAQ: PANW): -12%.

- Lucid Team Inc. (NASDAQ: LCID): -80%.

- Zscaler Inc. (NASDAQ: ZS): -62%.

- Datadog Inc. (NASDAQ: DDOG): -55%.

The cumulative go back for 2022 of the above companies was once -46%, and the index go back reached -31%.

Conclusion

From 2018 to 2021 inclusive, a quantitative easing programme was once in position, and america rate of interest was once reduced from 2.5% to 0.25%. This was once a beneficial trade setting that, even all over the COVID-19 pandemic, allowed shares of corporations added to the index to turn sure returns.

Then again, in 2022, the Federal Reserve Device (FED) started to lift the rate of interest and introduced a quantitative tightening programme. Because it became out, those choices had a extra unfavorable affect on inventory costs than the pandemic.

Of the classes mentioned above, simplest in 2019 have been the returns on investments within the newbies to the index upper than the returns on investments within the NASDAQ-100. As well as, the extent of go back on each and every of the shares indexed was once no longer correlated with the index or the opposite shares at the listing.

It may be concluded that the inclusion of businesses within the index does no longer have a robust affect on their inventory value. In line with knowledge from the closing 4 years, it may be assumed that the Fed coverage has been a key issue affecting inventory costs.

Spend money on American shares with RoboForex on favorable phrases! Actual stocks will also be traded at the R StocksTrader platform from $ 0.0045 in line with proportion, with a minimal buying and selling price of $ 0.5. You’ll be able to additionally take a look at your buying and selling talents within the R StocksTrader platform on a demo account, simply sign in on RoboForex and open a buying and selling account.