Heiken Ashi 20-50 the Forex market Buying and selling Technique

Despite the fact that many non-traders or even merchants consider that buying and selling may be very tough, fact of the topic is, the concept that of buying and selling the foreign exchange markets may be very easy. the Forex market merchants merely will have to purchase a foreign money pair after they consider that worth goes up and promote it again to the marketplace as soon as worth is upper than their access worth. At the turn facet, merchants too can brief a foreign money pair after they consider worth will move down, then purchase it again once more when worth is not up to their access level.

Alternatively, maximum merchants revel in numerous problem buying and selling the foreign exchange marketplace no longer as a result of it’s tough however as a result of they overcomplicate issues. Considered one of my buying and selling mentors even mentioned that the primary reason why foreign currency trading is hard isn’t as a result of it’s inherently tough however as a result of merchants really feel the want to be doing one thing to earn despite the fact that they must simply let their trades play out. If a dealer has a successful buying and selling technique, she or he must be capable of draw constant income over the long term. The regulation of huge numbers would end up to them that their methods are successful.

With that mentioned, easy buying and selling methods may paintings really well within the foreign exchange marketplace. So long as a dealer is both successful extra incessantly than they’re shedding, as in a prime win price technique, or successful larger than they’re shedding, which is a prime risk-reward technique, that dealer must be successful over the long term.

Easy buying and selling methods similar to trend breakouts paintings neatly within the foreign exchange marketplace or some other buying and selling marketplace. It is because those breakout issues are incessantly prime likelihood access issues to go into the marketplace. On best of this, maximum trend buying and selling methods permit for a favorable risk-reward ratio.

Heiken Ashi Candlesticks

Buyers had been historically viewing their charts as a bar chart. Then got here the Eastern candlesticks, which revolutionized the best way merchants have a look at their charts. Now, they may be able to simply determine the course of each and every candle in keeping with its colour. Buyers may additionally simply interpret worth motion in keeping with the low and high of worth in terms of its opening and shutting worth. Maximum merchants at the moment use Eastern candlesticks to view a tradeable safety or foreign exchange pair.

Alternatively, new inventions coming from the Eastern have additionally been just lately advanced. The Heiken Ashi Candlesticks is a brand new approach of viewing worth which is a amendment of the unique Eastern candlesticks.

Heiken Ashi Candlesticks plot the usual low and high of each and every era simply as the unique Eastern candlestick. Alternatively, as a substitute of plotting the open and shut of each and every candle, the Heiken Ashi Candlesticks alter it in keeping with the typical motion of worth. This creates candles which trade colour most effective when the momentary pattern or momentum has shifted.

The Heiken Ashi Candlesticks are superb signs to lend a hand merchants determine momentary momentum reversals in addition to the present momentary pattern course.

Shifting Reasonable Convergence and Divergence

Shifting Reasonable Convergence and Divergence or extra popularly referred to as the MACD, is a vintage momentum technical indicator which is most likely probably the most broadly used oscillating technical indicator.

The MACD, because the title suggests, is in keeping with the crossing over of a couple of transferring averages.

It’s computed by way of subtracting the price of an Exponential Shifting Reasonable (EMA) from a sooner transferring EMA line. That is normally plotted as a histogram bar representing the MACD.

Then, a sign line is derived from the prior MACD bars or line. The sign line is principally a Easy Shifting Reasonable (SMA) of the prior MACD bars or traces.

Pattern course and bias is in keeping with the site of the MACD bars or line and the sign line in terms of its midline, which is 0. Sure values point out a bullish pattern bias, whilst unfavourable values point out a bearish pattern bias. The craze could also be thought to be bullish if the MACD bars or line is above the sign line, and bearish whether it is underneath the sign line.

Buying and selling Technique

Heiken Ashi 20-50 the Forex market Buying and selling Technique is a straightforward pattern following technique which is in keeping with momentum breakouts of helps and resistances shaped throughout retracement or contraction classes. It additionally uses the 2 signs above to substantiate the industry setup.

The MACD is used to spot the fashion course bias. That is in keeping with whether or not the histogram bars and the sign line are certain or unfavourable. This must additionally consider the fashion course indicated by way of the crossing over of the 20-period and 50-period EMA traces.

Throughout a trending marketplace, worth must retrace against the realm of the 20-period EMA line. This must create a minor make stronger or resistance line. Business setups are advanced as worth breaks out of the make stronger or resistance line against the course of the fashion.

The Heiken Ashi Candlesticks are used to substantiate the momentary momentum reversal happening aftern the retracement, within the course of the fashion.

Signs:

- 20 EMA

- 50 EMA

- Heiken Ashi

- MACD

- Speedy EMA: 17

- Sluggish EMA: 31

- MACD SMA: 14

Most well-liked Time Frames: 15-minute, 30-minute, 1-hour and 4-hour charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York classes

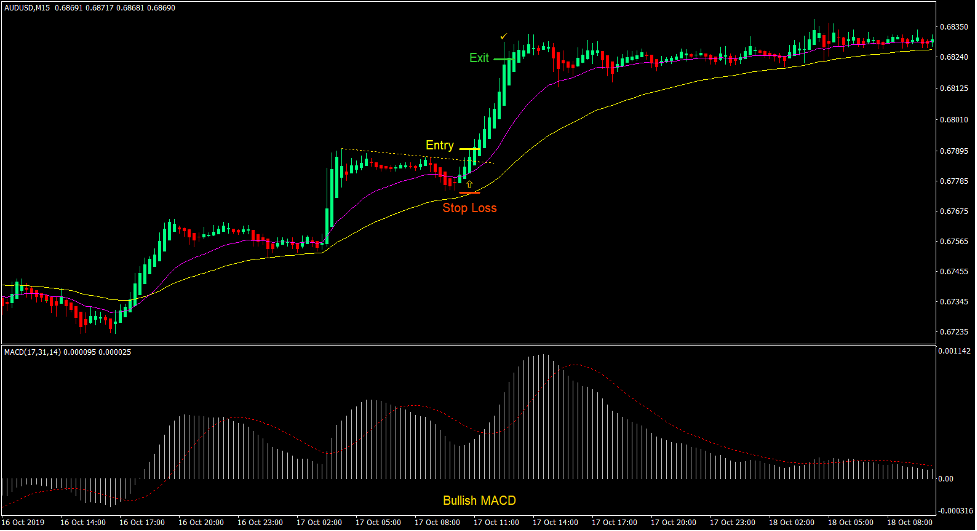

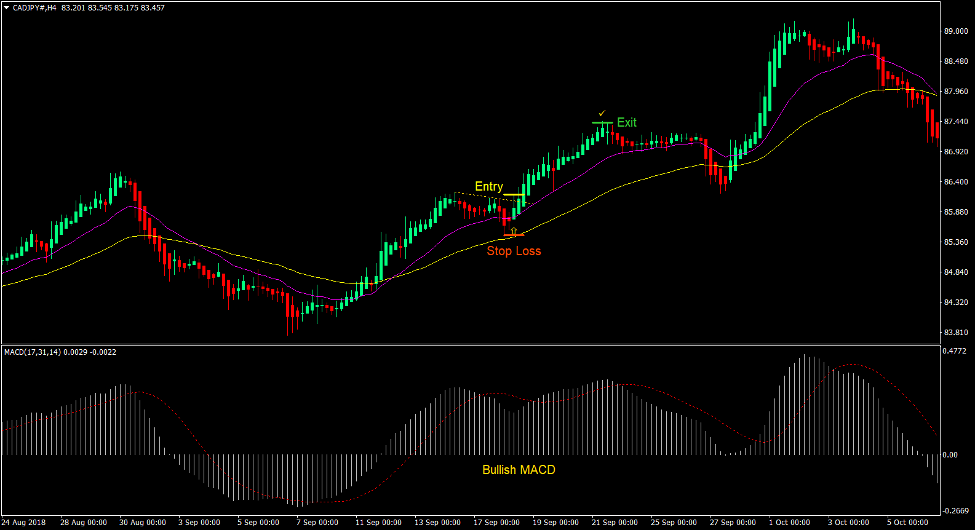

Purchase Business Setup

Access

- The 20 EMA line must be above the 50 EMA line.

- The MACD bars and sign line must be certain.

- Worth must retrace against the realm of the 20 EMA line.

- A resistance line must be shaped.

- Worth must wreck above the resistance line.

- The Heiken Ashi Candlesticks must trade to inexperienced.

- Position a purchase prevent order above the prime of the Heiken Ashi Candlestick.

Forestall Loss

- Set the prevent loss at the make stronger underneath the access candle.

Go out

- Set the take benefit goal at 2x the danger at the prevent loss.

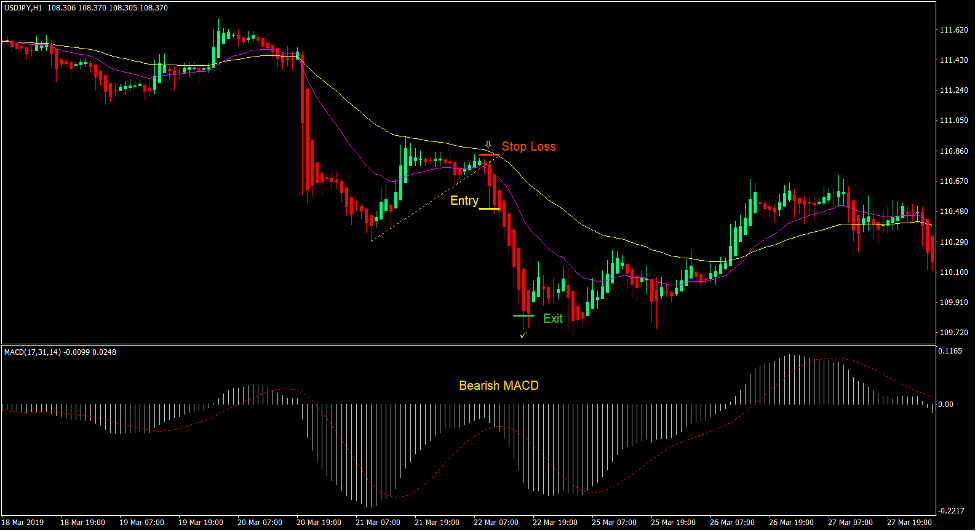

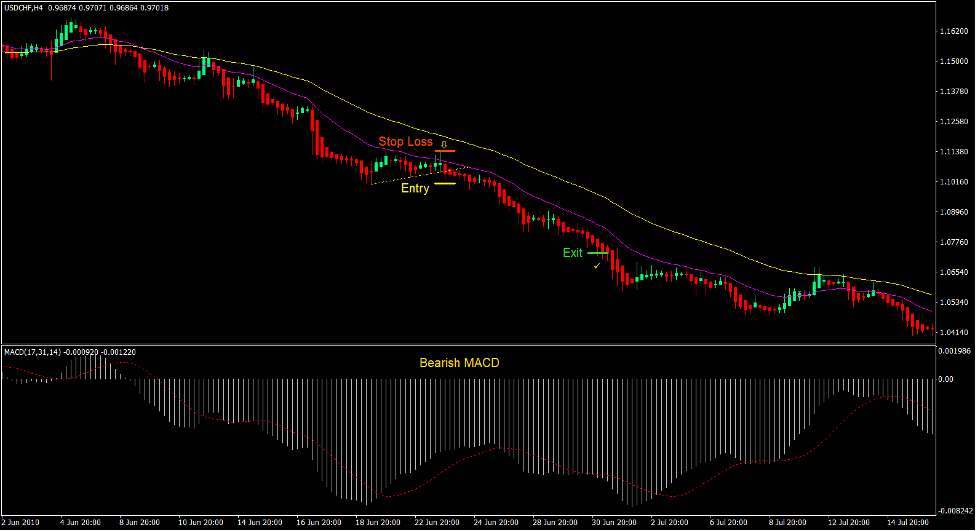

Promote Business Setup

Access

- The 20 EMA line must be underneath the 50 EMA line.

- The MACD bars and sign line must be unfavourable.

- Worth must retrace against the realm of the 20 EMA line.

- A make stronger line must be shaped.

- Worth must wreck underneath the make stronger line.

- The Heiken Ashi Candlesticks must trade to purple.

- Position a promote prevent order underneath the low of the Heiken Ashi Candlestick.

Forestall Loss

- Set the prevent loss at the resistance above the access candle.

Go out

- Set the take benefit goal at 2x the danger at the prevent loss.

Conclusion

This buying and selling technique is a operating buying and selling technique. If you happen to would glance intently, the make stronger or resistance traces shaped throughout a retracement would normally be part of a flag trend. Flag patterns are prime likelihood pattern continuation patterns. Alternatively, figuring out those patterns may end up to be very tough. Via combining those technical signs to shape this template, merchants can now extra simply determine those stipulations as breakouts proper after a retracement that happen throughout sturdy trending markets.

the Forex market Buying and selling Methods Set up Directions

Heiken Ashi 20-50 the Forex market Buying and selling Technique is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to turn into the amassed historical past information and buying and selling indicators.

Heiken Ashi 20-50 the Forex market Buying and selling Technique supplies a chance to come across more than a few peculiarities and patterns in worth dynamics that are invisible to the bare eye.

According to this data, merchants can suppose additional worth motion and modify this technique accordingly.

Really useful the Forex market MetaTrader 4 Buying and selling Platform

- Unfastened $50 To Get started Buying and selling In an instant! (Withdrawable Benefit)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable the Forex market Dealer

- Further Unique Bonuses Right through The 12 months

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-Via-Step XM Dealer Account Opening Information

Methods to set up Heiken Ashi 20-50 the Forex market Buying and selling Technique?

- Obtain Heiken Ashi 20-50 the Forex market Buying and selling Technique.zip

- *Replica mq4 and ex4 recordsdata in your Metatrader Listing / mavens / signs /

- Replica tpl report (Template) in your Metatrader Listing / templates /

- Get started or restart your Metatrader Consumer

- Choose Chart and Time-frame the place you need to check your foreign exchange technique

- Proper click on to your buying and selling chart and hover on “Template”

- Transfer proper to choose Heiken Ashi 20-50 the Forex market Buying and selling Technique

- You are going to see Heiken Ashi 20-50 the Forex market Buying and selling Technique is to be had to your Chart

*Observe: No longer all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Signs from the MetaTrader Platform.