Harmonic Patterns in Buying and selling – R Weblog

On this article, we can believe using harmonic patterns in buying and selling. We can get familiar with the historical past in their emergence, and the foundations in their formation, and inform you about the most well liked patterns.

What are harmonic patterns?

Harmonic patterns are graphical value patterns in keeping with a mix of Fibonacci ratios and Elliott wave parts. The foundation for such patterns was once laid down within the works of Harold Gartley, a famend analyst, and technical research specialist. His e book “Income within the Inventory Marketplace” describes his buying and selling method intimately.

The harmonic patterns was well known and in style on the finish of the final century when Gartley’s works have been additional evolved via his fans – Scott Carney, Larry Pesavento, and Bryce Gilmore. They have got delicate the outline of already recognized fashions, and likewise recognized and described new ones.

Harmonic patterns are flexible: they are able to be used to industry on other timeframes and fiscal markets. The most well liked are Gartley, Butterfly, 5-0, Crab, ABCD, Bat, and Shark.

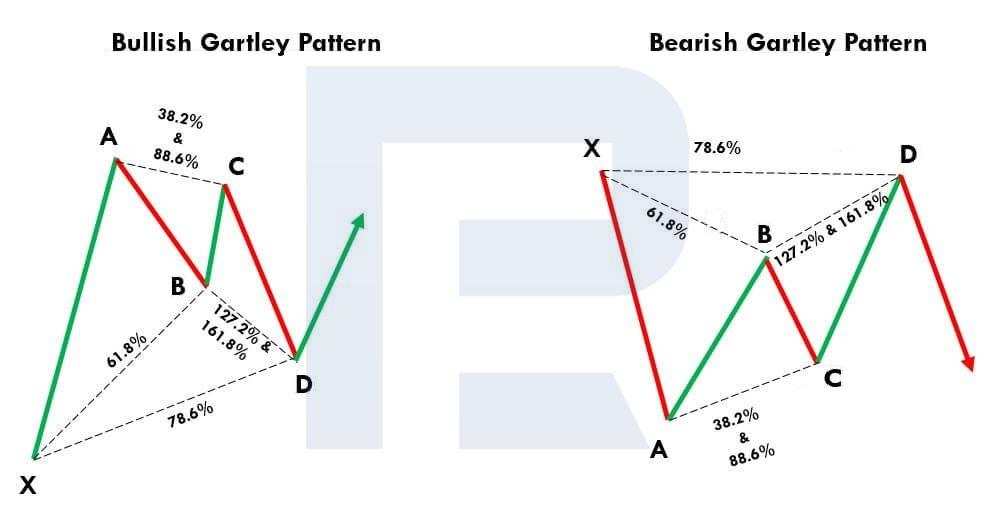

Gartley development

The Gartley development is without doubt one of the first harmonic patterns described. Additionally it is referred to as “Gartley’s butterfly” on account of the similarity within the outlines of value actions, and the Fibonacci traces at the chart corresponding to the wings of a butterfly.

Phases within the formation of the Gartley development:

- XA is the primary impulse of the fee motion at the chart

- AB is the correction from the primary XA motion at roughly 61.8%

- BC will also be 38.2%, 50%, 61.8%, 78.6%, 88.6% of the AB wavelength

- CD will also be 127.2%, 146%, 150%, and 161.8% of the BC wavelength and ends across the correction stage of 78.6% of the XA wavelength

- The D-point is the general level within the development, the place a reversal of quotes is anticipated

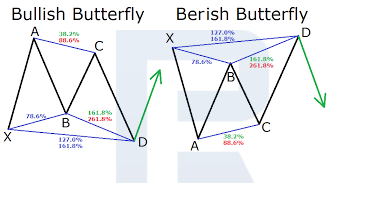

Butterfly development

The Butterfly development, created via Bruce Gilmore, is similar to the only discussed above. Subsequently, understandably, many buyers confuse the 2.

Phases within the formation of the Butterfly development

- XA is the primary impulse of the fee motion at the chart

- AB is the correction from the primary XA motion at roughly 78.6%

- BC can vary from 38.2% to 88.6% of the AB wavelength

- CD can vary from 161.8% to 224% of the BC wavelength and ends at about 127.2% of the XA wavelength

- The D-point is the general level within the development, the place a reversal of quotes is anticipated

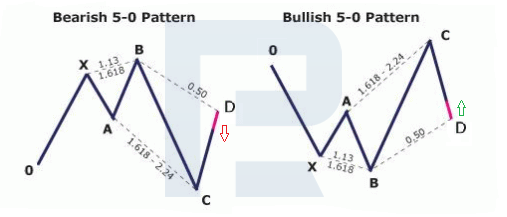

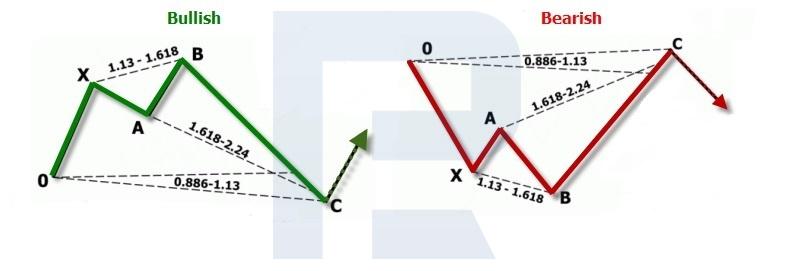

5-0 Trend

The 5-0 development was once first described intimately in Scott Carney’s e book “Harmonic Buying and selling: Quantity Two”, which was once revealed in 2007. Visually, it resembles the Head & Shoulders and Wolf Waves patterns.

Phases within the formation of the 5-0 development:

- OX is the primary impulse of the fee motion at the chart

- XA is the correction from the primary OX motion

- AB can vary from 113% to 161.8% of the OX wavelength

- BC is the longest wavelength and will also be between 161.8% and 224% of the AB wavelength

- CD is the general leg of the development and ends at roughly 50% of the BC wavelength and 88.6-113% of the OX wavelength

- The D-point is the general level within the development, the place a reversal of quotes is anticipated

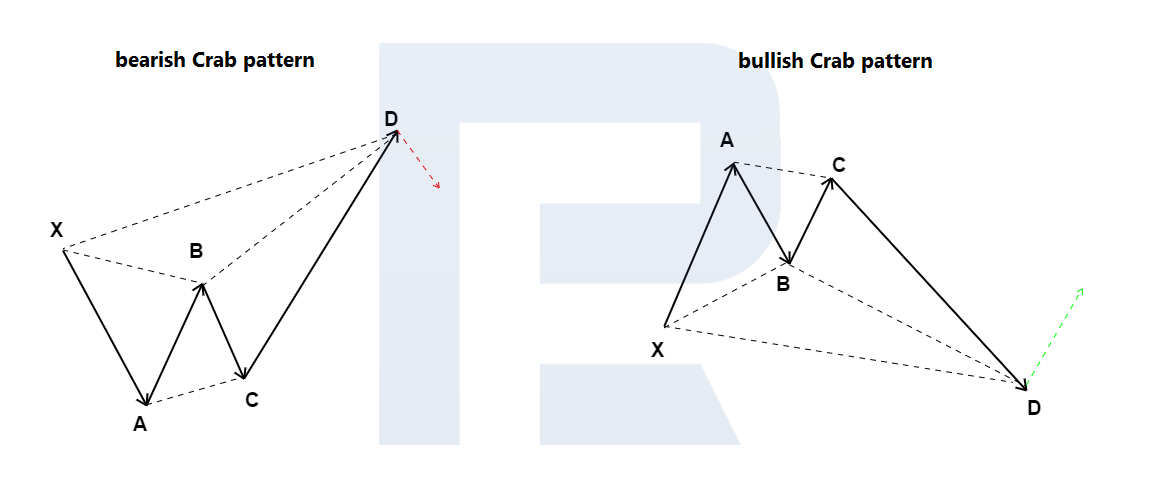

Crab development

The harmonic Crab development was once presented to the buying and selling neighborhood via Scott Carney in 2000. Its look at the value chart indicators the top of the present value momentum and an approaching reversal.

Phases within the formation of the Crab development:

- XA is the primary impulse of the fee motion at the chart

- AB is the correction from the primary XA motion, starting from 38.2% to 61.8%

- BC can vary from 38.2% to 88.6% of the wavelength of AB

- CD, the longest wave, ends at about 161.8% of the XA wavelength and is an extension of 224-361.8% of the BC wavelength

- The D-point is the general level within the development, the place a reversal of quotes is anticipated

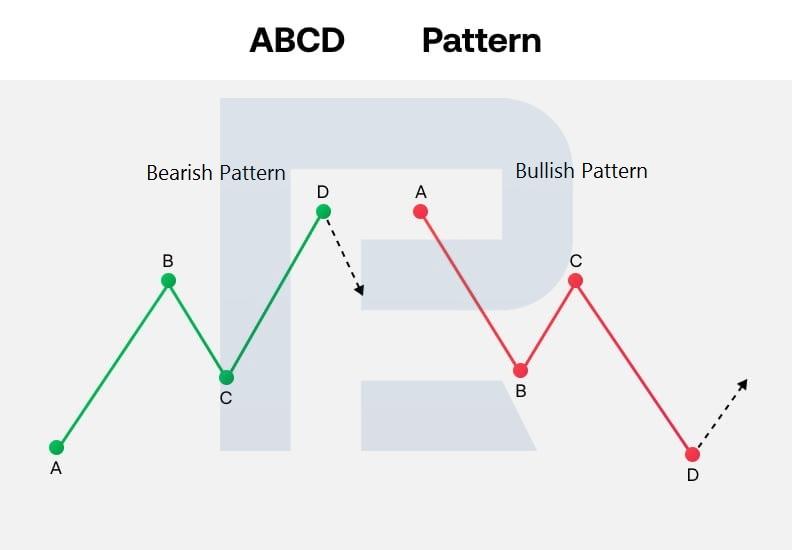

ABCD Trend

ABCD is without doubt one of the most simple harmonic patterns and seems like diagonal lightning on a value chart. It’s necessarily a three-wave correction, and then the fee motion against the principle development can proceed.

Phases within the formation of the ABCD development:

- AB is the primary impulse of the fee motion at the chart

- BC is a correction from the primary AB motion, starting from 61.8% to 78.6%

- CD is the general wave, which might be 127.2% to 161.8% of the duration of the BC wave, and will have to be more or less equivalent to the AB impulse

- The D-point is the general level within the development, the place a reversal of quotes is anticipated

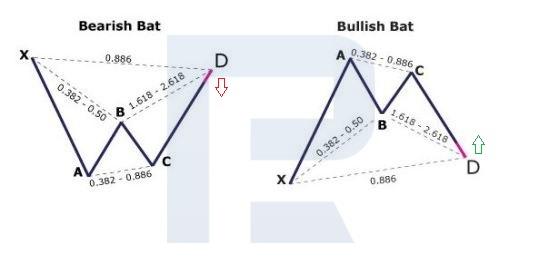

Bat development

The Bat style was once presented via Scott Carney in 2001. It’s characterized via a just right Prevent Loss to Take Benefit ratio: most often 1:2 and above.

Phases within the formation of the Bat development:

- XA is the primary impulse of the fee motion at the chart

- AB is the correction from the primary XA motion, starting from 38.2% to 50%

- BC can vary from 38.2% to 88.6% of the wavelength of AB

- CD, the general wave, constitutes an extension of 161.8% to 261.8% of the BC wavelength and ends at concerning the correction stage of 88.6% of the XA wavelength

- The D-point is the general level within the development, the place a reversal of quotes is anticipated

Shark development

The harmonic Shark development was once described in 2011 via Scott Carney. Its look at the value chart indicators a conceivable development reversal. The shaped development visually resembles a shark’s fin or its open mouth.

Phases of Shark development formation:

- OX is the primary impulse of the fee motion at the chart

- XA is the correction from the primary OX motion

- AB can vary from 113% to 161.8% of the OX wavelength

- BC is the longest wavelength, finishing at about 113% of the OX wavelength, and will also be 161.8-224% of the AB wavelength

- Level C is the general level within the development the place a reversal is anticipated

Conclusion

Many buyers like to make use of harmonic patterns when buying and selling. The mix of Fibonacci ratios with parts of Elliott Waves in those patterns is helping to spot attainable pivot issues at the value chart and in finding trades with a just right Prevent Loss to Take Benefit ratio.

Harmonic patterns are flexible: they are able to be utilized in other timeframes and fiscal markets. Particular signs had been created to automate their detection at the chart. Ahead of the use of harmonic patterns in actual buying and selling, you will have to check their detection and execution on a demo account.