Gold Worth Stays Bearish Beneath $1,661, Eying Inflation Information

- The XAU/USD maintains a bearish bias so long as it remains beneath the downtrend line.

- The United Kingdom and Canadian inflation knowledge may well be decisive on Wednesday.

- A brand new decrease low turns on extra declines.

The cost of gold rebounded within the quick time period as the USA buck dropped just a little. The yellow steel used to be buying and selling at $1,657 on the time of writing. The steel is combating arduous to method and highs.

-Are you on the lookout for the most efficient AI Buying and selling Agents? Test our detailed guide-

Essentially, the XAU/USD bounced again as a result of the USA retail gross sales got here in combined on Friday. The Retail Gross sales indicator rose by way of 0.0%, lower than 0.2%, whilst Core Retail Gross sales surged by way of 0.1% as opposed to a nil.1% drop. America Prelim UoM Shopper Sentiment got here in higher than anticipated, but it surely has failed to spice up the dollar.

Gold larger by way of 1.25% from Friday’s low of $1,640 to $1,660 as of late’s excessive. These days, the USA is to unlock the Empire State Production Index, which is predicted at -4.3 issues under -1.5% within the earlier reporting duration.

The United Kingdom and Canadian inflation knowledge can have a large influence on gold. The CPI and Core CPI constitute high-impact occasions, so the volatility may well be actually excessive.

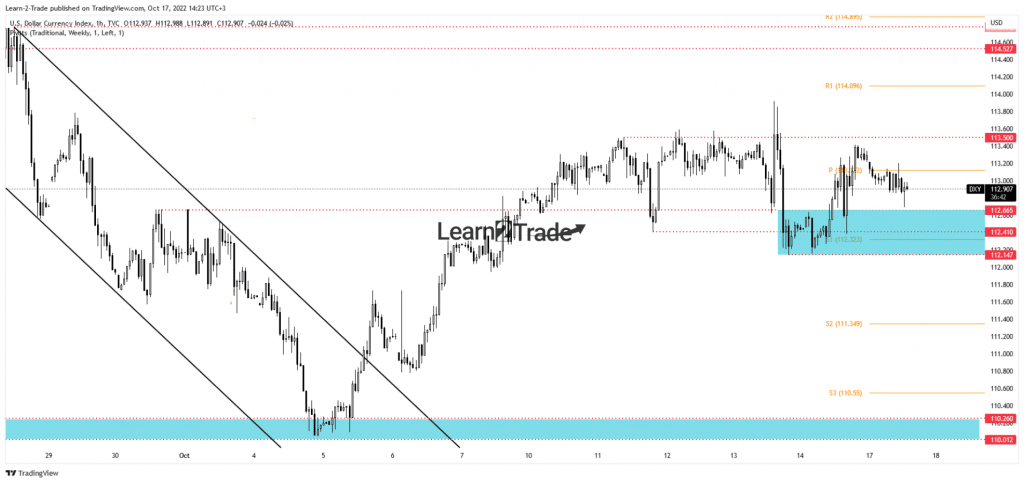

Greenback Index value technical research: Sideways motion

The Greenback Index strikes sideways within the quick time period. That’s why XAU/USD may just transfer in a variety as smartly. The DXY maintains a bullish bias so long as it remains above the 112.41 – 112.14 zone. A brand new upper excessive turns on additional enlargement. DXY’s upside continuation may just drive the cost of gold to method and achieve new lows. Alternatively, DXY’s drop under 112.14 would possibly sign a brand new leg upper in gold.

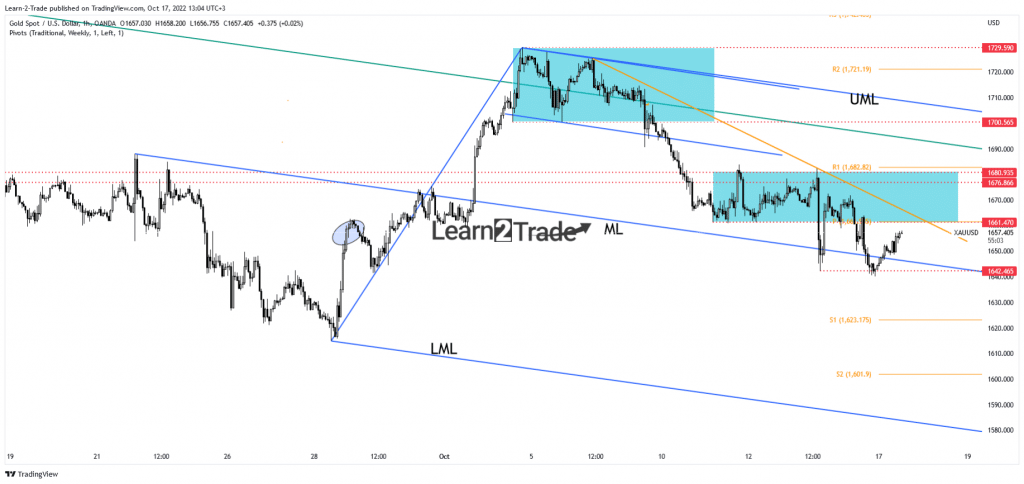

Gold value technical research: Leg down

Technically, the prejudice stays bearish so long as it remains beneath the down trendline. The $1,642 stands as a problem impediment. The associated fee didn’t take out this toughen and to stabilize under the median line (ML), signaling exhausted dealers. Trying out the down trendline and the $1,661 key resistance, registering best false breakouts may just lead to a brand new sell-off. A bigger problem motion may well be activated by way of a legitimate breakdown under 1,642. A brand new decrease low stabilizing under the median line (ML) broadcasts a problem continuation.

-Are you on the lookout for the most efficient MT5 Agents? Test our detailed guide-

The median line represents dynamic toughen. Staying above it’ll sign a brand new swing upper against the higher median line (UML). Nonetheless, this situation may just take form provided that the cost makes a legitimate breakout during the down trendline and after leaping and stabilizes above $1,680.

Taking a look to business foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must imagine whether or not you’ll manage to pay for to take the excessive chance of shedding your cash.