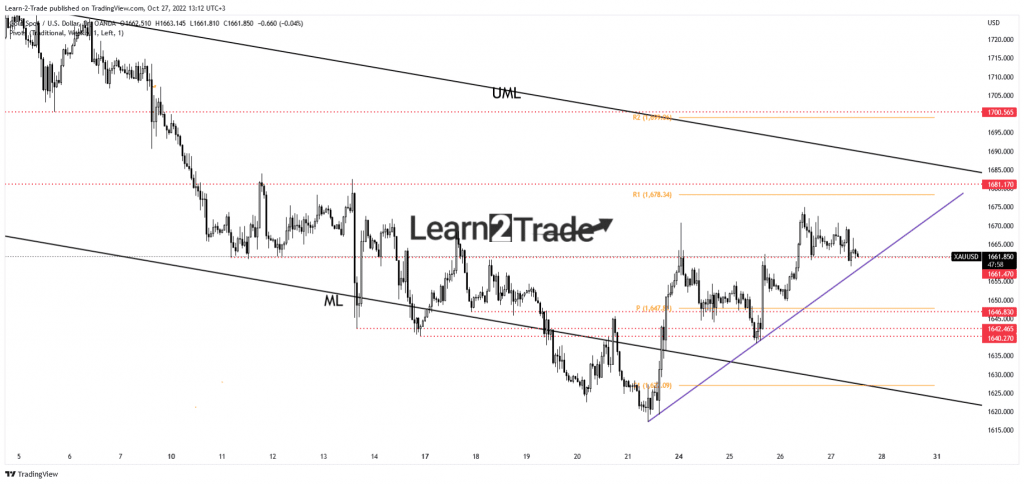

Gold Worth Difficult $1,661 Give a boost to Forward of the ECB Fee Determination

- XAU/USD maintains a bullish bias so long as it remains above the uptrend line.

- The ECB and the United States Advance GDP may in point of fact shake the markets.

- Shedding and shutting beneath the uptrend line turns on extra declines.

The gold worth slipped decrease after achieving $1,675 the day past. The valuable steel is buying and selling at 1,662 on the time of writing.

–Are you to be informed extra about ECN agents? Take a look at our detailed guide-

Gold has modified brief time period as investors stay up for the ECB sooner than taking motion. The Eu Central Financial institution is predicted to extend the Primary Refinancing Fee from 1.25% to two.00%. The Financial Coverage Commentary and the ECB Press Convention may considerably influence and convey sharp actions in gold. The XAU/USD may drop deeper if the ECB proclaims additional fee hikes within the subsequent financial coverage conferences.

Moreover, the United States is to unencumber high-impact knowledge as smartly. The Advance GDP would possibly document a 2.3% enlargement in comparison to the 0.6% drop within the earlier reporting duration. The basics will force the markets these days. That’s why you’ll need to be cautious. Gold may sign up sharp actions across the ECB and after the United States knowledge sell off.

As well as, the Advance GDP Worth Index may document a 5.3% enlargement, and Core Sturdy Items Orders are anticipated to sign up a nil.2% enlargement. On the similar time, the Unemployment Claims indicator may bounce from 214K to 219K within the earlier week. The next day to come, the BOJ is observed as a high-impact match and may shake the markets.

Gold worth technical research: Transient retreat?

Technically, the unfairness stays bullish within the brief time period so long as it remains above the minor trendline. The $1,661 represents a drawback impediment as smartly. It stays to peer how XAU/USD reacts across the confluence house shaped on the intersection between those drawback hindrances. Trying out the make stronger ranges and registering most effective false breakdowns would possibly sign a brand new upside momentum.

–Are you to be informed extra about making a living in foreign exchange? Take a look at our detailed guide-

However, a sound breakdown would possibly turn on an additional drop towards the weekly pivot level of one,647. From the technical standpoint, the present drop may constitute a flag development which might lead to extra beneficial properties. Nonetheless, it’s untimely to speak about an upside continuation because the ECB, and the United States knowledge may exchange the sentiment.

Taking a look to industry foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to believe whether or not you’ll be able to come up with the money for to take the excessive chance of shedding your cash.