Gold Value Tempting Dealers as Marketplace Eying FOMC Mins

- The FOMC Assembly Mins and the United States knowledge constitute high-impact occasions.

- The prejudice is bearish so long as it remains underneath the downtrend line.

- A brand new decrease low turns on extra declines.

The gold worth slipped decrease from the previous day’s excessive of $1,749. The steel is buying and selling at $1,737 on the time of writing. The XAU/USD dropped as the United States buck rebounded around the board.

-Are you interested by finding out in regards to the foreign exchange indicators telegram team? Click on right here for details-

These days, the FOMC Assembly Mins might be decisive. As you might know, the United States reported decrease inflation in October. This example may lend a hand the FED to ship just a 50 bps hike in December.

Nonetheless, the November CPI and Core CPI knowledge may give us a clue of what may occur within the subsequent financial coverage assembly. A dovish FED may weaken the USD and lend a hand gold bounce upper.

Basically, the yellow steel remains decrease since the RBNZ larger the Professional Money Fee from 3.50% to 4.25%, as anticipated. Previous, the United Kingdom and Eurozone production and products and services knowledge got here in higher than anticipated, whilst Germany and France reported combined figures.

Later, the United States financial knowledge may truly shake the markets. The Flash Products and services PMI might be reported at 48.0 issues above 47.8 within the earlier reporting duration, whilst Flash Production PMI may drop from 50.4 to 50.0 issues.

As well as, the Sturdy Items Orders, Core Sturdy Items Orders, Unemployment Claims, New House Gross sales, and Revised UoM Shopper Sentiment can also be launched.

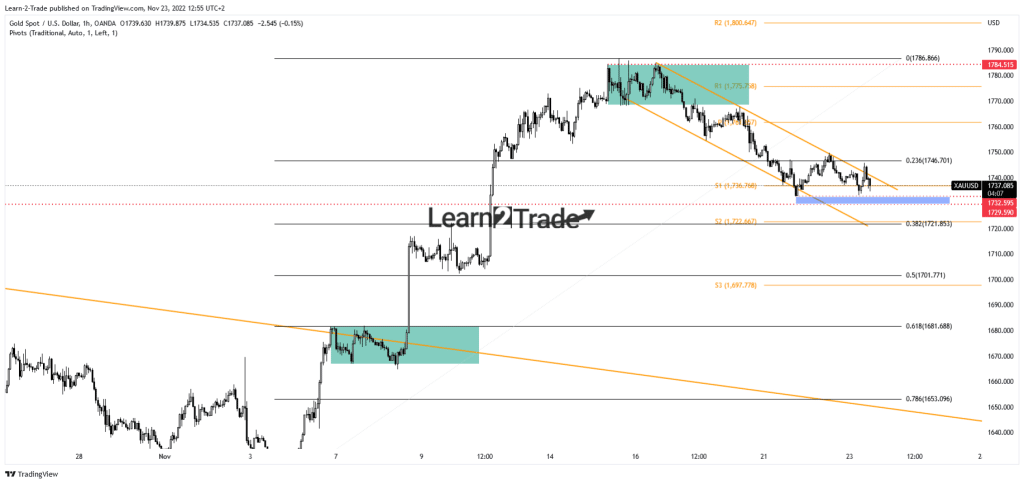

Gold worth technical research: Flag development

The XAU/USD dropped inside the down channel development, and now it hovers above the $1,729 – 32 beef up zone. The prejudice stays bearish so long as it remains underneath the down trendline. Nonetheless, just a legitimate breakdown underneath $1,729 turns on extra declines.

–Are you interested by finding out extra about creating wealth with foreign exchange? Test our detailed guide-

Staying above the beef up zone and registering a sound breakout in the course of the down trendline may announce a brand new swing upper. I consider the yellow steel may broaden sharp actions after the United States knowledge and after the FOMC Mins.

Taking a look to business foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to believe whether or not you’ll manage to pay for to take the excessive possibility of dropping your cash.