Gold Value Research – XAU/USD Forecast for 2024

On 17 January 2024, we appeared on the prevailing gold (XAU/USD) marketplace developments, exploring historic developments and the important thing components influencing the cost of the valuable steel. We performed a technical research of the associated fee chart and exposed skilled evaluations at the gold value outlook for 2024.

Ancient research of XAU/USD costs

Allow us to check out the gold value efficiency during the last 140 years:

- Since 1887, throughout the gold usual duration, the United States executive fastened the gold value at 20.67 USD in line with troy ounce. After forsaking the gold usual and devaluing the buck in 1933, the price of an oz. greater to 35 USD and remained at this stage till 1967

- Later within the Nineteen Seventies, gold costs greater considerably because of global financial and geopolitical instability. From 1971 to 1980, quotes skyrocketed through over 1600%, from 35 to 800 USD in line with ounce

- Within the Nineteen Eighties-Nineties, gold costs corrected downwards as the worldwide and US economies skilled a duration of relative steadiness, with declining oil costs

- Within the 2000s, the associated fee stage remained somewhat strong till the 2008 monetary disaster, when quotes soared once more from 800 to over 1,900 USD in line with ounce in 2011. The surge in costs and the top of the disaster have been adopted through a powerful downward correction against 1,100 USD

- From 2012 to 2020, the worldwide financial system and inventory markets confirmed stable expansion, with gold buying and selling inside of a sideways value vary from 1,100 to at least one,400 USD in line with ounce

- In 2020, pushed through the COVID-19 disaster, gold quotes resumed their upward motion, surpassing 2,000 USD in line with ounce

- In December 2023, amid emerging inflation and geopolitical turbulence, the gold ounce set an all-time value file of two,150 USD

In spite of the top rates of interest of the central banks, many buyers favor to speculate their budget in gold. This steel is a safe-haven asset amid emerging inflation and the present financial and geopolitical instability.

Key components influencing XAU/USD

- Financial signs. This comprises inflation, rates of interest, unemployment, GDP, and different financial information. As an example, a top inflation fee and financial instability would possibly spice up the call for for gold as a shop of worth

- Geopolitics. Buyers historically believe gold a safe-haven asset in opposition to dangers and uncertainty throughout wars, conflicts, sanctions, political and geopolitical instability, and tensions. Call for for gold normally will increase throughout such classes

- New monetary era. As an example, the improvement of the cryptocurrency marketplace would possibly negatively impact the call for for the valuable steel. Buyers may put money into virtual belongings as a substitute of gold, lured through the opportunity of top returns

- US buck alternate fee. As international gold costs are set within the USD, the United States forex alternate fee fluctuations may additionally have an effect on the cost of the valuable steel. Gold costs continuously fall when the United States buck strengthens because it turns into dearer for consumers. Conversely, with a vulnerable USD, gold costs is also on the upward thrust

- Provide and insist. The valuable steel’s value would possibly build up, propelled through sturdy call for, as an example, from central banks, buyers, and jewelry firms, or decreased provide led to, for example, through mining restrictions or a scarcity of latest deposits

2023 XAU/USD value marketplace outlook

2023 noticed a long-term expansion pattern in gold costs, with a median value of one,950 USD in line with ounce. Beginning the 12 months on the 1,823 USD mark, quotes traded inside of a value vary of one,805 USD-2,150 USD all through 2023. A brand new all-time top of two,150 USD in line with ounce was once reached in December 2023.

Geopolitical tensions, army conflicts, financial turbulence, and a world inflation surge drove gold quotes’ expansion in 2023. The speed hike coverage pursued through the Federal Reserve and different central banks and the strengthening US buck acted as headwinds. The associated fee reduced after achieving an all-time top, appearing indicators of a downward correction.

2023 XAU/USD value marketplace outlook*

Technical research of XAU/USD developments

Allow us to read about a weekly chart to analyse the present pattern and the mid-term outlook for the cost of the valuable steel. On the time of writing, XAU/USD quotes hovered close to 2,020 USD in line with ounce.

Since April 2020, they’ve been shifting inside of a wide sideways vary, with the decrease boundary at 1,611 USD-1,615 USD and the higher one at 2,070 USD-2,078 USD. The associated fee broke above the variability’s higher boundary in December 2023 however pulled again, failing to realize a foothold above 2,078 USD. As a result, a ‘false breakout’ technical construction has shaped at the chart.

Even though gold has been experiencing a gentle uptrend showed through the Alligator and 200-day SMA signs, there’s a top chance {that a} downward correction would possibly increase within the medium time period. This may also be supported through a ultimate value drop underneath the mental threshold of two,000 USD.

A decline goal is also an important make stronger space of one,805 USD-1,810 USD. If the quotes smash above 2,078 USD once more and identify themselves there, a corrective state of affairs shall be cancelled. Therefore, the uptrend it is going to be anticipated to proceed, with the associated fee hitting an all-time top of two,150 USD.

Technical Research of XAU/USD Traits*

Skilled XAU/USD value predictions for 2024 and past

- UBS World forecasts that gold costs will upward push to two,250 USD in line with ounce through the top of 2024

- In line with Saxo Financial institution’s experts, the valuable steel quotes will achieve the two,300 USD mark in 2024

- J.P. Morgan expects gold costs to face at 2,175 USD through mid-2024 amid attainable fee cuts through the Federal Reserve

- In line with Pockets Investor, the quotes will hover at 2,058 USD through the top of 2024, emerging to two,104 USD through December 2025

- The Economic system Forecast Company (EFA) analysts recommend that the valuable steel value will climb to two,158 USD through the top of 2024 and proper to two,019 USD in December 2025

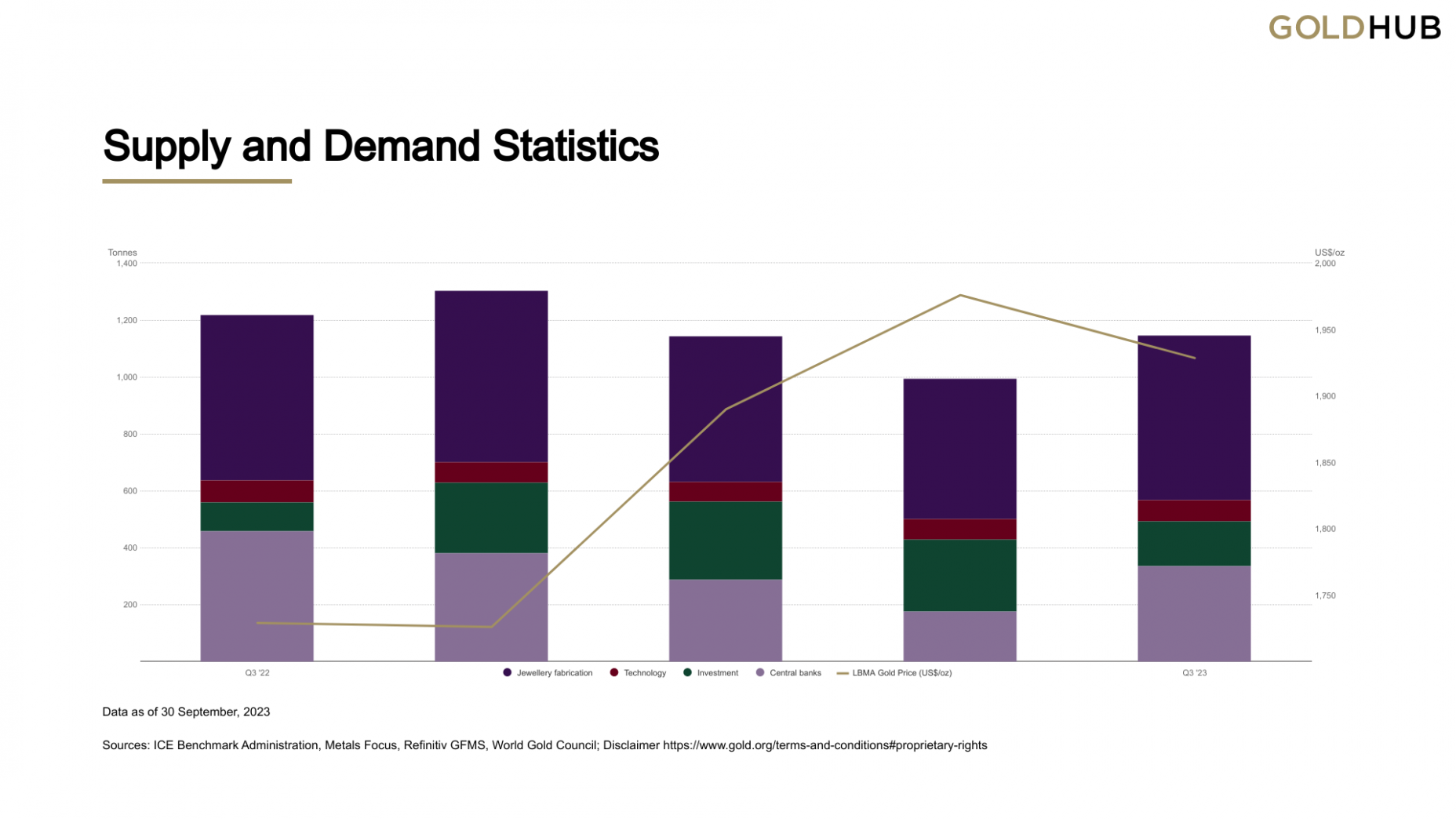

World call for and provide dynamics for gold in 2023

In line with the Q3 2023 survey through the International Gold Council (WGC), international gold call for and provide confirmed the next efficiency:

- Call for was once 8% upper than a five-year reasonable, achieving 1,147 tonnes. General call for, together with OTC provides, was once up 6% from 2022 at 1,267 tonnes

- Central financial institution purchasing was once 337 tonnes, falling wanting the file 459 tonnes in Q3 2022. However, because the starting of 2023, call for from central banks is 14% upper than in the similar duration of 2022, coming in at a file 800 tonnes

- Bar and coin investments reduced through 14% in comparison to the Q3 2022 effects, all the way down to 296 tonnes, even though final firmly above the quarterly reasonable of 267 tonnes. A decline from 2022 is attributed to a hunch in Eu gross sales

- Jewelry purchases have been down 2% y/y to 516 tonnes amid emerging gold costs. Jewelry fabrication sank through 1% to 578 tonnes because of an build up in inventories

- Mine manufacturing reached a file 971 tonnes in Q3, marking a 6% build up from the corresponding duration in 2022. Recycling was once additionally upper than in 2022, up 8% to 289 tonnes

Methods for buying and selling XAU/USD

Quite a lot of monetary tools akin to futures, choices, ETFs, CFD contracts, and notice can be utilized for buying and selling gold.

Lengthy-term buying and selling – making an investment

The underlying idea of this technique is to shop for an device firstly of a brand new expansion wave led to through elementary components, anticipating it to achieve peaks once more or set new highs. This technique is somewhat easy however calls for endurance to watch for the projected earnings.

Particular ETFs are continuously used for investments. Gold ETFs have been created to allow investments in gold with no need to shop for, stay, and set up the valuable steel itself. As an alternative, buyers can purchase and promote stocks of a gold ETF on a inventory alternate, very similar to inventory buying and selling. Probably the most greatest ETFs like that is SPDR Gold Stocks (GLD), with belongings underneath its control amounting to 58.27 billion USD in January 2024.

Brief and medium-term buying and selling

This buying and selling normally comes to leverage. Brief-term buying and selling methods goal to stay a place from one to a number of days, whilst medium-term ones deal with it from a number of days to at least one or two months. Buying and selling varieties akin to swing buying and selling, day buying and selling, and scalping can be utilized for gold buying and selling.

Except elementary components, the decision-making is according to a technical research. Beef up/resistance ranges and contours, value patterns, candlestick mixtures, value motion patterns, and indicator indicators – these kind of and different equipment assist in finding promising buying and selling alternatives.

The primary idea of such buying and selling is to go into a place the use of leverage (as an example, according to a technical research trend that has shaped), having small objectives and controlling dangers.

Abstract

Gold stays a good looking funding device as it’s believed to be a competent retailer of worth over the longer term. In 2023, the associated fee reached an all-time top of two,150 USD in line with ounce, pushed through emerging inflation, geopolitical tensions, and the top of the Federal Reserve’s financial tightening cycle.

Whilst the valuable steel chart displays indicators of a downward correction firstly of 2024, the long-term uptrend persists. Mavens be expecting gold quotes to proceed their upward trajectory in 2024 amid attainable fee cuts through the Federal Reserve, geopolitical tensions, and persisting sturdy call for from central banks. The forecasts vary from 2,058 to two,300 USD in line with ounce.

FAQ

XAU is the forex code used to indicate one troy ounce of gold within the international monetary markets. This code is derived from the periodic desk of components, the place ‘Au’ is the emblem for gold. The ‘X’ in entrance means that gold isn’t a countrywide forex however a commodity. This coding device is standardised through the World Group for Standardization (ISO) for treasured metals.

Quite a lot of components, together with international financial steadiness, inflation charges, US buck power, rate of interest selections through primary central banks just like the Federal Reserve, geopolitical tensions, and insist for gold in jewelry and era, affect the cost of XAU/USD. Moreover, marketplace sentiment and funding developments can play important roles within the fluctuation of gold costs.

Mavens recommend that XAU/USD costs in 2024 will likely be within the vary of two,058 USD-2,300 USD in line with troy ounce.

Deciding to put money into gold depends upon your personal monetary targets, chance tolerance, and funding portfolio. Gold is continuously thought to be a ‘safe-haven’ asset that may diversify your portfolio and hedge in opposition to inflation and forex devaluation. On the other hand, like several funding, it carries dangers, and its value may also be unstable. You must seek advice from a monetary guide to decide if making an investment in gold aligns together with your total funding technique.

A number of strategies for making an investment in gold come with bodily gold, mutual budget, ETFs, futures, CFDs, and extra. For extra detailed knowledge, please confer with our put up “How one can Spend money on Gold“.

* – The TradingView platform provides the charts on this article, providing a flexible set of equipment for examining monetary markets. Serving as a state of the art on-line marketplace information charting provider, TradingView permits customers to have interaction in technical research, discover monetary information, and hook up with different buyers and buyers. Moreover, it supplies treasured steerage on how you can learn foreign exchange financial calendar successfully and provides insights into different monetary belongings.