Gold Value Aiming for a Bull Run Above $1,810, US PPI Eyed

- The United States knowledge may convey sharp actions later as of late.

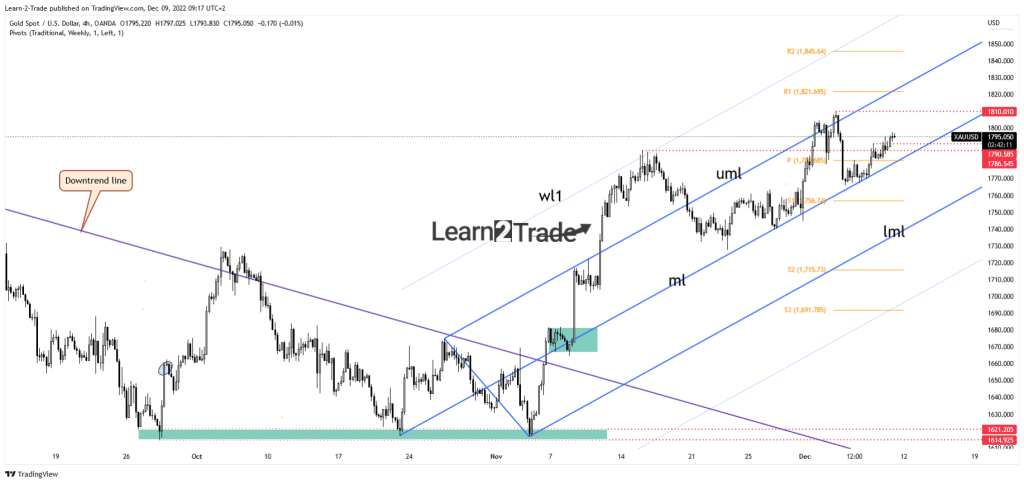

- The unfairness is bullish so long as it remains above the median line (ml).

- A brand new upper excessive turns on additional enlargement.

Gold worth grew to become to the upside, buying and selling at $1,795, a long way above the weekly low of $1,765. The unfairness stays bullish, so additional enlargement is preferred.

–Are you interested by studying extra about purchasing NFT tokens? Test our detailed guide-

The dear steel jumped upper even supposing the RBA and BOC higher the rates of interest as anticipated. The United States Unemployment Claims got here in at 230K remaining week, matching expectancies above 226K within the earlier reporting length.

These days, the United States is to unencumber high-impact knowledge, so the basics must stay within the using seat. The PPI is anticipated to document a zero.2% enlargement. Core PPI might also document a zero.2% enlargement as opposed to 0.0% enlargement within the earlier reporting length, whilst Prelim UoM Shopper Sentiment may build up from 56.8 issues to 56.9 issues.

As well as, the Ultimate Wholesale Inventories may sign up a zero.8% enlargement, whilst the Prelim UoM Inflation Expectation indicator may also be launched.

The United States inflation knowledge, FOMC, ECB, SNB, and BOE, may majorly influence XAU/USD subsequent week. Possibly, the cost of gold may sign up sharp actions round those high-impact occasions.

Gold worth technical research: Bullish bias stays intact

Technically, the unfairness stays bullish so long as it remains above the median line (ML) of the ascending pitchfork. It has handed above the 1,786 and 1,790 rapid resistance ranges. The $1,810 upper excessive represents an instantaneous goal for the patrons. An upside continuation may well be activated by way of a brand new upper excessive.

–Are you interested by studying extra about British Business Platform Assessment? Test our detailed guide-

The higher median line (UML) represents a dynamic resistance and a possible goal. An upside continuation may well be invalidated by way of a sound breakdown underneath the median line (ML). A legitimate breakdown would possibly announce a sell-off and produce new shorts. Consolidating above $1,790 and the median line, retesting those enhance ranges may cause a brand new upside momentum. As you’ll see at the 4-hour chart, the median line (ML) rejected the fee and stood as sturdy dynamic enhance.

Having a look to industry foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must believe whether or not you’ll find the money for to take the excessive possibility of dropping your cash.