GBP/USD Weekly Forecast: BoE Assured to Minimize Charges Additional

- US products and services sector PMI knowledge confirmed enlargement.

- US jobless claims fell, indicating a still-tight exertions marketplace.

- The pound fell as markets pondered the Financial institution of England’s first charge minimize.

The GBP/USD weekly forecast is somewhat bearish regardless of the new rally, because the Financial institution of England seems extra assured about chopping charges additional.

Ups and downs of GBP/USD

The pound had a bearish week however closed a long way above its lows. The pair began the week down as buyers dumped dangerous property amid fears of a US recession. Knowledge within the earlier week confirmed weaker-than-expected financial efficiency.

–Are you curious about studying extra about STP agents? Test our detailed guide-

On the other hand, this modified with america products and services sector PMI knowledge, which confirmed enlargement. In the meantime, jobless claims fell, indicating a still-tight exertions marketplace. However, buyers have been already pricing a extra vital 50 bps Fed charge minimize in September.

Moreover, the pound fell as markets pondered the Financial institution of England’s first charge minimize.

Subsequent week’s key occasions for GBP/USD

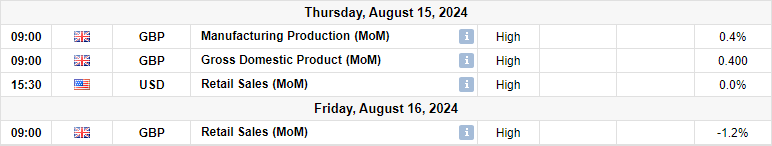

Subsequent week, the pound may revel in vital volatility because of US and UK inflation and retail gross sales knowledge. Moreover, the United Kingdom will unlock knowledge on employment, GDP, and production manufacturing. Markets will focal point at the client inflation stories, shaping the outlook for financial coverage in the United Kingdom and america.

The Fed is intending to start its rate-cutting cycle in September. Inflation in america has been on a downtrend, and the economic system is starting to crack. Due to this fact, additional easing inflation will give policymakers sufficient self belief to chop rates of interest.

In the meantime, the Financial institution of England just lately applied its first charge minimize. On the other hand, maximum policymakers consider underlying inflation stays top. Nonetheless, they’ve received sufficient self belief to start out reducing borrowing prices.

GBP/USD weekly technical forecast: Bears eying 1.2620 fortify

At the technical facet, the GBP/USD value trades under the 22-SMA with the RSI under 50. Due to this fact, bears are in keep an eye on. On the other hand, the fee has made upper highs and lows on a bigger scale, indicating a bullish development.

–Are you curious about studying extra about getting cash with foreign exchange? Test our detailed guide-

After puncturing the 1.2800 fortify, bears at the moment are eyeing the 1.2620 stage. First of all, GBP/USD reached a better low at this stage. Due to this fact, this can be a robust barrier. On the other hand, if bears breach this stage, the fee will make a decrease low, breaking the bullish development trend. On this case, GBP/USD would ascertain a brand new bearish development. However, if the extent holds company as fortify, bulls may resurface to make a brand new top.

Taking a look to industry foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You will have to believe whether or not you’ll have enough money to take the top chance of dropping your cash.