GBP/USD Value Suffering to Retain Bulls Forward of Key UK Information

- The GBP/USD pair maintains a bullish bias within the quick time period.

- A legitimate breakout in the course of the median line may turn on a bigger enlargement.

- DXY’s deeper drop must weaken the dollar.

The GBP/USD worth is buying and selling round 1.1770 on the time of writing and is combating arduous to stick upper as the USA greenback unearths purchasing momentum these days.

Basically, the United Kingdom knowledge got here in combined on Friday. The Gross Home Product dropped by means of 0.6% as opposed to the 0.4% anticipated, and Prelim GDP fell by means of 0.2% lower than the 0.5% estimated.

When compared, Building Output registered a nil.4% enlargement even though the buyers anticipated a nil.6% drop. As well as, Items Business Steadiness, Index of Products and services, Commercial Manufacturing, Production Manufacturing, and Prelim Trade Funding got here in higher than anticipated.

However, the Prelim UoM Shopper Sentiment got here in at 54.7 issues, a long way underneath the 59.5 anticipated. Nowadays, the United Kingdom Rightmove HPI reported a 1.1% drop. Later, the CB Main Index will probably be launched as neatly.

The following day, the United Kingdom is to liberate Claimant Depend Exchange and Moderate Profits Index, whilst the USA is to liberate the Empire State Production Index, PPI, and the Core PPI.

GBP/USD worth technical research: Bullish bias

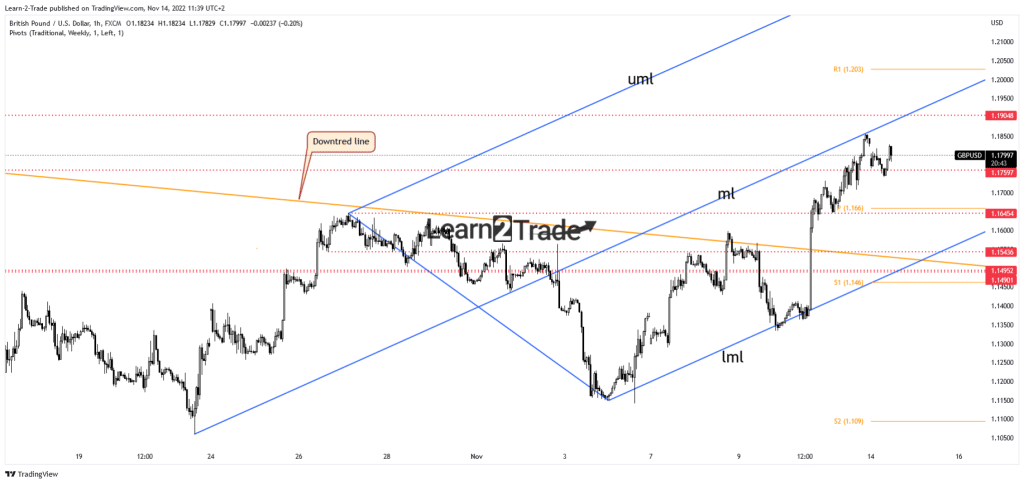

Technically, the GBP/USD pair retreated after failing to hit the median line (ML). Now, it tries to near the distance down. So long as it remains above 1.1759, the cost may resume its enlargement. The 1.1645 and the pivot level (1.1660) additionally constitute problem objectives. After its sturdy rally, a brief retreat is herbal. The pair might retest the near-term give a boost to ranges sooner than creating a brand new bullish momentum.

–Are you interested by studying extra about foreign exchange bonuses? Test our detailed guide-

As you’ll see at the hourly chart, the cost showed the ascending pitchfork after checking out and retesting the decrease median line (LML). So long as it remains inside the ascending pitchfork’s frame, the velocity may nonetheless hit the median line (ML), representing a dynamic resistance. The 1.1904 historic degree represents an upside goal as neatly.

The GBP/USD pair may way and succeed in new highs if the DXY drops deeper. A bigger upwards motion may well be showed after a legitimate breakout in the course of the median line (ML). To the contrary, false breakouts might lead to a brand new sell-off.

Taking a look to business foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must believe whether or not you’ll manage to pay for to take the prime possibility of shedding your cash.