Fibonacci Worth Swing Pattern the Forex market Buying and selling Technique

Investors have alternative ways of figuring out developments and pattern path. Some buyers determine pattern purely in response to the trajectory of worth motion. Some use transferring averages. Others use other technical signs.

Natural worth motion buyers are very distinctive in figuring out developments as a result of maximum worth motion buyers depend only on a unadorned chart. This loss of construction and urban laws make figuring out developments and pattern path very tough for brand new aspiring worth motion buyers. Then again, there are methods to objectively determine pattern path in response to worth motion.

First, allow us to glance into how worth motion buyers determine pattern path. Worth motion buyers determine developments in response to worth swings. The marketplace is in an uptrend if worth swings are making upper swing highs and swing lows. Alternatively, the marketplace is in a downtrend if worth swings are making decrease swing highs and swing lows.

This system makes figuring out pattern path a little bit bit extra concrete. Then again, that is nonetheless very subjective and would possibly nonetheless turn out to be tough for brand new buyers.

Right here we will be able to glance into how the Zig Zag indicator can be utilized to spot worth swings and pattern path, and the way the known worth swings may also be built-in with Fibonacci retracements to spot prime chance access issues.

Zig Zag Indicator

The Zig Zag indicator is a technical indicator which was once evolved to lend a hand buyers determine worth swings. It identifies swing issues at the worth chart in response to worth reversals which might be a share more than the preset components. Those components come with intensity, deviation and backstep. The indicator then connects those swing issues with a line making a zigzag like construction.

The reversal issues known by means of the Zig Zag indicator are principally the swing highs and swing lows of worth motion. Investors can use this knowledge to objectively determine swing issues with out 2nd guessing themselves and subjectively adjusting what they’d believe as a legitimate swing level.

Investors can use the swing issues to spot pattern path. That is in response to whether or not the swing issues known are growing upper or decrease swing highs and swing lows.

Investors too can use the swing issues as a foundation for horizontal helps and resistances, in addition to a foundation for figuring out provide and insist zones.

Fibonacci Retracement Software

Fibonacci Retracement is a method in technical buying and selling by which beef up and resistance ranges are known in response to a share of a worth swing. Those percentages are in response to a series of ratios, that are known as the Fibonacci Ratio.

The Fibonacci Ratio is a series of ratios which was once found out by means of Fibonacci or Leonardo of Pisa as he was once staring at nature.

Strangely the similar ratio that he seen in nature can be carried out in our modern day technical buying and selling research. Investors have seen that worth do have a tendency to admire the Fibonacci ranges as a beef up or resistance degree. The preferred Fibonacci retracement ranges are 23.6%, 38.2%, 61.8% and 78.6%, with the extent 61.8% being the preferred. In reality, the 61.8% degree is popularly known as because the golden ratio.

Fibonacci research gave upward thrust to the improvement of the Fibonacci Retracement device, which is a staple device in maximum buying and selling platforms. This device merely plots the degrees as buyers attach swing issues. This removes the trouble of getting to manually compute for the degrees.

Investors can use those ranges as a foundation for beef up or resistance bounces and is usually a buying and selling device in itself.

Buying and selling Technique

Fibonacci Worth Swing Pattern the Forex market Buying and selling Technique is a pattern following technique in response to the id of a pattern the usage of worth motion swing issues.

The tactic makes use of the Zig Zag indicator as a device to objectively determine the swing issues. Traits are known in response to whether or not worth motion is plotting upper and better swing highs and swing lows or decrease and decrease swing highs and swing lows.

Once the fashion is known, lets then attach the swing issues within the path of the fashion the usage of the Fibonacci Retracement device.

Then, we set our pending prohibit access orders at the golden ratio, 61.8%. The prevent loss is then positioned at the 78.6% Fibonacci Ratio degree whilst the take benefit goal worth is about on the prior swing level.

Signs:

- ZigZag (default environment)

- Fibonacci Retracement Software

Most well-liked Time Frames: 1-hour and 4-hour charts

Foreign money Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York classes

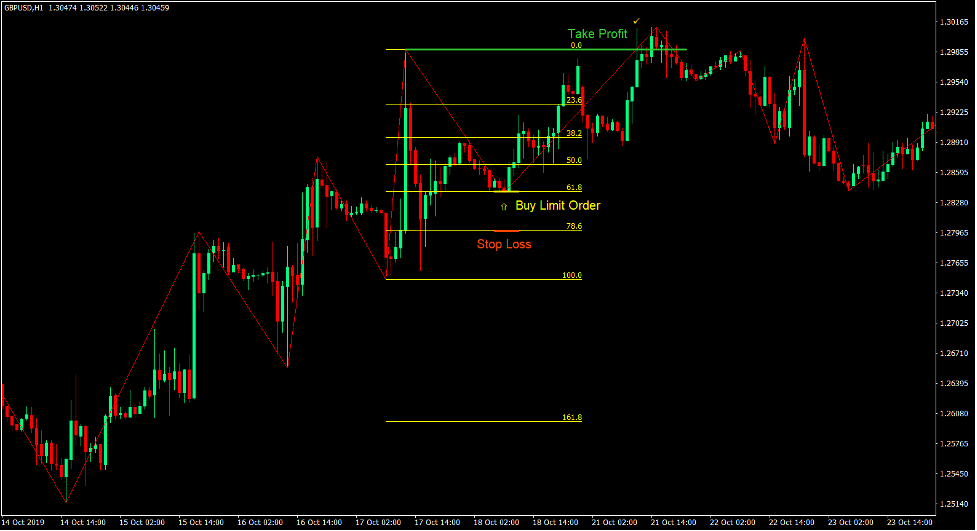

Purchase Business Setup

Access

- The Zig Zag indicator will have to determine upper and better swing highs and swing lows indicating a bullish trending marketplace.

- Use the Fibonacci Retracement device from toolbar and fasten the latest swing low to the swing prime.

- Set a purchase prohibit order at the 61.8% degree.

Forestall Loss

- Set the prevent loss at the 78.6% degree.

Go out

- Set the take benefit goal at the latest swing prime.

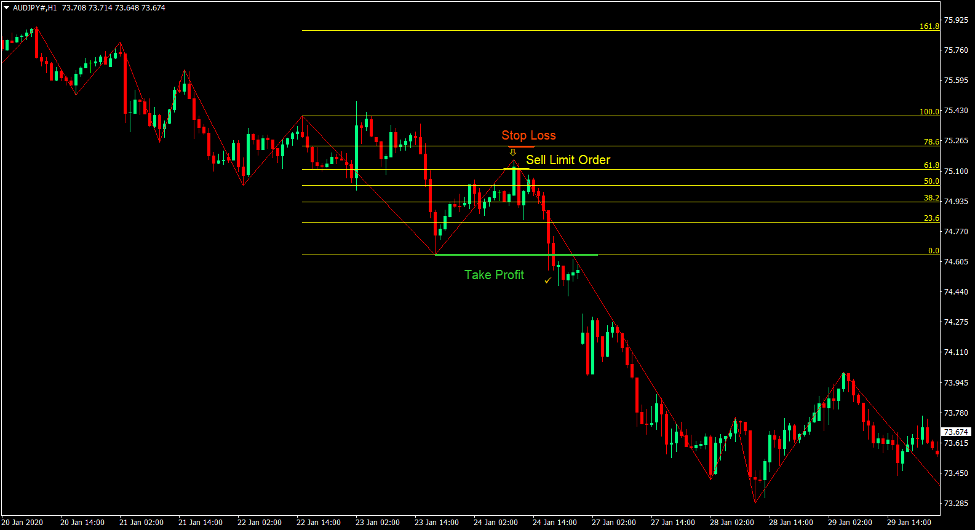

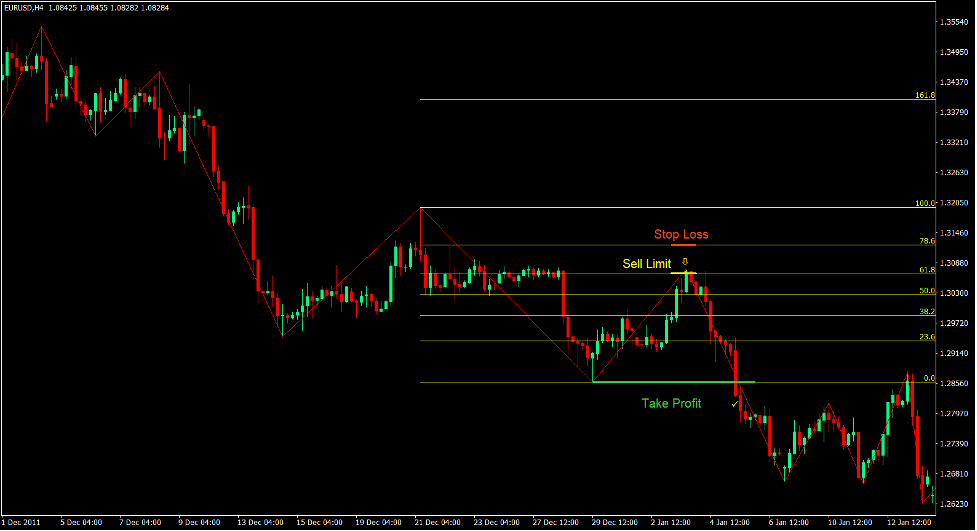

Promote Business Setup

Access

- The Zig Zag indicator will have to determine decrease and decrease swing highs and swing lows indicating a bearish trending marketplace.

- Use the Fibonacci Retracement device from toolbar and fasten the latest swing prime to the swing low.

- Set a promote prohibit order at the 61.8% degree.

Forestall Loss

- Set the prevent loss at the 78.6% degree.

Go out

- Set the take benefit goal at the latest swing low.

Conclusion

This system of buying and selling is a operating buying and selling technique utilized by {many professional} buyers. Fibonacci research is a confirmed manner which many buyers use.

Then again, figuring out the swing issues could be very subjective. Figuring out trending markets in response to swing issues proves to be much more tough for a brand new dealer.

The usage of the Zig Zag indicator is helping buyers objectively determine the swing issues making the method extra useable by means of new buyers.

This technique has a tendency to have an excessively prime chance. Then again, every now and then worth would jump off the prior ranges of the Fibonacci Retracement device. Sticking to the golden ratio permits us to have extra accuracy and the next risk-reward ratio. Then again, the selection of trades precipitated can be lesser.

It is usually a viable strategy to set the prevent loss a little bit past the 78.6% degree as this degree may be a beef up or resistance degree which worth may additionally jump off from and make a benefit.

Investors who may get a really feel of trending markets and their swing issues the usage of the Zig Zag indicator and the Fibonacci Retracement device could make use of this technique to constantly take advantage of the marketplace.

the Forex market Buying and selling Methods Set up Directions

Fibonacci Worth Swing Pattern the Forex market Buying and selling Technique is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to grow to be the collected historical past knowledge and buying and selling alerts.

Fibonacci Worth Swing Pattern the Forex market Buying and selling Technique supplies a possibility to discover quite a lot of peculiarities and patterns in worth dynamics that are invisible to the bare eye.

In response to this knowledge, buyers can suppose additional worth motion and regulate this technique accordingly.

Really useful the Forex market MetaTrader 4 Buying and selling Platform

- Loose $50 To Get started Buying and selling Right away! (Withdrawable Benefit)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable the Forex market Dealer

- Further Unique Bonuses During The 12 months

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By means of-Step XM Dealer Account Opening Information

How you can set up Fibonacci Worth Swing Pattern the Forex market Buying and selling Technique?

- Obtain Fibonacci Worth Swing Pattern the Forex market Buying and selling Technique.zip

- *Replica mq4 and ex4 information on your Metatrader Listing / mavens / signs /

- Replica tpl report (Template) on your Metatrader Listing / templates /

- Get started or restart your Metatrader Shopper

- Make a choice Chart and Time-frame the place you need to check your foreign exchange technique

- Proper click on to your buying and selling chart and hover on “Template”

- Transfer proper to choose Fibonacci Worth Swing Pattern the Forex market Buying and selling Technique

- You are going to see Fibonacci Worth Swing Pattern the Forex market Buying and selling Technique is to be had to your Chart

*Notice: No longer all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Signs from the MetaTrader Platform.