EUR/USD Underpinned through Higher-Than-Anticipated Euro House PMIs, Susceptible US Greenback

EUR/USD Underpinned through Higher-Than-Anticipated Euro House PMIs, Susceptible US Greenback

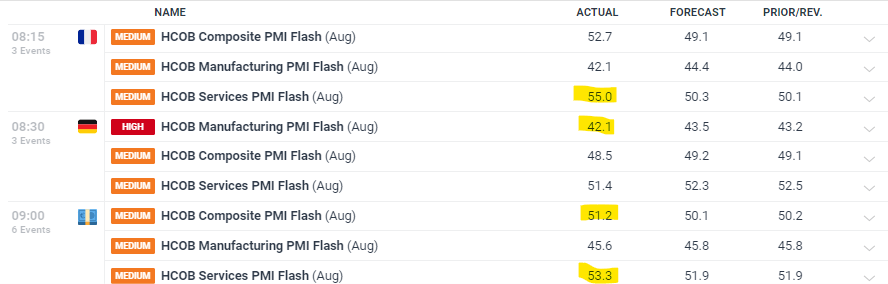

- Euro House composite PMI beats expectancies however warning wanted

- German production woes proceed

- Can Powell enhance an ill US greenback?

Financial job within the Euro House picked up in August, in line with the most recent HCOB PMIs, however a more in-depth have a look at the numbers ‘finds that the underlying basics could be shakier than they seem,’ in line with HCOB leader economist Dr. Cyrus de l. a. Rubia.

‘It’s a story of 2 worlds. The producing sector stays mired in recession, whilst the services and products sector nonetheless seems to be rising at a tight clip. However with the transient Olympic spice up in France fading and indicators of waning self assurance around the Eurozone’s carrier business, it’s most probably just a topic of time ahead of the struggles of the producing sector get started weighing on services and products too.’

Advisable through Nick Cawley

Buying and selling the Forex market Information: The Technique

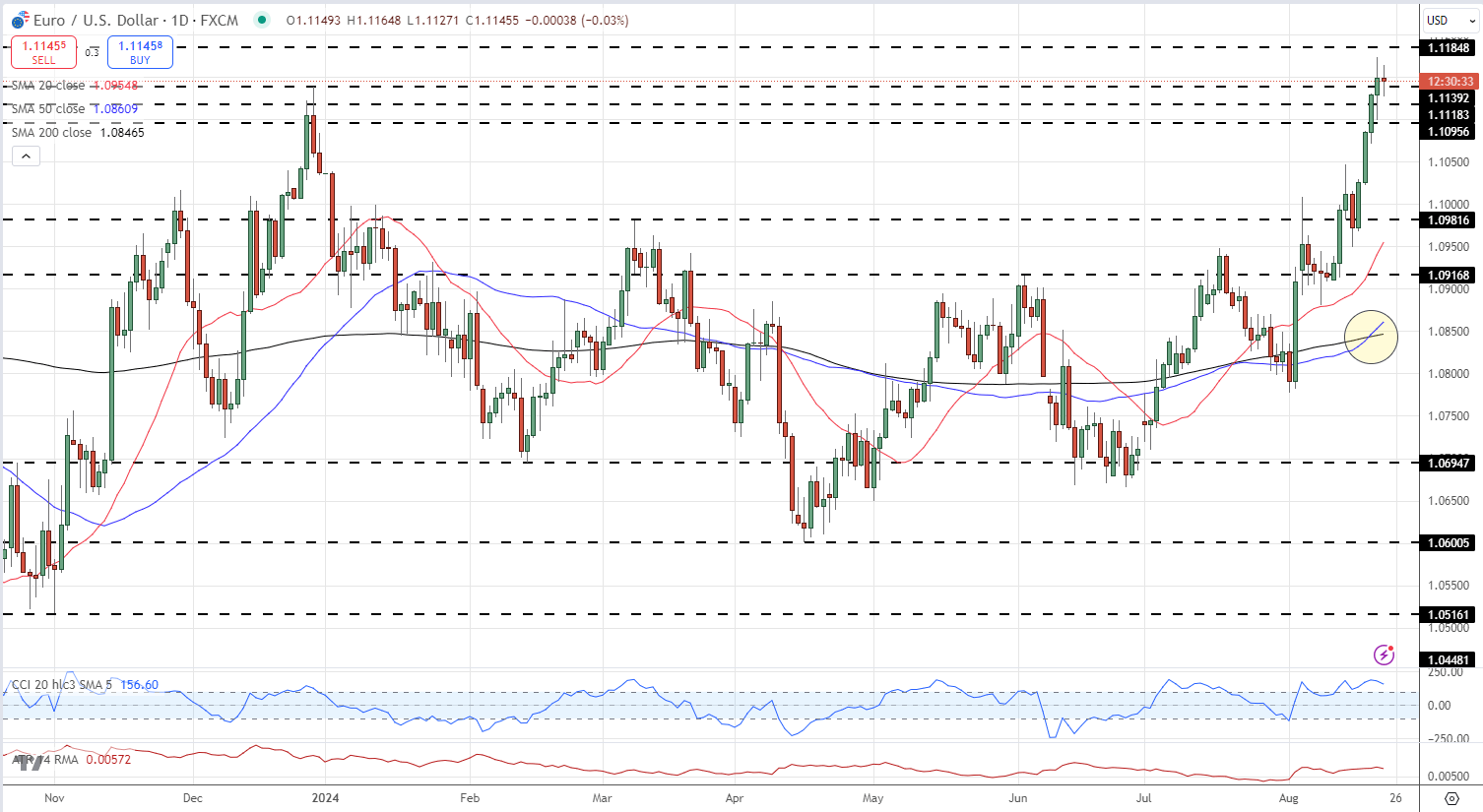

The Euro posted a contemporary 13-month top towards america greenback on Monday and stays inside touching distance of posting any other top as of late. The USA greenback stays vulnerable because the Federal Reserve prepares a sequence of rate of interest cuts which are anticipated to start out in September. Friday’s look through Fed chair Jerome Powell on the Jackson Hollow Symposium can give the marketplace a greater working out of the central financial institution’s present pondering and the anticipated pace of fee cuts going ahead.

As of late’s EUR/USD worth motion is prone to stay inside Monday’s vary – 1.1099-1.1174 – with the day prior to this’s top the much more likely to be examined.

EUR/USD Day by day Chart

Chart The use of TradingView

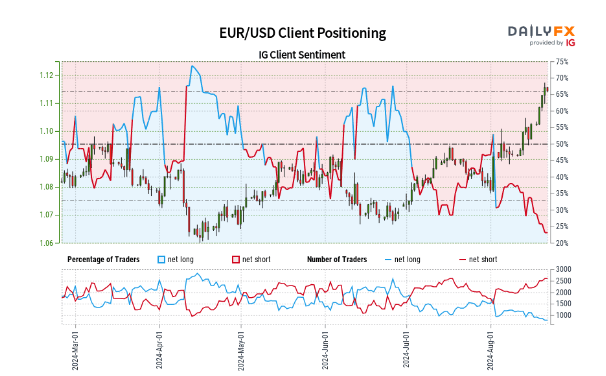

Retail dealer knowledge displays 22.77% of buyers are net-long with the ratio of buyers quick to lengthy at 3.39 to one.The selection of buyers net-long is 5.47% not up to the day prior to this and 23.95% decrease from remaining week, whilst the selection of buyers net-short is 1.73% upper than the day prior to this and seven.93% upper from remaining week.

We generally take a contrarian view to crowd sentiment, and the reality buyers are net-short suggests EUR/USD costs might proceed to upward push. Investors are additional net-short than the day prior to this and remaining week, and the mix of present sentiment and up to date adjustments provides us a more potent EUR/USD-bullish contrarian buying and selling bias.

| Alternate in | Longs | Shorts | OI |

| Day by day | 15% | -1% | 3% |

| Weekly | -20% | 20% | 6% |