Dynamic Channel Momentum Breakout the Forex market Buying and selling Technique

Momentum breakouts are top buying and selling prerequisites during which buyers can in finding just right buying and selling alternatives. It’s because momentum breakouts generally tend to purpose value to transport in a single normal path and may just ceaselessly lead to a pattern.

Momentum buying and selling is a technical buying and selling methodology during which buyers would purchase or promote a tradeable tool in response to the energy of a pattern. Principally, buyers buying and selling momentum methods are buying and selling with a powerful pressure in the back of a worth transfer. Those robust value actions ceaselessly purpose value to transport in the similar path and may just ceaselessly lead to a trending marketplace.

Momentum out of doors of buying and selling is a results of mass and velocity. In buying and selling, mass and velocity can also be recognized in response to quantity and the gap traveled through value inside of a brief duration.

One approach to establish robust momentum is through staring at for momentum candles. Momentum candles are lengthy, full-bodied candles with little to no wicks. This means that value moved in a single path inside of that candle duration. That is ceaselessly accompanied through top quantity buying and selling inside of that candle.

On this technique, we can be having a look at the usage of a few technical signs as a way to verify momentum.

Dynamic Worth Channel

Dynamic Worth Channel is a customized channel kind indicator which is in response to the Moderate True Vary (ATR).

The ATR is principally the common vary of value candles inside of a predetermined duration.

The Dynamic Worth Channel contains the ATR with shifting averages as a way to establish pattern, volatility, momentum and imply reversals.

The Dynamic Worth Channel plots shifting reasonable line as its major line and is represented through a dashed yellow line. This line may just both be a Easy Shifting Moderate (SMA), Exponential Shifting Moderate (EMA), or a Smoothed Shifting Moderate (SMMA). Buyers can choose the choice within the parameters tab of the indicator.

Then, six strains radiate from the shifting reasonable line. 3 above and 3 under. Those strains are plotted a distance clear of the center line, which is the shifting reasonable line, in response to an element of the ATR.

The indicator can be utilized as a volatility indicator. Buyers can establish volatility in response to the contraction and enlargement of the bands clear of the center line.

It will also be used to spot pattern path, in response to how the center line is sloped and in response to whether or not positive strains act as a dynamic beef up or resistance within the path of the fad.

It could possibly additionally point out overbought or oversold markets in response to how value reacts in opposition to the outer bands. If value motion is appearing indicators of value rejection at the outer bands, then the marketplace may just both be overbought or oversold. Those prerequisites are top for a median reversal.

Then again, the similar outer strains can be utilized to decide robust momentum. If value motion is appearing indicators of robust momentum breakout in opposition to the outer strains, the marketplace may well be gaining robust momentum which might lead to a pattern.

Relative Energy Index

The Relative Energy Index (RSI) is a flexible technical indicator which is part of the oscillator circle of relatives of signs. It may be used to decide tendencies, momentum and overbought or oversold value prerequisites.

The RSI plots a line that oscillates throughout the vary of 0 to 100. It additionally generally has markers at stage 50, which is the midline. If the RSI line is above 50, then the marketplace bias is bullish, whilst if the road is under 50, then the marketplace bias is bearish.

It additionally has markers at stage 30 and 70. An RSI line losing under 30 may just point out an oversold situation, whilst an RSI line above 70 may just point out an overbought situation. Each prerequisites are top for a median reversal.

Alternatively, momentum buyers might also view a breach above 70 as a bullish momentum indication, and a drop under 30 as a bearish momentum indication. This is a topic of ways value motion is responding because the RSI line breaches those ranges.

Buyers additionally upload stage 45 and 55 to beef up a trending marketplace indication. The extent 45 acts as a beef up stage in a bullish trending marketplace, whilst the extent 55 acts as a resistance in a bearish trending marketplace.

Buying and selling Technique

Dynamic Channel Momentum Breakout the Forex market Buying and selling Technique is a momentum breakout technique which trades on confluences between the momentum breakout sign coming from the Dynamic Worth Channel indicator and the RSI.

At the Dynamic Worth Channel, momentum is recognized in response to a powerful momentum candle breaking past the outer strains of the Dynamic Worth Channel. That is represented through the pink strains above and under the center yellow line.

At the RSI, momentum is showed in response to the RSI line breaching above 70 relating to a bullish momentum or under 30 relating to a bearish momentum.

Confluences between the 2 momentum alerts have a tendency to be top likelihood momentum alerts which might lead to a pattern.

Signs:

- Dynamic_Price_Channel

- Relative Energy Index

Most well-liked Time Frames: 1-hour and 4-hour charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York classes

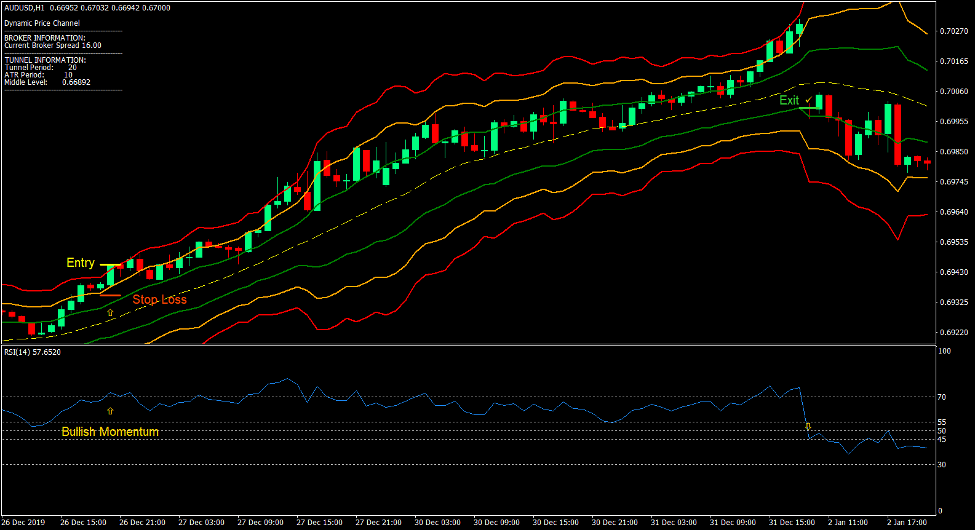

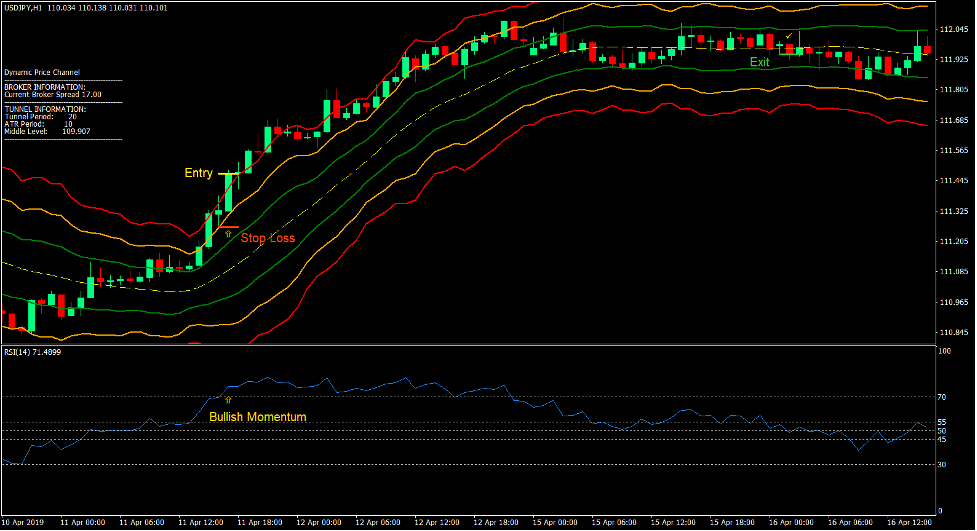

Purchase Industry Setup

Access

- A bullish momentum candle must breach above the higher pink line of the Dynamic Worth Channel.

- The RSI line must breach above 70.

- Input a purchase order at the confluence of each alerts.

Prevent Loss

- Set the forestall loss on a beef up stage slightly under the access candle.

Go out

- Shut the industry as quickly because the RSI line drops under 50.

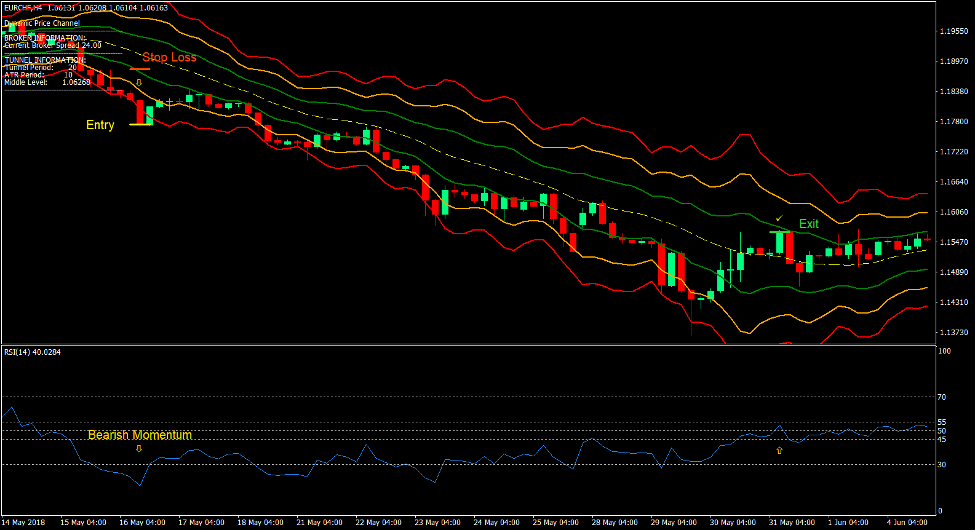

Promote Industry Setup

Access

- A bearish momentum candle must breach under the decrease pink line of the Dynamic Worth Channel.

- The RSI line must drop under 30.

- Input a promote order at the confluence of each alerts.

Prevent Loss

- Set the forestall loss on a resistance stage slightly above the access candle.

Go out

- Shut the industry as quickly because the RSI line breaches above 50.

Conclusion

This momentum breakout technique produces momentum industry setups which might be in response to two top of the range momentum alerts.

There are lots of skilled buyers who industry the usage of this technique with various parameters and with confluences coming from a couple of time frames. Alternatively, as a standalone momentum sign, this technique may just already produce top of the range industry setups.

It’s also essential to notice that those industry setups generally tend to paintings neatly each time the breakouts got here from a decent marketplace congestion.

Buyers can observe with this technique as part of an general momentum technique with a couple of time frame confluences.

the Forex market Buying and selling Methods Set up Directions

Dynamic Channel Momentum Breakout the Forex market Buying and selling Technique is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to change into the amassed historical past knowledge and buying and selling alerts.

Dynamic Channel Momentum Breakout the Forex market Buying and selling Technique supplies a chance to hit upon quite a lot of peculiarities and patterns in value dynamics which might be invisible to the bare eye.

In response to this knowledge, buyers can suppose additional value motion and modify this technique accordingly.

Really helpful the Forex market MetaTrader 4 Buying and selling Platform

- Loose $50 To Get started Buying and selling Right away! (Withdrawable Benefit)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable the Forex market Dealer

- Further Unique Bonuses Right through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By means of-Step XM Dealer Account Opening Information

How you can set up Dynamic Channel Momentum Breakout the Forex market Buying and selling Technique?

- Obtain Dynamic Channel Momentum Breakout the Forex market Buying and selling Technique.zip

- *Replica mq4 and ex4 information on your Metatrader Listing / mavens / signs /

- Replica tpl report (Template) on your Metatrader Listing / templates /

- Get started or restart your Metatrader Consumer

- Choose Chart and Time frame the place you need to check your foreign exchange technique

- Proper click on for your buying and selling chart and hover on “Template”

- Transfer proper to make a choice Dynamic Channel Momentum Breakout the Forex market Buying and selling Technique

- You are going to see Dynamic Channel Momentum Breakout the Forex market Buying and selling Technique is to be had for your Chart

*Observe: Now not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Signs from the MetaTrader Platform.