Dow Jones Commercial Moderate Forecast 2024 – DJIA Technical Research

On 27 December 2023, we tested the well-known Dow Jones inventory index, exploring the standards influencing its dynamics and assessing the size of its enlargement in 2023. We carried out a technical research of the Dow Jones chart and reviewed analysts’ forecasts referring to its possibilities for quotes in 2024.

Complete review of the Dow Jones index

The Dow Jones Commercial Moderate Index (DJIA, US 30) is among the main and oldest inventory indices in america. It used to be created in 1896 via journalist and Wall Side road Magazine editor Charles Dow and his trade spouse Edward Jones.

The Dow Jones index tracks the inventory dynamics of the 30 biggest US corporations referring to marketplace capitalisation. Moreover, those enterprises show off prime inventory values and prime ranges of trustworthiness. To be integrated within the DJIA listing, an organization should habits a good portion of its financial task in america, and its stocks should be traded at the NASDAQ or NYSE. The index’s composition is periodically reviewed and licensed via a unique committee.

In-depth research: most sensible 7 influential stocks within the Dow Jones

To resolve the price of the Dow Jones Commercial Moderate Index, a price-weighted moderate calculation is hired, utilising the Dow adjustment issue. This technique assigns extra weight to corporations with prime inventory costs, giving their inventory price adjustments extra affect at the prevailing index quotes. In keeping with Slickcharts knowledge as of twenty-two December 2023, the highest seven weight leaders within the index are:

| No | Corporate | Index Weighting | Value in USD |

| 1 | Unitedhealth Crew Inc. (NYSE: UNH) | 9.17% | 520.40 |

| 2 | Goldman Sachs Crew Inc. (NYSE: GS) | 6.70% | 381.34 |

| 3 | Microsoft Company (NASDAQ: MSFT) | 6.60% | 374.71 |

| 4 | House Depot Inc. (NYSE: HD) | 6.14% | 349.45 |

| 5 | McDonald’s Company (NYSE: MCD) | 5.14% | 293.00 |

| 6 | Caterpillar Inc. (NYSE: CAT) | 5.11% | 295.60 |

| 7 | Amgen Inc. (NASDAQ: AMGN) | 5.00% | 282.42 |

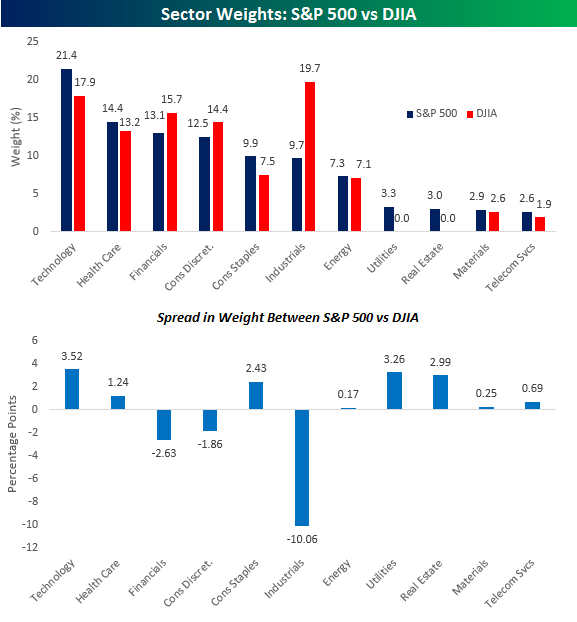

Sector breakdown: figuring out Dow Jones’ corporate distribution

- Era – 17.9%

- Healthcare – 13.2%

- Financials – 15.7%

- Client Discretionary – 14.4%

- Client Staples – 7.5%

- Industrials – 19.7%

- Power – 7.1%

- Fundamental Fabrics – 2.6%

- Telecommunications – 1.9%

2023: a retrospective have a look at the Dow Jones index

In 2023, the Dow Jones Moderate Index demonstrated spectacular enlargement: at first of the 12 months, the quotes crossed the 33,150-point mark and reached 37,641 issues on 22 December. Significantly, the former prime set on 5 January 2022 stood at 36,953 issues.

Steadiness in america economic system, the Federal Reserve’s luck in controlling again inflation, and the anticipated rate of interest lower helped traders triumph over their fears of a imaginable recession, enabling them to proceed making an investment in stocks of main corporations. The principle query now’s whether or not this tough inventory marketplace rally will persist in 2024.

Expansion of the Dow Jones index in 2020 – 2023*

Financial signs shaping the Dow Jones

- The Fed’s financial coverage. Adjustments within the rate of interest can affect corporations’ expenditures and their strategy to borrowing, due to this fact impacting index quotes

- World financial enlargement. Sustained enlargement on the planet economic system usually boosts production and intake, definitely affecting the income and inventory costs of businesses indexed within the index

- US financial signs. An build up in vital US financial signs such because the GDP, the unemployment price, commercial manufacturing output, and retail gross sales definitely influences america 30 index

- Monetary experiences of businesses. Powerful quarterly and annually effects for Dow Jones corporations can force up their inventory costs, developing beneficial stipulations for index enlargement

- Necessary home occasions. As an example, tax reforms or regulatory adjustments can considerably affect the inventory marketplace and, as a result, the index

- World geopolitical occasions. As an example, army conflicts may end up in the rupture of industry agreements and disruption of provide chains, inflicting greater uncertainty and volatility in monetary markets

- Commodity costs. This usually issues the index companies, the percentage values of which rely on commodity costs

- Marketplace sentiment and investor behaviour. Speculative task, for instance, can strongly affect the dynamics of index quotes

Technical deep dive: Dow Jones index research

Following a downward correction in 2022, Dow Jones quotes skilled a gentle uptrend in 2023. Having began the 12 months round 33,150 issues, in December, the index surpassed the ancient most of 36,953 issues recorded in 2022. Supported via the Alligator and SMA (200) signs, robust upward momentum persists on the time of writing, emphasising uptrend steadiness.

After hitting a brand new all-time prime, the quotes hover at 37,545 issues. The former most price of 36,953 issues recently acts as a reinforce stage. The fee will most probably go through a slight correction and check this stage within the quick run.

If the index quotes fail to wreck it, an upward rally would possibly proceed, with the associated fee now and again attaining new all-time highs. Will have to the quotes consolidate under this stage, a deeper downward correction will most probably observe, focused on a reinforce stage of 35,680 issues.

Technical Research of Dow Jones

Taking a look forward: Dow Jones predictions for 2024

- In keeping with LeoProphet forecasts, the Dow Jones will upward push to 38,777 issues in 2024

- Pockets Investor predicts index quotes to face at 37,861 issues in December 2024

- Analysts on the Economic system Forecast Company (EFA) counsel {that a} world fall in inflation will permit central banks to decrease rates of interest, thereby propelling the Dow Jones to a file stage of 46,594 issues via the tip of 2024

The way to spend money on the Dow Jones

America 30 index can be utilized for each temporary buying and selling and long-term making an investment. Purchasing or promoting the index at once is inconceivable since that is only a calculated price. Due to this fact, quite a lot of monetary tools corresponding to shares, futures, choices, CFD contracts, and ETFs are used for buying and selling. Basic and technical analyses and indicator methods can be utilized for analysis and decision-making.

One of the fashionable funding automobiles is the acquisition of an ETF (exchange-traded fund). Development a portfolio comprising all index shares will also be dear. In consequence, quite a lot of ETFs were created to make making an investment inexpensive, together with DJIA shares on the proper proportion correlation. Traders should buy the fund’s stocks and generate source of revenue from doable inventory enlargement and dividend payouts. One of the fashionable ETFs for the Dow Jones is the SPDR Dow Jones Commercial Moderate ETF Consider (DIA).

Assessing the hazards: a cautionary observe on Dow Jones investments

In spite of the inventory indices regularly appearing a favorable development in long-term making an investment, investments within the Dow Jones elevate positive dangers. As an example, an financial downturn adopted via a long lasting, deep recession can ship down inventory costs and the index for a very long time.

In particular, the 2008 monetary disaster in america, brought about via a housing bubble, prompted an index decline of about 50% from its most values noticed in 2007. It took the Dow Jones 5 years to retrace to its highs and proceed emerging.

Conclusion

The Dow Jones Commercial Moderate (US 30) is among the global’s most generally used inventory indices, score some of the most sensible 3 hottest US indices. Its basket contains shares of the 30 US biggest corporations via marketplace capitalisation, all traded on US inventory exchanges. This index is thought of as a a very powerful indicator of the rustic’s financial well-being.

In 2023, the index demonstrated a assured upward rally, updating the ancient most set in 2022. Inventory marketplace mavens are fairly positive, expecting persisted enlargement in 2024 amid expectancies for a discount within the rates of interest via america Federal Reserve. Essentially the most positive forecasts expect enlargement of round 46,000 issues. On the other hand, the hazards of a possible slowdown in america economic system would possibly obstruct the realisation of those forecasts.

FAQ

The Dow Jones Commercial Moderate (DJIA) is a inventory marketplace index that measures the inventory efficiency of 30 massive, publicly owned corporations indexed on inventory exchanges in america. It is among the oldest and maximum regularly adopted fairness indices, continuously used as a barometer for the full well being of america inventory marketplace and economic system.

The DJIA is a price-weighted index, that means that businesses with upper inventory costs considerably affect the index’s price. Its price is calculated via including the costs of all 30 shares and dividing this general via a divisor, which is adjusted to account for inventory splits, dividends, and different elements.

A variety of things can affect the DJIA’s efficiency, together with financial signs (like GDP enlargement charges, unemployment figures, and rate of interest adjustments), company profits experiences, geopolitical occasions, and world marketplace traits. Investor sentiment and marketplace hypothesis additionally play vital roles.

Particular person traders can spend money on the Dow Jones via buying stocks of mutual finances or exchange-traded finances (ETFs) that monitor the efficiency of the DJIA. On the other hand, traders should buy stocks within the person corporations that make up the DJIA or purchase a Contract for Distinction in accordance with DJIA, like US 30 Index Money.

Not unusual dangers come with marketplace possibility (the potential of all the marketplace declining), sector-specific dangers (if specific industries inside the DJIA carry out poorly), and person corporate possibility. Financial downturns and geopolitical occasions too can negatively impact the DJIA.

Sure, the DJIA is continuously seen as a trademark of the industrial well being of American corporations’ commercial sector. Whilst it does no longer constitute all the economic system, traits within the DJIA can mirror investor self assurance and financial stipulations.

Key occasions to look at come with selections via the Federal Reserve on rates of interest, ongoing industry negotiations, geopolitical trends, and main company profits experiences. The end result of those occasions can considerably affect investor sentiment and the efficiency of the DJIA.

Traders can observe DJIA updates thru monetary information web pages, inventory marketplace apps, monetary information channels, and funding platforms. Continuously studying marketplace analyses and experiences from monetary mavens too can supply precious insights.

* – The charts showcased on this article come from the TradingView platform, widely known for its complete suite of equipment crafted for examining monetary markets. Serving as a complicated and user-friendly on-line provider for charting marketplace knowledge, TradingView empowers customers to habits technical research, delve into monetary knowledge, and connect to fellow buyers and traders. Moreover, it imparts precious steerage on adeptly comprehending learn how to learn foreign exchange financial calendar, in conjunction with providing insights into quite a lot of different monetary belongings.