Cooling US Jobs Knowledge Weighing Forward of CPI

- The Fed raised charges for a fourth time by means of a large 75bps signaling extra.

- The United States added extra jobs than anticipated in October.

- The unemployment charge in the USA got here in upper than anticipated at 3.7%.

The USD/CHF weekly forecast is bearish as a combined US jobs file uncovered the affect of the Fed’s competitive hikes. This might imply smaller hikes one day.

–Are you curious about finding out extra about CFD agents? Test our detailed guide-

Ups and downs of USD/CHF

The pair had a gradual begin to the week however picked up on Wednesday. For the fourth time in a row, the U.S. central financial institution larger rates of interest on Wednesday by means of three-quarters of a proportion level. The pair moved upper when Powell said it used to be too early to imagine a pivot as a result of inflation used to be nonetheless top.

A combined US jobs file introduced at the sharp drop on Friday. In October, america added extra jobs than used to be predicted. Alternatively, the speed of activity expansion is slowing. The unemployment charge rose to three.7%, indicating that the exertions marketplace might loosen.

In line with the survey of companies, nonfarm payrolls rose by means of 261,000 remaining month, which used to be the smallest achieve since December 2020.

Subsequent week’s key occasions for USD/CHF

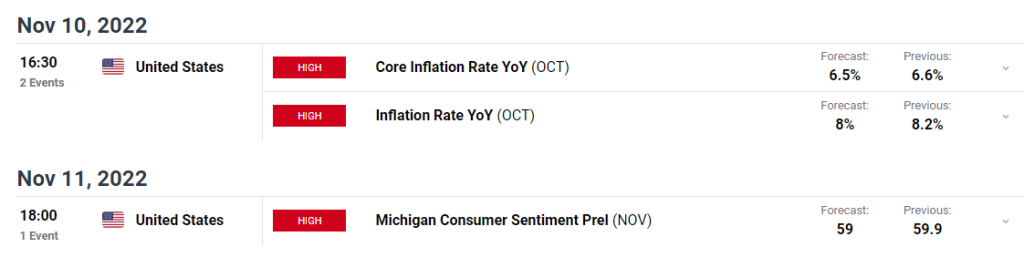

Within the upcoming week, traders will intently observe the USA inflation figures. This may reveal whether or not the Fed is a success in controlling the inflationary force. The markets await a lower in inflation from 8.2% to eight.0%. The next studying, although, may spice up USD/CHF.

USD/CHF weekly technical forecast: Trendline strengthen might ruin

The day by day chart presentations the fee buying and selling somewhat underneath the 22-SMA and RSI somewhat underneath 50. The bears have the higher hand however have nonetheless no longer totally taken over. The cost used to be sharply rejected on the 1.0125 key resistance stage. This can also be observed within the bearish engulfing candle that went on to wreck underneath the SMA. The bears closed with numerous momentum.

–Are you curious about finding out extra about MT5 agents? Test our detailed guide-

Alternatively, the shut got here close to robust strengthen from a bullish trendline. The cost will want to ruin underneath this trendline for the bearish transfer to proceed. If bears fail to wreck underneath, we may see the go back of bullish momentum. Alternatively, if the fee breaks underneath, bears will glance to take out the following strengthen ranges at 0.9852 and nil.9625.

Taking a look to industry foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must imagine whether or not you’ll find the money for to take the top chance of shedding your cash.