Cash Waft ADX Pattern the Forex market Buying and selling Technique

Buyers dabble within the foreign exchange marketplace for one reason why, income. Buyers who industry in any marketplace search for income. the Forex market buying and selling specifically is among the markets that provide such a lot alternatives. The sheer measurement of the marketplace manner that there’s sufficient volatility and quantity to transport the marketplace, and with volatility comes alternatives. The foreign exchange marketplace could also be a world marketplace which is open greater than 5 days per week, so long as there may be an financial system open which trades with such currencies. Which means alternatives are to be had at any time of the day. Additionally, the foreign exchange marketplace permits for top leverages, which in the best palms permits investors to briefly multiply their profits if used correctly.

Alternatives are provide within the foreign exchange marketplace. The query is the place do we discover them?

Some of the highest marketplace prerequisites that provide such a lot buying and selling alternatives with prime possible returns are trending markets and momentum-based reversals. Trending markets allow you to watch for which route the marketplace is transferring. Momentum permits investors to industry setups with an excessively prime chance that worth would transfer strongly in a undeniable route.

Buyers who can in finding confluences between development and momentum indications stand to earn large income from the marketplace so long as they understand how to industry throughout such marketplace prerequisites.

Cash Waft Index

The Cash Waft Index (MFI) is a vintage technical indicator which is of the oscillator form of signs. It’s extensively to be had in maximum buying and selling platforms and is definitely available to maximum investors.

The MFI is an oscillator, similar to the Relative Power Index (RSI), which additionally mimics the motion of worth motion and is helping in figuring out development route, in addition to overbought or oversold worth prerequisites.

Alternatively, the MFI places extra emphasis on quantity at the side of historic worth actions. In some way, the MFI may also be regarded as as a volume-weighted RSI.

The MFI plots a line that oscillates inside the vary of 0 to 100. It additionally normally has markers at degree 20 and 80. Many investors establish oversold markets in keeping with the MFI line shedding beneath 20, and overbought markets in keeping with the MFI line breaching above 80. Some investors on the other hand believe those ranges to be 10 and 90.

Some investors additionally upload degree 50 as it’s the median of the variability. Some would believe the rage bias to be bullish if the MFI line has a tendency to stick above 50, and bearish if the MFI line remains beneath 50.

Slope Course Line

The Slope Course Line (SDL) is a development following indicator which is in keeping with transferring averages. If truth be told, the Slope Course Line is in itself a changed transferring reasonable.

Some of the highest techniques investors objectively establish traits is in keeping with the site of worth motion with regards to the transferring reasonable line, in addition to the slope of the transferring reasonable line.

Crossovers between worth motion and a transferring reasonable line is a commonplace development reversal sign. Reversals may be recognized in keeping with the transferring of the slope of a transferring reasonable line. Alternatively, maximum transferring averages have a tendency to be too erratic, making them prone to false indicators.

The Slope Course Line makes an attempt to lower such false indicators by means of enhancing its computation as a way to smoothen out the reaction of the road. This makes the road extra resilient to erratic worth adjustments.

This model of the Slope Course Line additionally adjustments colour relying at the route of the rage it detects. A mild blue line signifies a bullish development bias, whilst a tomato line signifies a bearish development bias.

ADX Candles

The ADX Candles is a customized development following indicator which signifies development instructions in keeping with the Moderate Directional Motion Index (ADX).

The ADX Candles indicator overlays worth bars over the present worth bars. It plots the similar highs and lows. The one distinction is that the colours of the candles alternate most effective when the ADX Candles indicator detects a metamorphosis in development route or momentum in keeping with its underlying ADX computations.

Darkish inexperienced bars point out a bullish development, whilst lime bars point out a bullish development with a powerful momentum. Maroon bars point out a bearish development, whilst crimson bars point out a bearish development with sturdy momentum.

Buying and selling Technique

Cash Waft ADX Pattern the Forex market Buying and selling Technique is a mixture of a development following technique and a momentum technique the usage of the above-mentioned technical signs.

First, trades are filtered in keeping with the long-term development. The long-term development is recognized in keeping with the site of worth motion with regards to the 200 SMA line, in addition to its slope.

Pattern reversal indicators are showed in keeping with the converting of the colour of the Slope Course Line and showed by means of the crossing of the MFI line over its median.

Pattern and momentum are then showed in keeping with the colour of the ADX Candles.

Signs:

- ADX Candles

- Large Pattern

- Cash Waft Index

Most popular Time Frames: 30-minute, 1-hour and 4-hour charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York classes

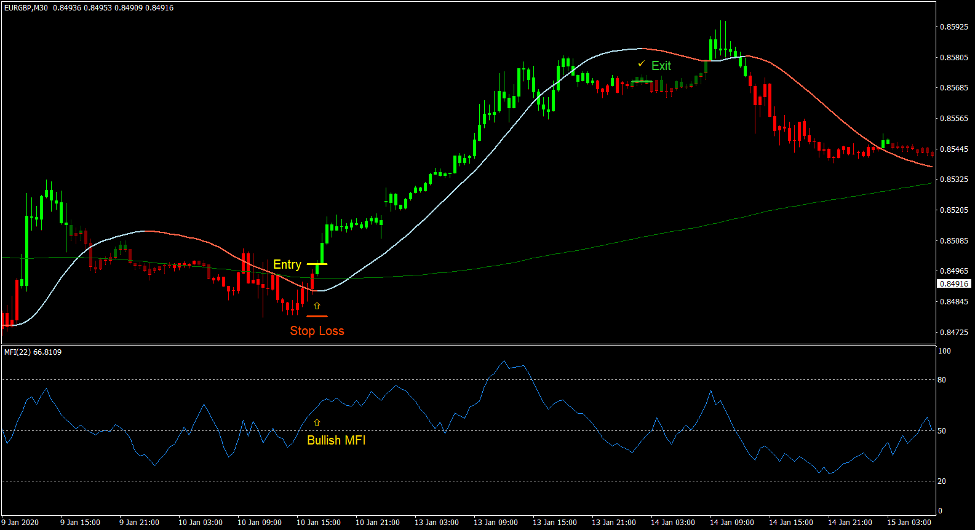

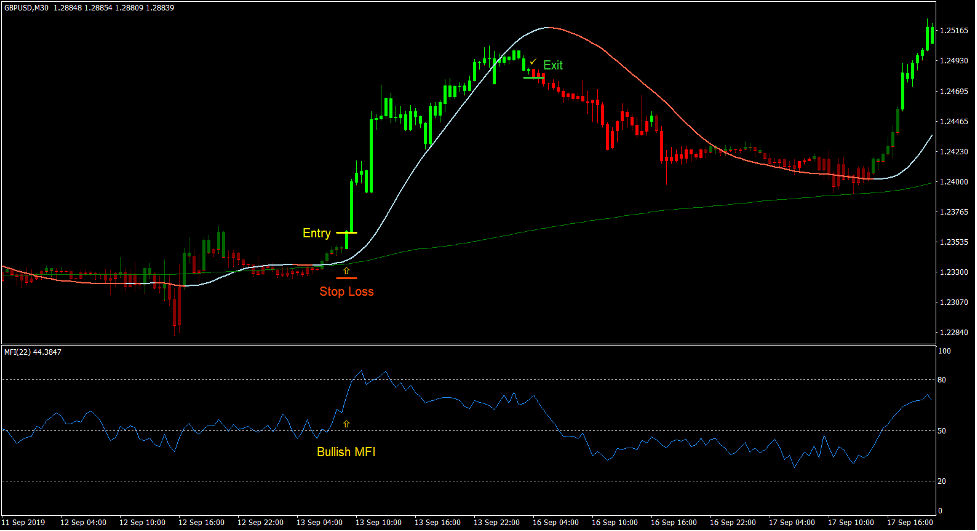

Purchase Industry Setup

Access

- Value motion will have to be above the 200 SMA line.

- The Slope Course Line will have to alternate to gentle blue.

- The MFI line will have to pass above 50.

- The ADX Candles will have to alternate to lime.

- Input a purchase order at the affirmation of those prerequisites.

Forestall Loss

- Set the forestall loss on a make stronger beneath the access candle.

Go out

- Shut the industry as quickly because the ADX Candles alternate to maroon or crimson.

- Shut the industry as quickly because the Slope Course Line adjustments to tomato.

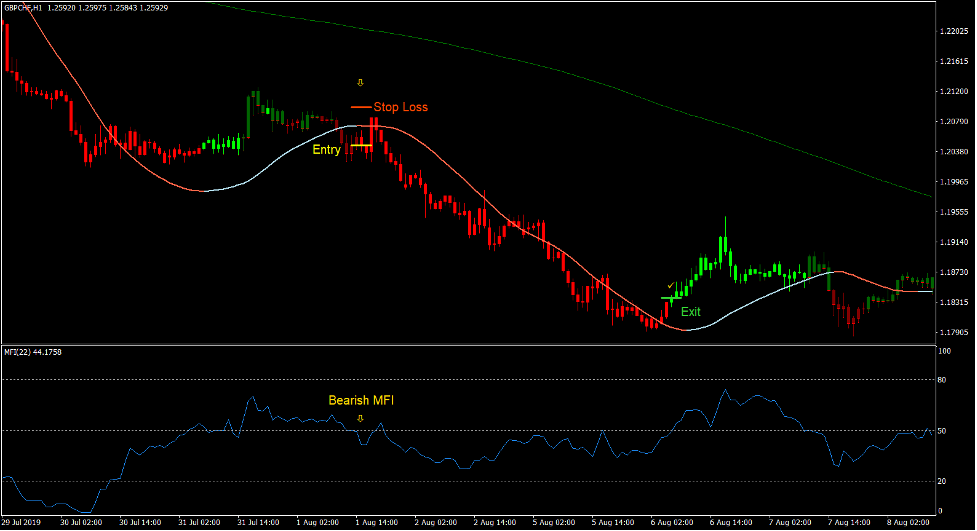

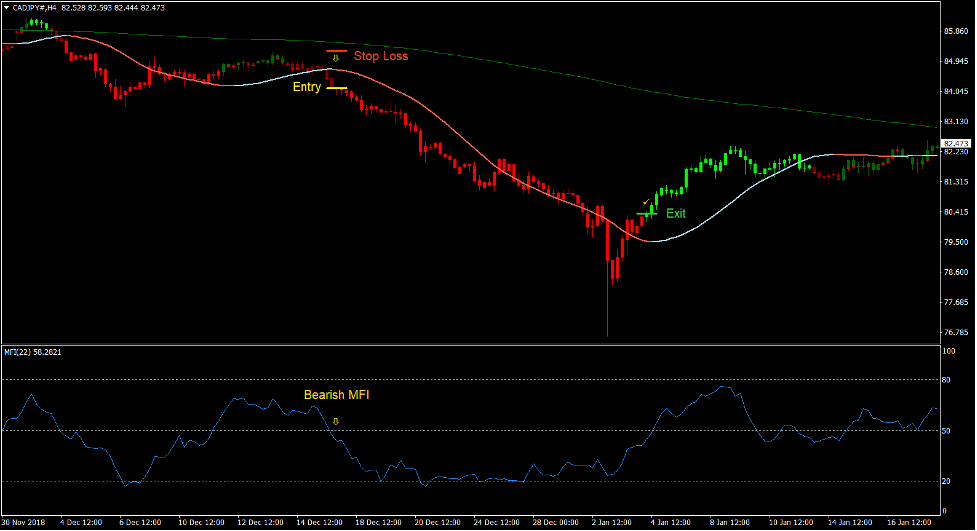

Promote Industry Setup

Access

- Value motion will have to be beneath the 200 SMA line.

- The Slope Course Line will have to alternate to tomato.

- The MFI line will have to pass beneath 50.

- The ADX Candles will have to alternate to crimson.

- Input a promote order at the affirmation of those prerequisites.

Forestall Loss

- Set the forestall loss on a resistance above the access candle.

Go out

- Shut the industry as quickly because the ADX Candles alternate to darkish inexperienced or lime.

- Shut the industry as quickly because the Slope Course Line adjustments to gentle blue.

Conclusion

This buying and selling technique is a workable development following technique which is blended with momentum indications.

Even though this technique isn’t as prime chance as many development following methods, it does organize to supply prime yielding trades that would make or smash a buying and selling account.

Buyers could make use of this kind of solution to earn some income over the long term.

the Forex market Buying and selling Methods Set up Directions

Cash Waft ADX Pattern the Forex market Buying and selling Technique is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to change into the accrued historical past knowledge and buying and selling indicators.

Cash Waft ADX Pattern the Forex market Buying and selling Technique supplies a chance to stumble on quite a lot of peculiarities and patterns in worth dynamics that are invisible to the bare eye.

In keeping with this knowledge, investors can suppose additional worth motion and modify this technique accordingly.

Really helpful the Forex market MetaTrader 4 Buying and selling Platform

- Unfastened $50 To Get started Buying and selling In an instant! (Withdrawable Benefit)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful the Forex market Dealer

- Further Unique Bonuses All the way through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-Via-Step XM Dealer Account Opening Information

Really helpful Choices Buying and selling Platform

- Unfastened +50% Bonus To Get started Buying and selling In an instant

- 9.6 General Score!

- Mechanically Credited To Your Account

- No Hidden Phrases

- Settle for USA Citizens

The right way to set up Cash Waft ADX Pattern the Forex market Buying and selling Technique?

- Obtain Cash Waft ADX Pattern the Forex market Buying and selling Technique.zip

- *Reproduction mq4 and ex4 information for your Metatrader Listing / professionals / signs /

- Reproduction tpl record (Template) for your Metatrader Listing / templates /

- Get started or restart your Metatrader Shopper

- Make a selection Chart and Time frame the place you need to check your foreign exchange technique

- Proper click on to your buying and selling chart and hover on “Template”

- Transfer proper to make a choice Cash Waft ADX Pattern the Forex market Buying and selling Technique

- You’re going to see Cash Waft ADX Pattern the Forex market Buying and selling Technique is to be had to your Chart

*Notice: No longer all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Signs from the MetaTrader Platform.

Click on right here beneath to obtain:

Get Obtain Get right of entry to